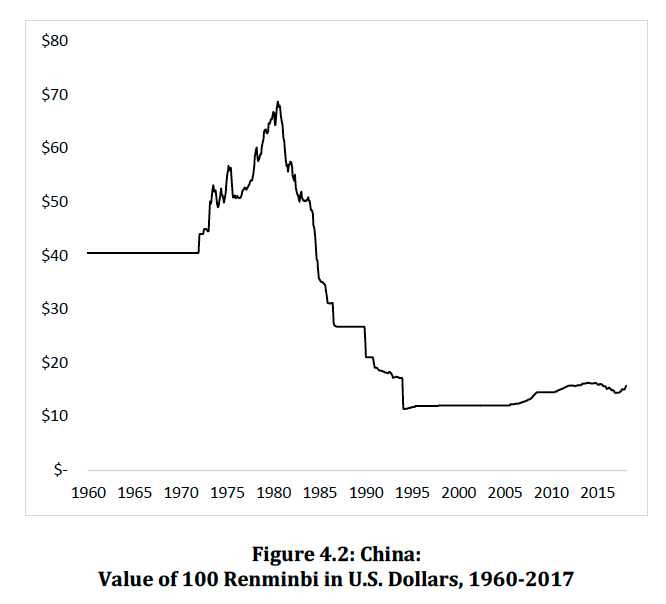

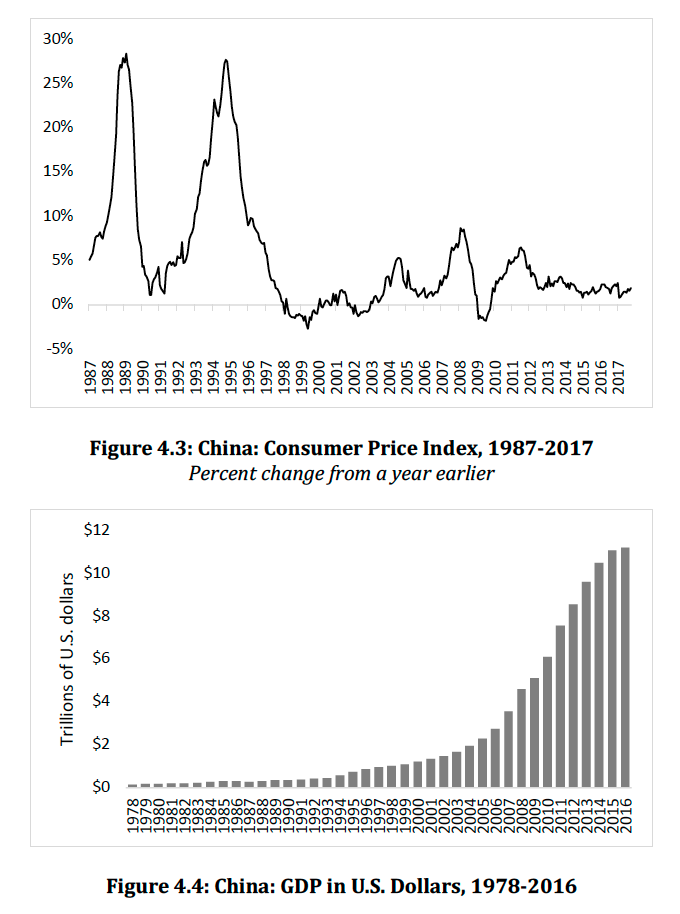

We saw, in The Magic Formula (now in FREE pdf form), that China didn’t start on its path to becoming a world economic power until it got its currency under control in the mid-1990s — Stable Money.

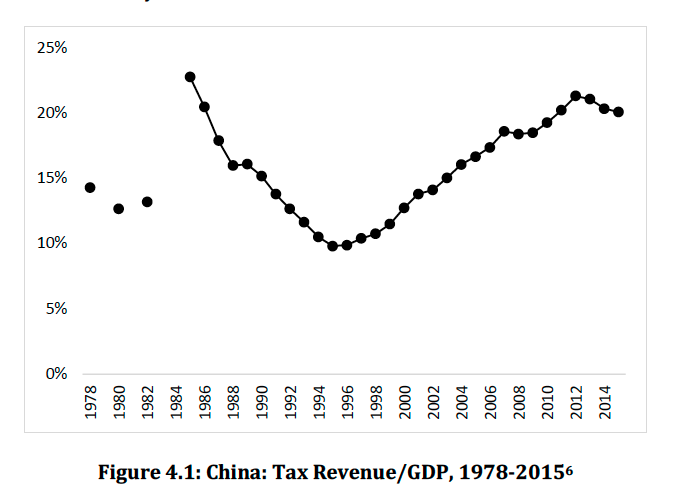

China also had Low Taxes, with tax revenue/GDP generally under 20%.

Russia also has a pretty good tax regime, with its 13% Flat Tax income tax system. However, this is combined with a 20% VAT and a 30% combined Payroll Tax rate, producing a rather heavy tax burden overall. This taxation system is, I would say, quite efficient, using simple taxes at (relatively) low rates and a broad base. Nevertheless, the combination is quite heavy.

The ruble currency, however, has been quite unreliable in the past, similar to China before 1995. If Russia is to become a Great Power, it needs a better currency. There are clear steps, recently, toward making gold-based payments systems available in Russia, as an alternative to the unreliable ruble. Maybe, in the not-so-distant future, the ruble will be once again based on gold, as it was in the past.

January 29, 2023: Gold Ruble 3.0

How Russia Can Go To A Gold Ruble series

With it now difficult to even trade RUB and USD between each other, I think that any USDRUB charts are a little suspect, and easily manipulated. Let’s look instead at a more significant cross rate, RUB and CNY:

Well, that has an interesting look to it! This is a pretty good track record of reliability, on this basis, over the past decade. Nevertheless, the RUB still has a bit of a tendency to decline in value. Again, I reiterate that central banks should ignore everything related to interest rates, or various “money supply” indicators in a Monetarist format, and just look at the value of the currency. If it is a little weak (it is), then Base Money supply should be constrained (slower growth rate), or even contracted, until the currency regains its desired value. In Monetarist theory, this is almost equivalent to an “economic contraction” and there is typically much fear among those lesser intellects who were trained this way at University and actually take this fallacious theory seriously. Having a sound and reliable currency is a good thing, not a bad thing (look at China after 1995), and so steps to support currency value tend to lead to positive economic outcomes, not worse.

I think I would aim to get the ruble back to around 11 RUB/CNY, from 12.87 recently.

From the standpoint of gold, the Ruble is following the CNY lower.

This is not bad overall. I would try to keep the RUB roughly in line with the CNY, since they are now major trading partners, and violent fluctuations in exchange rates create big problems.

Also, both Russia and China should intensify efforts to provide a whole range of payments and banking systems that use gold as a basis — the “gold checking accounts” and other such systems (crypto stablecoins, etc.) that allow people to “transfer digital gold” i.e. make payments to each other in gold, bypassing the floating fiat RUB, CNY etc altogether.

In time — not too much time I hope — we should see both borrowing and lending on a gold basis. Borrow 10 kg of gold at 4% per year, pay it back in ten years. It’s just a loan or a bond. Banks can have interest-bearing “savings deposits” in gold, and make “gold loans.” Larger corporations can issue “gold bonds.” All of this is based on a payments system that allows us to buy and sell, borrow and lend, through digital platforms (a “gold based checking account”), of course not in actual gold coins or bars. Governments should issue a few gold bonds, just to establish the protocols of how such a thing is administered.

Monetary Metals: “What Are Gold Bonds?”

Gold-Eagle: “The Benefits of Issuing Gold Bonds”

Details on the “Sovereign Gold Bonds” now being issued by the government of India.

CBonds: “What Are Gold Bonds?”

This all follows the “try it and see” model that I outlined in my 2012 Testimony in Congress (thank you Ron Paul!)

August 5, 2012: My Testimony in Congress

I also have an extended discussion in Chapter 14 of Gold: The Monetary Polaris (2013), “The Parallel Currency Option.” Gold is basically a “parallel currency” (alternative currency) to the domestic floating fiat RUB and CNY.

You can read it in FREE .pdf format here: