Now that a little time has passed, let’s see where things stand with the Russian ruble.

How Russia Can Go To A Gold Ruble series

Here is the ruble vs. the USD.

In the absence of some other organizing factor, it seems like the ruble, or Central Bank of Russia, has defaulted to “stabilizing vs. the USD.” Anyway, most other countries have also maintained a level of stability vs. the USD, so the result is that the ruble has also returned to some semblance of prior levels with other main trading partners, such as China.

Here’s how the ruble looks vs. gold.

As we can see, the ruble has returned to a plateau that has been defined since 2020. Earlier, it returned to a 2019 level vs. gold. But, they may have perceived that that was too much of a rise in ruble value, too fast. Inflation (currency depreciation) is typically a one-way street. It is hard to go back to prior levels, as this introduces deflationary/recessionary pressures. Still, I think it would have been nice if they did.

Today, we are around 140,000 rubles per oz. of gold. Since there are 31.10348 grams in a troy oz., this translates into a price of 140,000/31.10348 or 4,500 rubles/gram, pretty close to the 5000 rubles/gram level that came up in the past.

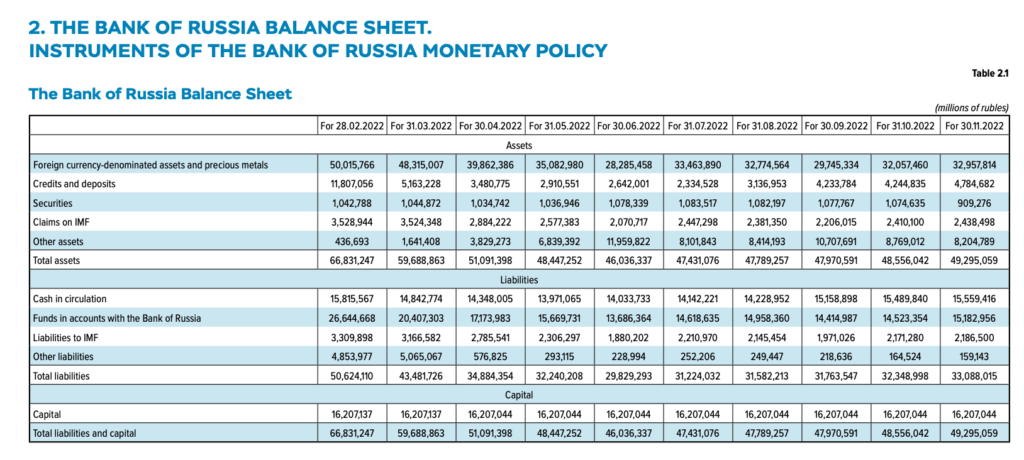

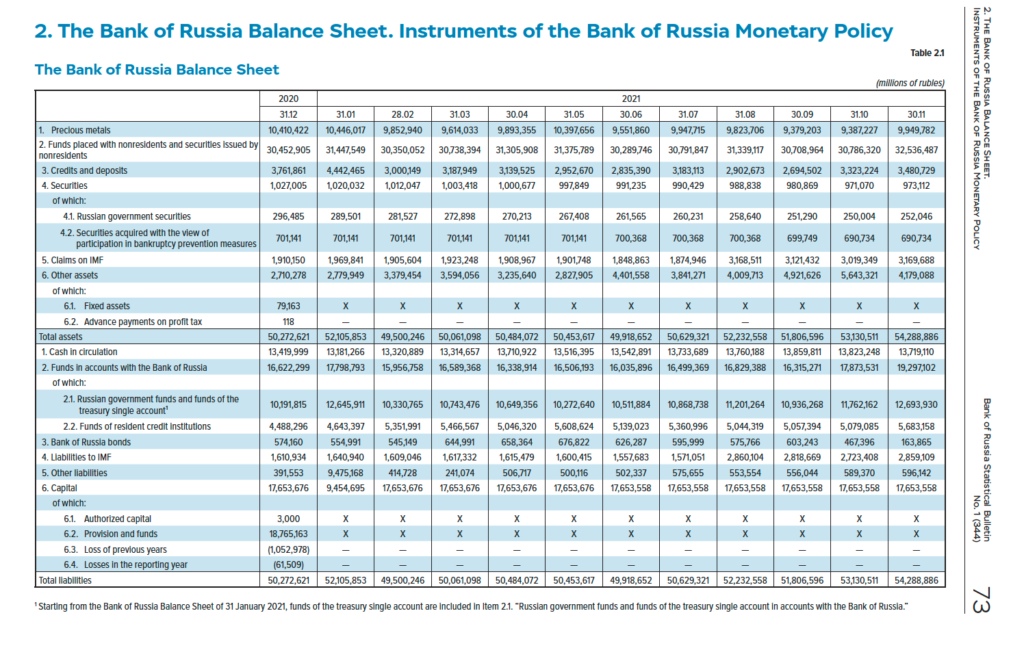

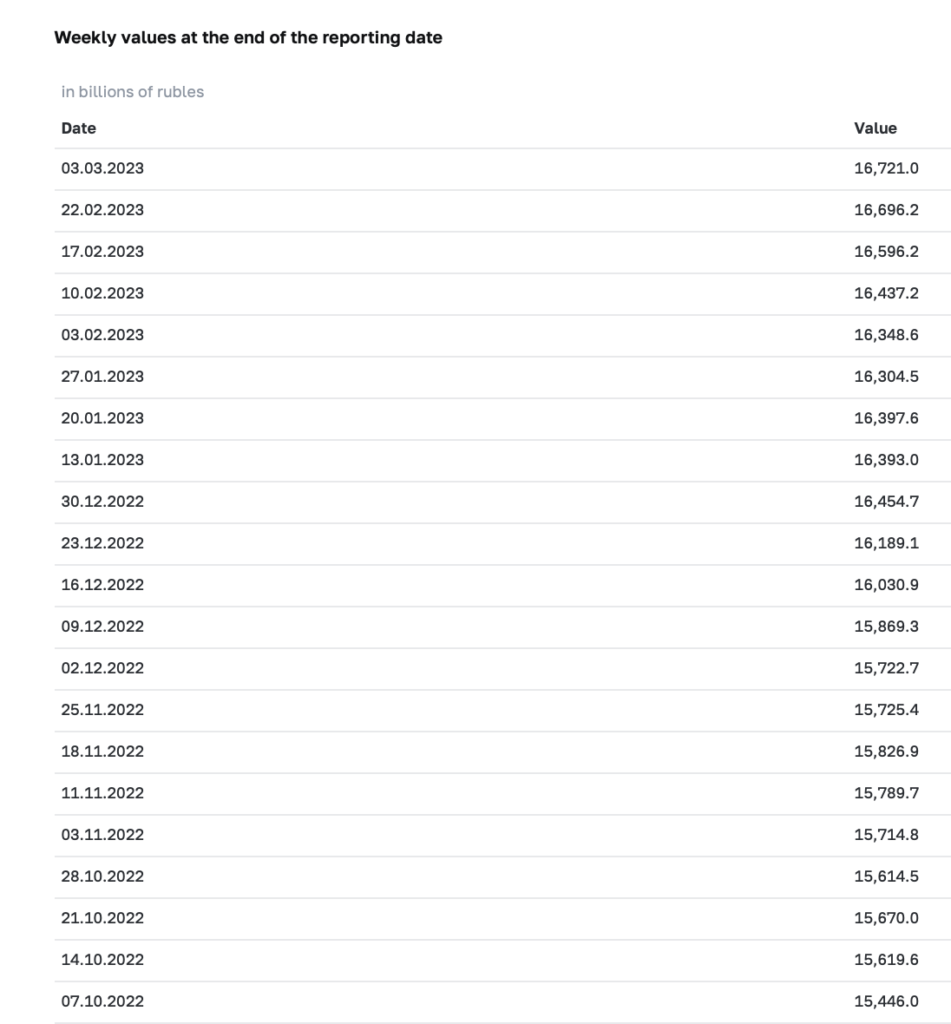

This source only gets us up to the end of last November, but it is a good overview.

Cash in circulation (banknotes) has been pretty stable throughout here. Good.

Funds in Accounts (deposits, bank reserves) have actually fallen considerably. Just as I recommended, to support the ruble, you just reduce the base money supply. It worked — again!

March 27, 2022: How Russia Can Go To A Gold Ruble #3: Day To Day Activity

It is unusual to see a central bank with a very large Capital base, as we have here. This is good, as it means that we have better reserve coverage of all monetary liabilities (currency and bank reserves, or base money). There is also a large “other assets” line, which is what I don’t know.

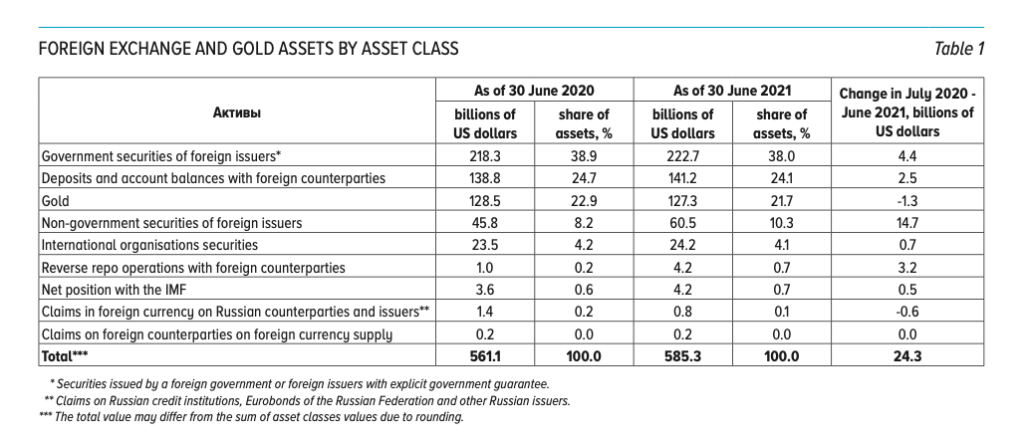

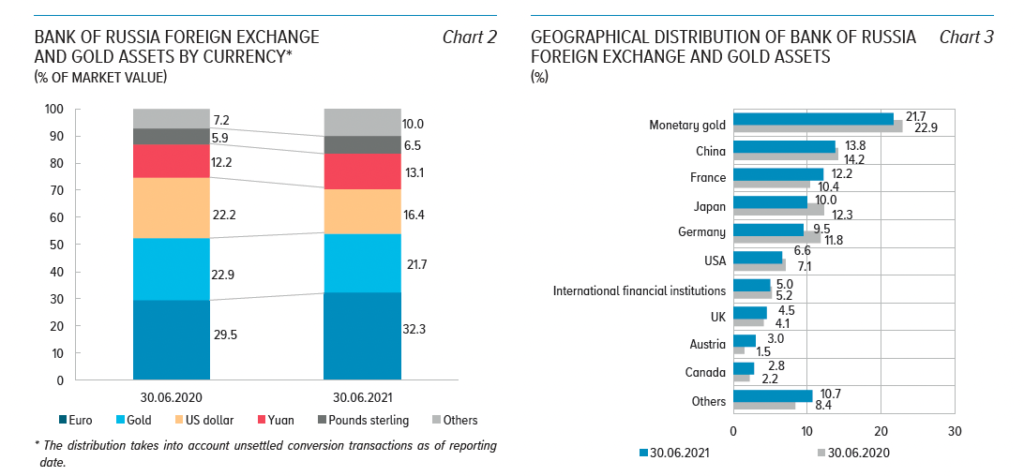

The Central Bank of Russia produces a “Foreign Exchange and Gold Asset Management Report,” but it is rather laggy. The latest is from August 2022, and illustrates the situation in June 2021.

Since gold, USD and CNY vs. the Ruble haven’t changed much since 2021, we can estimate that the present value of $128B of gold holdings, with the ruble now around 75/USD, is about R9.6 trillion. The value of the CNY reserves is about 13%*$585B or $76B, or R5.7 trillion. The Bank of Russia used to give a more detailed look at its holdings:

Most of the deposits at the CBR are from the government, so the reduction here can be seen as the government simply spending down its checking account, probably to pay war-related expenses. Nevertheless, the pattern has been for the CBR to avoid any expansionism.

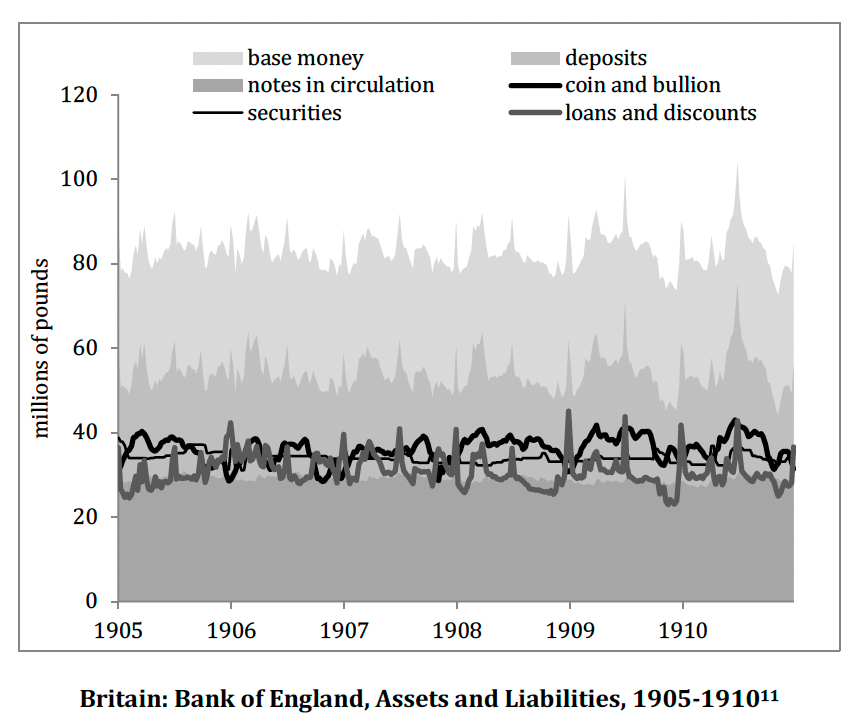

Officially, the CBR has 2298 tons of gold as of the end of 2022. At 4,500/gram, that translates to R10.3 trillion. That would cover about 33% of the R30.8 trillion of banknotes and deposits as of November 2022. This is certainly plenty of coverage, similar to the Bank of England in the 19th century. At that time, the BOE typically maintained about 1/3rd gold, 1/3rd commercial short-term lending (“discounting”), and 1/3rd government debt in its reserve portfolio.

The weekly values for “monetary base narrow definition,” which seems to be banknotes in circulation plus required reserves of banks, has been pretty stable since November 2022.

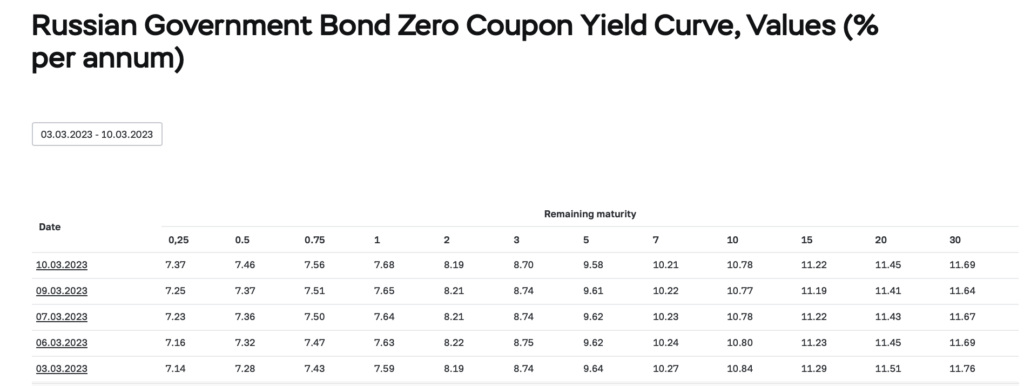

Here is the recent Russian government bond yield curve.

More reliability for the ruble has allowed the yield curve to achieve some stability. However, rates are still quite high, reflective of the generally poor history of the ruble.

One of the reasons that governments have issued debt in gold, in the past, is that they could issue at a low yield, typically 3%-5%. Then, since governments want to keep their assets and liabilities in line, they would have a gold-based currency so that tax revenues are also effectively paid in gold.

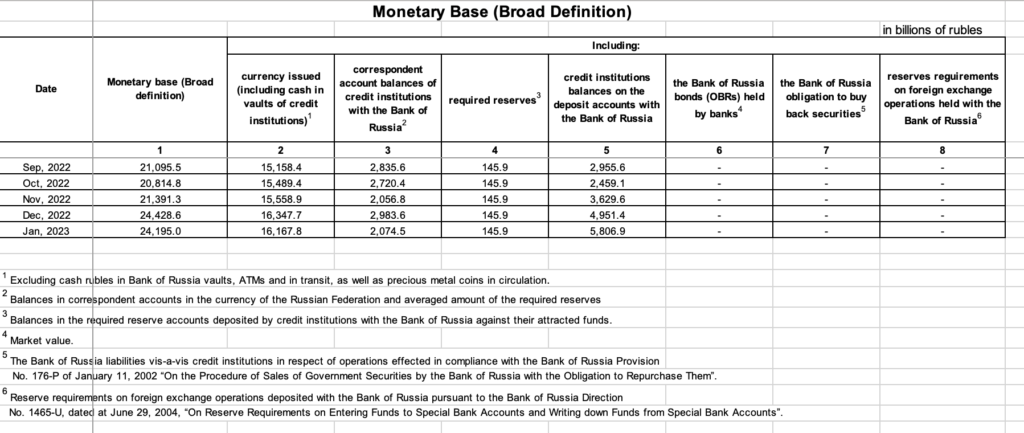

The “monetary base broad definition” seems to include currency in circulation, and total bank reserves.

Here we see quite a lot of expansion in recent months, in bank reserves, which might be related to the recent decline in ruble value. We also see that required reserves are basically negligible.

This expansion in bank reserves might be related to the government spending down its deposit account (“checking account”) at the CBR. This would have to be “sterilized” by a drawdown of other assets, probably the R3.4 trillion of “credits and deposits” on the balance sheet as of November 2022.

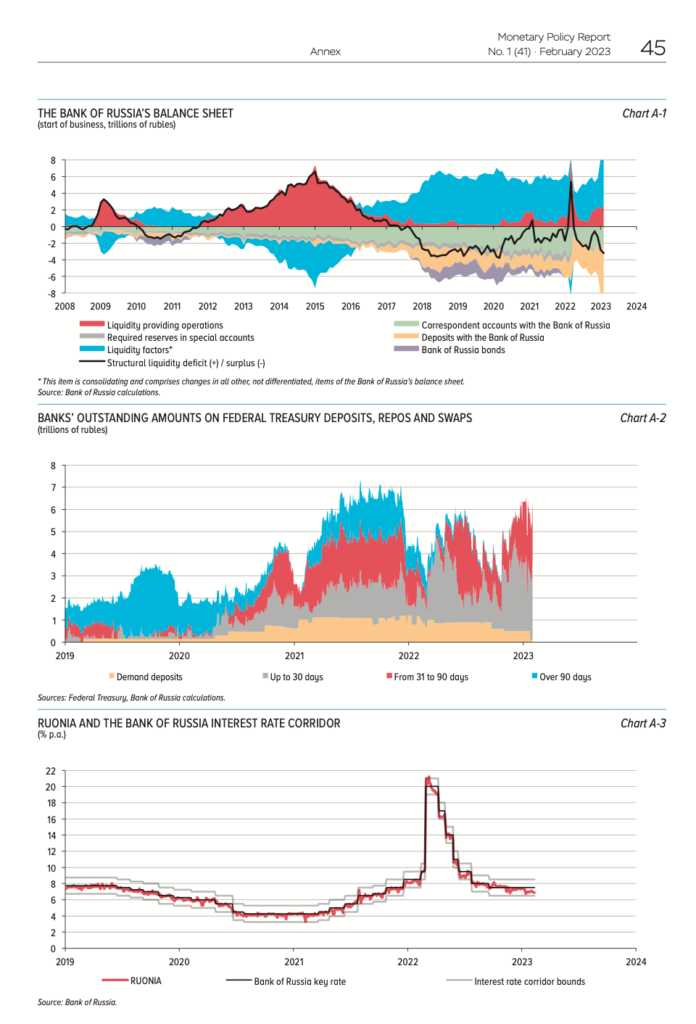

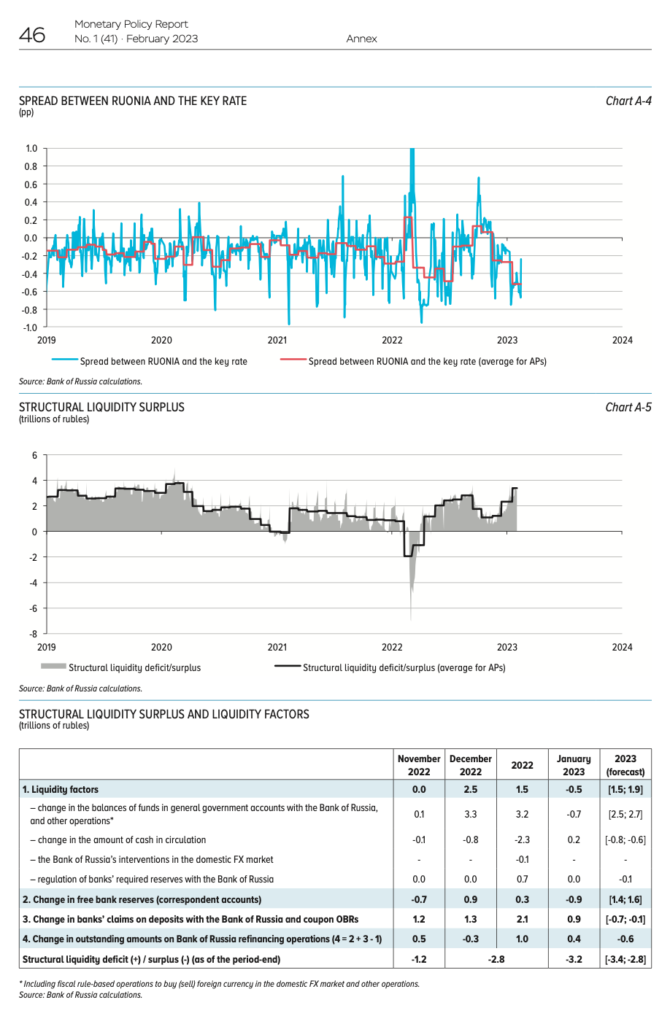

Here are some other details, from the February 2023 Monetary Policy Report.

At some point, the government and CBR might have to fix up the balance sheet by substituting marketable Russian domestic government bonds for foreign reserves that are essentially lost or at least unusable. The Bank of England did something like this in the 1920s. Then, any further drawdown of the government’s account could be “sterilized” with domestic bond sales, preventing an expansion of base money ex-government, which might have a tendency to depress currency value.

Or, maybe the CBR could gin up some other means of “absorbing” this potential excess base money, as the Federal Reserve has done recently with its “Reverse Repo” program.

With all this in mind, the Central Bank of Russia is in a fairly nice position here. It has about R10.3 trillion of gold and R5.7 trillion of CNY reserves. Even if we assume a total loss on all other foreign assets, that still covers 52% of existing banknote and deposit liabilities, and 67% of liabilities ex-government as of Jan23. This is a good place to start.