The End of the 1970s Gold Bull

November 27, 2011

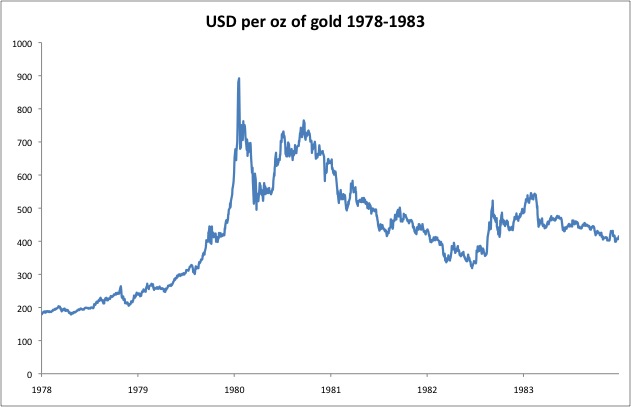

I noticed some interesting things regarding the end of the “bull market in gold” (dollar devaluation episode) of the 1970s that I thought were worth passing on.

Here’s what it looked like:

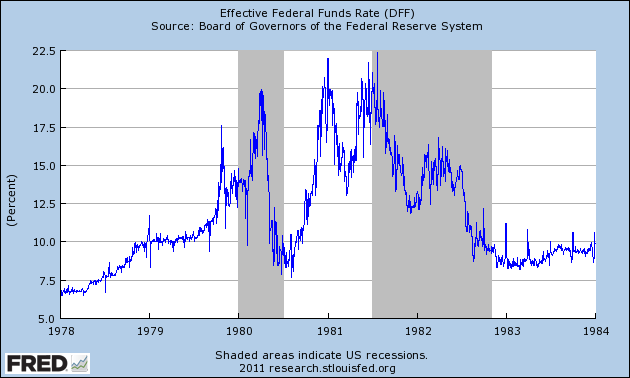

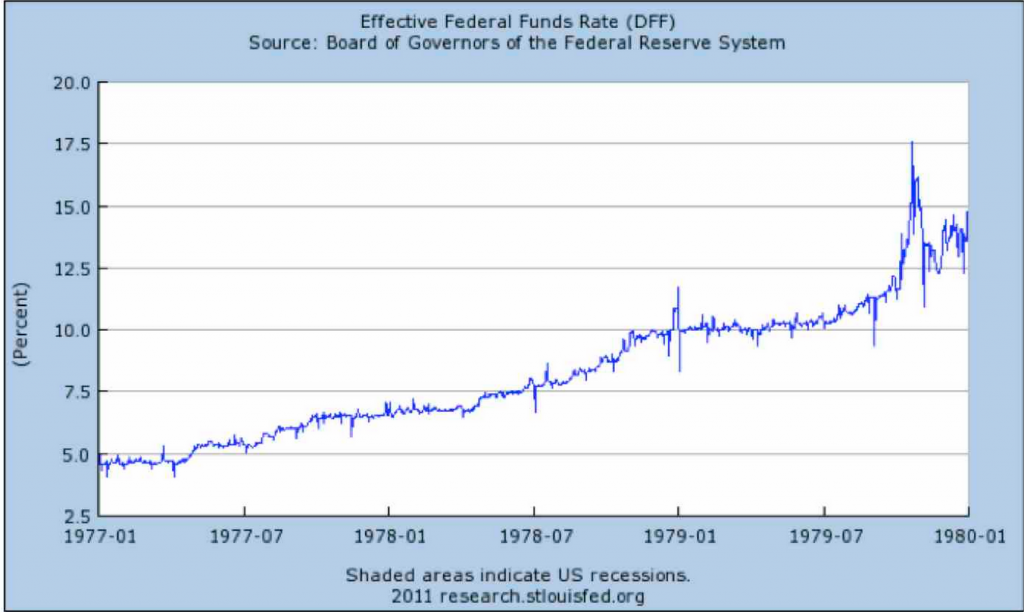

Here’s a chart of the Fed Funds rate of that time. Remember, the Fed didn’t have a Fed Funds rate target in those days, at least in the late 1979-1982 period. They were busy with the Monetarist Experiment.

From this, I think you can see that there was, first, some amazing volatility, but also that a higher FF rate tended to be accompanied by a rising dollar, and a lower FF rate would be accompanied by a falling dollar.

I suppose some people will see that and immediately become a little too dogmatic about their “real interest rate” types of theories. I’ve seen too many countries blow up trying to support their currencies with a high interest rate target to take that very seriously. It’s important to remember that there wasn’t an interest rate target at the time. Rather, the interest rate was the consequences of open market operations within the Monetarist framework. However, I think we can also see that they weren’t being too serious about the Monetarist thing, and were also keeping an eye on interest rates.

One thing that the high interest rate showed was that the Fed was willing to do something apparently economically destructive in order to support the dollar’s value. For many years, the Fed had a policy of “accomodation,” which is to say that they would keep policy relatively easy to avoid recession. The result was the gradual, and then not-so-gradual decline of the dollar’s value.

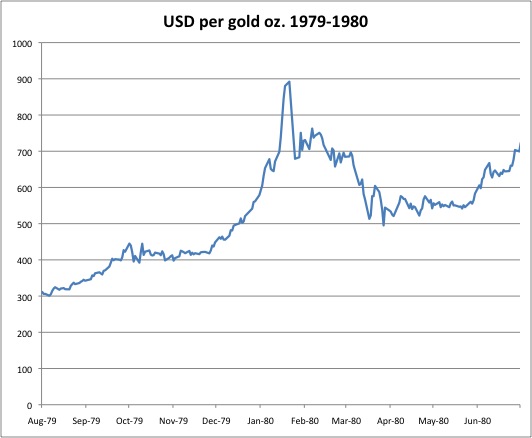

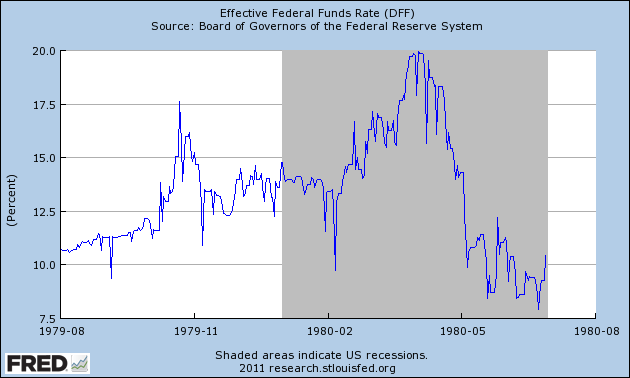

Let’s look at the most dramatic 1979-1980 period a little more closely.

We can see clearly that the dollar decline paused in October-November 1979, when there was a big rise in the Fed Funds rate. Was the Fed finally getting serious? I can imagine there was then a big backlash and stocks dropped a bunch, so the Fed backed off. This was evidence that the Fed wasn’t serious after all, and the dollar’s value collapsed. Then, beginning around February 1980, the Fed Funds rate climbs again to very high levels, and the dollar rises. The Fed Funds rate falls again in May 1980, and the dollar declines again.

This sort of thing no doubt added to the “Volcker Myth” that very high interest rates and a recession were necessary to stop the inflation. In practice, nothing of the sort is necessary. What if, instead of fooling around with this sort of seat-of-the-pants Monetarism, a gold standard policy was announced? In that case, interest rates might fall quickly, because it is wonderful to get paid 15%+ in a gold-linked currency. The lower interest rates and stable currency would cause the economy to boom.

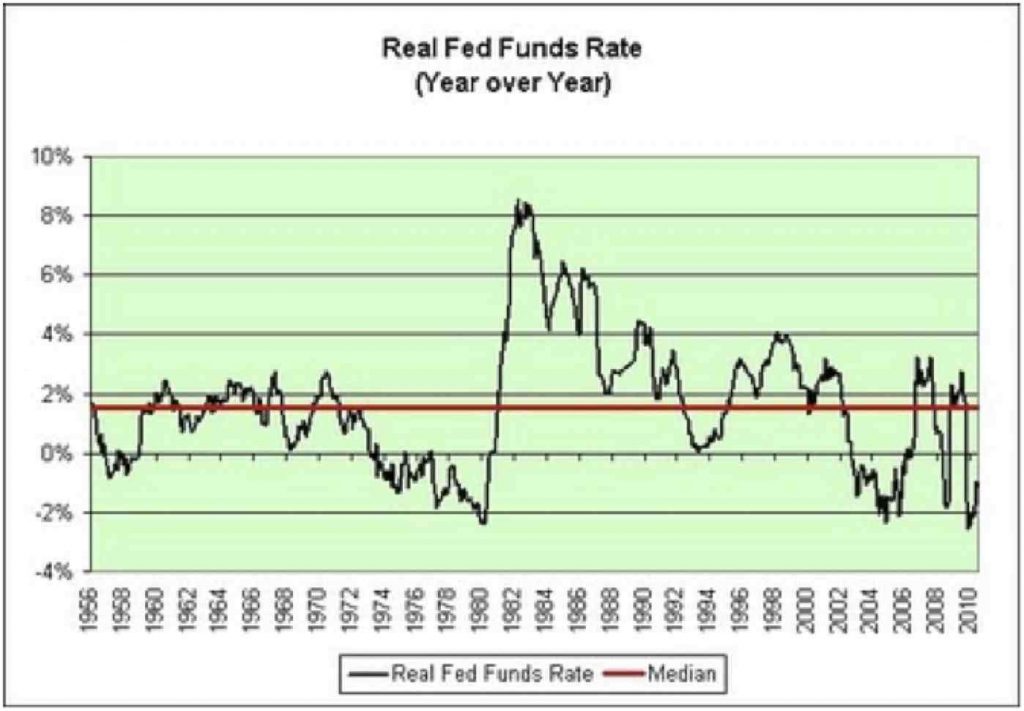

Here’s a look at the “real Fed Funds rate” during that time:

This data is why I expect the present devaluation episode of the U.S. dollar to continue probably until a) “real interest rates” are strongly positive; b) the Fed abandons all “accomodative” tendencies to support the value of the currency, even if this has consequences thought to be bad for the economy at the time; or c) we get a gold standard system.

Obviously, we are a long way from any of these conditions today. There are some alternative outcomes, along the lines of the Asian central banks around 1998, who supported their currencies through what amounted to a sort of open-ended quantity framework. In that case, interest rates fell instead of rising.

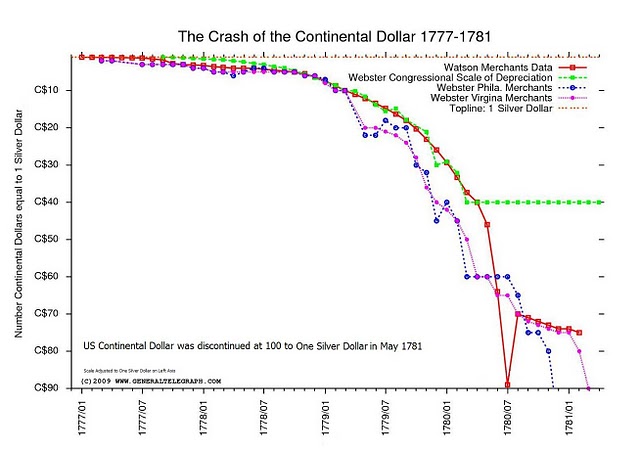

I also have here a nice chart of the devaluation of the Continental Dollar in the 1770s and early 1780s. It was this experience that convinced the Founding Fathers that gold and silver would be mandated as money in the U.S. Constitution of 1789.