We’ve been talking about The Midas Paradox (2015), by Scott Sumner.

July 23, 2017: The Midas Paradox (2015), by Scott Sumner

July 31, 2017: The Midas Paradox #2: Blame Gold

August 3, 2017: The Midas Paradox #3: It’s So Because I Say It Is

August 11, 2017: The Midas Paradox #4: Much Ado About Nothing

I’ve mentioned many times the “Prices, Interest, Money Box” that economists got themselves into beginning in the 1870s, and are still in today. The result of this, regarding the Great Depression, is that people have generally blamed nothing at all (mostly left-leaning Keynesians), or they have blamed Money (mostly right-leaning Austrians and Monetarists). The reason for this is that there is not a lot to complain about regarding interest rates, which were very low, and also prices, which were mostly pretty flexible at the time. There were a few issues regarding prices, particularly the price of labor (wages), and these have been cited (rightly) as an additional factor in the Great Depression, but I think people have sensed that this factor was too minor to lay very much blame there. This doesn’t leave anything on the menu except for Money, and thus the right-leaning economists have been blaming money since the beginning, even though the main consensus for many years (until the 1960s) was that money was not a major factor, at least until the turmoil of devaluation beginning in 1931. The Austrians and Monetarists had a big Blame-Money festival in the 1960s, but both of them were really focusing on credit, not money — either a “credit expansion” in the Austrian model or a “credit contraction” in the Monetarist. I’ve said that you really couldn’t Blame Money without blaming some kind of major rise in gold, which, despite some precursors like Cassell, didn’t really pop up until the 1980s. We looked at a lot of evidence last week, which suggests to me why, for fifty years, people did not blame some kind of major rise in gold.

July 10, 2016: The Tyranny of Prices, Interest and Money

November 27, 2016: The Tyranny of Prices, Interest and Money 2: The Old Historicism

The Midas Paradox reminds me a lot of Murray Rothbard’s book America’s Great Depression. Rothbard also led with a monetary explanation — the “Austrian Theory of the Trade Cycle”. But, he later devoted many chapters to a variety of nonmonetary elements that were also going on at the time. He sensed that there was a lot more to the story — a vast array of nonmonetary factors that did not fit in the Prices, Interest, Money framework, including tariffs, taxes, regulation, sovereign defaults, and so forth. Nevertheless, Rothbard was not really able to integrate all these factors, and concluded again by reiterating his “Austrian Theory of the Trade Cycle” theme.

February 7, 2016: Blame Benjamin Strong 2: So Obvious It’s Hard To Believe

January 31, 2016: Blame Benjamin Strong

In a similar fashion, Sumner began by blaming all declines in prices on a rise in the value of gold by definition, which also, by definition, excludes all other factors. I might note that this is the perfect opposite of the Keynesian “aggregate supply/aggregate demand” model, which implicitly blames a “decline in aggregate demand” of some unknown nonmonetary source, within a context of stable money value. The Monetarists tried to wiggle their way into the AS/AD model by claiming that the reason for the “decline in aggregate demand” was monetary, but the model itself was made by Keynesians and they did not blame monetary causes.

A theory (Sumner’s) which excludes all nonmonetary factors by definition is certainly restrictive in the extreme, so it is no surprise that he, like Rothbard, spent a lot of time later chewing over some of the many other factors at play during that time. This discussion is somewhat haphazard, with some minor issues getting loads of attention (changes in the yield of German government debt prior to the eventual default), and others getting hardly any mention at all (the Hoover 1932 tax increase). Nevertheless, there is a discussion, which is good because that is exactly what we need — a real investigation into the things that were really happening at the time, not some ridiculously simplistic mathematical model with no relationship to reality. Today, I will have my own rather haphazard and disorganized commentary on some of Sumner’s commentary, for now leaving aside the “giant rise in the value of gold” hypothesis that we are pretty much done with at this point.

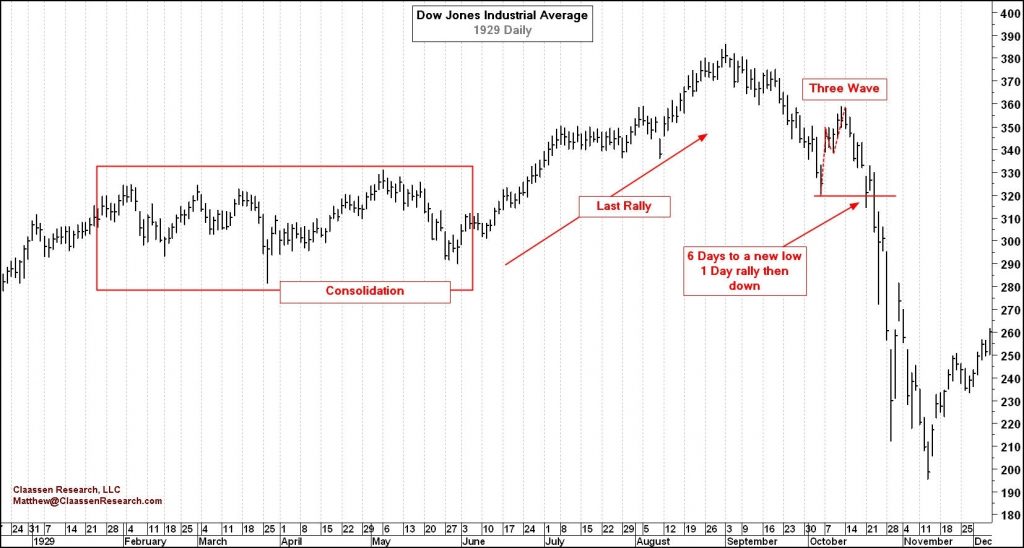

I was amused to find that Sumner directly mentioned Jude Wanniski’s 1978 proposal that the top in the stock market, and subsequent crash, in 1929 was related to the fact that the Smoot-Hawley Tariff had gone from majority Senate opposition to majority Senate support — thus making it a lot more likely. This political feat was accomplished by making the Tariff, which originally applied mostly to agricultural products, apply to a wide variety of products from Senators’ home states — thus making it a lot more destructive. Already by September 1929, around 30 governments had warned that they would retaliate with their own tariffs if the Smoot-Hawley Tariff passed. Some of them, including Canada, had already imposed retaliatory tariffs, with the understanding that they would be removed if the U.S. backed down. Before then, Wall Street had seen a booming economy (corporate profits of listed firms grew 17% in 1929), plus big budget surpluses at the Treasury, and Treasury Secretary Andrew Mellon suggesting that he would “deal with” these big surpluses with another round of big tax cuts, following the big tax cuts that he engineered in 1921 and 1925. Good times and more tax reductions? Woo hoo! But the threat of a global trade war wiped away this happy vision, and replaced it with one of potential recession. Hoover almost immediately stepped up and started spending a lot of money as a counter-recessionary strategy, thus making the big budget surpluses disappear. Mellon quickly fell out of favor with Hoover, although he did manage a minor (one percentage point) tax rate reduction before he was kicked out.

October 30, 2016: Nonmonetary Perspectives on the Great Depression 3: Nonmonetary Causes

Given this, it is not too surprising that the stock market would go down. But, I think that many people feel that this did not quite, in itself, justify the horrible crash in stock prices that took place in 1929. I agree with this.

This fundamental negative was combined with another factor, which you could call “market structure.” Basically, people had a huge amount of leverage and margin on stocks. This included many “trusts,” which were basically what we would call mutual funds today. However, unlike today when such things are regulated (since the 1930s), these “trusts” could take on as much margin as they liked. Individuals did too. Brokers would offer as much as 10:1 leverage on stocks, which also doesn’t happen today, because this too got regulated in the 1930s.

Two things resulted: One is, a lot of stockholders got margin calls, which resulted in forced selling, thus pushing prices lower. Also, brokers themselves probably got their borrowing lines called (they borrowed overnight from banks), which means that they had to reduce margin lending no matter what the individual stockholders’ situation was, and also they could not finance margin on the other side of the trade (the buyers). So, if you had a seller with $100 of capital and $300 of stocks, they would go to $50 of capital and $250 of stocks and get sold out in a margin call. However, on the other side of the trade, the buyer, they could not step up with $100 of capital and buy $300 of stock at lower prices. They could only buy $100 of stock, with no margin, because banks were pulling brokers’ funding. You can see how this could lead to an enormous collapse.

Dow Jones Industrial Average, 1929-1934

DJIA in 1929

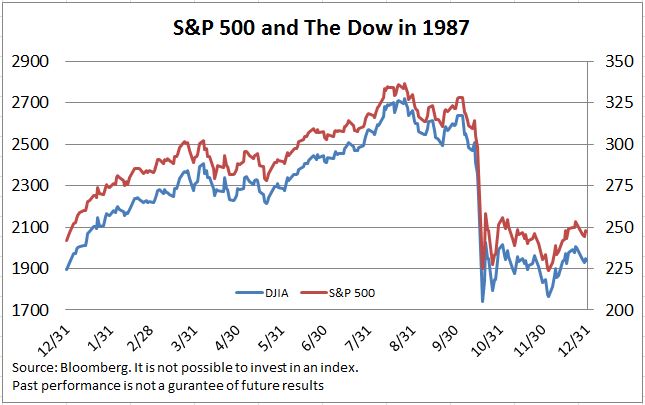

I say this because a similar thing happened in 1987, which led to the alarming one-day drop in October of that year. I wrote about it in Gold: the Once and Future Money (2007). There was a fundamental cause of the selloff, which was Alan Greenspan’s apparent abandonment of any dollar-supportive action even when the dollar was at precariously low levels. However, that fundamental element doesn’t really account for the shocking decline that followed.

For that, we have to look at “market structure,” especially something that became very popular that year, which was “portfolio insurance.” Portfolio insurance was a financial product that a lot of mutual funds and pension funds signed up for. Basically, the idea was that, if there was a certain percentage drop in the S&P500, the funds would automatically sell S&P500 futures contracts to protect the downside. The problem was, if everyone was selling futures (which, via arbitrage, would result in selling in the cash stocks), then there would be no buyers and the market would collapse. The genius trader Paul Tudor Jones understood this backwards and forwards before it happened, which is why he made a bundle on that day, why we know that the suddenness of the decline was caused by portfolio insurance, and why we call PTJ a genius to this day (even though he has been having a bit of a hard time recently).

Read a brief explanation of “portfolio insurance” and how it helped cause the 1987 crash.

You can tell that the Wanniski thesis has really irritated the academics. After trying to pretend that it didn’t exist, enough people have been pointing fingers that it seems like Sumner felt a responsibility to discredit it as much as he is able. Sumner blames the decline beginning in mid-1930 on the passage of Smoot-Hawley by Hoover, disappointing those who thought Hoover would veto the bill. As Sumner noted, the decline in the DJIA of 5.8% the next day was the biggest single-day decline of 1930. It was also the point at which the stock rally of the previous seven months crumbled into another decline. Obviously, people at the time thought it was a big deal. However, Sumner also did everything he could to avoid the suggestion that the decline in 1929 was related to the bill’s advance in Congress. Does that make sense? Sumner noted that Roger Babson, an influential investor and economist of the time (a 3% decline in stocks on September 5, 1929, was attributed to bearish comments that he made), cited the Senate’s actions as the “most important” factor in the decline of stock prices in late 1929. Instead, Sumner argues that “political turmoil” in late 1929 was a major factor in the downturn, specifically the agitation of anti-Tariff Republican and business groups. Sumner cites Babson in favor of these arguments, suggesting that “a comparable example might be the adverse stock market reaction to the disarray in the Republican Party during the summer of 1990 after President Bush abandoned his no new taxes pledge.” In other words, it was not the Tariff, or the taxes in 1990, but the “disarray” that caused the problem.

Political “gridlock” is beneficial, if it prevents bad legislation, just as people later hoped for Hoover to go against Republican Party consensus and veto the Tariff. Sumner argued that the Tariff supporters lost influence in November 1929, so the risk of the Tariff’s passage could not have been a factor. It is not surprising that the Tariff supporters would lose some confidence and influence, when people like Roger Babson were blaming a big stock decline on them. And yet, whatever “disarray” there may have been, the Tariff was indeed passed by the Senate in March 1930, on a vote of 44 to 42, with 39 Republicans in favor and 5 Democrats. The House bill passed 222 to 153, with 208 Republicans and 14 Democrats in favor. (There were 55 Republicans and 39 Democrats in the Senate, and 270 Republicans and 164 Democrats in the House.)

Sumner did note some interesting discussion that has taken place since 1987 among academics, however. In the past, the Keynesian narrative put a lot of focus on the Crash of 1929, explaining a lot of the following Depression on a sort of “fear psychology” caused by the Crash itself. But, the 1987 crash has proven to be a counterexample to that notion, as it was not followed by even a mild recession, and instead financial markets recovered nicely.

Sumner noted an interesting reaction to the 1933 devaluation of the dollar.

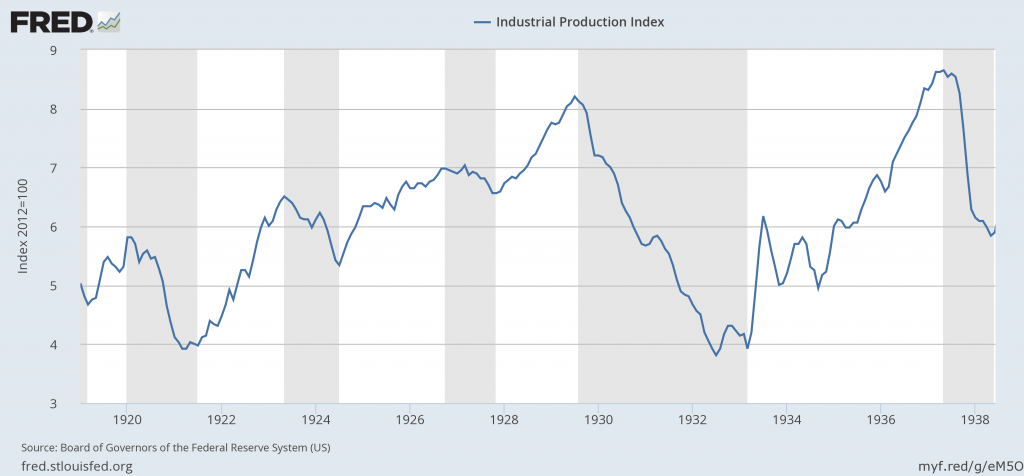

This index blasted an amazing 57% higher between March 1933 and July 1933, then dropped and stagnated until around the end of 1934. Why?

Well, if you were an investor or corporate CEO, what would you do? The Roosevelt administration said that it was going to devalue the dollar and also that it aimed to increase nominal commodity prices as a result. Owning gold was made illegal. Most countries in the world had already left the gold standard by that time, and the remaining France-centric gold bloc, now very lonely having been abandoned by the U.S., was under pressure. Sovereign defaults littered the landscape. Bond yields were very low and did not discount the loss of real value coming due to the devaluation. Plus, you might be sitting on an additional pile of cash because you were forced to sell your gold to the government. You would rush into hard assets, because they were cheap, because Roosevelt explicitly said that he intended for their prices to rise, and also, if you already had some corporate capex and production plans, you would front-load purchases as much as possible rather than wait for higher prices later. “Hard assets” would also include corporate equities, which yielded a rather nice 13% at their nadir in 1932.

Sumner then blamed considerable problems after 1933 on Roosevelt’s National Industrial Recovery Act of 1933. This indeed introduced all kinds of problems, which Amity Shlaes described nicely in The Forgotten Man, until it was declared unconstitutional in March 1935, followed by a nice economic recovery.

Here’s a little flavor of what it involved:

NIRA, as implemented by the NRA, became notorious for generating large numbers of regulations. The agency approved 557 basic and 189 supplemental industry codes in two years.[11] Between 4,000 and 5,000 business practices were prohibited, some 3,000 administrative orders running to over 10,000 pages promulgated, and thousands of opinions and guides from national, regional, and local code boards interpreted and enforced the Act.[12]

The backlash against the Act was so significant that it generated a large loss of political support for the New Deal and turned a number of Roosevelt’s closest aides against him.[6] Roosevelt himself shifted his views on the best way to achieve economic recovery, and began a new legislative program (known as the “Second New Deal“) in 1935.[48]

Implementation of Section 7(a) of the NIRA proved immensely problematic as well. The protections of the Act led to a massive wave of union organizing punctuated by employer and union violence, general strikes, and recognition strikes.[17] At the outset, NRA Administrator Hugh Johnson naïvely believed that Section 7(a) would be self-enforcing, but he quickly learned otherwise. In addition, the National Labor Board was established under the auspices of the NRA to implement the collective bargaining provisions of the Act.[7][18] The National Labor Board, too, proved to be ineffective, and on July 5, 1935, a new law—the National Labor Relations Act—superseded the NIRA and established a new, long-lasting federal labor policy.[18]

The leadership of the Public Works Authority was torn over the new agency’s mission. PWA could initiate its own construction projects, distribute money to other federal agencies to fund their construction projects, or make loans to states and localities to fund their construction projects.[3] …

President Roosevelt sought re-authorization of NIRA on February 20, 1935.[3] But the backlash against the New Deal, coupled with continuing congressional concern over the Act’s suspension of antitrust law, left the President’s request politically dead.[6][12][48] By May 1935, the issue was moot as the U.S. Supreme Court had ruled Title I of NIRA unconstitutional.

However, in keeping with the general trend of oversimplification, Sumner isolated one element of the NIRA:

Unlike most other researchers, I focus almost exclusively on the wage and hours aspects of the NIRA, taking no position on the other elements of the program. (p. 202)

Why?

The NIRA was a complex program that has proven difficult to model. (p. 205)

I see.

Basically, Sumner blames the NIRA for a 22.3% increase in nominal wage rates in two months. (In terms of gold, however, wages fell due to the devaluation.) This was accomplished not by an increase in wages, but by a NIRA mandate that employers reduce weekly hours by 20% with no change in wages. With simple application of the Prices, Interest Money model, this was blamed for continuing economic difficulties.

Of course the wage mandate was a problem, but so were a thousand other elements of NIRA, and other disruptive socialistic efforts by the Roosevelt administration. These continued interventions into economic affairs throughout the 1930s, even after NIRAs demise, certainly led to the prolonged difficulties of the time, especially combined with a continuous trend toward higher taxes at the Federal, State and Local level. Tax policy has been implicated in particular in the 1937 recession.

June 27, 2010: U.S. Tax Hikes of the 1930s

Sumner generally ignored all of this, just as he ignored the 1932 tax increase, tax policy in other countries (Britain and Germany especially), several rounds of tariff hikes worldwide, and all other elements which don’t fit neatly into the Prices, Interest and Money box.

Sumner finished the book with fifty-three pages of “Theoretical Issues in Modeling the Great Depression.” The primary “theoretical issue,” it seems to me, is that you can’t “model” all of these factors — tax and tariff policy worldwide, thousands of regulatory statues of all levels of destructiveness (not to mention the question of their practical implementation), financial market issues, sovereign defaults, military activity, and much, much more. This is not real subtle. It is stuff that any businessman can tell you is bad for business, and which many businessmen at the time were saying was bad for business, and which most any free-market-leaning economist would agree is bad for business in principle, before acting as if it doesn’t exist because it interferes with their beautiful “models,” whether it be Friedman’s M2, or the “Austrian Theory of the Trade Cycle,” or AS/AD or Blame Gold or whatever. You can investigate them, and evaluate them, but you can’t model them. Throw out the models! They don’t accomplish anything except creating their own problems, including the (price level)=1/(value of gold) “model” that serves as the centerpiece of this book.

This “throwing out of the models,” and re-integrating all the things that we already know do matter, is, basically, the “supply side revolution” that began in the 1970s.

August 11, 2016: The Gigantic Importance of “Supply-Side Economics”

And yet, here we are, forty-five years later, and not even the better right-leaning free-market economists are anywhere near absorbing these lessons. They won’t, either, because it doesn’t work that way. Young people might, though.

I think, with that, we will bring to a conclusion our look at The Midas Paradox. All in all, it was a productive exercise, to review the present state of understanding of the Great Depression among academic economists (not much better than it was in the 1990s), and also to expose the typical fallacious reasoning that passes as expert opinion these days. For me personally, it was an inspiring reminder of why I continue with these efforts. Even after all this time, we really have the whole continent of economics all to ourselves. There are vast tracts pretty much free for the taking. You go right ahead and write the definitive book on the Great Depression, or the Classical Gold Standard era, or the 1987 Crash, or Japan’s troubles since 1990, because apparently nobody else is going to do it. Go and crush it like Larry Kudlow and Brian Domitrovic crushed the Kennedy tax cut story in JFK and the Reagan Revolution — thirty-eight years after Jude Wanniski briefly mentioned it in The Way the World Works, and 47 years after Herb Stein’s Keynesian version in The Fiscal Revolution in America. It is easy to assume that “conservative” (non-Keynesian) economics was all worked out during the days of Hayek and Mises in the 1960s. And yet, here we have Sumner — a Fellow at the Koch-financed Mercatus Center and Independent Institute, plus a professor at the Austrian-friendly George Mason University, in other words about the best there is today (supposedly) among the conservative Classical Liberal free-market alternative to statist Keynesian orthodoxy in academia, basically serving as a cautionary example of the very poor state of economic understanding today.