“The Rise and Fall of the Gold Standard in the United States” is Chapter 7 of Money Free and Unfree (2017), by George Selgin. The book is a collection of previous essays. This chapter originally appeared as Cato Institute Policy Analysis no. 729 (June 2013), which you can read here. I will refer to the book version. The rest of the book has some interesting stuff, but it is mostly about technicalities regarding various central bank operations, or operations of free banking systems.

George Selgin is the head of the Center for Monetary and Financial Alternatives at the Cato Institute. Selgin has an “Austrian” background, but he is basically a Nominal GDP-targeting guy. He did a lot of research into free banking and also issues in British coinage in the late 18th century, which is a bit of a funny background for an NGDP-targeting fan but there you go. Thus, this essay is somewhat unfriendly. Obviously, if Selgin thought a gold standard was a good idea, he would not be an NGDP-targeting advocate. The Cato Institute, despite being co-founded by Murray Rothbard, has been a center for monetarism at least since 1980 or so. They generously host a few gold advocates including Larry White (and myself), but monetarism is their bread and butter. Monetarism is, of course, a doctrine of floating fiat currencies and macroeconomic manipulation via currency distortion. It is an anathema to the Stable Money principles that form the rationale for a fixed-value system based on gold, or indeed based on any “standard of value,” even including today’s dollar bloc or euro bloc. Obviously, if you are managing a currency to keep its value stable vs. gold, the dollar or the euro, then you are not managing it in such a way as to produce a stable nominal GDP, or whatever monetarist target is currently in fashion.

The original paper was written in 2013, and thus comes effectively before the release of Gold: the Monetary Polaris (2013) and Gold: the Final Standard (2017). It represents thinking of that time. I think things have moved on a little since 2013, even among academics. Nevertheless, a lot of what I’ve responded to in the past was writing from the 1980s and 1990s, so it is nice to see something relatively recent.

Let’s get started. I will have some brief quotes and then some discussion. The discussion does not refer to the quote alone, but to the arguments in the paper as a whole. The quote is just to give the flavor of the arguments.

There is, in informal discussions and even in some academic writings, a tendency to treat U.S. monetary history as divided between a gold standard past and a fiat dollar present. … In truth, the “money question” — which is to say, the question concerning the proper meaning of a “standard” U.S. dollar– was hotly contested throughout most of U.S. history. (p. 177)

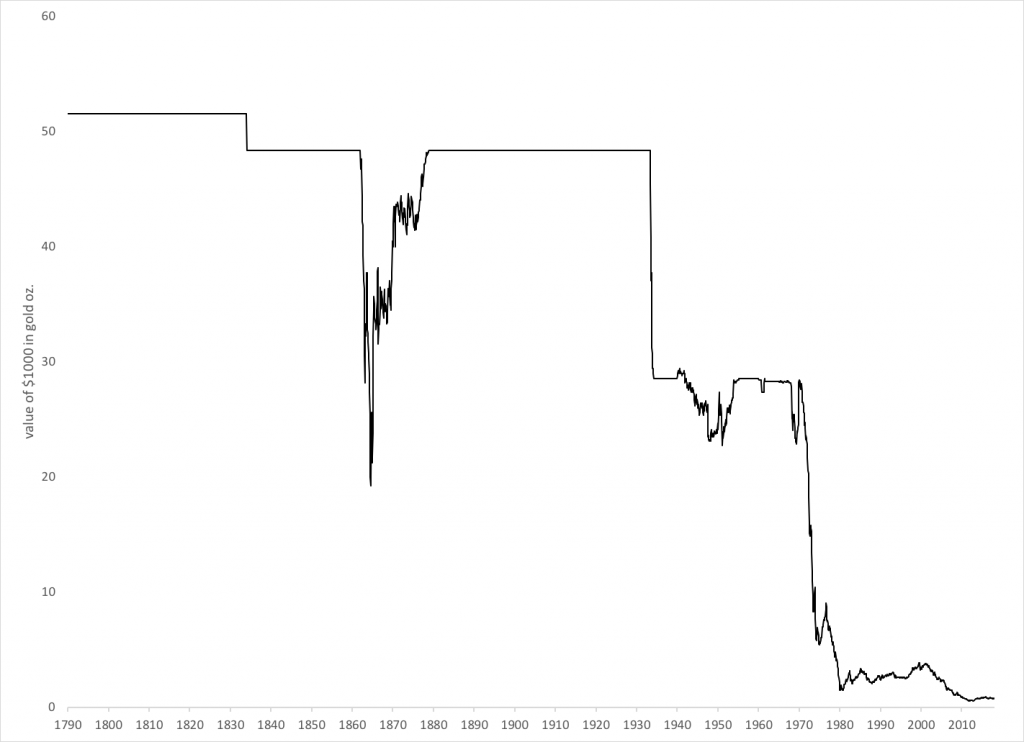

I’ve been reading this sort of thing a lot recently, from various authors. It can tend toward intentional misrepresentation, in particular that the “gold standard” was something that was tried for just a few decades around 1875-1914, rather than the basis for nearly all money worldwide for millenia. It is true that there were a lot of discussions about minor technicalities, leading to the adjustment in the gold/silver ratio in the bimetallic system in 1834, the effective abandonment of silver and adoption of a monometallic system in 1873 (in principle, since the dollar was still floating until 1879), the National Bank System after 1863, the introduction of the Treasury Gold Certificates, the dramatic debates about “free coinage of silver” in 1892-1896, and the official embrace of gold monometallism in 1900, and the introduction of the Federal Reserve after 1913. After 1934, the dollar’s value was still linked to gold, in an automatic sort of fashion (without domestic discretionary “monetary policy”), but it was illegal to own gold coins. After 1944, the U.S. had a flawed “pegged” system which combined a $35/oz. official parity with domestic discretionary “monetary policy.” But, the fact of the matter was, the dollar’s value was linked to gold, from 1789 to 1971, with some well-known lapses around wartime.

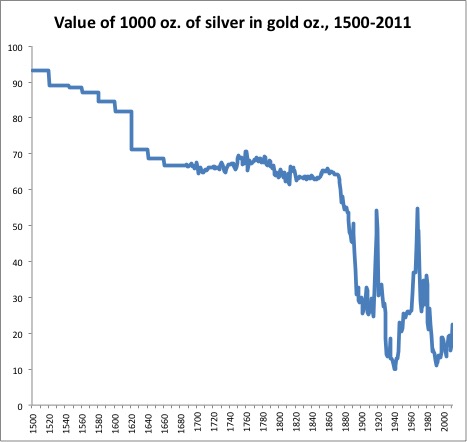

I should mention that I use the term “gold standard” in a broad sense, to mean any currency system that maintains the value of the currency fixed to gold. I include in this general historical category bimetallic and even pure silver systems, such as was true in China or Mexico in the nineteenth century before 1870. Because the market value of silver was tightly tied to gold, a currency whose value was linked to silver was in turn linked to gold, to the extent that silver’s value represented gold’s value. I called this the “gold/silver complex” in Gold: the Final Standard, and included a long discussion of what I meant by that, but since nobody is going to know what that is supposed to mean, I typically simplify as “gold standard” for rhetorical purposes.

From 1700 to 1870 — 170 years — silver’s market value varied between about 15:1 vs. gold and 16:1. This is a difference of only about 7%, from one extreme to another; or, about 3.5% on either side of the average value of 15.5:1. Thus, a silver-only currency did not vary from a gold-only currency by more than about 3.5%, and even this drift was commonly spread over a period of years. That is why I talk about a “gold/silver complex” that made bimetallism possible.

The Coinage Act of 1792 defined a dollar as either 371.25 troy grains of silver or 24.75 grains of gold, a ratio of 15:1 (24.75*15=371.25). You could argue that the effective value of the dollar was thus whatever was the cheapest to deliver: 371.25 grains of silver or 24.75 grains of gold. If the market value of silver was at a ratio of 15.5:1, then silver would be the cheapest to deliver. The market value of a “dollar” of gold would be 15.5*24.75 or 383.625 grains of silver. Thus, it would be “cheaper to deliver” 371.25 grains of silver rather than gold worth 383.625 grains of silver. The dollar’s effective value would thus be equivalent to its value in silver, and thus vary slightly from gold. But, as you can see, this was minor, amounting to a few percentage points.

In 1834, the value of the “dollar” was reduced to 23.2 grains of gold, but remained unchanged at 371.25 grains of silver. Thus, the effective bimetallic ratio was 16:1. Now, gold was the cheapest to deliver, unless the value of silver dropped below 16:1 vs. gold, which didn’t happen until the 1870s. Thus, the value of the dollar was 23.2 grains of gold.

The point of this explanation is to show that you can equivocate all you want, but the value of the dollar was pretty darn close to 23.2 grains of gold from 1792 to the devaluation in 1933, excepting the known lapses such as during and after the Civil War. The dollar’s value was then (in principle at least) pretty close to $35/oz., until 1971.

The next bit of equivocation is regarding the terminology of what constitutes a “gold standard.” Obviously, I use the term very broadly, encompassing bimetallic and even pure silver standards, if the result is, in terms of its overall macroeconomic effect, functionally equivalent to a monometallic gold standard. Selgin, like many others, instead tried to define this very narrowly, in this way arguing that this, that, or some other thing “was not really a gold standard” because it did not fit his overly-restrictive definition.

The other requirement of a genuine gold standard is that actual exchange media other than full-bodied coins themselves must consist either of paper money that is readily convertible, by either domestic or foreign holders, into full-bodied coins, or of “token” or “subsidiary” coins, generally representing small fractions of the standard money unit, that may consist of other metals but that are rated well above their metallic worth. The value of such coins, which are necessarily coined not freely but on the government’s own initiative, derives either from direct limitation of their quantity or from their also being made freely redeemable in full-bodied coins. (p. 178)

I should mention that my practice, of using the term “gold standard” as an umbrella term to include most any system for which gold is the standard of value, was also embraced by Edwin Walter Kemmerer, who was very influential from 1900 to the 1930s setting up real gold standard systems for a number of countries worldwide, beginning with the Philippines and later working with several governments in Latin America. You would think that the guy who actually created gold standard systems in the real world would have something useful to say on the topic, and he did. I gave a long quote from Kemmerer on the topic here:

For now, let’s just use this excerpt from Kemmerer:

What Constitutes a Gold Standard

Definition and Explanation

… It is not a question of the means adopted to obtain a particular result, but rather, one of the result itself. The gold standard exists then in any country whenever the value of a fixed quantity of gold in a large and substantially free international market is actually maintained as the standard unit of value.

In other words, it is much the same as mine.

Let’s continue with Selgin:

As for what a gold standard is not, it is not, first of all, a standard or “measure” of value. Under a gold standard, prices–not “values”–are expressed in gold units, and those prices indicate nothing more concerning values than that sellers of goods value the gold in question more than the goods they are prepared to exchange for it. The treatment of the gold standard as a “standard of value” invites the mistaken conclusion that, insofar as it does not rule out variations in the general level of prices, such a standard must be “inaccurate” and therefore faulty. The conclusion is mistaken both because it rests upon a faulty analogy and because inflation and deflation, whether under a gold standard or under any other sort of monetary standard, are not necessarily symptoms of either a superabundance or a shortage of money. (p. 178)

There is a bit of jumble here between gold as a “standard of value,” and gold as a “measure of value.” The “standard of value” is the benchmark in a fixed-value system. I would say that the floating fiat dollar is the “standard of value” for the Hong Kong dollar’s existing currency board. However, I would say that the floating fiat dollar is not a very good “measure of value,” because its value goes up and down, as anyone can see in the foreign exchange market. This what “floating” means.

Nevertheless, the floating fiat dollar does actually serve as a “measure of value,” or as Keynes said, a “measuring-rod of value.” For example, when the price of oil goes from $50 a barrel to $80, we assume that the value of oil has gone up, rather than the value of the dollar has gone down. This might be incorrect, of course, but that is always the first assumption. Thus, the floating dollar is indeed a “measure of value” like any currency. But, it is, perhaps, not a very good one. One day it has eleven inches, and the next day it has thirteen. I would say that gold is a better “measure of value” than the dollar because it is a closer approximation of the ideal of unchanging Stable Money, which does not vary in value at all.

Under a gold standard, prices–not “values”–are expressed in gold units, and those prices indicate nothing more concerning values than that sellers of goods value the gold in question more than the goods they are prepared to exchange for it.

This seems to refer to the “marginal theory of value” which certain groups like to claim was a big advance in economic thinking in the latter 19th century, but which I think everybody already knew already. If you actually read Adam Smith or John Stuart Mill, you will find that they understood very well that the market value of something was not necessarily reflective of the amount of labor it took to make. A very great painting might sell for much more than another painting which took just as much time to make. And, there are infinite ways to spend a lot of time making something that doesn’t have much market value. Smith and Mill were really talking about “equilibrium” conditions, in which the cost of a product basically reflects its production costs plus some return on capital, which is itself subject to “equilibrium” effects and thus tends to remain in a tight range. “Production costs” ultimately amount to the cost of labor and capital, because any goods that are production inputs must themselves be created with labor and capital.

In discussions such as this, the term “price” tends to mean a nominal price, and “value” tends to mean a market price compared to some standard of stable value, whether gold or some imaginary perfect ideal. For example, if the price of oil goes from $50 to $80, and the dollar’s value is perfectly unchanged, then the “value” of oil has also increased by 80/50ths. However, if the change in the price of oil is wholly due to a change in the value of the dollar, then we could say that the “value” of oil is unchanged. If we take the assumption common throughout history that gold serves as a practical representation of “stable value,” then the “values” are expressed by the market price in gold, this being the same as the “price” in gold when gold is unchanged in value.

The treatment of the gold standard as a “standard of value” invites the mistaken conclusion that, insofar as it does not rule out variations in the general level of prices, such a standard must be “inaccurate” and therefore faulty. The conclusion is mistaken both because it rests upon a faulty analogy and because inflation and deflation, whether under a gold standard or under any other sort of monetary standard, are not necessarily symptoms of either a superabundance or a shortage of money.

It took me a little while to figure out what this might mean. It seems to say that: if you claim that gold is a measure of “stable value,” then you are open to the criticism that “the general level of prices” in fact did go up and down, and thus, gold must not be a stable standard of value. This is, of course, the common conflation of “purchasing power” and “value,” which the better Classical economists have destroyed a thousand times dating back at least as far as David Ricardo. They have had to do it over and over because this sort of thing keeps cropping up. I consider a grasp of this principle to be a minimum standard for discussing monetary issues rationally, and as I have shown, David Ricardo and Ludwig Von Mises did too. It seems that Selgin has some appreciation of this, which puts him ahead of many of his peers in this matter.

August 3, 2017: The Midas Paradox #3: It’s So Because I Say It Is

February 19, 2017: “Prices” and Value

I also have a discussion about this topic in Gold: the Once and Future Money (2007), so as you can see I am very consistent about this.

Unfortunately, if you do not assert that gold serves as some approximate measure of “stable value,” then you are left with the question of what, exactly, the point is. You could just as easily say:

Under a banana pancake standard, prices–not “values”–are expressed in banana pancake units, and those prices indicate nothing more concerning values than that sellers of goods value the banana pancakes in question more than the goods they are prepared to exchange for it.

Selgin then continues with some decent observations regarding reserve coverage, “price fixing,” etc. All in all, it is better than you get from most “experts” on the topic.

I would establish some basic assertions about the gold standard something like this:

1) The value of the dollar was linked to gold from 1792 (and earlier), to 1971, excepting some well-known lapses.

2) A gold standard system is a system in which the goal is to maintain the value of the currency linked to the value of a fixed quantity of gold. This can take a wide variety of forms, and, in the past, it has.

3) Gold is chosen for the role of a “standard of value” because it serves as a functional approximation of the ideal of Stable Value.

4) To the degree that gold does in fact achieve this, gold serves as an accurate and superior “measuring-rod of value” of other things in the market.

In the end, there are really only two criticisms you can make of a gold standard system:

1) That we want a currency of perfectly stable value, but using gold as a “standard of value” does not adequately achieve this; and also, that there is some better alternative available. (You could probably add a subset of this, which is that the advantages of participating in a shared currency bloc, such as the floating fiat dollar bloc, outweigh the advantages of having a currency that might be close to an ideal of “stable value,” but as a consequence, experiences dramatic exchange rate swings with other floating currencies.)

2) That we do not want a currency of perfectly stable value, but would rather have something that we can use as a tool of macroeconomic manipulation, varying its value to achieve other ends, such as an NGDP target.

These are, of course, the “Hard Money Paradigm” and the “Soft Money Paradigm,” as I described in Gold: The Monetary Polaris.

We will continue with this paper in the future.