(This item appeared at Forbes.com on May 21, 2024.)

The idea of “Sound Money” — this means using gold and silver as money — has been persistently popular among the States for over a decade. Beginning with Utah in 2011, one State after another has removed barriers and impediments to using gold and silver, and digital or other alternatives based on gold and silver, in a monetary role. With over 40 States now having passed some kind of Sound Money legislation, it is now time to take on the Federal government. Representative Alex Mooney (R), of West Virginia, recently introduced the Monetary Metals Tax Neutrality Act, HR 8279, into the US House. The bill aims to repeat, at the Federal level, what has already been accomplished in many States.

Article I Section 10 of the US Constitution reads: “No State shall … emit Bills of Credit; make any thing but gold and silver Coin a Tender in Payment of Debts …” The term “Bills of Credit” refers to paper money, which States often used to pay debts in the past, often resulting in terrible inflation and even, in the 1780s, hyperinflation.

Today, most people have no clear idea of what the Federal Reserve, and the US Treasury, is actually doing with their money, but they suspect that more monetary inflation is a likely outcome. The principle of allowing the free use of an alternative — we all know there is only one that has been proven to work — gains widespread popular support, among Republicans and Democrats alike. The main difficulty is related to taxes on gold and silver, primarily sales taxes and capital gains taxes. This is related to the categorization of gold and silver as a “collectible,” rather than as a currency like Canadian dollars or euros, which falls into a different tax treatment. You can buy a cola with Canadian dollars today, and as long as buyer and seller agree to it, there is no particular problem. However, if you tried the same with a gold coin, or some digital alternative (many of which now exist), the transaction might be classified as a “barter transaction” and be subject to sales taxes or capital gains taxes. There could be additional regulatory requirements, such as reporting mandates.

Some States have gone a step further, and have initiated the acceptance of tax payments in gold and silver, or hold some of their cash holdings in the form of gold and silver. Just in 2024 alone, Alabama has removed all taxes from gold and silver transactions; Nebraska has ended income taxes on gold and silver, and has declared that Central Bank Digital Currencies are not lawful money; Kentucky has ended sales taxes on gold and silver; Utah has voted to expand its use of gold and silver at the State government; and Wisconsin ended sales taxes on gold and silver. Similar efforts in Missouri, Idaho and New Jersey have gained widespread support, but have not passed yet.

News on legislative advances is collected at the website of the Sound Money Defense League, which also supports Representative Mooney’s bill at the Federal level. Citizens for Sound Money has also been highly effective, with a recent effort in Missouri that teamed up with local grassroots organizations in the State.

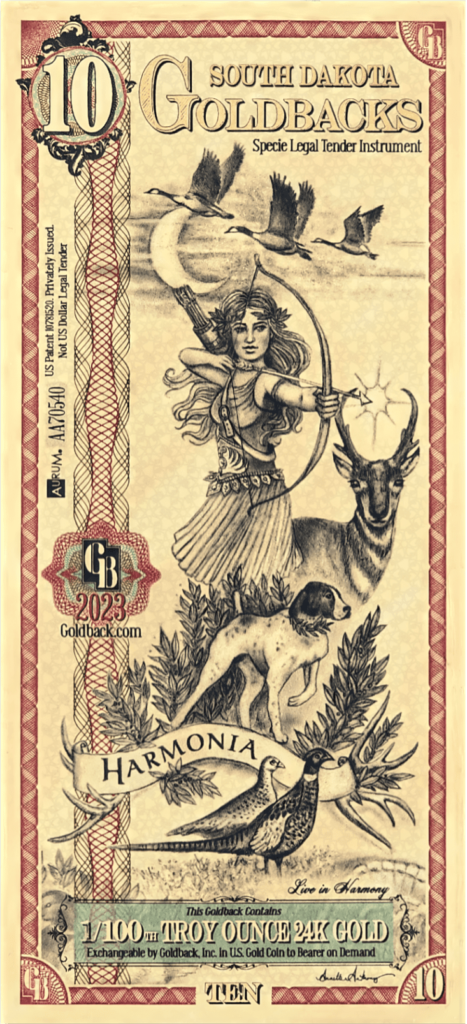

Some of the private-market alternatives that have popped up in response include the remarkable Goldbacks, which look like banknotes but actually contain gold equivalent to their face value, impregnated into a plastic sheet.

However, the primary form of alternative gold-based transactional platforms is likely to be digital. Already there is a profusion of such platforms, including cryptocurrency “stablecoins” such as Tether Gold and Pax Gold, and other crypto-based solutions from Kinesis, Lode and Glint. The United Precious Metals Association offers a checking account-like service that allows the use of standard debit cards that run on Visa and Mastercard networks. Users can even opt to lease their gold holdings, like a regular bank, and earn 2%-3% on their balances.

Probably the easiest way to implement large-scale adoption of gold-based transactional systems is through regular commercial banks. Any commercial bank today can easily use all of its existing software and regulatory systems to set up “checking accounts based on gold.” As a bank, they could even make a profit on gold lending, just as UPMA does. Even just one bank — let’s say it is a regional bank in gold-friendly Utah — can do this acting alone, and allow transactions between anyone holding a “gold checking account” at that bank, settling all transactions internally.

Commercial bank systems are quite old-fashioned and clumsy compared to some of the alternatives around today, including those based on Hashgraph as recommended by technologist George Gilder in the last chapter of Life After Google (2018). Among other advantages, Hashgraph allows up to 500,000 transactions per second, about 10x more than the entire worldwide Visa and Mastercard network. Also, it facilitates “atomic settlement,” in real time, rather than the next-day settlement (or later) common at commercial bank checking accounts today.

However, commercial banks have a lot of advantages too. They have huge legacy administrations to take care of all the security and regulatory elements of money transmission today. Also, they are perceived as reliable — an important quality if gold-based payment systems are to move beyond the small-scale retail level into big-business size. If you were going to make a payment of 200 kilograms of gold, let’s say from an oil refiner to an oil producer, it is nice to know that Wells Fargo has your back.

All of this is right in line with the “parallel currency solution” that I described in a US Congressional Testimony in 2012 — thank you Ron Paul — and described in greater detail in my 2013 book Gold: The Monetary Polaris (available in free .pdf format at newworldeconomics.com).

This was pretty radical stuff in 2012, when Bitcoin and other crypto offerings were still very much under the radar. But it is the norm in most of the world, where there is typically a low-quality domestic currency (maybe the Guatemalan quetzal or Vietnamese dong), and a higher-quality international currency such as the dollar or euro, in common everyday use.

I think we all know that today’s dollars and euros are starting to smell like quetzals and dongs. There has always been one “international currency” that everyone can agree on, and we all know what it is. It’s the same one that the BRICS consortium has already agreed on, and it is gold. Already, BRICS members including Russia have been introducing “gold checking accounts” at major commercial banks. Russia even has its own version of goldback notes, and I hear they are becoming popular.