Typical Bureaucratic Strategy

December 12, 2010

In a moment of clarity, I said back in 2008 that governments, when faced with demands to reduce spending, would cut the most important things first:

This idea has turned out to be more important than I thought, so it is worth chewing over it a little more.

Of course, you have to ask: “most important things” according to who? I naturally assumed that we meant: most important to the citizens that the government serves. From the citizen’s perspective, there is important and necessary spending, and waste. The important and necessary spending is the minimum necessary to provide the desired services. For example, if it were possible to provide a decent education at a state university for $4,000 per student — and why not, since it’s just some people in a room with a poorly paid professor and some books, and the facilities have already been paid for — then the necessary spending is $4,000. If we spend $10,000 per student, but get the same results as we could get with $4,000, then we obviously have $6,000 of waste.

The bureaucrats look at it a different way. There is the money going out the door, and the money that is not going out the door. The money that is not going out the door is going into the pockets of bureaucrats and public employees, in the form of salaries, pensions, perks and so forth. Plus a rather large amount of pork and other handouts to government contractors and other cronies. Not to mention a healthy dose of simple theft. From their perspective, any money that is going out the door (i.e. spent on important services) is money that is not landing in their pocket. Those are their expenses. So of course when there is pressure on revenues, they want to cut those expenses first, to preserve their profit margin.

Charles Hugh Smith has done such a nice job of describing this bureaucratic tendency that I will just reproduce his entire posting here:

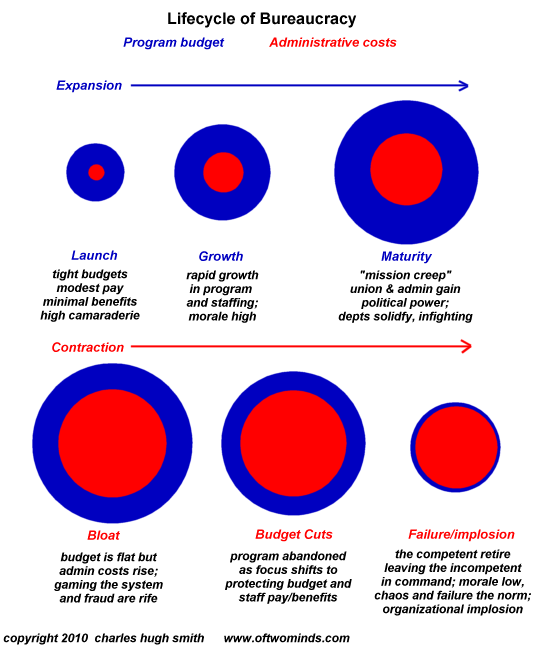

All bureaucracies share a lifecycle of growth, self-protection and implosion.

Yesterday I discussed the doubling, tripling and quadrupling of the “big ticket” household expenses: property taxes, public college tuition and healthcare costs.

( Inflation Is Rampant in Tuition, Healthcare and Property Taxes).

Correspondent Andrew T. asked:

The common thread I could immediately see after the first few sentences was the public sector employees and their unions who inhabit those entities.

Andrew writes from Canada, where healthcare is overtly a public/Central State service. But in the U.S., if you tote up Medicare and Medicaid, the Veterans Administration healthcare system (over $1 trillion per year for the three agencies) and all 2,300 pages of regulations on the so-called “private” healthcare system (profits are privatized, costs are socialized), then what you have is a defacto government-controlled healthcare system with all the fraud, fiefdoms, waste, duplication, and resistance to efficiency of a government bureaucracy.

Before we get to the lifecycle of bureaucracy, I want to be clear this is not a slam on people who dutifully work in bureaucracies. Bureaucracies arise to serve a social or political need (or perceived need) in an organized fashion, and systems of management, accounting, oversight and so on are required.

But just as bureaucracies arise, they also ossify, devote their energy to self-preservation and then implode.

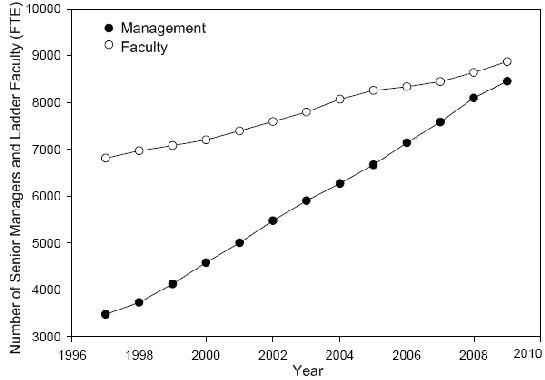

We can see how this works in this chart of the University of California system’s count of faculty and administrators. I suspect this phenomenon is universal in state-funded universities: bureaucratic staff that have nothing to do with the classroom, research or teaching grow to dominate the payroll and the budget.

Much of this is human nature: if the budget can be expanded to serve my department or agency, then it will be expanded. There are other organizational tropisms as well: ENA, for example: “everyone needs an assistant,” including the current assistant.

When an economy is growing rapidly, then the waste, fraud, duplication, inefficiency and bloat go unnoticed because tax revenues and the budget are rising even faster than the bloat and inefficiency. The problem arises when tax revenues fall. Then the bureaucratic impulse to never-ending growth is stymied, and the various bureaucracies turn inward as they muster their forces to wage internecine warfare with other protected fiefdoms.

(That’s straight from the Survival+ critique.)

Self-preservation become the paramount concern, and the original purpose of the bureaucracy is buried beneath the urgent priority of saving perquisites, benefits, staffing, and budgets.

When cuts are required, the actual service provided is slashed to maintain bureaucratic bloat. Thus the Administration of a university suffers simulacrum cuts (a “hiring freeze,” etc.) while the teaching and graduate-student teaching assistant staff levels are slashed and burned.

“Tip of the spear” military forces and readiness are left twisting in the wind while the thousands of senior officers in the Pentagon and Services jostle for promotions. At the point of implosion, there are more captains, colonels and generals than actual war-fighters. (There are plenty of barbers, cooks, waiters and assistants, though, to serve the senior officers.)

Benefits for the survivors are left basically untouched while new hires are fired to preserve the budget for those with seniority.

At some point, the mission of the bureaucracy is completely lost, and the citizens’ patience with institutional incompetence and self-aggrandizement finally runs out. Although it seems “impossible” in an era where the Federal Reserve just conjures up $1 trillion and the Federal governments sells $1.3 trillion in bonds every year to fund its ballooning deficit, bureaucracies can and will implode.

On a small scale, we are seeing this process in action as small-town police forces are disbanded. This process will eventually be seen in smaller cities merging with adjacent cities to cut costs.

I have prepared this visual representation of the bureaucratic lifecycle:

This is interesting, but it has some special significance when it comes to the politics of “austerity.”

I say that citizens are, for the most part, very much in favor of spending cuts right now. They know that these 10%-of-GDP deficits are not sustainable, and that the process of them not being sustained will be unpleasant. Also, they know that most of that river of govenment largesse is being effectively stolen (i.e. financing the red circle). If that’s so, why is it that as soon as there is any tiny spending cut, people are out in the streets demonstrating?

February 14, 2010: The Problem with Greece

May 2, 2010: Thoughts on Greece

The reason, of course, is because it is always the most important things that are cut first, rather than the waste. If some bureaucrat stood in a room with a Powerpoint presentation, and said: “We are going to cut all the most important services to the most disadvantaged people first, while preserving our absurd compensation, bloated headcount, and gallery of corporate parasites. What do you think of that strategy?” Obviously you would then want to throw something at that person. That’s why they never, never, ever actually say that. People are clamoring for a reduction in the red circle, but all they ever get is a reduction in the blue circle. The media and most political analysts never make this distinction — nor do they want to, because they understand that their natural allies are the elite/bureaucrats, not the citizens. They just say: “Well, you can see that people are unhappy with even the very small cuts we’ve made, so there you have it, we simply cannot cut our spending, not one little bit, and while we’re at it maybe some stimulus would help.”

Assholes.

The next thing that happens, of course, is the tax hikes, fee increases, absurd speeding ticket fines, and all the other efforts to squeeze more blood out of the taxpaying citizen. The citizen naturally says: “Is the expansion of bureaucratic bloat/theft/corruption/corporate parasitism caused by taxes that are too low? I think rather not!” Taxes are already high enough to fund all the necessary and desired services. In fact, they are too high. Maybe way too high. Of course the media and the political analysts say: “People are complaining about the deficit, but they don’t want a tax hike. It just goes to show that they are irrational and should be ignored. Of course higher taxes are necessary. Not to mention inevitable. And a moral necessity.” The notion of, hmmmm … maybe spending less money … is never brought up. So taxes head higher, but they don’t actually create any new revenue, in large part because the citizens think this is simple thievery, so they find a way not to pay.

January 17, 2010: The Futility of Raising Taxes

May 9, 2010: The Two Santa Claus Theory

Thus, I say again that the solution is:

Less Spending

I have to hand it to the Republican Party here. They have really held fast to the idea that you Do Not Raise Taxes in a Recession. There were even some pretty decent tax-reform plans in the various deficit-reduction discussions, such as a reduction in the top corporate tax rate to 25%, in line with Europe. Obama’s reduction of the payroll tax is not a bad idea, but I find that for a “lower income tax cut” a better solution is to raise the standard deductible, i.e. the income which is not taxed. We should make the first $30,000 or so of income tax-free, $60,000 for a couple, and an additional $10,000 for each child. So, a family of four would be tax-free on the first $80,000 of income. Doesn’t that sound nice?

Republicans also understand that you can’t really reduce Federal government spending without tackling Social Security and Medicare in some way. Unfortunately, they aimed at the wrong one, Social Security, which is actually in pretty good actuarial shape. It’s Medicare and other healthcare spending which needs to be reformed. Alas, all that Medicare spending out the door is revenue to big healthcare industries, and the Republican Party kinda likes government money landing in the pockets of corporations, if you know what I mean. Government money landing directly in the pockets of lower-income retired people, i.e. Social Security, well, that is a problem. And defense spending? Best not to bring that one up at all. I applaud Republicans’ attempt to grapple with the spending issues, but it would be nice if they weren’t so obviously corrupt about it. I suppose that’s the age we live in.

The problem with Federal (and state) healthcare spending is not that there are too many services provided. The problem is that there is too little. In other words, the blue circle is kinda skimpy and the red circle is huge.

Today, the U.S. government, federal and local combined, is spending about 7.5% of GDP on healthcare. In 2004, Britain’s National Health system, which provides completely free healthcare to all British citizens, cost 6.9% of GDP. (It cost less than that in the past.) So, the first question is: why don’t we have National Health here? We’re already paying for it. The second question is: If 6.9% of GDP is enough for soup-to-nuts healthcare for the masses, then why spend more than that in the future? In other words, we could solve the healthcare spending problem simply by declaring that 6.9% of GDP is what we will spend, no more, and there you go.

August 16, 2009: Healthcare Reform Conservatives Could Love

I am saying this mostly for the future period, when it will be time to pick up the pieces. Probably we will have our little disaster. But in the future, we will need some people who can understand this stuff. Then we can have a nice recovery after the disaster.

At some point I may tell you the story of the decline of the Spanish empire. They actually tried to fix it, but they didn’t know how. After their disaster, they had another disaster. And another. And another. It took centuries. Spain’s decline finally ended when — believe it or not — the ruling Hapsburgs were replaced, by a quirk of royal succession, with a branch of the Bourbons. The new monarchs brought in a whole set of new bureaucrats from France. The people just had to be replaced.

I should add one word about the Obama/Republican tax deal. This is not a “tax cut.” It simply maintains things the way they have been since 2001-2003. How can it “cost enormous amounts of money” to keep things the same? The fact that we even have this sort of rhetoric, on such a widespread basis, is disturbing. Like the endless AMT extensions, this is really a way to avoid a tax hike. The Republicans have done a good job here of blocking tax-hike efforts. Maybe that’s why they defeated the Democrats in the last Congressional election hmmmm? Earth to U.S. political commentators: the tax-hikers (Democrats) ate shit in the election. Maybe you should draw some conclusions about that. If you are worried about the deficit — and you should be — then you have to cut Federal spending from 25%-ish of GDP down to 19% or so. Over the past fifty-five years or so, no tax hike has ever been able to raise Federal tax revenues above its 18.5%-of-GDP average for any appreciable length of time. You are NEVER going to fix the deficit with tax hikes.

January 17, 2010: The Futility of Raising Taxes

May 9, 2010: The Two Santa Claus Theory