(This item originally appeared at Forbes.com on May 3, 2019.)

Venezuela — what a mess!

Despite how bad things are right now, I think that Venezuela could become happy in prosperous in a very short time; and become the wealthiest country in Latin America within fifteen years, or even ten. In 1948, what you are now seeing in Venezuela — hyperinflation and general economic collapse — was happening in Germany and Japan. Two years later, both countries’ economies were roaring to life, and they continued roaring throughout the 1950s and 1960s. They were among the greatest economic comebacks of all time. Venezuela could do the same today.

The solutions implemented in Germany and Japan were very similar:

First: In 1948-49, the hyperinflationary mark and yen were linked to the dollar at fixed rates. Since the dollar itself was linked to gold at $35/oz. within the Bretton Woods system, this meant that the mark and yen were effectively linked to gold. Stable Money.

Second: Both Germany and Japan had huge tax reductions in 1948-1950, and followed up with several more rounds of tax cuts in the 1950s and 1960s.

Third: Price controls, rationing, labor restrictions, and other socialistic interventions were eliminated in 1948-49.

Fourth: In 1948-49, both Germany and Japan outlawed all deficit spending and bond issuance, to eliminate the urge to finance the government with the printing press. The government was to spend out of current income only.

I described this process in Japan in more detail in Gold: The Once and Future Money (2007), and for Germany in The Magic Formula (2019).

The solution for Venezuela must involve what I’ve called “the Magic Formula“: Low Taxes, and Stable Money.

The Stable Money aspect should include a link to a major international currency, probably the dollar although the euro could also be used. This should be either a formal currency board, such as used by Bulgaria, or adoption of the currency itself, i.e. “dollarization” or “euroization.” Unfortunately, such a step would probably induce some fears of excessive political influence by the United States or EU; and these fears have some justification. However, Venezuela could adopt a dollar-linked currency board, or even dollarize, without any other U.S. influence on policy. Hong Kong today, which is of course part of China, has a dollar-based currency board. El Salvador is dollarized, but maintains its sovereign independence in other spheres. The introduction of euro-based currency boards in Estonia and Bulgaria stopped hyperinflation overnight.

For Low Taxes, I suggest an aggressive approach that is suited to Venezuela’s present crisis condition.

A review of successful emerging market economies around the world shows a common pattern of a tax revenue/GDP ratio between 10% and 20%. Although developed economies often have a revenue/GDP ratio much higher than this, they do not have high-growth economies. France or Denmark can stagnate in apparent comfort with these heavy taxes, but when such systems are applied to emerging markets, the result tends to be stagnation at poverty levels. For Venezuela to get rich, the “tax burden” or revenue/GDP ratio should be in the teens.

The next question is: what is the best way to generate this level of tax revenue? I suggest that Venezuela should have a one-tax system: a VAT of 20%. This is only a little above today’s VAT of 16% in Venezuela, and all the administrative structures are already in place. The present personal income tax (34% top rate), corporate income tax (34% top rate), and payroll tax (24.5% combined) can be eliminated. With the addition of a few other taxes such as property taxes or tariffs, the result should be a revenue/GDP ratio around 15%-18%. This is enough to provide basic government services and also some social services including public education, health and welfare. It is about the same as China and Singapore today.

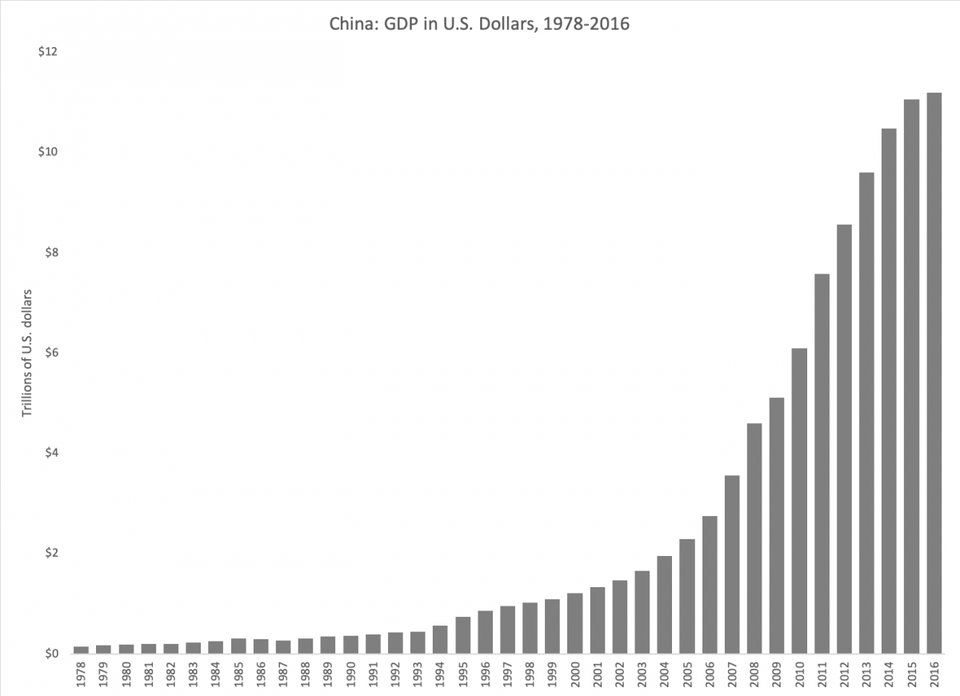

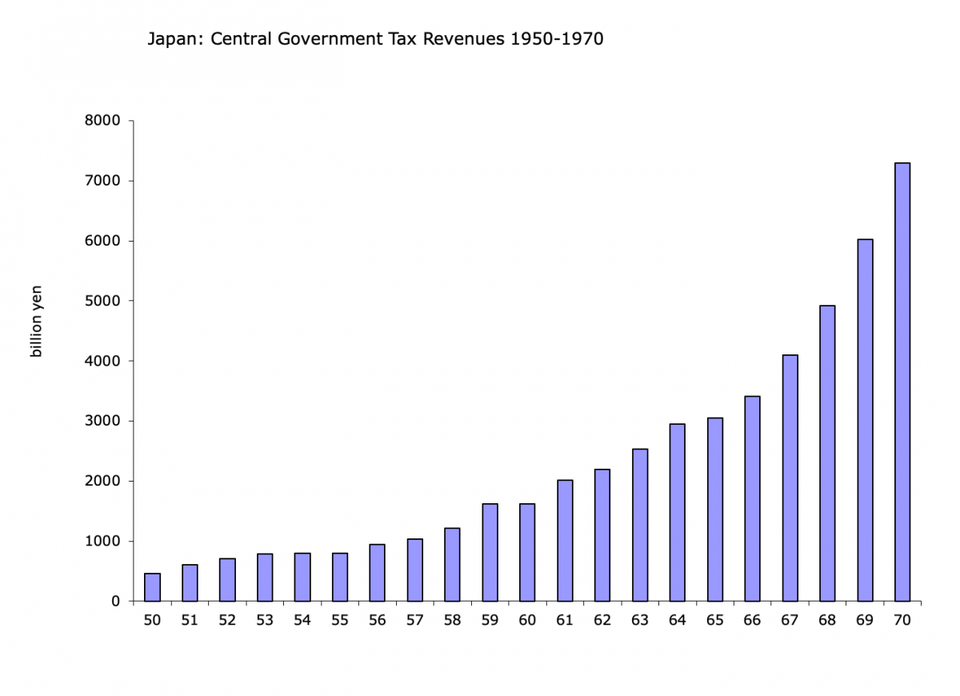

With no income or payroll taxes, and Stable Money in the form of a dollar link, Venezuela should be one of the best places to do business in the world. GDP would quickly grow; and with that, tax revenue would also grow, which would allow a broader range of government services. People have little idea how much an economy can grow, when it has the Magic Formula. Between 1994 and 2004, China’s economy, in terms of nominal U.S. dollars, grew 24 times larger. Tax revenue, naturally, also got about 24 times larger. But this sort of thing has happened before: between 1950 and 1970, Japan’s economy got about sixteen times larger.

With Low Taxes and Stable Money in place, there would be no more need for the various socialistic band-aids that seem necessary in an environment of hyperinflationary collapse. Price controls, rationing, restrictions on hiring and firing, and other such measures can be eliminated overnight. In 1948, the German government announced on the radio that price controls and rationing would be eliminated. German citizens were surprised to hear that the changes would apply the next morning. In the next ten months, Industrial Production grew 71%.

The last element in the successful German/Japanese example was a hard ban on all government deficit spending and bond issuance. Until 1965, all Japanese government bond issuance was outlawed. The country had no government debt. But the soaring economy quickly produced so much tax revenue that they had to have a special meeting each year (a “supplementary budget”) to get rid of the excess money. They cut taxes further, and also increased their spending plans, especially on public works. Hong Kong — which combined its dollar currency board with a 16% “flat tax” and a tax revenue/GDP ratio of 13% — enjoyed so much revenue that, not only did it have no government debt, but years of budget surpluses accumulated into a “fiscal reserve” of assets that was recently 67% of GDP.

I would add one more principle for Venezuela:

Fifth: Ignore everything the International Monetary Fund says. (I would normally add the World Bank also, but David Malpass, the World Bank’s new president, would probably agree with every element in my plan.)

The Magic Formula works. It worked for Germany. It worked for Japan. And it would work for Venezuela today.