Watch How They Steal The Money

August 7, 2011

The amount of theft going on these days is immense. I thought I would catalog at least a few ways in which it is happening in Europe. This is not supposed to be a comprehensive list. I hope that some Matt Taibbi will compile some sort of record of these things. Real journalists are as rare as unicorns these days. Plus, they have a tendency to die suddenly.

Sovereign bailouts: This is billed as “saving governments” and, by extension, entire nations. Actually, the governments are worse off than before. They not only have just as much debt, they have more, all of which must still be paid. So where’s the bailout? The bailout is of the banks. If Greece’s government defaulted, and restructured with a 50% haircut (i.e. they promised to pay back €0.50 for every €1.00 of principal), then a lot of banks and private institutions would take a loss of €0.50 on their Greek government debt. The “bailout” is not just a way to add more new debt, it is a way to roll over existing debt that matures. Every month that passes, a little more Greek debt matures. The bankers get paid back €1.00 instead of having their debt default, as it certainly would have if not for various “bailouts.” Greece’s government owes just as much money, but now it owes the money to, essentially, German taxpayers rather than bankers. So who takes the loss when Greece later defaults? Why, German taxpayers! Who didn’t even own the stuff until a little while ago. The same applies for Portugal, and now Italy and Spain.

This is all standard “economic hitman” operating procedure. The very same thing happened in Latin America in the 1980s and in Asia in the 1990s. I wrote about it in my book.

July 1, 2008: Privatize the Profits. Socialize the Losses.

Bank bailouts: Ireland’s government and people got such a gang rape — in full public view with all the world’s media standing by — you just have to laugh.

Ireland To Spend More Than 50% Of GDP To Bailout Banks (But Bank Bondholders Will Not Lose A Dime!)

The Irish government’s debt/GDP ratio was 25% at the end of 2007. 25%! At the end of 2010, it was 99%. Projections are for it to rise to 111% in 2013. How did that happen? It looks like pretty much the same thing: Ireland’s government takes the hit so that the banks’ lenders get paid back 100%. Remember how banks work:

March 23, 2008: How Banks Work 7: the Lender of Last Resort

March 16, 2008: How Banks Work 6: Liquidy Crises and Bank Runs

March 9, 2008: How Banks Work 5: Selling Loans

February 24, 2008: How Banks Work 4: Banks and the Economy

February 17, 2008: How Banks Work 3: More Elephant Poop

February 10, 2008: How Banks Work 2: Shitting Like an Elephant

February 3, 2008: How Banks Work

What should be happening here is a debt/equity swap. A large portion of the banks’ debt gets converted to equity. This solves the insolvency problem instantly, and doesn’t cost the taxpayer a dime. You just take a red pencil to the balance sheet, mark it up a little bit, and all is well again. This is how capitalism is supposed to work. Why don’t governments do this? Interesting question.

October 12, 2008: Effective Bank Recapitalization 2: Three Examples

October 5, 2008: Effective Bank Recapitalization

I think it is funny that people then get upset about “bankers’ bonuses.” As if that mattered, when crime of this magnitude is happening in front of your eyes. “You killed my mother and my brother and my sister, so I think you should wear less expensive shoes.” This is the talk of slaves.

Asset Sales: Once you’ve corrupted governments to this degree, you might as well go whole hog. Sovereign debt, for the most part, is unsecured. If it defaults, the lender has no recourse. So why is Greece’s government being forced into “asset sales”? Because, when you’ve already got them bent over, you don’t just stop halfway. When you get mugged in an alley, does the mugger only take half your money?

Greece Will Accelerate State Asset Sales to Stem Debt Crisis as Bonds Drop

Central Bank bailouts: Since taxpayers have pretty much been sucked dry, the bailout parade has moved on to central banks, who of course have the printing press. Read this:

http://www.iie.com/publications/pb/pb11-13.pdf

This talks about something I’ve heard a little bit about, but didn’t understand in full. Actually, it is not well described in the paper but there is enough of an outline that I think we can make out what is happening.

What basically appears to be happening here is something like this:

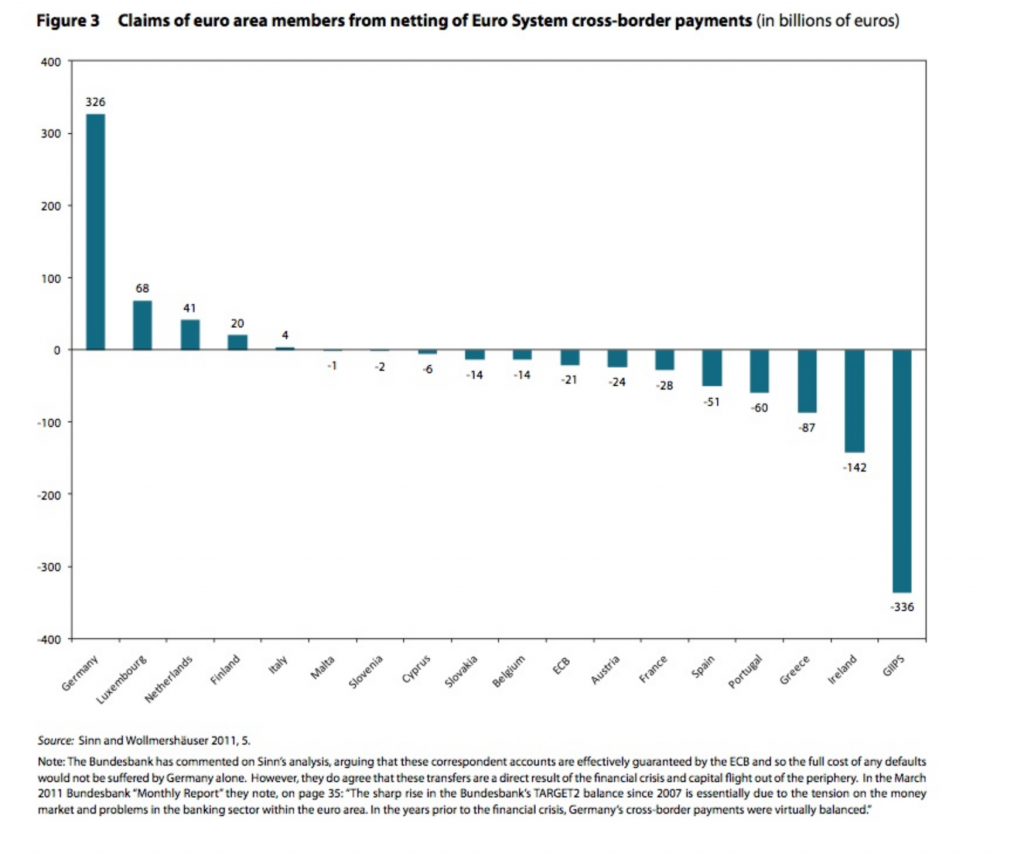

Let’s say that IrishBank borrowed $1 billion from GermanyBank, for a period of 90 days. Ninety days pass, and it’s time for IrishBank to pay the money back to GermanyBank. However, IrishBank doesn’t have the money, and nobody will lend IrishBank the money because they are a bunch of losers. Now GermanyBank faces taking a loss on its loan to IrishBank. GermanyBank says to the Bundesbank (which apparently still has a function as a payments clearinghouse), “we have a big problem. If IrishBank doesn’t pay us back the money, then we too will face a solvency crisis just like IrishBank, and nobody will lend money to us either!” What in effect happens is that the Bundesbank pays GermanyBank, but nobody has yet paid the Bundesbank. In effect, they are owed the money from the Irish Central Bank. This creates the “cross-border payments netting claims.” The numbers are big — €326 billion owed to German banks! In effect, the “GIIPS” have been suffering a bank run, and this is covered up by the central banks saying that IrishBank paid GermanyBank, when in fact they didn’t.

This is only a brief outline of some of the larger avenues of banker theft. There are many, many other things going on, from HFT front-running on the stock markets and other forms of market rigging, to piracy via the bankruptcy courts, to stuffing Fannie and Freddie with losses, and on and on and on. Rob Kirby has done an excellent job of investigating some of these more arcane avenues.

http://www.kirbyanalytics.com/

Lehman’s Bankruptcy and the Hidden $138 Billion Bailout of JP Morgan

Amaranth Kill Shot: 78 Trillion Dollar Derivatives Book Compliments of J.P. Morgan Chase