(This item originally appeared at Forbes.com on February 13, 2020.)

Judy Shelton, a very good monetary economist who — like very good economists for centuries — is a fan of Stable Money, begins her Senate confirmation hearings today for appointment to the seven-member Federal Reserve Board of Governors. As a long-time gold standard advocate, she thinks it would be a good idea for the Federal Reserve to do what the Federal Reserve did between 1913 and 1971: keep the dollar’s value linked to gold. But, since an official gold standard policy is not likely right away, I think she would also be in favor of generally keeping the dollar from any kind of gross instability (a major rise or decline in dollar value), and having interest rates that are reflective of market forces. This is nothing new in the history of the Federal Reserve: These principles were followed by Paul Volcker, Alan Greenspan, Wayne Angell, and perhaps even by Janet Yellen.

First of all: One person, on the twelve-person Federal Open Market Committee, is not going to change things very much. The FOMC has a long history of rubber-stamp unanimous decisions anyway. Isn’t the point of having a committee supposed to be a diversity of opinion?

Actually, we have a disturbing amount of “diversity of opinion” these days in central bank matters already. “Negative interest rates.” “QE.” “Not-QE.” “Interest on overnight reserves.” Outright purchases of equities. Direct support of troubled government bond markets. “Operation Twist.” This is the stuff that central banks are already doing, or recently did. In the batting lineup of even-weirder, untried notions we have: “Modern Monetary Theory.” “Nominal GDP targeting.” Deeply negative interest rates. “Cashless society.”

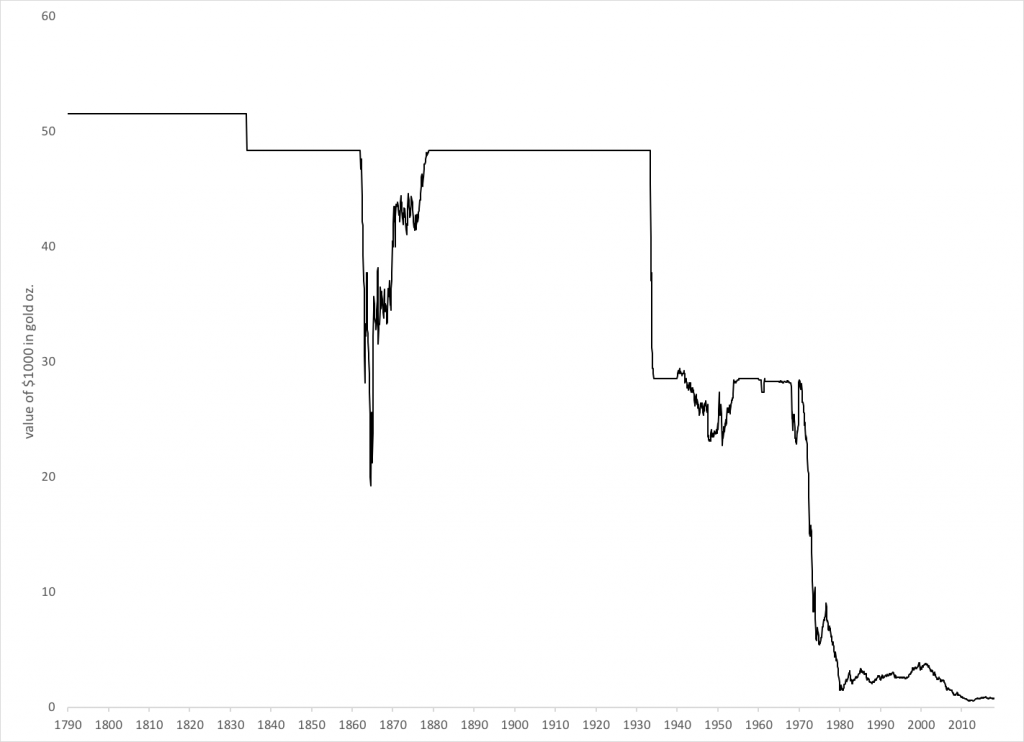

Into this intensifying central bank clown world we introduce Judy Shelton, who proposes that the monetary principle that the United States used for 182 years (1789-1971) — in the process becoming a world economic superpower, the wealthiest nation in human history, with the broadest and most prosperous middle class — is, maybe, not a bad idea. And even if such a fundamental change to Federal Reserve policy is not immediately forthcoming, then we should at least try to roughly adhere to the principle of Stable Money: money that reliable, neutral and unchanging, and which can serve as the bedrock foundation for rational economic calculation — rather than, as so many academics seem to want today, monetary policy that turns up macroeconomic distortion to the max. Shelton’s recent statements indicate that she is wary of so many innovations at once, and would prefer to return to some kind of “normalcy,” possibly by eliminating “interest on excess reserves” for example, which did not exist before the financial crisis in 2008.

We may not be far off — perhaps the next recession — when big deficits combined with the urge to spend more money results in Congressional pressure on the Federal Reserve to adopt “Modern Monetary Theory,” which is basically straight-up printing-press finance of the government. There are already a lot of academics who are convinced this would be a good thing. I think there should be someone on the FOMC that opposes it — a person like Judy Shelton.

The Federal Reserve is the largest employer of economics PhDs in the country, and they imagine that it is their little sandbox. The more power and influence the Federal Reserve has, the more power and influence is obtained by academic economists, who are peeved that they get so little respect otherwise. The more they crank up the engines of macroeconomic distortion via monetary means, the more power and influence they have. Thus, many elements of the Federal Reserve, and the existing academic establishment, are opposed to any challenge to the near-monopolistic control they imagine they have over monetary policy. They really don’t want someone like Judy Shelton blocking all the oh-so-very-creative schemes they have for manipulating the economy and your money. They think that the Federal Reserve should be like the academic departments where they spend their lives: a place where all meaningful dissent has been expelled, and where Democrats outnumber Republicans 5:1.

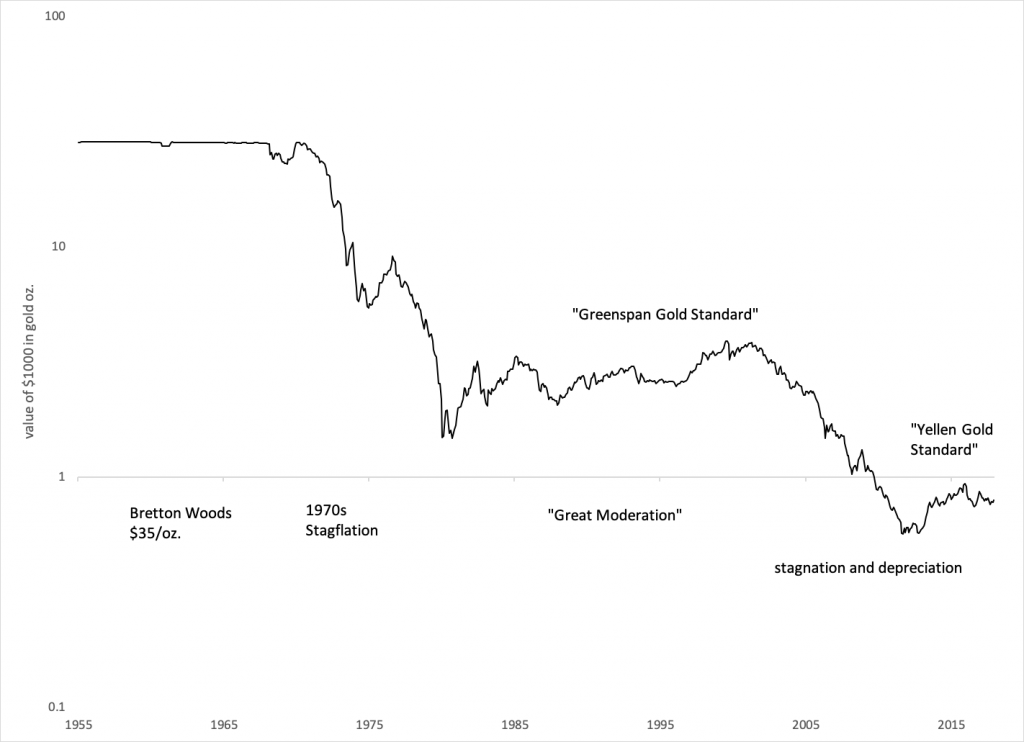

One reason that we’ve had some success, since floating currencies emerged in 1971, was that money-manipulating academics were never really dominant. As Treasury Undersecretary for International Affairs in 1969-1971, Paul Volcker actively defended the Bretton Woods gold standard. Alan Greenspan, chairman of the Federal Reserve in 1987-2006, was also a gold standard advocate in his youth. He wrote an op-ed in favor of a gold standard in 1981, and, as Chairman, told a Senate Committee in 1997 that he favored a return to the gold standard system. The dollar’s value vs. gold was surprisingly stable during his tenure. Maybe it was a coincidence.

Before him, William McChesney Martin, who presided over the Federal Reserve from 1951 to 1970, defended the Federal Reserve’s gold standard policy from Treasury influence in 1951 and President Johnson’s bullying in the late 1960s, both of which threatened to lead to devaluation. Wayne Angell, who was a member of the Board of Governors in 1986-1994, at one point traveled to Russia to recommend a gold standard system for the ruble. The dollar was again oddly stable vs. gold during the tenure of Janet Yellen, who never mentioned any public advocacy for the idea, but did invite a number of leading gold-standard advocates to a conference at the Federal Reserve in 2015.

There should be at least one person at the Federal Reserve who is a supporter of the monetary principles that made America great. A person who is not a dogmatic follower of academic fashion. A person who is skeptical of the ever-more-aggressive attempts to solve all economic problems with central bank manipulation and even overt printing-press finance. A person in favor of the idea of Stable Money in general — money that is neutral, reliable and unchanging, and which serves as a transparent medium of rational economic calculation. In the past — even in the floating fiat era since 1971 — there has been at least one person, and sometimes more, that played those roles, and we are all better off for it. If there are a lot of people who are threatened by the nomination of Judy Shelton to the Federal Reserve Board of Governors, take it as evidence that, today, Judy Shelton is that person.