(This item originally appeared at Forbes.com on April 2, 2018.)

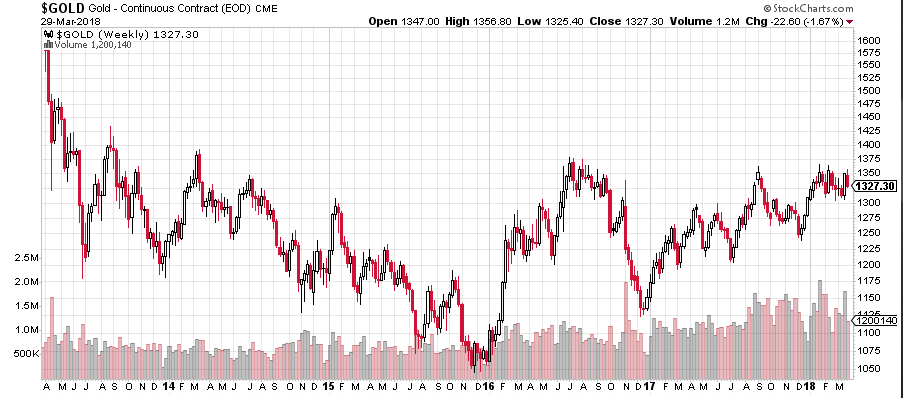

On February 3, 2014, Janet Yellen’s first day in office at the Federal Reserve, the dollar’s value compared to gold was 1261:1, or “$1,261 per oz.” On February 3, 2018, her last day, it was 1331:1, a difference of 5.6%. Not bad, over four years.

Between those two endpoints, the dollar varied between $1049 and $1366 per oz., which is a rather broad range. It would probably be too much to say that Yellen overtly used gold as a target, as her predecessor Alan Greenspan says he did. But, she probably had it in mind. Paul Volcker, head of the Fed in August 1979-August 1987, perhaps had a similar view.

When I was Chair of the Federal Reserve I used to testify before U.S. Congressman Ron Paul, who was a very strong advocate of gold. We had some interesting discussions. I told him that US monetary policy tried to follow signals that a gold standard would have created. That is sound monetary policy even with a fiat currency. In that regard, I told him that even if we had gone back to the gold standard, policy would not have changed all that much.

On February 27, 2015, Yellen met with a group of twenty-one members of “the center right,” which included American Principles in Action chairman Sean Fieler; APA monetary policy director Steve Lonegan, Ralph Benko, Prof. Brian Domitrovic, Judy Shelton, and then-Cato Institute president John Allison — all of them among the best of a rather small group of gold standard advocates (or, at the least, people friendly to the idea). Brian Domitrovic’s presentation at the event is described here. To summarize: when monetary policy more closely resembles a gold standard system (that is, the value of the dollar is more stable vs. gold), good things happen; and when it does not, bad things happen.

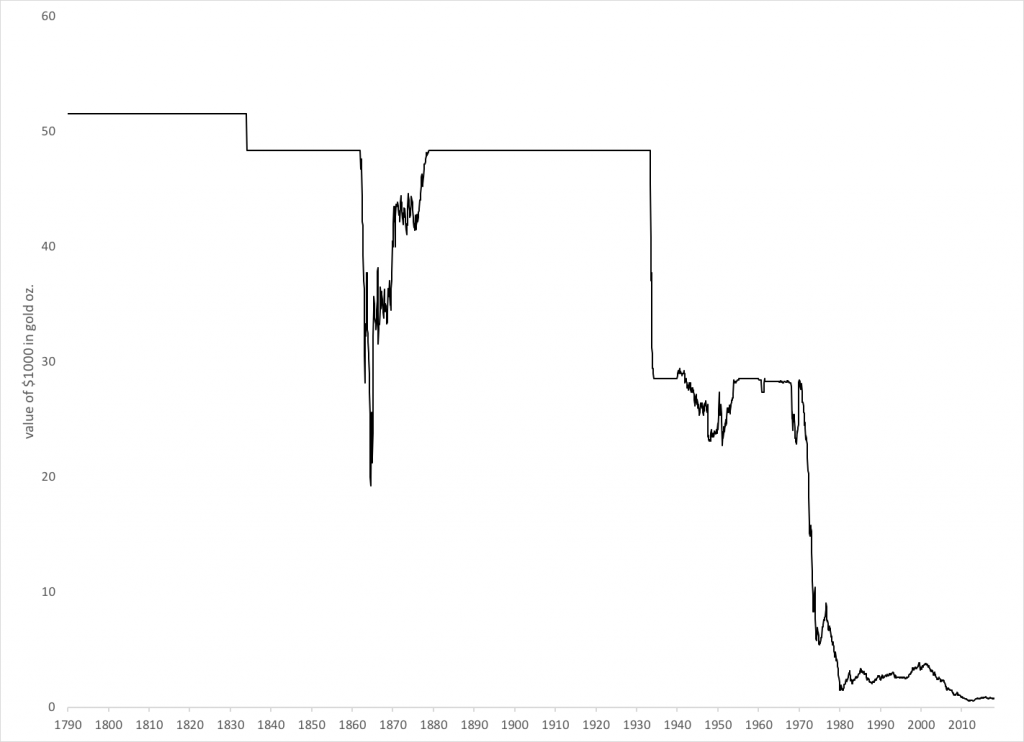

Naturally, the closest resemblance to a gold standard system is an actual gold standard system, which was the principle the U.S. adhered to for nearly two centuries until 1971. We went from thirteen colonies along the Atlantic seaboard to continent-dominating world economic superpower. Economists today want to tell you this was a mistake — because when you make the same mistake over and over again for 182 years, wonderful things happen. This makes sense … to economists.

Volcker heard a similar message during the 1980s, in similar sorts of private meetings, which you can read about in Domitrovic’s history of the era, Econoclasts: the Rebels Who Sparked the Supply Side Movement and Restored American Prosperity (2014).

The Yellen era was Bizarro-World, in the U.S. and worldwide. Quantitative Easing (and discussions about its unwind), “interest on overnight reserves,” sustained negative interest rates on government bonds, and large-scale asset purchases by central banks worldwide suggested an environment where central bank and official influence in asset markets had reached an unprecedented level. All of this might have an interesting period of “unwind” in the future.

But somehow, nothing overtly horrible happened. The U.S. economy managed to putter along fruitfully; and with the Trump tax reforms, perhaps it can do a little better than that.

Maybe Yellen, like Greenspan, will let us know if the stability of the dollar vs. gold during her tenure was an accident or on purpose.

Yellen’s term is yet more evidence that gold remains “the Monetary Polaris,” the best-possible representation of stable monetary value available today. In the end, we have only one choice: the Gold Standard, or the PhD Standard. One has always worked, and worked well. One has never worked. We’re still waiting for people to figure this out.