(This item originally appeared at Forbes.com on July 29, 2020.)

Soon, the Senate will vote on whether to approve the appointment of Judy Shelton to the Federal Reserve Board of Governors. Shelton is one of our better gold standard advocates, the author of Fixing the Dollar Now(2012), and a longtime fixture at monetary conferences in Washington. The Federal Reserve absolutely should have someone on its Board who understands the policy that the Federal Reserve itself followed for the first 58 years of its history (1913-1971); and which the United States followed for the 124 years (1789-1913) that preceded the Federal Reserve.

The idea behind the gold standard is that a currency should be stable, reliable, and unchanging in value — the monetary equivalent of other weights and measures like the kilogram, meter, or minute. As George Gilder described in detail in The Scandal of Money(2016), this monetary stability allows rational economic calculation of profit and loss, success and failure. When this rational economic calculation takes place properly, capital is allocated to its best uses, and the economy thrives. Capitalism works like it is supposed to.

President James Madison summed up why a mandate to use gold-based money appears in Article I Section 10 of the U.S. Constitution:

“The only adequate guarantee for the uniform and stable value of a paper currency is its convertibility into specie [gold] — the least fluctuating and the only universal currency.”

This is a nice idea. The United States spent two centuries proving that it works. Sticking to gold-based money, the U.S. became the most successful country in the world. Today, we ask: “WTF Happened In 1971?”

The Federal Reserve is imagined to be a purveyor of floating currencies; and, no doubt the creation of the Federal Reserve in 1913 (under veeeery suspicious circumstances) was an important step to that eventual outcome. But, for a long time, the Federal Reserve actively supported and maintained the gold standard. William McChesney Martin was Chairman of the Federal Reserve from 1951 to 1970. His first task was to implement the “Accord of 1951”, which effectively returned the dollar to a gold standard at $35/oz., after a period of modest wartime floating when the Fed was pressured by the Treasury to manipulate interest rates.

In 1960, Vice President Richard Nixon wanted the Fed to “ease,” to give him a boost in his election campaign against John F. Kennedy that year. Martin told him to pound sand. In 1965, President Lyndon Johnson physically bullied Martin for “easy money.” Martin stood up to this pressure. At the end of his term, in January 1970, the market value of the dollar was right at its $35/oz. gold parity.

With the help of Martin’s Stable Money efforts, the 1950s and 1960s are today considered the most economically prosperous time, in the U.S. and worldwide, since the Classical Gold Standard ended in 1914.

When Martin’s term ended in January 1970, President Nixon took the opportunity to put in his old friend, Arthur Burns, at the Fed. Burns soon opened the “easy money” spigot, and interest rates collapsed. The economy boomed, and Nixon won in 1972.

But, this had consequences. In August 1971, the pressure on the gold standard, from all the excess money, was so great that Nixon took the step of “closing the gold window,” which had the unplanned effect of creating the environment of floating currencies we have today. Nixon’s re-election boom quickly collapsed into stagflationary disaster.

From this, you might think that Nixon and Burns were enemies of the gold standard. But, they were not. Nixon himself attempted to put the world gold standard back together just months later, at the Smithsonian Agreement of December 1971. The dollar would be repegged to gold at $38/oz., suffering a slight devaluation, much as Britain and France had also devalued (and returned to gold) just a few years earlier. (That was the idea, although it didn’t work out.) Burns, at the Fed, was distraught that the gold standard, the U.S.’s super-successful monetary policy, could come to an end. In August 1971, Burns told Nixon not to close the gold window, if he could at all avoid it. Nixon recalled: “He warned that I would take the blame if the dollar were devalued. ‘Pravda would write that this was a sign of the collapse of capitalism,’ he said. On the economic side he worried that the negative results would be unpredictable …”

In August 1971, a reporter asked the economist Arthur Laffer, who was then the 31-year-old Chief Economist of the Office of Management and Budget, what the effects of Nixon’s “closing the gold window” would be. Laffer reportedly said: “It’s not going to be as much fun to be an American anymore.” And, he was right. Economist Paul Krugman once called our post-1971 era: The Age of Diminished Expectations.

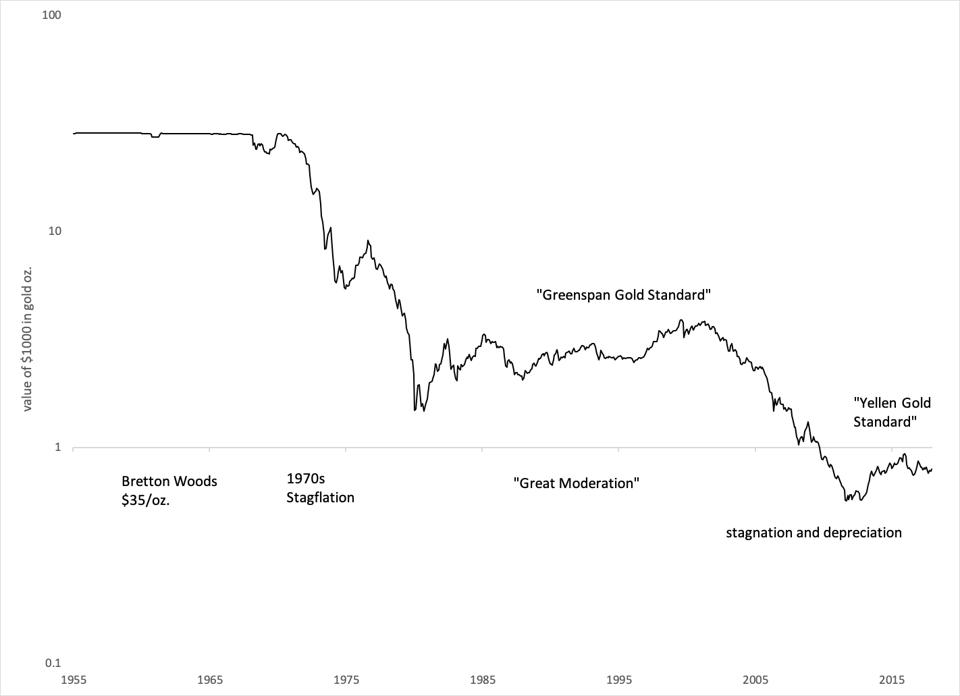

Another person at that fateful meeting with Burns and Nixon in 1971 was Paul Volcker, then the Treasury Undersecretary for International Affairs. Volcker was also in favor of keeping the dollar’s link to gold at $35/oz., although he was confused as to how to do so. During his term as Chairman of the Federal Reserve (1979-1987), the dollar ended its devaluation trend of the 1970s and stabilized again vs. gold. This came about in part through the influence of people like Arthur Laffer and Alan Greenspan, both of whom participated in Ronald Reagan’s Gold Commission of 1981, which discussed returning the dollar to its gold basis. Economists cheered the “Great Moderation” that resulted, although, with typical cluelessness, they still have no idea what created it.

Federal Reserve Chairman Alan Greenspan (1987-2006) was a gold standard advocate in the 1960s, part of a group centered around Ayn Rand. In 1981 — by that time already with a stint as the head of President Ford’s Council of Economic Advisors under his belt, and a director of the Council on Foreign Relations — he wrote an op-ed piece for the Wall Street Journal in favor of returning to a gold standard. To nobody’s surprise, the value of the dollar vs. gold during his 18-year tenure was quite stable, which Greenspan later said was definitely on purpose. Today, he remains a staunch admirer of the pre-1914 Classical Gold Standard period. During Greenspan’s term, he enjoyed the support of Wayne Angell, a member of the Federal Reserve Board of Governors, who, in 1991, recommended that Russia implement a gold standard for the ruble.

If we look at the history of Federal Reserve Chairmen since 1951, we find that Martin, Burns, Volcker and Greenspan were all supporters (in principle) of the gold standard system. The exception was G. William Miller (1978-1979), who presided over the worst of the Carter-era “stagflation.” He came from a corporate background, rather than banking or economics, and was generally considered to be in over his head. Carter kicked him out by making him Treasury Secretary before the end of his term, and replaced him with Volcker.

Federal Reserve Chairman Ben Bernanke (2005-2014) made his academic reputation by arguing that “easy money” from the Federal Reserve would have helped ameliorate the Great Depression. Perhaps it is no surprise that the value of the dollar during his watch collapsed to a low of $1920/oz. before stabilizing, less than a fifth of its value around $350/oz. during the Volcker/Greenspan years.

Janet Yellen (2014-2018) never said anything favorable about the gold standard during her tenure. But, in 2015, she invited a group of gold standard advocates (including Judy Shelton) to make presentations at the Federal Reserve, with Yellen in attendance. Perhaps it is no surprise that the value of the dollar vs. gold was surprisingly stable during her term, somewhat like it was during Greenspan’s.

Today, a braying mob from academia, the press, and the Federal Reserve itself wants to keep Judy Shelton from playing a role in monetary affairs. But, I would argue that whatever success we have had since the bad old days of 1970s “stagflation” has come about because people like Volcker, Greenspan, Angell and perhaps Yellen have kept the Fed loosely (sometimes, very loosely) anchored to gold, even during our era of floating currencies.

For some reason, the principle that made the U.S. great, over a period of nearly two centuries (1789-1971) is, to these people, unthinkable. Instead, they offer a long list of experiments — zero interest rates, QE, Treasury yield control, corporate bond buying, interest on reserves, and now, Modern Monetary Theory — which have no track record of success at all. Instead of “rational economic calculation” these schemes and tricks are all calculated to create as much economic distortion as is necessary to achieve their goals. For some reason, it seems like capitalism doesn’t quite work right anymore. Why is that?

David Stockman — Congressman from Michigan, director of the Office of Management and Budget, and later cofounder of the Blackstone private equity group — called the monetary distortion under Bernanke’s term The Great Deformation: The Corruption of Capitalism in America (2013). Today, these complaints seem a little quaint, since things have become so much more distorted since then. Bank of England Governor Mervyn King begged central bankers for The End of Alchemy: Money, Banking and the Future of the Global Economy (2017). “Quit deforming everything!” King seemed to complain. Former Fed staffer Danielle DiMartino Booth was Fed Up: An Insider’s Take on Why the Federal Reserve is Bad for America (2017).

The COVID era just made everything much more wacky. Everything that economist George Selgin warned about in The Menace of Fiscal QE (February 2020), came true with alarming speed only weeks later.

And that, basically, is why Judy Shelton should have a spot at the Federal Reserve. In the end, you have to put your faith in the PhD Standard, or the Gold Standard. One of them has never worked; one of them has always worked.