If we are going to use gold as a standard of value in the future, then naturally we want it to be stable in value. That is the whole point of using gold as a standard of value — not because it is yellow, or shiny, or causes “manias” or “obsessions”, or something of that sort. Ideally, we would have money that is perfectly stable in value, but since we don’t live in an ideal world, we have to make do with the next best thing, which has always been gold.

February 19, 2017: “Prices” and Value

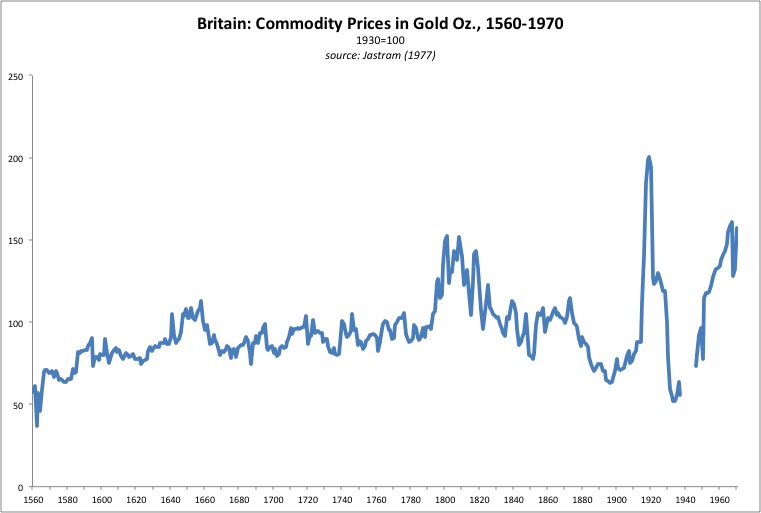

We can look back at the period before 1971, going back five centuries, and see that gold was, if not perfectly stable in value, at least stable enough that it didn’t cause any major problems when used as a standard of value. Every other option that has ever been tried has been worse. Today’s central bankers talk about “stability” in a sort of vague way, but none of them have ever attempted to create some standard of value more stable than gold; not surprisingly, none of them have ever achieved it.

July 29, 2016: Don’t Be Fooled: “Stable Money” Means Gold

December 7, 2016: The Gold Standard Vs. the PhD Standard

This stability has been expressed, to some degree, by the stability of commodity prices vs. gold. We must always remember that commodity prices have their own supply/demand characteristics, and do not themselves constitute some perfect measure of value. It would be perfectly normal to find that commodity prices vary quite a bit vs. gold, even if gold were perfectly stable in value, which it is not. So, this outcome is actually somewhat unexpected, in my opinion — it is better than one would rationally expect. If there is some major change in commodity prices vs. gold, then you have to do some work to determine whether this change comes from the “side of commodities” (supply and demand for commodities, as expressed by a measure of stable value) or from the “side of money” (changes in commodity prices caused by a change in the value of the monetary unit). However, it is hard to imagine some sort of situation where there is a major change in the value of the money, but there is no major change in nominal commodity prices. That would require an extraordinary coincidence in which a change in the supply/demand of commodities neatly cancelled out the effects of a change in the value of money.

After 1970, the picture changes somewhat. Commodity values vs. gold collapse, and stay low for a long period of time. One could argue that gold’s value has risen. Anyway, gold’s “purchasing power” vs. commodities has certainly risen.

This is a somewhat unexpected notion. A lot of people thought that once gold was “demonetized” in 1971 — the basis of no currency worldwide — its value would collapse. After all, the aboveground supply of gold is about 50 times annual mining supply, and even annual mining supply is not consumed by industrial or utilitarian uses, but is simply piled up in the form of bullion and jewelry. It would seem that, if there were no more monetary role for gold, then it would be radically in surplus, and its value would plummet. Something a little like this happened to silver in the 1870s.

Silver, at the time, was not “demonetized.” Governments had to abandon silver within their bimetallic systems, adopting gold monometallism, but that was almost entirely a reaction to market prices, not some intentional act. Mostly, it was done on a temporary basis before becoming official years later. Silver continued to be used in coinage. The amount of silver coinage used in the U.S. tripled between 1880 and 1913.

So, the fact that we did not get an outcome like this, but rather that gold at the very least held its value, and perhaps even rose in value, was for many people unexpected.

This is a chart of commodity prices vs. gold. The CRB Commodity index is used after 1947, so it is all from one consistent source since that time. As we can see, the value of commodities has collapsed vs. gold since 1970, which suggests to some that perhaps gold has risen in value since 1970. The value of commodities vs. gold today is about one-fifth of its long-term average (0.88 today vs. roughly 5.0 on this chart).

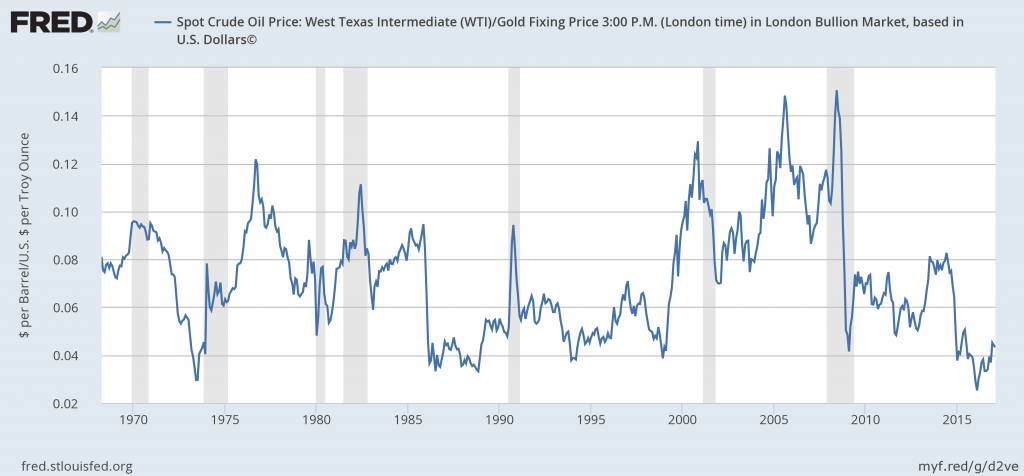

However, not all commodities have collapsed in value vs. gold. Crude oil, for example, is still within a broad range:

The value of crude vs. gold is a little low now, but it was a little high back in 2008. There is no obvious trend of higher gold/lower oil here.

Now, if gold did indeed soar in value since 1970, then oil must have soared in value too, since they are roughly in line with each other. I would say that there is not a lot of evidence of this. If the value of oil really did soar by that much, we would expect to see some kind of practical consequence of it, such as automobiles that used one-fifth as much gasoline, or enormous profit margins for oil companies, or something of that sort. But, we Americans today still drive big gas-guzzlers not so much different than in 1970, and a tank of gasoline is still not terribly expensive, and oil production is still a risky business that is apparently unprofitable at today’s prices, which is exactly what the chart above suggests.

Are there some nonmonetary reasons why commodity prices are so much lower now vs. gold than in the past? Indeed there are.

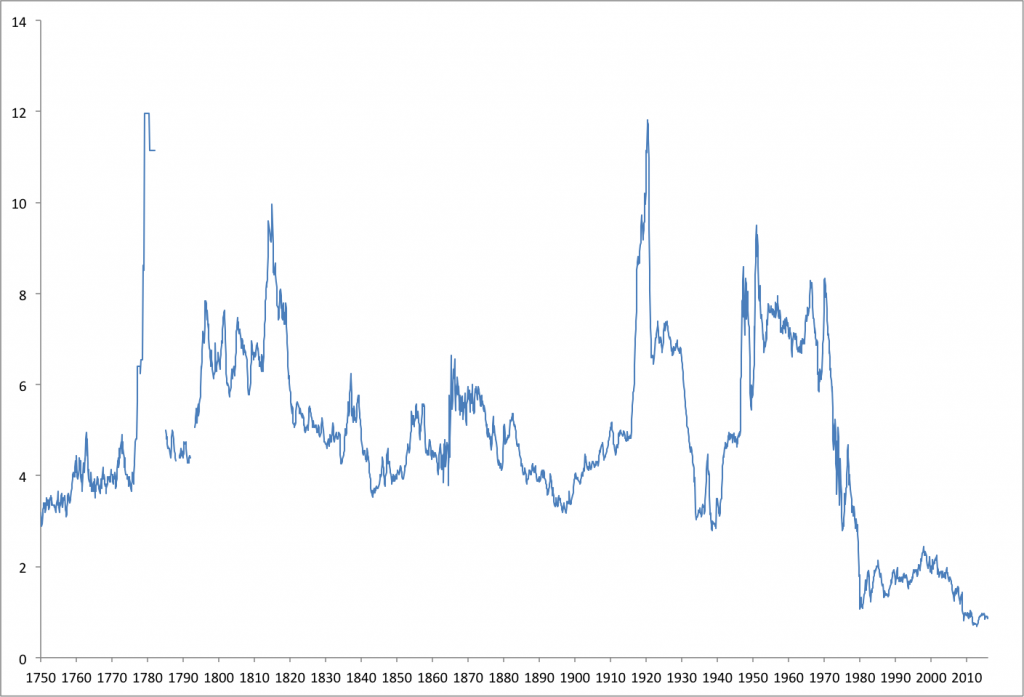

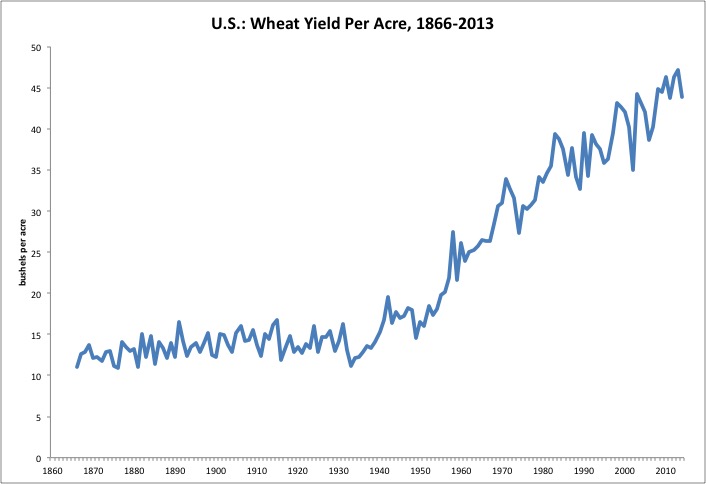

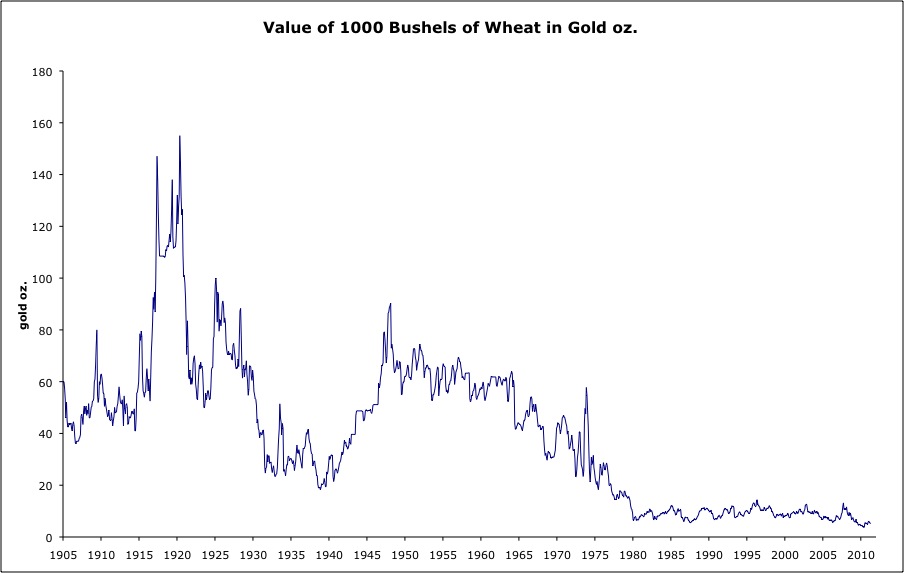

The “Green Revolution”, beginning in the mid-1950s, led to dramatically higher yields per acre for wheat, and also all other major staple crops such as corn or soybeans. This has been accompanied by a collapse in the value of wheat vs. gold. This collapse really got going in the mid-1960s, before the monetary turmoil that began in 1971.

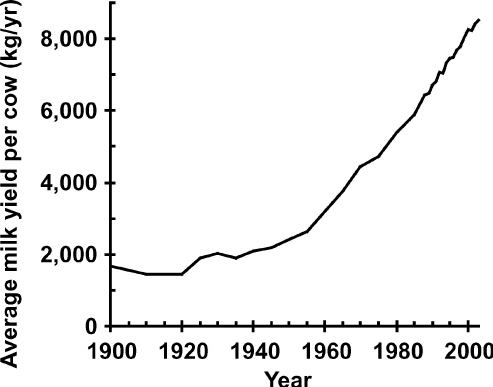

This sort of increase in agricultural production has taken place even where one might not expect it, such as in the milk yield per dairy cow:

Amazing, really.

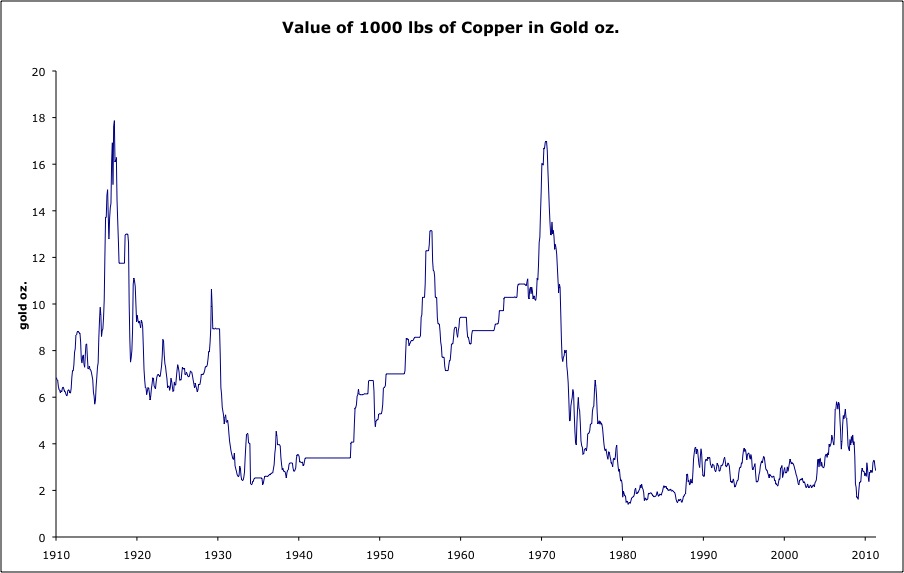

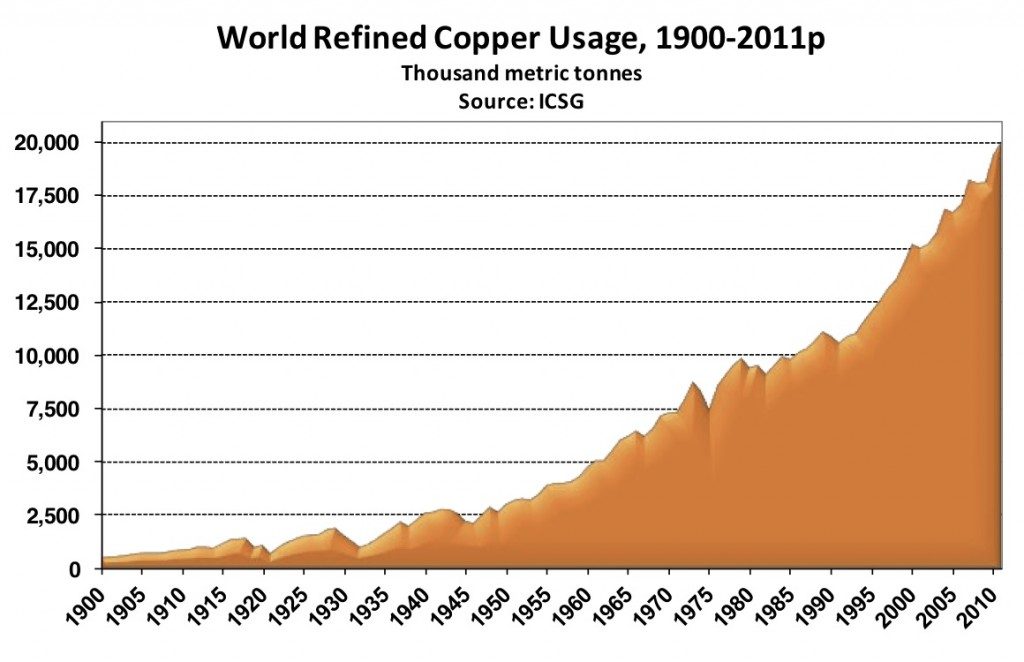

It is a little harder to make a similar argument for copper or other base metals, whose values have also collapsed vs. gold:

One thing that I think is going on here is that the decline in currency value (“worldwide inflation”) of the 1970s made commodity production very profitable due to rising nominal prices. Enormous investments were made in additional commodity production. This was actually rather contrary to what was going on economically. The real economy, worldwide, was in contraction from the bountiful years of the 1960s. If anything, the real economy would have needed less commodities and commodity investment, not more. So, the combination of a flood of new investment and production, combined with the reality of contracting economies, led to a collapse in the real value of commodities as markets balanced supply and demand. It was all a product of monetary distortion.

Investment in mining is very long term. It takes years to plan, permit and build a mine. Most of the investment is upfront — a huge capex cost to build the milling facilities, roads, electrical lines, and so forth. After the big upfront capex cost, there is only a little bit of continuing capex and operational costs, which continues over the life of the mine. Mine life is typically in the decades for a major project. So, once the mine is built, it tends to work at full capacity for its multi-decade life, unless commodity market prices are so low that they don’t even pay for the continuing operational costs. In other words, once a lot of mine capacity got built in the 1970s, it kept on churning out output for the life of the mine. This is a little different than oil drilling, where most of the investment is recouped in the first few years, and continuing investment in additional drilling is necessary to sustain production levels.

Around 2000, a lot of those old mines built in the 1970s were probably about done, and nobody wanted to build any new mines due to the low commodity prices. In an environment of stable money, commodity prices would have had to rise to a level that justified new mine investment. What happened instead was that we had another episode of worldwide currency depreciation 2000-2011, somewhat like the 1970s, and another round of monetary-induced artificial profitability for commodity production, and another round of investment in new mine construction, which tended to keep the real value of commodities low vs. gold.

You could also make some arguments regarding mining technology and so forth. Perhaps production costs really did decline for base metal mining too, just as was the case for agricultural commodities.

Now, having made all those arguments, let me admit that the data doesn’t support them at all:

The reality is that there was not so much of a rise in copper production in the 1970s, and a huge rise in 1995-2000, when copper prices were pretty awful, and it is hard to imagine why there would be much investment in rock-crushing at a time when everyone was gaagaa about tech/media/telecom. So, there is probably more to the story here.

Nevertheless, I think mining professionals will agree, the return on capital on mining since 1970 has been pretty awful — on a risk-adjusted basis, even more awful — which is another way of saying: prices have been too low, supply too abundant, investment too aggressive. The main reason for this outcome — which mostly did not exist before 1970 — was the confused signals caused by monetary distortion, or what the Austrians call “malinvestment.” Before 1970, high copper prices indicate that commodity investment was relatively restrained. Also, copper prices were a lot more stable in nominal terms, which makes mining a lot less risky. Higher prices and also more stable prices means a much higher risk-adjusted return on capital, which was probably where it should be.

We will continue these investigations soon.