We have been talking about the relationship between banks’ balance sheet structure, and the monetary base of the Federal Reserve.

May 26, 2019: The Federal Reserve and Bank Reserves

June 2, 2019: The Federal Reserve and Bank Reserves #2: What’s Old Is New Again

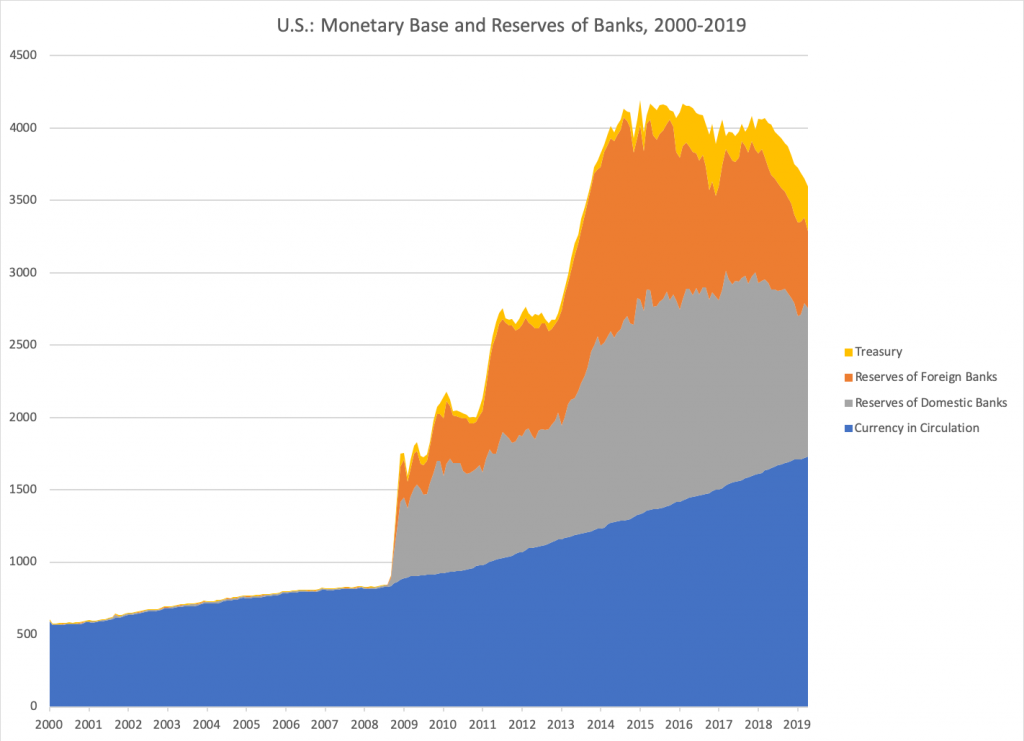

What we have seen is that, after 2008, “Cash Assets” as a portion of all assets has risen back near its long-term and traditional average around 10%; and that this “Cash Assets” has become nearly 100% reserves held at the Federal Reserve. This is actually a return to 1950s norms. Also, we have seen that foreign banks account for a lot of the reserves held at the Fed. This is what it looks like now:

I am estimating the foreign portion of reserves by taking the foreign portion of “cash assets” as a percentage of all banks’ cash assets, and applying that percentage to the “reserves” portion of the monetary base. I also included deposits held by the Treasury, which have become significant recently.

I suggest that what we see here is basically what we want to see: that this represents, to a large degree, a return to conservative “1950s-style” norms in banking. This has been accomplished, to some degree, by introducing interest on reserves, which increases their attractiveness for banks. It is quite possible that, if there were no interest on reserves, banks would again attempt to maximize profitability by minimizing their balances of non-interest-paying reserves held at the Fed. From this we might consider whether paying interest on reserves should become a regular policy, to encourage high reserve holdings via incentive rather than requirement; or, whether reserve requirements might be elevated back toward their 1950s norms, to prevent excessive risk at banks.

I tend to dislike reserve requirements, as they are commonly constituted today. The problem is that the reserves become unusable, due to the requirements. (At least, that is my understanding of it; perhaps the reality is different.) Ideally, banks would hold reserves above the requirement in normal times, but in a crisis, banks would be freely allowed to draw down their reserves as far as necessary. This would require some judgement as to what constitutes permissible behavior by banks; but, I don’t think this would be very hard to achieve.

Using reserve requirements of this sort would allow the removal of interest paid on reserves, which is probably a good thing. Banks, however, would not have much need for overnight lending or borrowing, since they would already have ample reserves, and not much incentive to attempt to lend out “cash assets” to make a little extra profit. Thus, we could also allow markets to find an appropriate interest rate without the influence of the Federal Reserve. That might be nice. (I think the Fed’s overnight rate target didn’t really become a formal policy until the 1980s. By then, banks were already heavily involved in overnight lending and borrowing.) This then leaves the question of how the monetary base is managed; and the best answer, of course, is that it is managed with the goal of achieving the desired (stable) value of the currency — preferably a gold standard system, but also, some alternative would be possible. We would assume also that the monetary base should be managed such that bank reserves are adequate to meet the reserve requirements.

But, the point that I wanted to make here is that, at least in terms of these quantity statistics (leaving aside various influences on interest rates, and many other topics) we have perhaps already achieved a rather nice “return to normalcy,” and any attempts to further reduce the monetary base toward pre-2008 norms would perhaps be more of a “return to abnormalcy,” and also introduce a lot more risk in the financial system. One reason for the very large bank reserves today is the large holdings of reserves by foreign banks. This is reflective of the U.S. dollar’s international character. Since these reserves are offset by Treasury holdings on the asset side of the Fed’s balance sheet, the government gets a little advantage from this (very little with interest paid on reserves and the yield curve inverted), so it is a good thing all around.

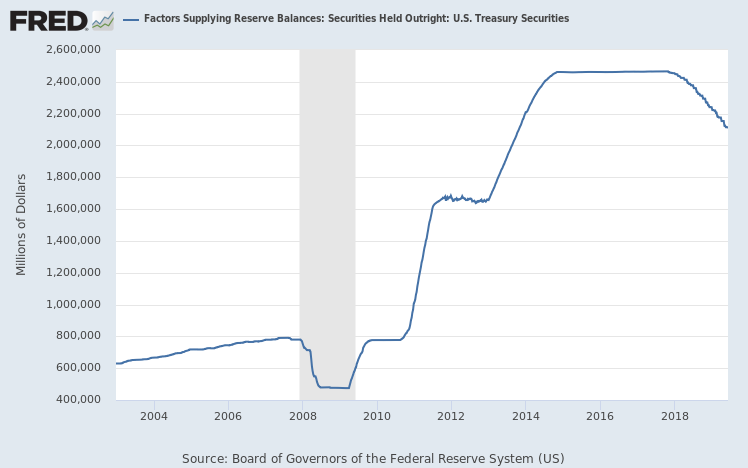

The other point is that, if there is a move toward reducing bank reserves (via selling of Treasury assets at the Fed), as has already been happening for some time now, that may, in practice, amount to an unnecessarily uncomfortable and counterproductive “tight” policy. It is a little hard to evaluate the situation today, as I think that asset markets in general, including the gold/dollar market, are under rather heavy influences; but nevertheless, even if by somewhat artificial means, it appears that the dollar has been maintaining a stable relationship vs. gold for some years now; and general macroeconomic conditions are reflective of this. From this we can conclude that banks are apparently happy to hold larger reserve levels, and that reserves are not in excess leading to currency weakness.