There is apparently some debate about whether Argentina can “dollarize” given its present foreign exchange reserves.

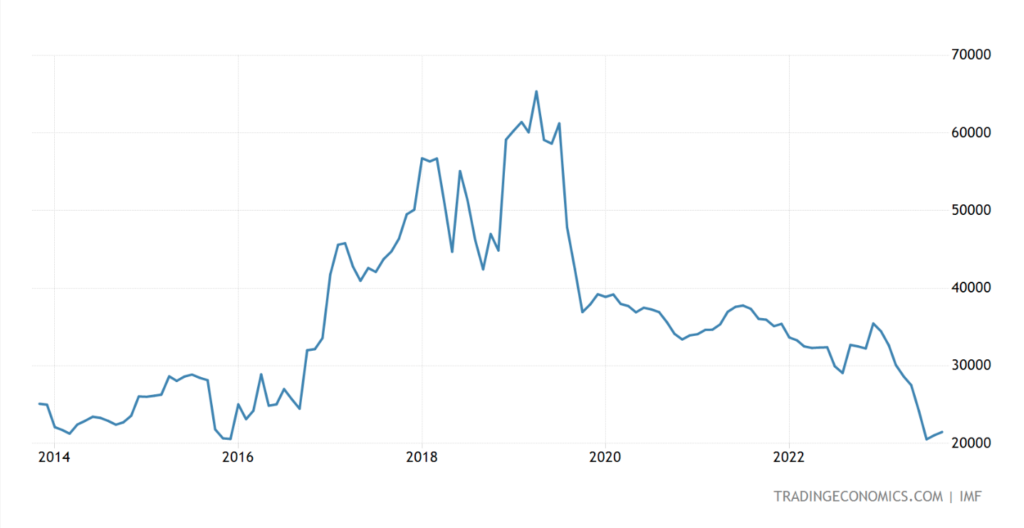

Here at AIER, Nicolas Cachanosky argues that the Argentine Central Bank only needs to replace physical banknotes, requiring about $6 billion. Others argue the figure is $40 billion, well in excess of the present $20 billion in foreign exchange reserves.

Foreign exchange reserves were actually in excess of $60 billion, before the most recent episode of dumbassery. But, so what else is new. (I wrote about this, and what to do about it, in great detail in Gold: The Monetary Polaris.)

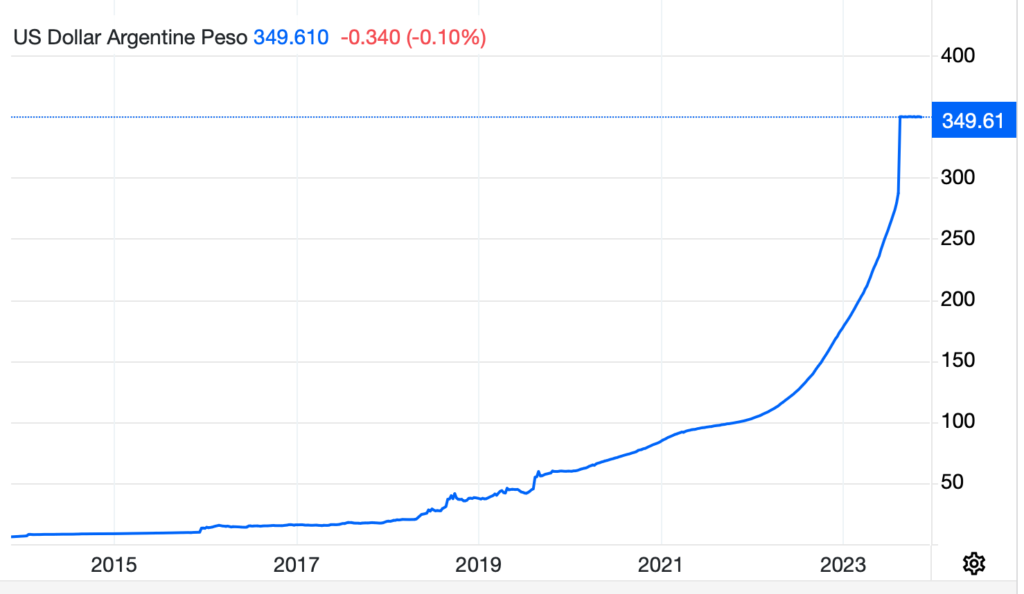

The peso has been collapsing of course. But, it is still a controlled rate.

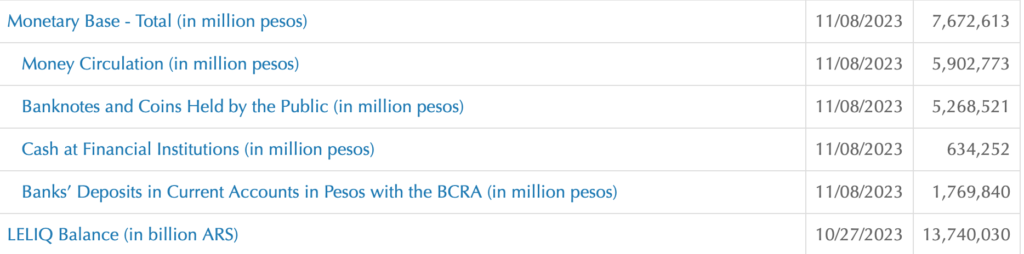

Let’s look at the Central Bank’s balance sheet, available here.

So, we have 5,902 billion pesos of banknotes, coins and bank reserves, the Monetary Base.

Also, we have 13,740 billion pesos of “LELIQs,” which are short-term notes sold by the central banks to commercial banks.

Basically, it is equivalent to bank reserves, and thus part of the Monetary Base which is why it is alongside here, but since (I assume) bank reserves pay no interest, banks want to make a little interest on 7-14 day paper (LELIQs), especially since rates on these have been in excess of 100% per annum.

All together, that is 19,642 billion pesos of base money liabilities, or about $54.56 billion. So indeed, it appears to me too that there are not enough dollars around to “dollarize” using existing foreign reserves, in a simple and straightforward way.

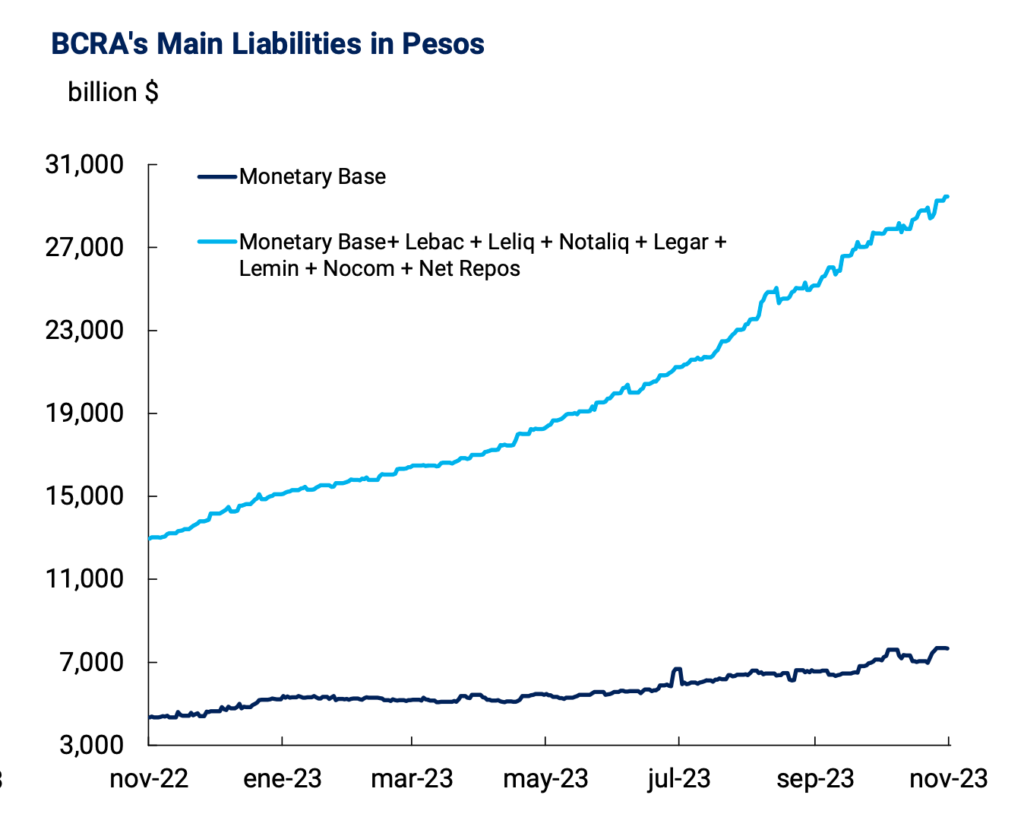

Here is another look, from the Daily Monetary Policy Report.

Now, you may say, where is the full Balance Sheet? I don’t see any Assets. This makes sense. The Assets are basically government bonds sold directly to the central bank, which are basically worthless since nobody would buy them on the market. In effect, the central bank and the government are one, and the “government debt” is the central banks’ liabilities. Taking all the liabilities, it looks like about 28 trillion pesos, or about $80 billion, not a terrible figure for a country with GDP of about $500 billion. So, basically these would become USD dollar bonds.

What are the options then?

The Central Bank could dollarize, using the existing banknotes only, and the existing bank reserves (not LELIQs and other liabilities), at the recent rate of 350/USD. What would this mean? It would mean that the central bank would effectively default on the other liabilities, or inflate them to zero which is the same thing. Or, they could be converted to government debt, with a little longer maturity of perhaps about a year, in USD of course. This is what Cachanosky means by “dollarized and redeemed over time.” But how would you “redeem” them? Where would the money come from? Basically, tax revenue, which is why I am calling this a form of government debt. Taking all the central bank liabilities, it looks like about 28 trillion pesos, or about $80 billion, not a terrible figure for a country with GDP of about $500 billion. So, basically these would become USD dollar bonds.

Banks would have to shut their doors momentarily, halting all deposit withdrawals into banknotes (since banknotes would be convertible to US dollar banknotes). Only banknotes existing today would be convertible. Banks may be able to allow interbank transactions (basically checking account transactions).

All of banks’ liabilities (deposits) and assets (loans) would convert to dollars at the 350/USD rate. This is basically just a changing of contracts.

Ideally, banks would skip the Central Bank entirely — there would be no Central Bank — and do their business in dollars directly with the Federal Reserve serving as a payments clearinghouse, or perhaps a large commercial bank such as JP Morgan Chase. But, this would take some time to set up, so in the short term banks could continue to use the central bank. The central bank should, as soon as possible, convert its domestic government bond holdings to foreign bond assets, or ultimately, to Federal reserve deposits directly.

This is all a little tricky, but not that hard to do. Basically, it is what Cachanosky suggests, and I think it is a good idea. But it would take some skill, and Argentina didn’t get where it is today by being smart. Another alternative is to burn all the existing assets and liabilities in a hyperinflation, and then “dollarize” basically at the street level. Banks would effectively start afresh, since their balance sheets would be basically zeroed out. This is the “car crash” scenario where nobody does anything. This is what Cachanosky means by “circumstances akin to Zimbabwe.” Another alternative is to basically convert all existing central bank liabilities at a rate that matches the level of existing foreign reserves, which would be about 1500/USD. That would be a big drop, but perhaps not too much of a problem, since things are a mess anyway. Still, the first option is better.