Back in 2019, gold stablecoins existed, but they were barely viable with sub-$10 million market caps. Even the biggest USD stablecoin, Tether, was still only around $2 billion. But now, Tether is around $70 billion, and the gold stablecoins are getting up over $100 million. According to CoinMarketCap.com, there are two leading gold stablecoins at present:

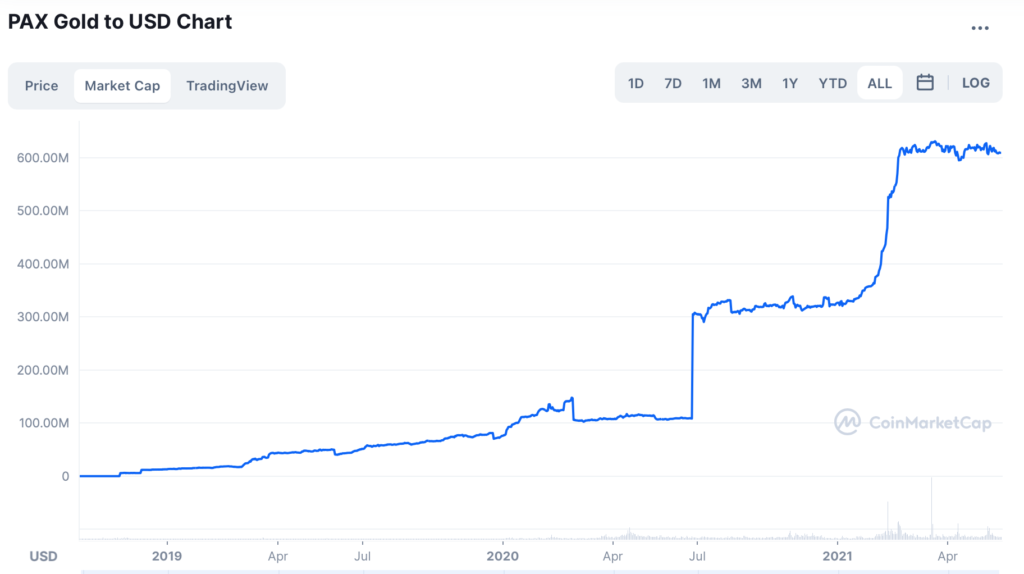

Paxgold (PAXG): $610m market cap. https://www.paxos.com/paxgold/

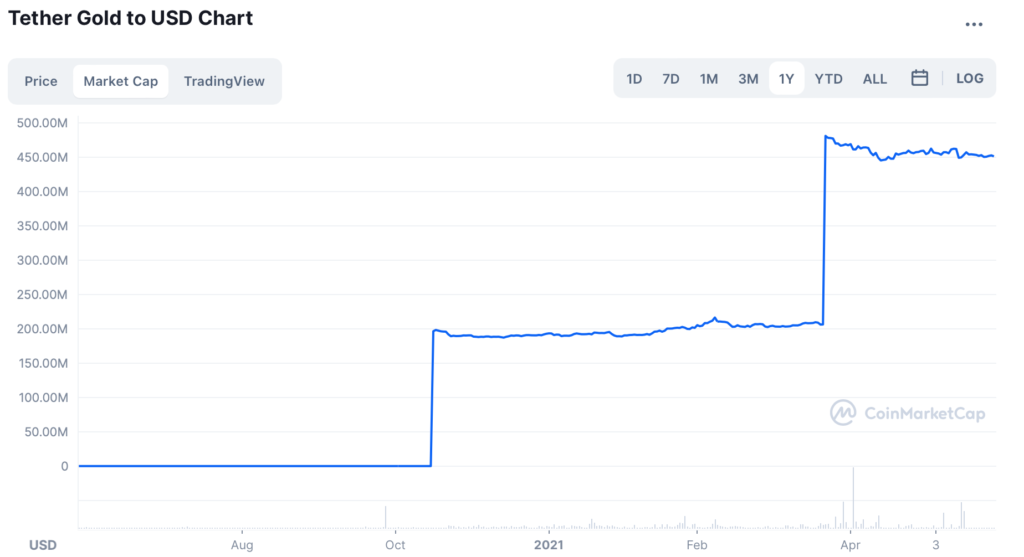

Tether Gold (XAUT): $451m market cap. https://gold.tether.to

The reported market caps on these look pretty weird, though. Not the curve of organic expansion that we saw for USD Tether. But, maybe it is a plan to attain scale quickly. After the huge success of Tether and other USD stablecoins, these are no longer kitchen table operations. Larger-scale venture money is involved.

This kind of crypto token can serve a purpose. However, a more centralized platform can also work well, and may be more viable for basic transactions. GoldMoney was the first example of this, although it never really realized its potential as a transactional device. Kinesis has set up an interesting platform for precious metals. Also, Coro has set up a gold-based platform that specifically targets transactional usefulness, with very low transaction costs and regulatory/banking system integration. It is not the kind of “pirate currency” that the crypto world promises, but probably more useful for 99% of daily business. WisdomTree, a large ETF provider, is also launching a similar platform that allows transfer of “digital gold.”

I’ll also give notice to LD2 or “Liberty Dollar II,” a silver-based crypto stablecoin founded by Extra von NotHaus, son of Bernard von NotHaus. Bernard von NotHaus issued the Liberty Dollar, gold-backed private banknotes, starting in 1998, a breakthrough attempt to establish a private-sector currency alternative to the floating fiat USD.

Liberty Dollar privately-issued banknotes

Banknotes actually have a lot of difficulties with them. It seems that crypto approaches, or other digital app-based platforms, have a lot of advantages to any banknote system. If you really wanted in-person anonymous real-world transactions, as banknotes offer, today you can just trade gold coins, with various digital alternatives better for small-scale transactions.

Any major bank today could set up “gold checking accounts” without much difficulty. At first, this could be a self-contained platform, similar to GoldMoney, where everyone would need accounts with the same bank. With a little more effort, interbank clearing could be established. They already have all the infrastructure today.