The USD/JPY rate had an important technical breakdown recently, breaking the 150/USD level that had been defended for some time earlier, and represents a major milestone going back to the 1980s. In the last few days, the Bank of Japan has engaged in large-scale yen-buying intervention, showing just how jittery they are about this.

This takes place in context of intensifying expectations that the Bank of Japan will, in time, be pressed into basically buying the government’s bonds, either to keep interest rates down, or to directly finance ongoing deficits.

However, the BoJ has not actually been very expansionary with its Base Money supply over the past several years. The “money printing” theme might be real for the future, but the present and recent past does not reveal much base money expansion. The general tone is that the BoJ’s ability to avoid money-printing is coming to an end — which would indeed be a big deal.

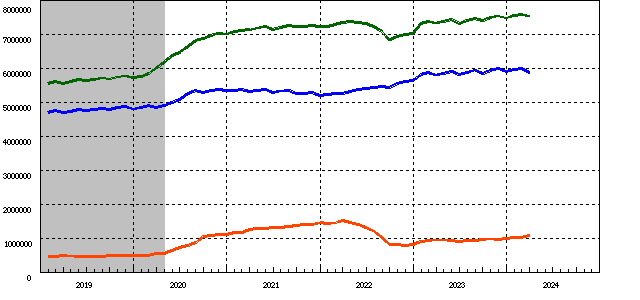

Here is how it looked as of the end of April. These are Assets, including Total Assets in Green, Government Securities in Blue, and Loans and Discounts in Orange.

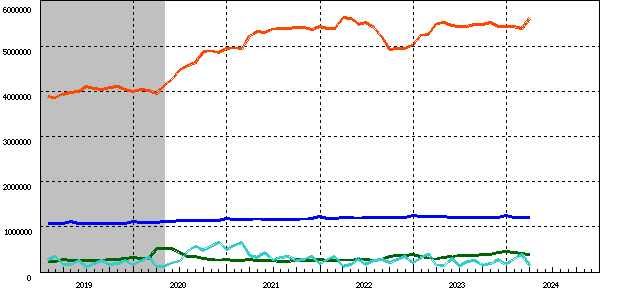

Liabilities include Current Account balances in Orange, and Currency in Circulation in Blue. The Ministry of Finance’s account is in light blue, and Other balances (I think these are mostly securities brokerages) are in green.

So, we can see that Base Money has actually been pretty flat after peaking in 2022. There was a sharp contraction in late 2022, which came about with a big drop in Loans and Discounts, while Securities holdings continued higher.

Here are month-end figures, to April 30. We see that Bank Reserves have had a pretty big jump higher in March and April, making new highs at the end of April. After months of flatlining, the Monetary Base is indeed expanding again. It’s worth noting that the fiscal yearend in Japan is March 31, and there is a seasonal pattern of a little peak at the FY-end, which carries into April. But, it is still a new high.

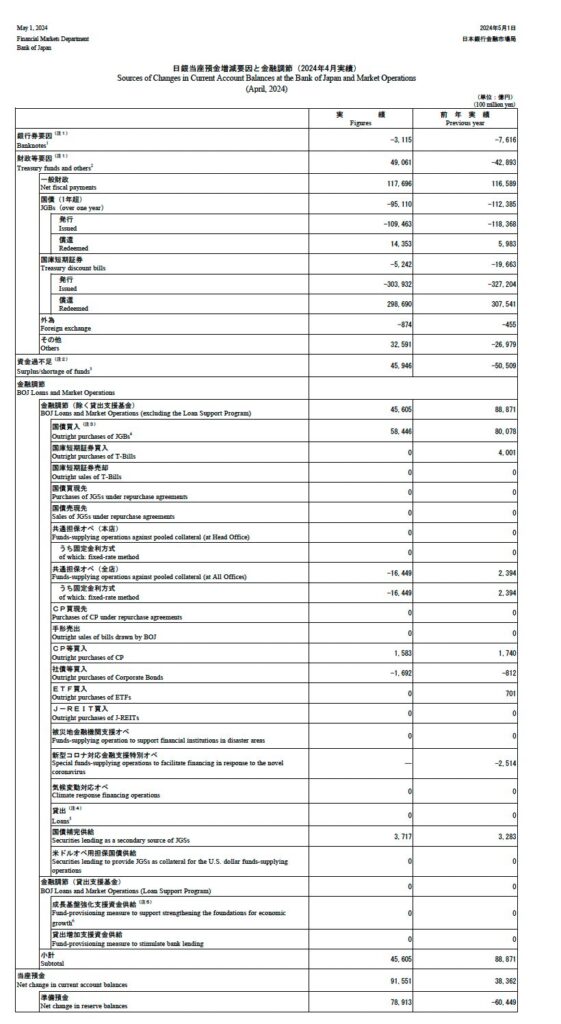

In April, most of the Base Money expansion came from the Treasury spending money. But, there was also significant buying of government bonds. These are all small changes, but they do suggest that the recent period of restraint on the BoJ’s balance sheet is coming to a close. The better traders watch this. There is no evidence here of BoJ accounts being affected by buying/selling of foreign reserves — suggesting that any intervention by April 30 was “sterilized” for now. Bad news if you want to support a currency’s value.

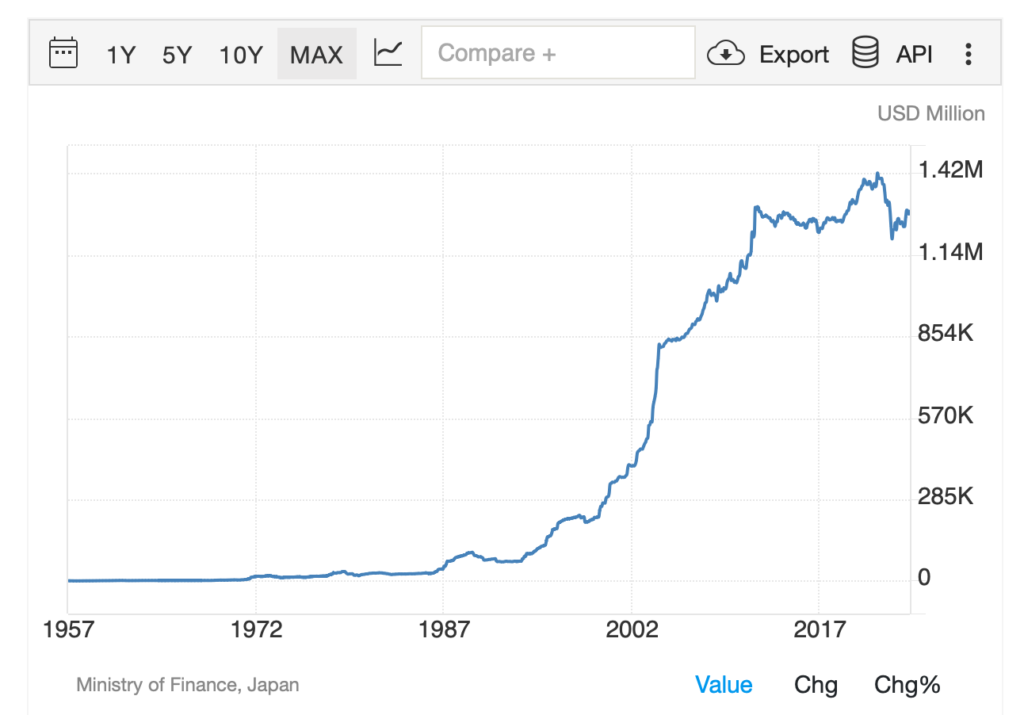

Of course we are interested in Foreign Currency Assets:

Not much change here from March-end.

But, this could reflect T+2 settlement and other factors, delaying figures.

Foreign reserves are pretty high, over $1 trillion USD, so there is a lot of room for action there. Foreign reserves on the BOJ balance sheet are only 10 trillion yen or about US$66 billion. Almost all of it is on the MOF balance sheet apparently.

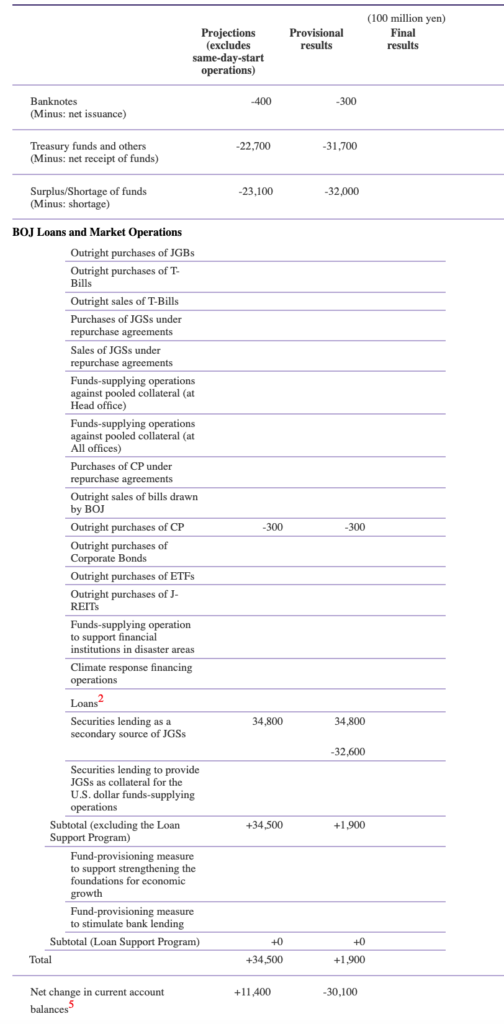

The Bank of Japan publishes a daily report of changes to current account balances (bank reserves).

Here is the projection for May 7. There is a small drop of 980 billion yen, (9800 x 100 million yen), which is about US $6.53 billion. Not much.

Here is the preceding May 2. There is a pretty big figure for the Treasury (Ministry of Finance). I think the intervention is accounted through MoF. Basically, a yen-buying intervention means that MoF’s account at the BoJ expands (with the yen they bought), reducing bank reserves. Here, it is 3,200 billion yen, about US $21 billion — in line with intervention estimates. This resulted in a corresponding 3,010 billion yen drop in Bank Reserves. So, no sterilization for now.

The Ministry of Finance used to be called “Okurasho” in Japanese, which is more directly translated as “Treasury” (literally “Ministry of the Big Storehouse”). Today, it is called the “zaimusho” or literally “Ministry of Finance.” Here is May 1, now including Final Results. We see a big 8,350 billion yen result from MoF, or about US $56 billion. This passes through for an 8,060 billion yen reduction in bank reserves. Again, no sterilization for now.

The money ends up on MoF’s account at the BoJ, comparable to the Treasury’s account at the Fed. This is basically MoF’s checkbook. It is hard to imagine how the money just sits there. They are likely to spend it. Thus, the yen would “re-enter circulation” over the following weeks and months, basically sterilizing the intervention.

I’ve often wondered exactly what the thinking patterns, policies and processes are that lead to the common result of forex sterilization. Here we have an interesting example that I am looking forward to following.

“Sterilization” basically means that, although yen is purchased, the supply of yen is not reduced. The result is nearly always a longer-term failure to support a currency’s value. That’s why I always say that, to be successful, any currency-supportive “intervention” must be “unsterilized,” leading to a reduction in the monetary base.

August 28, 2016: What Is “Sterilization”?

September 4, 2016: What Is “Sterilization” 2: The Complexity of Central Bank Activity

I also have an extensive discussion of this topic in Chapter 1 of Gold: The Final Standard, including quotes from Milton Friedman and Robert Mundell, describing exactly what I am talking about.