The word “sterilization” is one of those economic terms — like “inflation,” “deflation,” the “balance of payments,” and several others — with no clear meaning. It is applied to a wide variety of situations which are actually very different, in their causes and outcomes. This is confusing; and, like those other terms as well, it tends to be used by people who are confused.

The basic idea behind “sterilization” is a situation in which a central bank increases its holdings of one asset and decreases its holdings of another, which results in little change to overall assets and also little change to overall base money.

This condition can be the result of a variety of different processes, all of which have very different implications and consequences.

1) A central bank “intervenes” in the foreign exchange market, and then adjusts its holdings of other assets so that the forex intervention does not result in any change to the monetary base. This is extremely common today, and is the reason why “forex intervention” fails over and over to accomplish its goals, to either support or (occasionally) depress currency value. The reason is that it is ultimately the change in the monetary base which supports or decreases currency value, so if you eliminate that element, then the “forex intervention” tends to have a fleeting effect. Often, the result is that foreign exchange reserves are dangerously depleted, and a currency crisis ensues. This is very common, and I illustrated several examples in Chapter 6 of Gold: the Monetary Polaris. A good recent example has been given by Russia:

October 23, 2015: Russia’s Central Bank Might Be Getting A Clue After All

October 16, 2014: Russia’s Currency Crisis: This Is So 2008!

November 24, 2008: Russia’s Currency Crisis

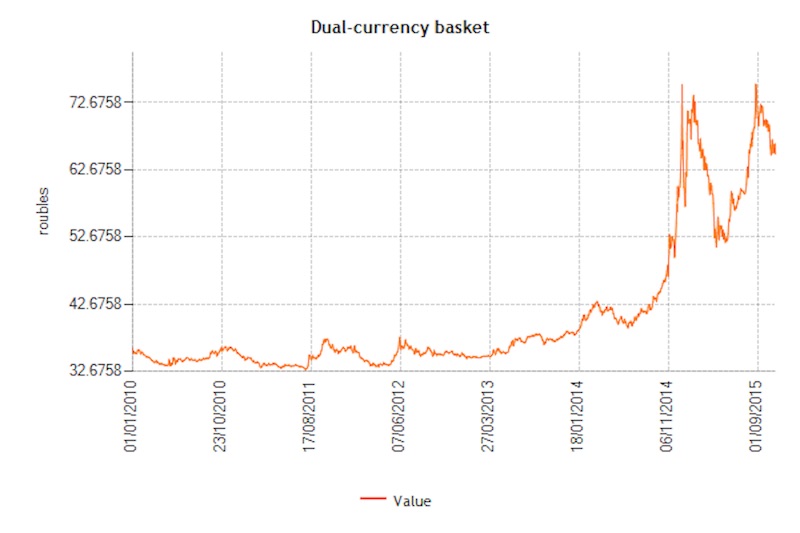

Here you can see the drop in the ruble’s value in the second half of 2014.

Substantial sales of foreign reserves (“forex intervention”) beginning mid-2013 to support the ruble’s value.

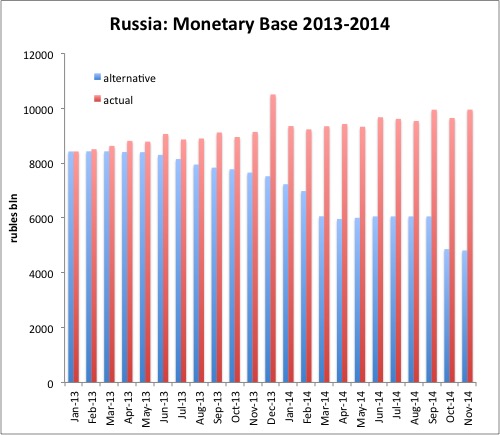

But no change in the monetary base, which continues to grow steadily (red bars). The blue bars indicate what the monetary base would have been if all of the rubles purchased in foreign exchange intervention had been removed from circulation, shrinking the monetary base. As you can see, the ruble base money supply would have contracted by roughly 50%! An actual contraction of this size would not have been necessary. The ruble’s value would have been supported by a much smaller contraction.

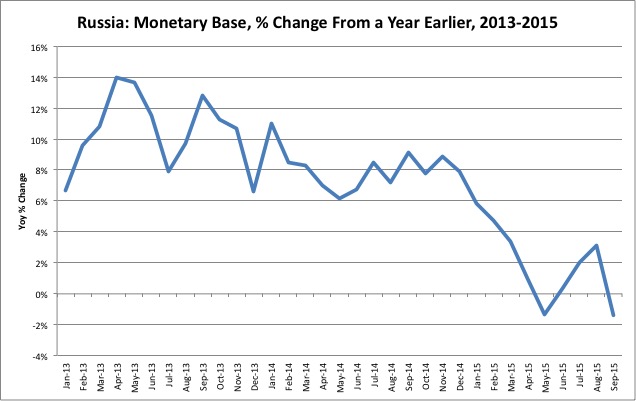

Although the monetary base did not contract much, the YoY growth rate fell significantly beginning around December 2014. This was exactly the point at which the ruble’s value rebounded and headed higher. Note also that, before December 2015, after the ruble had been falling (and the central bank intervening) for about eighteen months, there was not only no contraction in the monetary base, but the rate of growth remained very stable!

I think there is an idea among central banks that they should target a steady expansion rate of the monetary base. This was, after all, the idea presented by Milton Friedman in his 1962 Program for Monetary Stability. As you can see, it doesn’t result in “monetary stability” at all, but rather a terrible decline in currency value, because there is no mechanism to support the currency value when necessary. Even a fairly large contraction (10% let’s say) in the monetary base has no real economic effect (“deflation”), if it is done to support the currency value. For example:

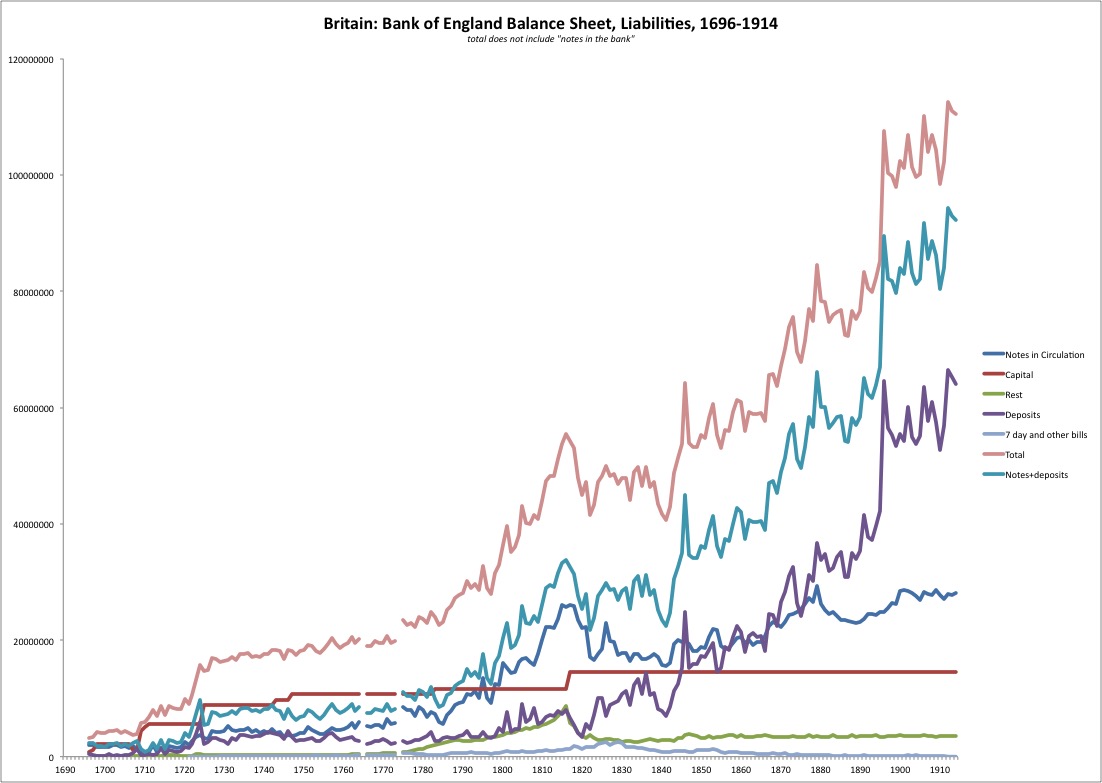

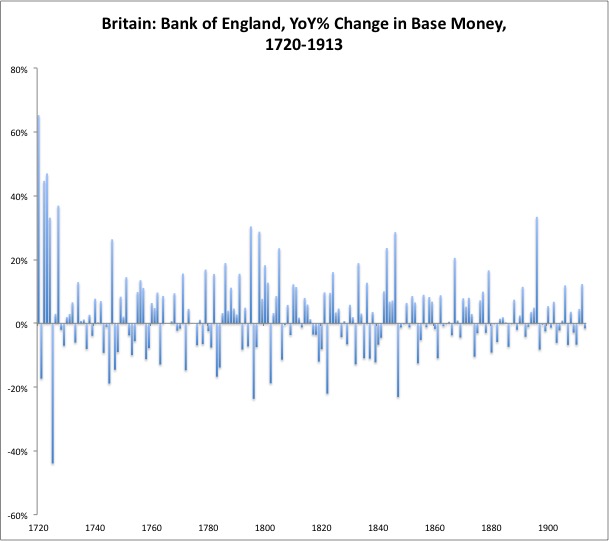

This is the Bank of England’s balance sheet, liabilities side, including base money (teal, “notes+deposits”). As you can see, there is no smooth curve of growth here. In fact, there were extended periods of contraction. These periods of contraction had no effect on monetary conditions, which reflected the pound’s solid link to gold during most of this period (except for 1797-1821).

This is how it looks in terms of YoY% change.

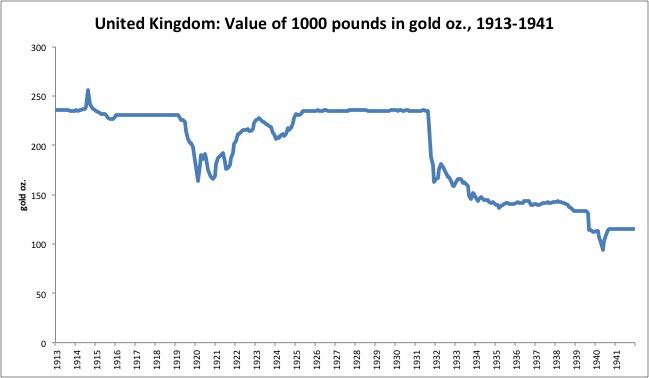

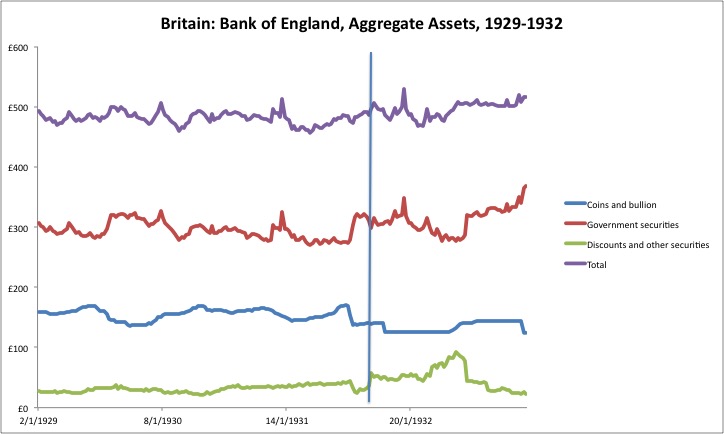

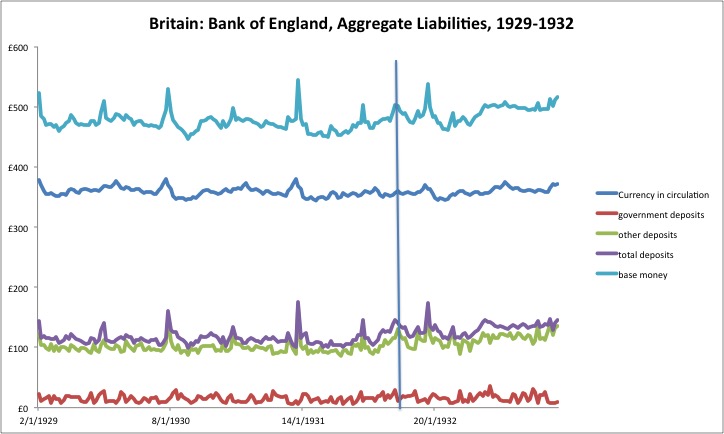

2) Gold (or foreign exchange) has an “outflow” due to conversion at the parity price, indicating a sagging currency value. This outflow is “sterilized” via purchases of debt assets, producing no change in the monetary base. This is very similar to #1 above, except that instead of an occasional “forex intervention” done via central bank discretion, sales of gold (or foreign exchange) are the result of convertibility at the parity price. The motivation seems to be similar — the belief that a contraction in the monetary base would cause “deflationary” consequences. This is not true. A thinking process along these lines may have been responsible for the British pound devaluation of September 1931, which we looked at here:

May 22, 2016: The Devaluation of the British Pound, September 21, 1931

In this case, a decline in gold reserves due to conversion was offset by a rise in government bond holdings, producing no change in the monetary base. If the decline in gold reserves was accompanied by a corresponding decline in base money — which would have been the case, if the BoE been otherwise inactive — then the British pound would not have been devalued.

However, in this case, it is a little hard to see what is going on here. Probably, the gold conversion happened first, and the bonds were purchased later, because of the fear that a decline in the monetary base would have some kind of recessionary consequences, or possibly lead to a rise in interest rates. However, it is possible that the bonds were purchased first, for some kind of reason, and then the gold outflows happened as a consequence, because the increase in the monetary base would have depressed the value of the pound, causing outflows.

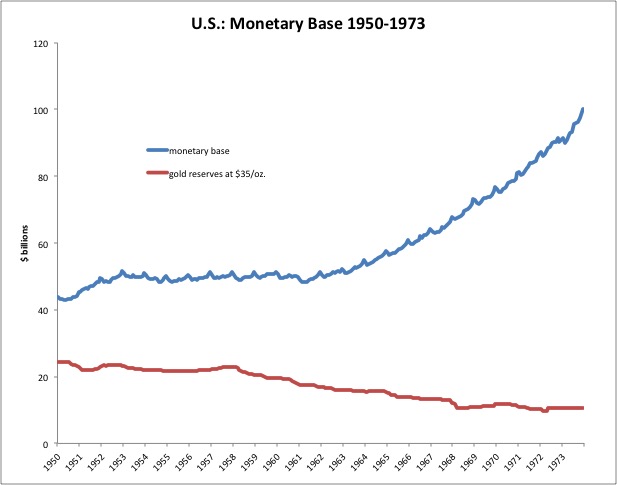

This was also the cause of the demise of the U.S. dollar’s gold parity at $35/oz. in 1971. Chronic dollar weakness, and the consequent outflows of bullion due to conversion at the $35/oz. parity, were not addressed by a reduction in the monetary base. In the first instance, the monetary base should have shrunk by the amount of the bullion outflow. Instead, base money went the other way. Yes, it really was as simple as that; and yes, they were too dumb to figure it out. Base money in the 1960s shows a curiously even rate of expansion, evidence that the Federal Reserve had adopted a base growth target (popularized by Milton Friedman) much as the Russian central bank appears to have done so in 2014-2014.

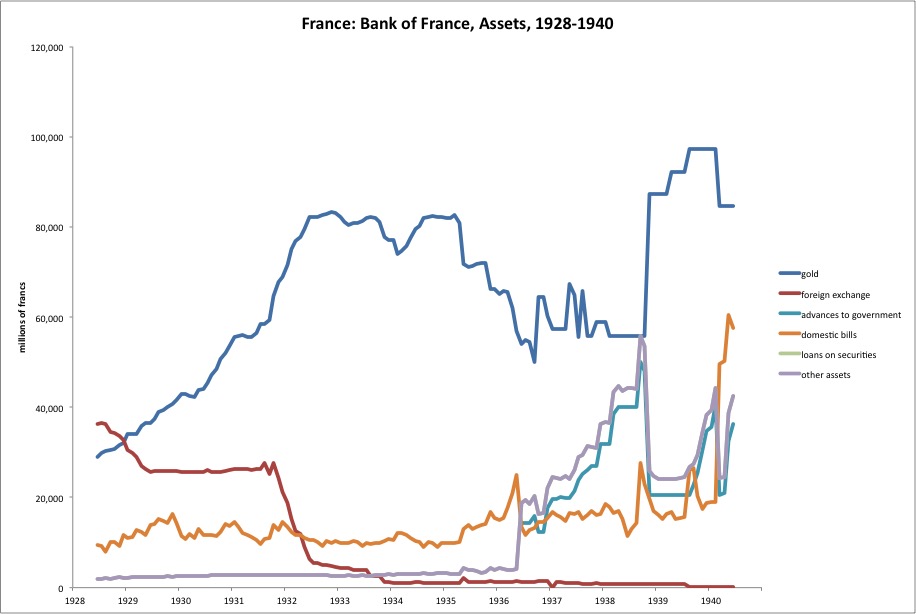

Conceivably, you might have an opposite version of the same thing, where a rising currency value vs. the gold parity produces gold bullion inflows, which are cancelled by discretionary sales of debt assets. Some people claim that the Bank of France did this in 1928-1932, but this was not so. Even if this does happen, it is generally not much of a problem because gold inflows would continue until, finally, all the debt assets are depleted and reserves are 100% bullion. In general, central bankers can easily find a way to deal with these situations without causing any great mayhem, even if they don’t really know what’s going on.

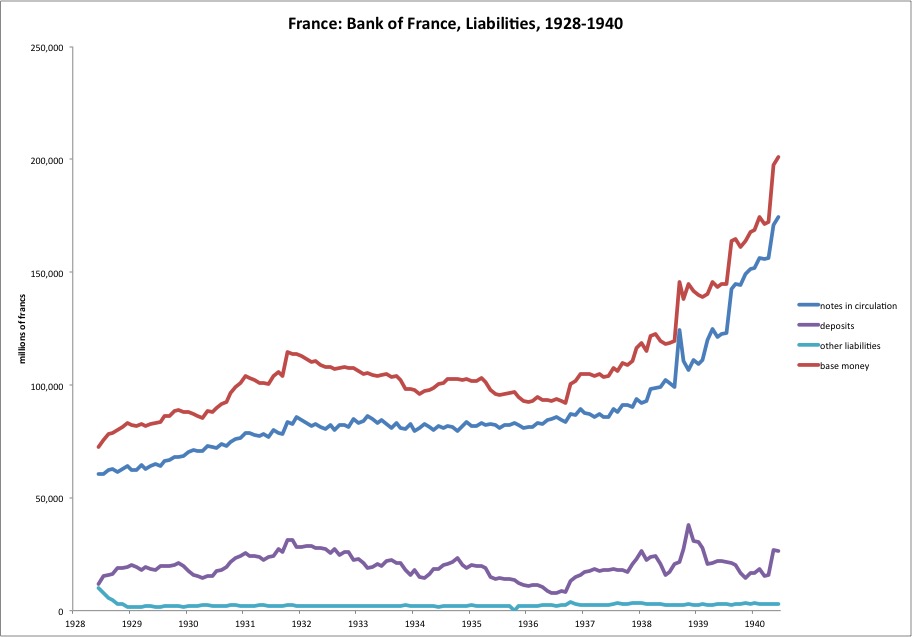

3) A reserve asset swap. The Bank of France did this in 1928-1932. Before 1928, the Bank of France had large holdings of foreign reserves (mostly British pounds). Beginning in 1928, the Bank of France swapped some of these reserves for gold bullion. This was basically a return to the BoF’s pre-1914 condition, when the BoF held large bullion holdings and no foreign reserves.

July 31, 2016: Blame France 2: Balance Sheet Peeping

It’s worth noting that the Bank of France did contract the monetary base beginning in September 1931, to support the franc which (along with the dollar) came under a lot of pressure as a result of the British devaluation that month. This had no “deflationary” consequences, because the value of the franc did not change.

A central bank can swap one asset for another at any time. The difference between this, and a #2 situation is that in #2, the decline in gold reserves was due to a conversion outflow. The correct action here would have been to reduce the monetary base to support the currency’s value vs. its gold parity. This happens naturally, if the central bank does not cancel the effect by a discretionary purchase of bond assets. Thus, #2 is BAD because it leads to a failure of the gold standard system (as in Britain in 1931). In the reserve-asset swap, the currency’s value is not weak vs. its gold parity, and thus there is no need for any change in the monetary base. The central bank is just changing one asset for another, without changing the monetary base. This is basically harmless.

I think we will stop there, and continue this discussion later.