(This item originally appeared at Forbes.com on August 7, 2020.)

Today, people have the impression that the wealthy are … a little too wealthy. Many propose to do something about that.

I would say that, in fact, the wealthy are too wealthy today. Let me explain.

“Wealth” today comes largely from ownership of assets, especially the equity of companies. Basically, you get wealthy by owning a company, and then you enjoy the profits of that company. You might own the whole company, or a part, or only a little bit, as part of an SP500 index fund.

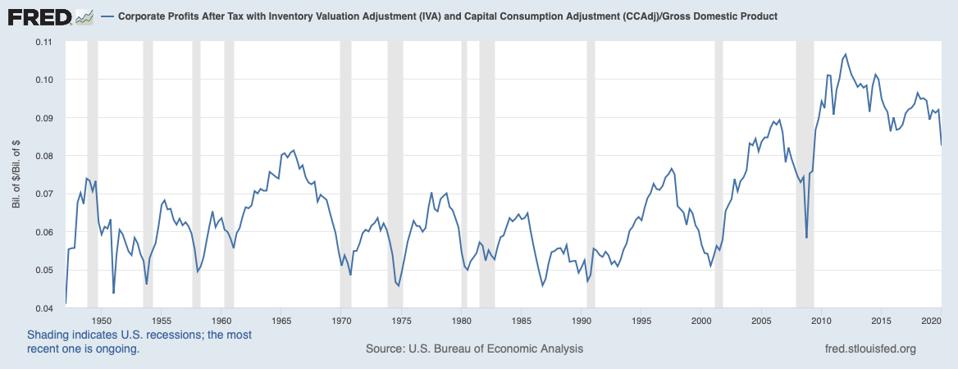

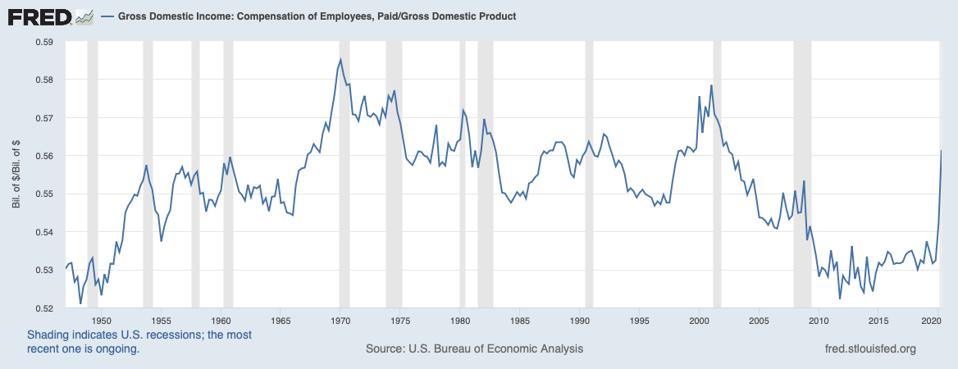

Profit margins in the U.S. today are unusually high. Historically, the reward to equity capital — corporate profits after tax — was about 6% of GDP. It is not a whole lot, but it is enough to reward capital, and make the founders and owners of companies very rich. Employees got about 56% of GDP in the form of employment compensation. Recently, corporation have been making about 9% of GDP in profits — about 50% higher than their long-term norm. This has come out of employees’ income. Employees now make about 53% of GDP in income. In the end, 53% is not so much different than 56%, so I would argue that employees have not been particularly impaired, at least by this measure. But, the extra 3% of GDP that goes to corporations creates a big boost.

Is this a problem? In the past, there has been a lot of variability in this figure. Normally, it is “mean-reverting.” When capital is unusually well-paid, new investment and competition tends to bring the returns on capital down. Certainly, the recent COVID recession will bring down corporate profits, at least for a while. Some people have been concerned that a new wave of effective cartelism has produced artificially high profit margins for corporations. Jonathan Tepper, a Wall Street strategist, argued in The Myth of Capitalism (2018) that we might need greater efforts to maintain adequate competition. This could take the form of anti-trust action such as blocking the merger of competitors in a wide variety of industries.

Financial theory 101 says that the market price of equities should reflect the discounted present value of future earnings. In other words, most “wealth” that you read about in the Forbes lists reflects the future earnings of companies owned by wealthy people — people like Jeff Bezos or Bill Gates, on down to small business owners who own a laundromat or an apartment building. Since earnings are about 6% of GDP on average, and then you have some kind of average multiple of those earnings, it makes sense that the value of equities would have some kind of average value vs. GDP. In other words, the wealth of the wealthy (as expressed in stock prices) should be proportional to GDP, just as the earnings of the companies are proportional to GDP.

Taking the Wilshire 5000 total market cap to GDP, we are now around 1.7x, compared to a long-term trend around 0.8x. Even that average includes some very extreme equity valuations since 1995. If you go farther back, the average is more like 0.6. So, we are 2x to 3x times that average. In other words, today’s wealthy are 2x to 3x more wealthy, compared to GDP, as their historical norms.

Just like corporate profit margins, valuations are theoretically mean-reverting, so there is nothing in particular that we have to do about it. You wouldn’t like it if it happened.

The moral basis of capitalism lies in the fact that, to get rich, a person has to serve others, by creating useful goods and services at a price that people will pay voluntarily. To do this, the business owner has to hire employees. Thus, both customers and employees benefit while the business owner gets rich. Everybody wins.

Unfortunately, it often doesn’t work out so well in the real world. People get wealthy in a manner that makes others worse off. This is true of drug dealers, for example. But, it is also true of a wide variety of businesses that are benefiting from a sort of parasitic “crony capitalism,” which typically involves the government in some way. The defense industries, big pharma, healthcare, education and financial industries have a lot of this. It has been particularly true in recent years, where it seems, through Federal Reserve financial distortion or government “bailout” and “stimulus” spending, people are getting rich who don’t deserve it.

Things are indeed a little odd these days. The wealth of the wealthy is about 2x-3x higher than it normally is, as a percentage of GDP. But, that is not such a big problem, and it tends to fix itself. We should aim at making everyone better off. In the capitalist economy, this means starting your own business, or getting a good job from someone who is starting or expanding their business. This comes about via the Magic Formula: Low Taxes and Stable Money. Unfortunately, our money today is not so stable, and our taxes are not so low. Both are likely to get worse, not better. This is the real problem we will need to fix.