We’ve been talking about the apparent shortage of “bank reserves” (Federal Reserve deposits of financial institutions), which has recently prompted the Federal Reserve to increase its base money supply with a program of $60B of “don’t call it QE” purchases per month, plus additional repo lending. I think this is a good thing, as long as it doesn’t go too far.

October 21, 2019: Basel III and Demand for Bank Reserves

Here is a pretty good description of the recent “repo-quake.”

We looked into related topics earlier this year:

May 26, 2019: The Federal Reserve and Bank Reserves

June 2, 2019: The Federal Reserve and Bank Reserves #2: What’s Old Is New Again

June 9, 2019: The Federal Reserve and Bank Reserves #3: Mission Accomplished

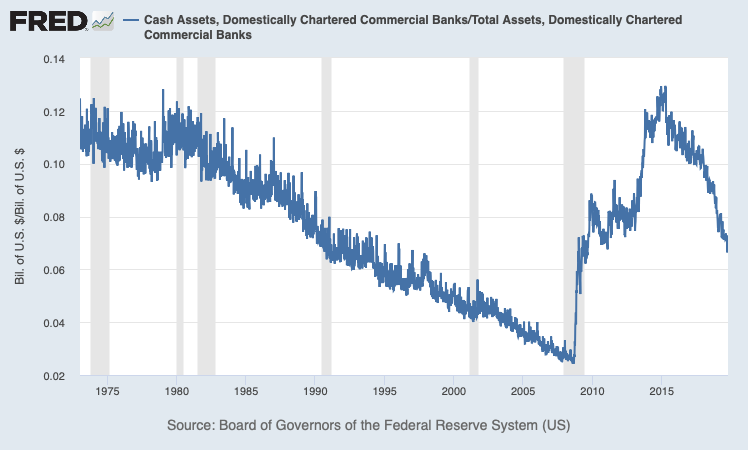

The gist of it is that banks have apparently returned to 1950s-style norms in their balance sheet construction. Specifically, this means: “cash assets” are 100% reserves held at central banks; and “cash assets” are about 10% of total assets. The combination means that bank reserves at the central bank should be about 10% of total assets. This was the norm in the 1950s, and also in prior decades going back to the 1860s. It appears that new Basel III requirements, decided upon in late 2010 but not fully implemented until 2019, basically require banks to act in this manner. We saw that in the case of JP Morgan, at the end of 2018, Basel III reserve requirements translated into a reserves/asset ratio of about 11%. This is far above the present reserves/asset ratio of about 7% for U.S. domestic banks as a whole, so it is no surprise that there seems to be a systemic shortage of bank reserves.

There may be something more to the recent repo market conditions, such as financial weakness at certain institutions, but I think this is most of the story. They are related: when reserves are scarce system-wide, they would presumably be most scarce at weaker institutions. As an extreme example, Bernie Madoff’s ponzi scheme blew up because of a general rush toward liquidity (cash) in 2008-2009. Madoff’s investors withdrew their funds, mostly for external reasons, which revealed the problems at the firm.

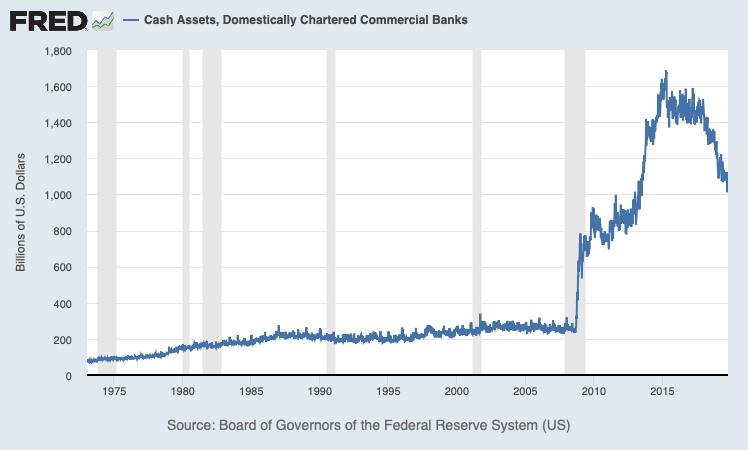

“Cash assets” soared after 2008, but have been contracting a lot since then.

In the 1950s to 1980, “cash assets” were about 10%-12% of total assets. Then, these were drawn down basically to increase profitability. We returned to the 1950s-1970s norm briefly in 2015, but have been drawing this down again rapidly.

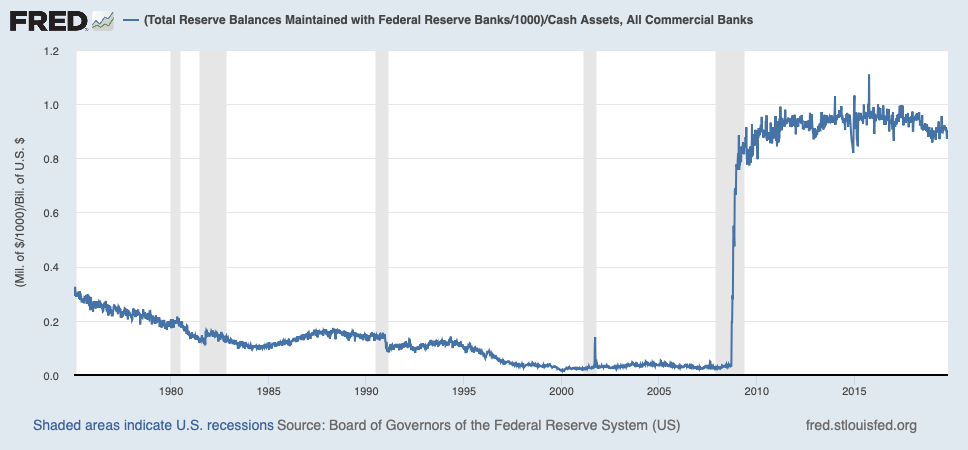

In the 1950s, these “cash assets” were 100% reserves at the central bank. But, in the 1960s to 2008, a greater and greater amount of “cash assets” consisted of interbank lending. Since 2008, “cash” is again effectively 100% bank reserves. The combination of much higher “cash assets” (to 1950s norms) and also effectively 100% of “cash assets” consisting of bank reserves (1950s norm) has led to much, much higher holdings of bank reserves. This has apparently been codified into Basel III regulations.

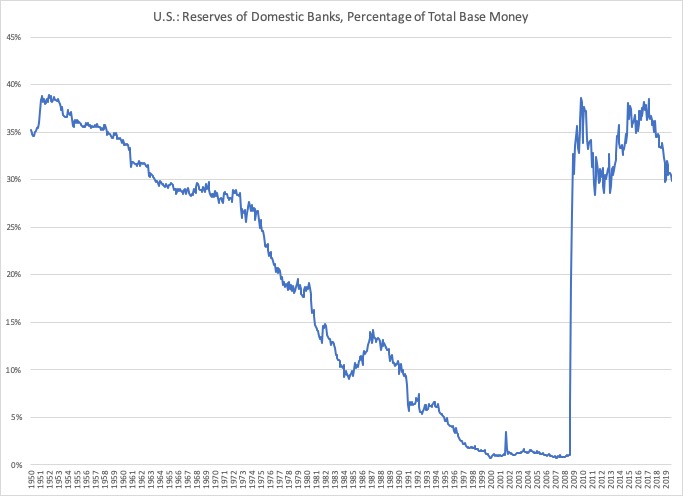

Thus, we should not be surprised to find that the present level of domestic bank reserves, about 30% of total Base Money, is about in line with what it was in the 1950s. This graph adjusts for the growing influence of foreign subsidiaries. This was done by taking the ratio of domestic cash assets/total cash assets, and applying it to bank reserves to generate an estimate of reserves of domestic banks.

We can go back earlier, before 1950:

March 6, 2011: Bank Reserves

March 13, 2011: Bank Reserves #2: Reserves Out the Wazoo

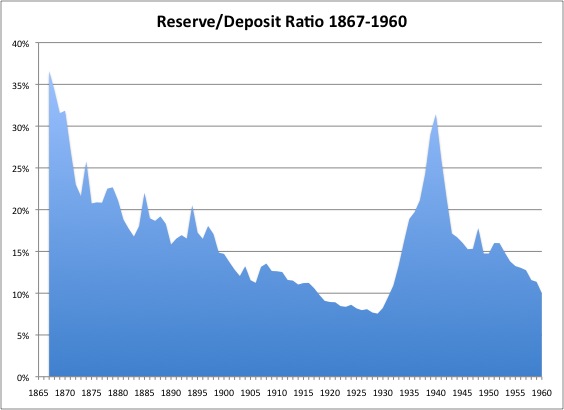

This uses the reserves/deposit ratio, which is almost the same as the reserves/assets ratio since deposits were typically about 90% of assets. Here we see that the high reserves/deposits ratio (reserves/assets ratio) was not just a fluke of the 1950s, but normal banking practice going back to the 1860s. In general, we see that economic difficulties (Civil War, Great Depression) tended to make banks hold a higher portion of reserves (“cash”), and good times a lower portion, in pursuit of higher profitability.

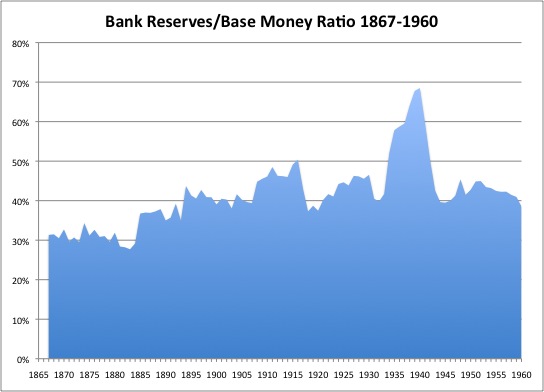

Here is a ratio of bank reserves to total base money going back to 1867. We see that it was about 40% for a long, long time. It is about 30% for domestic banks today, and hit a high of about 40% in 2015. So, the present situation is very normal for the banking industry, going back to 1867! (These numbers come from Milton Friedman’s Monetary History.)

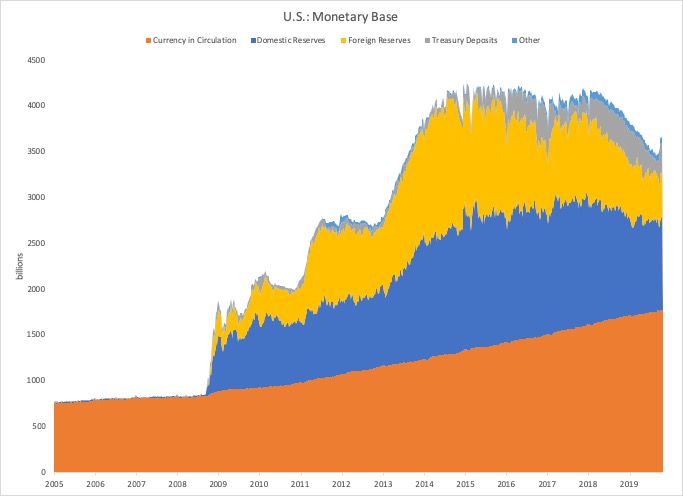

Here is how it looks now:

We can see the rolloff of the total, which doesn’t seem so big from very high levels. But, currency in circulation has been rising, and also, the Treasury itself now holds a rather large portion of base money. Between these two, total bank reserves (foreign and domestic) have been squeezed by quite a lot. Mostly, this has been on the foreign side, which is an interesting story itself. But, domestic reserves have also been squeezed.

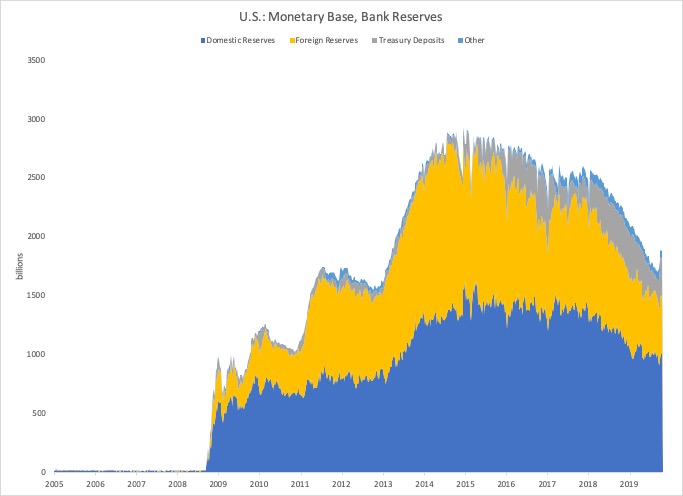

This chart is of bank reserves alone, where we can see a much larger decline. In total, bank reserves have fallen about $1.4 trillion from the peak in 2014. Most of this has been from the foreign banks, but domestic banks have also shrunk a lot. To bring domestic bank reserves/assets back up to 10% would require about 50% more reserves, or about $400 billion. Plus, the foreigners probably want a share too, so $700 billion or so looks about right to me. The Federal Reserve has committed to only $360 billion so far, so I think there will be more to do. Also, the Treasury has tended to run much larger balances in recent years, which will have to be accommodated somehow.

This is “normalcy” as it was for the period 1867-1960. I think it is prudent to maintain these kinds of high reserve levels, as has been codified in Basel III. I don’t know the details of the Basel III requirements (it’s complicated), but I would say that I think it is important to have a provision by which banks can actually draw down their reserves in a crisis — whether a systemwide crisis, or a crisis at that individual bank. The whole purpose of having cash “in reserve” is to be able to use it when you need it. In the past (notably, in 1907), there have been problems when banks have not been able to use their reserves when needed, due to the “requirements.”

For the rest of us, people should get used to having much larger bank reserve balances. It is not a problem, in itself, and was the norm for roughly a century of history.

However, we have enjoyed a one-time boost of “money-printing” due to the “normalization” of bank reserve levels to historical conservative norms. We will enjoy another round of “money printing” as the Fed tops up its reserve levels over the next few months. This “money printing” is basically U.S. Treasury debt monetization. It seems like we have been able to “print money” without consequences, as we have enjoyed this one-time adjustment since 2008, and this “money printing” has essentially financed Federal deficits. It would seem, to the typical politician who would love to spend more money, that there is nothing to lose and everything to gain; and a new class of courtiers (“advisors”) has arisen to fill this market demand. However, we can’t expand the monetary base beyond what banks “demand” for their reserve requirements, without inflationary consequences. It is true that Japanese banks have seen their bank reserves rise to as high as 20% of total assets. This is what has allowed the BOJ to “print” really amazing amounts of money without consequences thus far. But, Japanese bank balance sheets are much larger, compared to the size of the economy, than in the U.S., which uses much more direct financing such as corporate bonds and securitized lending.

January 22, 2017: Japan: Printing Money Without Consequences

Also, I think that Japanese banks have had quite a lot of arm-twisting applied by the government, so that they hold these very large cash balances without inflationary consequences. Maybe the U.S. banks will follow the Japanese banks, and eventually accept reserve/asset ratios on the order of 20%. But, maybe not.

All this “money-printing” will embolden those who want to apply “fiscal stimulus” to the economy, whether from the MMT camp or the more conventional deficit-spending camp. If we’re going to run big deficits anyway, it would be much better — MUCH BETTER — to enact permanent tax cuts, instead of increasing spending beyond what it will increase anyway due to entitlement obligations. I suggest a major reform of U.S. individual income taxes, that bring the top rate down to no more than 25%. This can be combined with an elimination of capital gains and dividend taxes, and also the removal of a wide range of exemptions including the remaining State and Local tax exemptions.

To conclude: We should allow some expansion of the monetary base in accordance with the increased demand for bank reserves in line with Basel III requirements, and also long-term banking best practices. But, we should not assume that we thus have a free license to print money willy-nilly. After this expansion, I do not see much scope for further expansion (beyond normal expansion in line with nominal GDP), without potential inflationary consequences.