Here’s something I’ve been meaning to get to for a long time. Let’s look at the description of the supposedly disastrous “inflation” of the 1920s, as described by Murray Rothbard in America’s Great Depression (1962), and see if it makes any sense at all.

https://mises.org/library/americas-great-depression

Rothbard was characteristic of a great number of “classical”-leaning economists who felt obligated to describe the Great Depression as basically a monetary event. I don’t think it was. The reason they were thus driven, I think, is because the notion that the world economy just suddenly coughs up blood and falls over dead, for no apparent reason, was abhorrent to them, and completely contrary to two centuries of thinkers (going back before Adam Smith in 1776), who said that capitalist economies are naturally self-adjusting and self-righting. Thus, they wanted to find some kind of government intervention, some kind of blatant infraction of all economic principles, that could cause such a disaster.

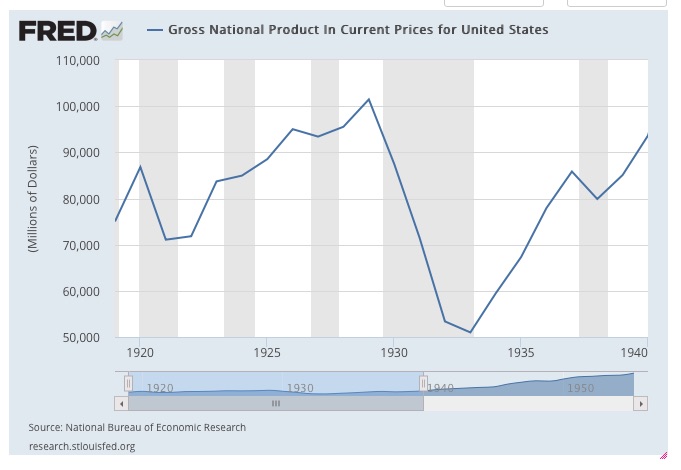

There was indeed such an infraction — but it was fiscal policy, not monetary policy. It began with the worldwide tariff war set off by the Smoot-Hawley Tariff in the United States. Over a thousand U.S. economists signed a petition against the tariff. When it passed, and indeed even before it passed, governments around the world imposed similar tariffs. World trade, not very surprisingly, collapsed. This put the world into recession, in 1930, but was not in itself, in my opinion, responsible for the disasters which followed.

In response to the recession and consequent falloff in tax revenue, governments imposed a round of very aggressive domestic tax increases. In the U.S., it was the Hoover tax increase of 1932. Similar things were done in Britain and Germany. France and Japan avoided this round of tax hikes, and their economies were at first better off.

June 27, 2010: U.S. Tax Hikes of the 1930s

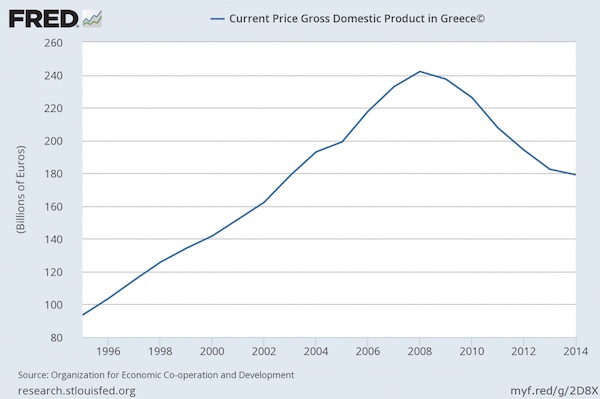

This was basically “austerity,” as we know it today, and it had a similar effect as the same kinds of “austerity” policies in Europe recently, except that these 1930s tax hkes were much more aggressive than the incremental sort of thing we see today. With the combination of tariff wars and domestic tax-hike “austerity”, economies were really not healthy at all. We saw recently that “austerity” has recently caused a 25% reduction in nominal GDP in Greece. That itself is Great Depression-like. However, this is without any global trade and tariff war, banks did not blow up, there was no sovereign default, and it has been an issue thus far limited to Greece and a few other places, while most other worldwide economies have been semi-OK, instead of several major economies all suffering similar problems together. Now, just add all those other factors back in, and you can see it is very easy to get a Great Depression conclusion without relying on some kind of monetary explanation.

Especially in 1931, banks everywhere had “systemic” issues, a round of bank failures. This is similar to what almost happened in 2008-2009. So, if you can imagine if governments didn’t bail out banks in 2008 to the tune of hundreds of billions of taxpayer theft, plus accounting changes that basically let them falsify their asset values and other such tweaks, plus government guarantees on everything from bank deposits to money market funds to Fannie and Freddie paper to AIG’s derivative obligations, and instead there was widespread bank failure in 2008-2009 — as would have happened in the normal course of events — that is a little like what was happening in 1931-1932.

On top of all that, beginning in 1931 there was a tremendous number of sovereign defaults. Some of these were not lasting defaults; governments suspended payments, but later made up their unpaid balances. I believe even the U.S. and Britain had payment suspensions of this sort. Of course, at the time, it was by no means certain that suspended payments would be later unsuspended; so you can imagine the uncertainty. Among those goverments that had a more permanent sort of default, we find in 1931: Hungary, Bolivia, Brazil, Chile, Dominican Republic, Ecuador, El Salvador, and Peru. (Note that Asia and Africa, at the time, were largely composed of European colonies, so there were a lot fewer countries then.) Argentina managed to get ahead of them in 1930. In 1932, they were joined by: Austria, Bulgaria, Germany, Colombia, Nicaragua, Panama, and Paraguay. In 1933, we find defaults by: Romania, Serbia/Yugoslavia, Cuba, Guatemala, and Uruguay. You can just imagine what that would have meant for financial system stability, the ability of nongoverment borrowers to refinance their debt, the consequences for those who had assets in the form of government debt, and so forth. Bad news.

If all that wasn’t enough, the devaluation of the British pound in September 1931 set off a whole new issue of currency instability, and in itself constituted a form of default for all holders of pound-denominated bonds, particularly the non-British ones who would experience the loss of value immediately, which were plenty. The British pound was the biggie, of course; but among devaluers (and consequently, governments that default via devaluation on local-currency-denominated bonds) we find:

Before 1931

Argentina

Brazil

China (effectively, on silver standard)

Hong Kong

Spain

Uruguay

1931

Britain

Australia

India

Canada

Denmark

Egypt

Finland

Japan

Mexico

New Zealand

Norway

Portugal

Straits Settlements (Singapore)

Sweden

Yugoslavia

1932

Chile

Greece

South Africa

1933

United States

Austria

Colombia

Czechoslovakia

1934

1935

Belgium

Romania

1936

France

Hungary

Italy

Netherlands

Switzerland

Did not devalue

Bulgaria

Germany

Poland

Turkey

July 18, 2014: Foreign Exchange Rates 1913-1941 #8: A Brief Summary

It would be nice sometime to do a proper narrative of all this, including all of the tax increases, details of all the sovereign defaults and currency devaluations, and so forth. But, that is not the task for today.

Oddly, none of these factors seem to get the attention of the “classical”-leaning economists today, just as they didn’t in the past either. I think one reason for this is that the people who were pushing all of this tariff war/”austerity” at the time were basically the “classical” economists, or, at least, the conservative/big business political bloc who, directly or indirectly, paid the “classical” economists’ salary. Of course they were blind to their own error, or they wouldn’t have made it. Also, other “classical” economists, like Rothbard, who may have followed afterwards have felt a responsibillity for not undermining “their team,” or their political allies and salary-payers, and would rather dump everything on the lap of the Keynesians, including, for example, the proto-Keynesian response of Herbert Hoover, which was to increase spending on public works, and of course the much more Keynesian-flavored strategy of Franklin Roosevelt afterwards. Rothbard actually does this in a funny sort of backwards way, by blaming the Federal Reserve as if it was acting in a Keynesian manner and managing a floating fiat currency, when of course that was not the case at all.

Obviously, if you have an agenda to describe the Great Depression as some kind of government policy mistake, but then ignore this very long list of government policy mistakes, then you are going to be forced back into monetary explanations by default.

June 19, 2014: Explaining “Freaky Friday” — How the Gold Guys Became Their Own Worst Enemies

The Keynesians, oddly, do not have this compulsion. They saw the Great Depression as something which didn’t really need explanation. It was just the “inherent instability of capitalism,” which naturally required their solution of aggressive government “management” of the economy. Thus, their “causes” typically have the flavor of the government didn’t do this and didn’t do that — the Keynesian policies that the Keynesians thought they should have done. The big-government/socialist crowd that the Keynesians allied themselves with, in the 1930s and later, were not particucarly adverse to higher taxes, but they certainly didn’t want to reduce government spending! Thus, the decline in government spending associated with “austerity” gets the blame. (Often, this decline in spending is part of the “austerity” plan, but in practice, spending never actually declines.) And, of course, “easy money.”

Keynes himself was no dummy regarding monetary matters, and had many insightful commentaries during the 1920s, especially regarding Britain’s return to the gold standard at the prewar parity in 1925. But, he didn’t blame some kind of monetary error for the Great Depression. Of course, he advocated leaving the gold standard, to deal with the problems of the day with some kind of funny-money solution. Thus he “blamed” the gold standard in the sense that, for as long as it lasted (which was only until September 1931), it prevented Keynes and his followers from enacting their various funny-money solutions (which Keynes described in 1936). Keynes’ descendants, notably Barry Eichengreen, take a similar stance.

However, Keynes too was insensitive to the effects of tax policy, in this case Britain’s decision to maintain high tax rates, which had been doubled during World War I, throughout the 1920s and even some additional tax hikes to pay for new welfare programs. The combination of the somewhat minor “monetary deflation” of the pound before 1925, plus these tax errors, caused the British economy to sag badly during the 1920s. The United States also devalued the dollar during World War I, in much the same manner as Britain, and also returned to the prewar gold parity, effectively in 1922 — and this was a major factor in the 1921 recession. If anything, the U.S. return to the prewar gold parity was much more harsh and abrupt than Britain’s. However, the United States also reduced wartime taxes beginning immediately after the war, and continued to do so through the Harding and Coolidge administrations. The result was “the Roaring Twenties,” an economic boom. France also had a big round of tax reductions in the 1920s, and also had a big economic boom, while Britain languished.

March 25, 2012: The U.S. Dollar During WWI and the Recession of 1920

And so we come to Murray Rothbard, who had an explanation that there was some kind of disastrous “inflation” during the 1920s. Rothbard’s notion of “inflation” seems to encompass two principles, which we looked at a little earlier. One is a “monetary inflation,” which is an overissuance of currency leading to a decline in currency value, and a consequent adjustment upward in prices denominated in a less-valuable currency. The other is a “credit inflation,” in which excessively aggressive lending drives economic activity. (I’m putting these terms in quotes, because the term “inflation” is so vague as to have no particular meaning in popular use.)

The credit boom can certainly exist. But, it doesn’t really have anything to do with “monetary inflation.” This is easy to see if you consider that banks can certainly make all kinds of aggressive loans even in a situation where gold and silver coinage alone is used as money. Whatever banks are making loans for will naturally see some kind of increase in activity. At some point, borrowers might not be able to pay the money back, in which all sorts of disaster ensues. This scenario could, and certainly did, happen from time to time, even in the pre-banknote era of gold and silver coinage. It should be obvious that none of it has any relationship with the money itself, which is made of gold and silver in this example.

December 13, 2015: Money and Credit 2: Credit

November 8, 2015: Money and Credit #1: Money

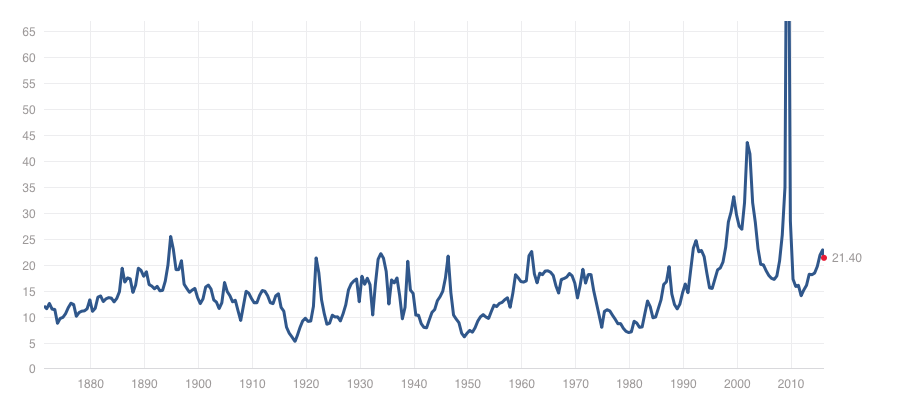

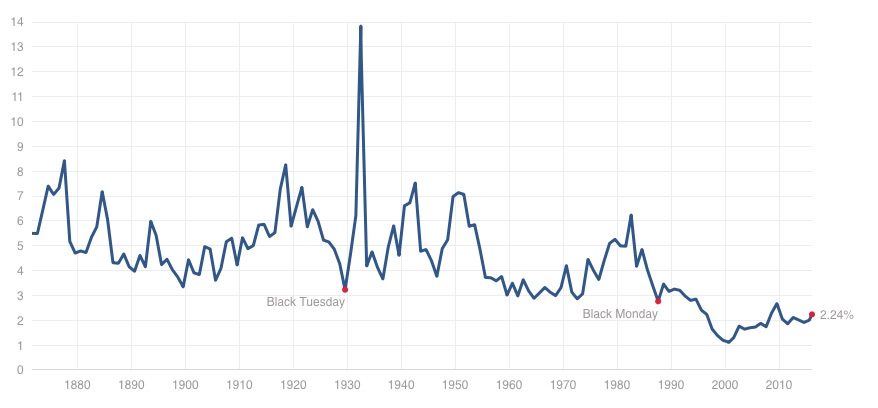

I don’t think there was a destructive credit boom in the 1920s. Certainly there was a big increase in credit, but you would expect that during any great economic expansion, and it was actually in line with GDP growth as a whole. Certainly a great number of borrowers defaulted in the 1930s, which blew up the banks. But, that was not necessarily because the original conditions of the loan were faulty. If you borrowed money to buy a house in 1925, or for business expansion in 1927, that might have been a perfectly sensible and judicious investment for the time, based on the available knowledge. The fact that the borrowers may have then defaulted in 1931 doesn’t mean that the original lending was a mistake. Things just changed. There were a few pockets of excess, as there are at any time, for example in Florida real estate. But, the Florida real estate bust didn’t cause a worldwide collapse. There was certainly some excess in the form of margin lending for stock purchases. 10:1 leverage for stocks was common at the time. This undoubtedly contributed to the very fast collapse of stock prices in 1929, basically a big margin call and consequent forced liquidation. However, on basic valuation metrics, stocks were not particularly high priced in 1929. At the very peak of the stock market in 1929, they traded for about 20x trailing twelve-month earnings, which would be considered pretty reasonable today considering the rate of earnings growth at the time.

SP500 price/earnings ratio, based on trailing 12-month reported earnings.

SP500 price/earnings ratio, based on trailing 12-month reported earnings.

SP500 dividend ratio

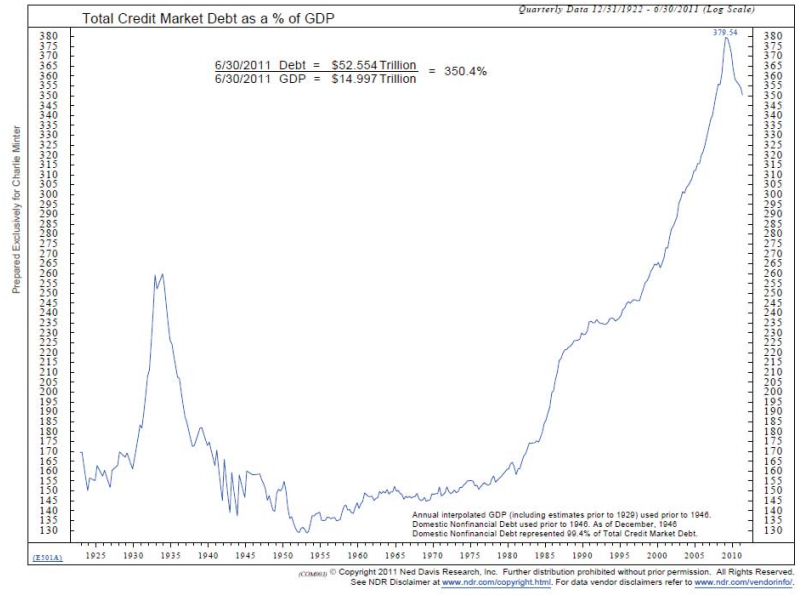

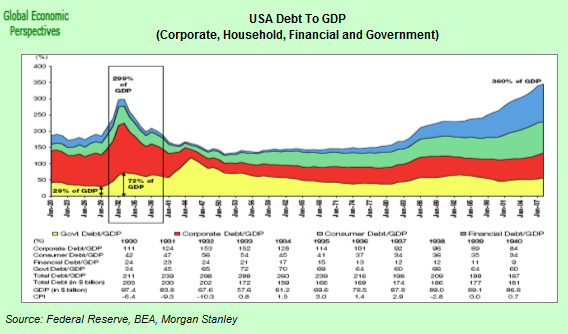

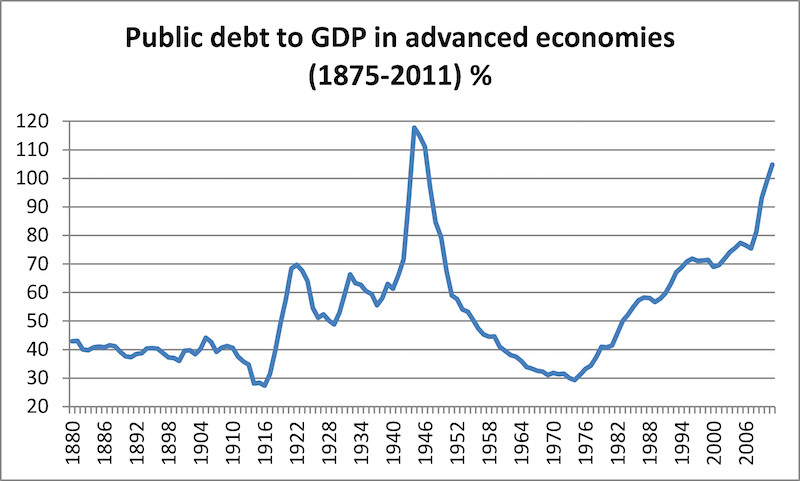

Here’s a look at total credit market debt/GDP in the U.S. The big spike during the Great Depression naturally attracts the attention, but this was actually after 1930, and a result of the decline in nominal GDP, not expansion of credit. As you can see, nothing very interesting happened during the 1920s, and in 1929 this figure was around its level for 1923. It was also rather low on an absolute basis.

The problem with every kind of monetary explanation is that they typically fail to answer the question of: how could this have happened with a gold standard system? And, of course, the answer is that it couldn’t have happened, except for a dramatic change in the value of gold itself. Some people make that claim, but we will set that aside for now. Thus, whether Rothbard’s Great Inflation, or Friedman’s Great Deflation, or the Blame France theories, or all the other minor variants down through the decades, we can generally dismiss them from this principle alone. Gold redeemability, in itself, would have prevented any currency from deviating from more than a few percentage points from gold parities. From this, we can also conclude that the base money supply, whatever it happened to be, was also basically what it needed to be to maintain the parity value, and thus could not be dramatically “inflationary” or “deflationary”. Also, currencies did not vary in value versus one another: one could claim that the U.S. $20.67/ounce parity was a fiction; but if so, how could the dollar also maintain its value against the British pound, French franc, German mark, and every other gold standard currency of the time? It is possible that a currency manager could be acting in variance with gold standard operating principles — in other words, not managing the base money supply correctly, and instead indulging in some sort of excess supply (“inflationary”) or insufficient supply (“deflationary”). If this was the case, we would immediately see the currency begin to vary from its parity value. This could be contained by capital controls; but this was generally not the case during the 1920s (it certainly was during the later 1930s). All of these things certainly did happen in the 1950s and 1960s, and caused periodic devaluations throughout that time, leading to the final breakup in 1971. So, we know what that looks like. Also, it was the cause of the British devaluation in 1931. But, in those cases, the result was a failure of the gold standard system. In the 1920s and early 1930s, the gold standard system didn’t fail; even the devaluations which followed were mostly intentional. As we saw during the 1960s as well, even if central banks are operating in a way which is contrary to the proper principles of a gold standard system, there aren’t a lot of consequences until after the currency actually changes value. There wasn’t really much “monetary inflation” in the 1960s, in the U.S., even though the Fed was being somewhat naughty. The consequences came after the devaluation in 1971.

To summarize: you really can’t have any kind of dramatic monetary “inflation” (Rothbard) or “deflation” (Friedman or “Blame France”) without a change in currency value, which would be very obvious.

Today, I think we will stop with just this bit of preliminary stage-setting, before getting into Rothbard in depth.