Classical Economic Theory and the Modern Economy (2020), by Steven Kates, kept coming up in the list of books that Amazon.com recommended to me, while I was searching for other books. Score one for the algorithms that run Amazon’s recommendations, because this oddball little book really is the sort of thing that I like, and which serves and important role today.

The author is an Honorary Professor of Economics at RMIT University (since when are universities getting acronyms?) in Melbourne, Australia.

The book begins with this paragraph:

Writing this book was an odd experience, since the premise of everything found within the rest of this book is that just about the whole of modern economic theory is perniciously wrong, that other than here and there, such as in its opposition to rent controls, there is virtually nothing useful one can learn from a modern economics text in how to manage an economy. (p. 1)

So …. tell me what you really think.

But, that is also the kind of thing we write about around here, isn’t it? That’s why this website exists.

The author was fully trained in the usual Keynesian or whatever they call it, “neoclassical” rubbish that you find in universities. Then, he had a real-world job for 24 years as the economist at the Confederation of Australian Industry, “which had the most profound effect on my intellectual destiny.”

In other words, unlike most academics who just mumble dogma in ivory towers, Kates had to investigate and interact with the real world economy. He was being paid by businesses, to craft real-world proposals for business-friendly policy to the Australian government — not groveling for tenure by babbling dogma to other academics. This experience was so shocking, that the whole second chapter is entitled: “The purpose of this book and why only I could write it.”

It’s worth noting that Ludwig von Mises, the greatest Keynesianism-is-bunk economist of the mid-20th century, had basically the same job in Austria. He worked at the Austrian Chamber of Commerce and Industry, for 25 years, from 1909 to 1934. This is one reason why Mises was never really accepted among academics. He was not of the Priest Class. He was, basically, a Scientist. All academics tend toward the forms of the Priest Class, which is Dogma arising from Consensus. Scientists look at the real world, and they don’t care about consensus. The real world is what it is, even if only one person understands it and 99 do not. Scientists are most interested in Destroying Dogma — finding the special places where The Real World deviates dramatically from Dogma — because that’s where all the fun is. The Priest Class shrinks from this like vampires from sunlight. It doesn’t really matter what von Mises’ opinions were, on specific matters. When Scientists show up, the Priests look bad.

So, naturally, Kates wondered where he could read about the economic principles that dealt with the real world as he experienced it.

He couldn’t find it anywhere in 20th century economic texts.

He couldn’t find it in the Austrian/”Marginal Revolution” – era texts (!).

He found it in: John Stuart Mill.

What, then, is the premise of this book? It is that economic theory reached its peak level of understanding with the nineteenth-century classical school, and, in particular, with the economic theory presented in John Stuart Mill’s Principles of Political Economy, whose first edition was published in 1848. …

Almost nothing from Mill’s time remains alive in economics. (p. 1)

People who hang around here won’t be surprised about his criticism of Keynesianism (including all its modern-day variants with Monetarist/neoclassical/whatever labels), but they might be interested in his critique of the Marginal Revolution-era stuff (1870-1913), which he thinks — and I agree — was a major step backward in economic thought. The main purpose of the Marginal Revolution was to criticise certain “labor theory of value” notions that were not from Mill or Smith, but perversions of Mill or Smith that were adopted by the mid-19th century Marxists (including, of course, Marx). However, in the process, economics of that era also lost a lot. Basically, it lost everything that didn’t fit into its mathematization of economics — such as tax policy, or really all economic policy including all sorts of regulations, spending or whatever. This is the “Price, Interest, Money Box” which I’ve said developed around that time, and which was a major contributor to the Great Depression and all the bad economics that came out of the Great Depression.

July 10, 2016: The Tyranny of Prices, Interest and Money

November 27, 2016: The Tyranny of Prices, Interest and Money #2: The Old Historicism

The labour theory of value was made the focus by the Austrian marginalists — Menger, Weber and Bohm-Bawerk in particular — because they were attempting to refute Marxist economiscs with its theory of surplus value that was utterly dependent, for what little coherence it had, on the labor theory of value (LTV). It may even have been integral to continental economic theory, but it was not the basis of the classical economics of J. S. Mill, nor of his mainstream contemporaries nor anyone thereafter among economists in the English-speaking world. It is a straw-man caricature not based on fact. (p. 114)

Absolutely right. Nobody who actually read Adam Smith would ever think that he thought something had value just because it took labor to create. What Smith argued was that, in a competitive economy of more-or-less fungible commodities — shoes, for example — anything that sold for well above its cost of production (basically, labor and its fruits), and thus produced a high profit margin and high return on capital, would attract new entrants into the field, thus reducing profit margins until returns on capital were roughly the same as were available in other industries. Conversely, where profits and returns on capital were slim, businesses would close and production would decline until returns on capital again regained an adequate level. The cost of the product or service would thus mostly reflect the cost of production; and since all things ultimately arise from labor, the cost of labor.

In Smith’s time, products were mostly made by a large number of small businesses and artisans. There weren’t as many cartels, or branded/patented products as today. Coke has a very high profit margin on sugar water, because of many factors including “brand.” But, for Smith, the economy mostly consisted of fungible unbranded products such as: wheat, lumber, leather, shoes, cloth, iron or steel, furniture, building materials and so forth. With broad competition and little barriers to entry, returns on capital would tend to equilibrate more readily.

Thus, when you see commentators today who make a big deal about the “marginal revolution,” they basically picked this up from some Austrian-era guys posing and preening, without really thinking about what it meant.

Kates mentioned that the LTV “may have been integral to continental economic theory.” I have also suspected that, although Mill and Smith definitely did not hew to this line, nevertheless it might have been a common notion among second-rate economists teaching in universities in the middle nineteenth century. Consider how bad economics professors are today — and how little evidence there is that today’s professors ever read Mill and Smith, and understood them. Maybe the common professors of the 19th century weren’t much better.

But, the result of the mathematization of economics, during the Marginal Revolution era (1870-1913), was to effectively eliminate everything that was not very compatible with reduction into numbers. Following the examples of physics and chemistry, everything mathematical tends to be timeless, or ahistorical. Chemistry is chemistry today just as in the 12th century. Two hydrogen atoms and an oxygen atom make water.

Take, for example, something big and important, that happened at a certain time and place: In this case, Franklin Roosevelt’s National Industrial Recovery Act of 1933.

This was a gigantic piece of legislation with many elements, which had a gigantic effect on the economy. Amity Shales wrote a very nice book about it, and other policies of the time: The Forgotten Man, a New History of the Great Depression (2007).

How would you represent the NIRA mathematically? Look at this popular equation:

MV=PT

Where is the National Industrial Recovery Act? Where does it go, in this equation? How would you describe its effects? How would you analyze it? How can you describe its historical progress, eventually leading to the Supreme Court striking it down in 1935?

Or this:

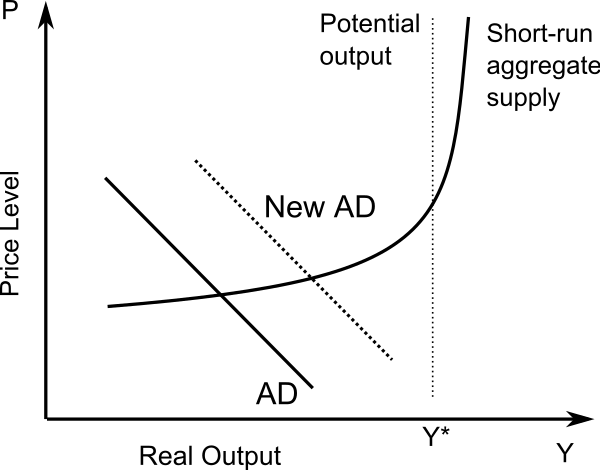

Aggregate Demand/Aggregate Supply

Or this:

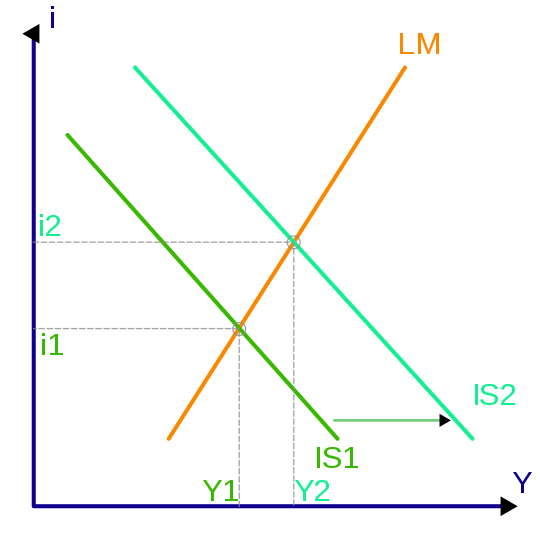

Where does the NIRA go?

Can you see how useless this is?

While I think the Marginal Revolution/Austrian stuff was basically correct, it was also very limited. It tended to produce “one-tool economists.” When all you have is a hammer (“Austrian theory of the trade cycle”), everything looks like a nail. Thus, even if the theory was often quite good — a hammer is exactly the right thing, when you actually have a nail — in implementation it was rife with error.

Some noteworthy subheadings include:

New Classical Economics Is Not Classical (p. 52)

and:

Classical Theory Is Supply-Side Economics (p. 54)

As I’ve said, it took the Supply-Siders, beginning in the 1970s, to really move beyond the Austrian view of things that began in the late 19th century. It is really just an extension of J. S. Mill-era economics.

August 11, 2016: The Gigantic Importance of Supply-Side Economics

Unfortunately, Kates did not quite understand the importance of what he wrote his heading about. In the following three paragraphs, he made no mention of “supply side economics” since 1970. Oh well.

As you can see already, this book is written in a fresh, personal style that characterizes people who really want to explain something important to you. It is very different than the argle-bargle we usually get from academic economists, which is often so bad that, to even create a response to it, I have repeatedly had to “interpret” it into something coherent enough that we can talk about it.

Blame France #3: Dump A Pile Of Argle-Bargle On Their Heads

This book has quite a lot of excellent material, and is well worth reading especially for serious students of economics. It is interesting for me especially to see someone who was trained in the usual university manner, and then conducted a personal study going back to Mill and Smith. This was a mind-altering experience, that was so revolutionary that he then saw most of academic economics as worthless garbage. Which tells you how many people read Mill and Smith, and think about it. We are not just quibbling about details here. In the Afterword, of three paragraphs, Kates sums up his summary:

I will only say it here at the very end, although it ought to be clear from the text. I have written a book that more or less states that pretty well the whole of mainstream economic theory is worthless in devising policy. Virtually none of it will assist anyone in making decisions on how to make an economy prosper. It may be great for writing aimless papers that end up published in major journals, and it may provide cover for governments wishing to waste enormous sums of money on projects that take their fancy, but there is nothing I can see that throws light on how an economy works or what to do to make an economy grow more rapidly. (p. 241)

Isn’t this what I’ve been telling you?

That’s why I had to write The Magic Formula (2019).