(This item originally appeared at Forbes.com on May 17, 2019.)

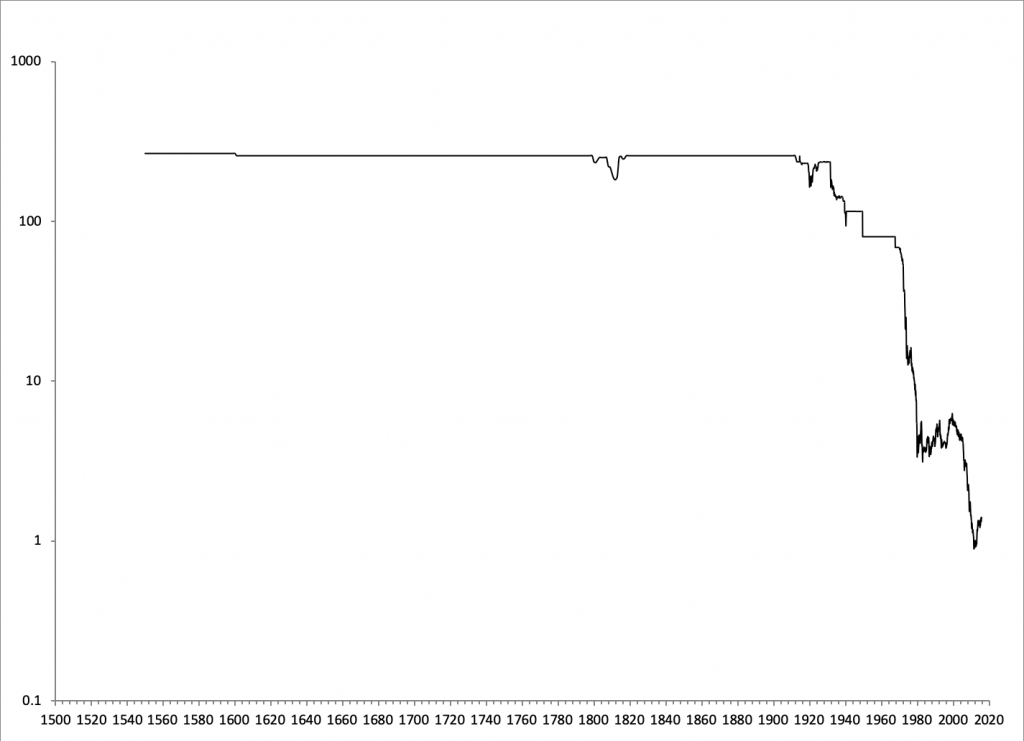

Money based on gold — the “gold standard” — was a near-universal element of human life for centuries, before the fatal break in 1971 that produced today’s environment of floating currencies. This was true in the West; but also, in Arabia, Turkey, Persia, India, China, Japan, and, to some degree, in the pre-Columbian Mesoamerican and Andean civilizations.

Nevertheless, some people today assert that the gold standard was a brief experiment tried by a few countries for a few years around the 1870-1914 period. Oddly, this misleading representation is common not only among the soft-money advocates of floating currencies, but also among gold standard advocates themselves.

In this way, the floating currency fans attempt to “rewrite history” to remove awareness of the central role that gold (and silver) have played as money throughout human history — which I described in detail in Gold: The Final Standard(2017). The gold standard advocates shoot themselves in the foot, as usual.

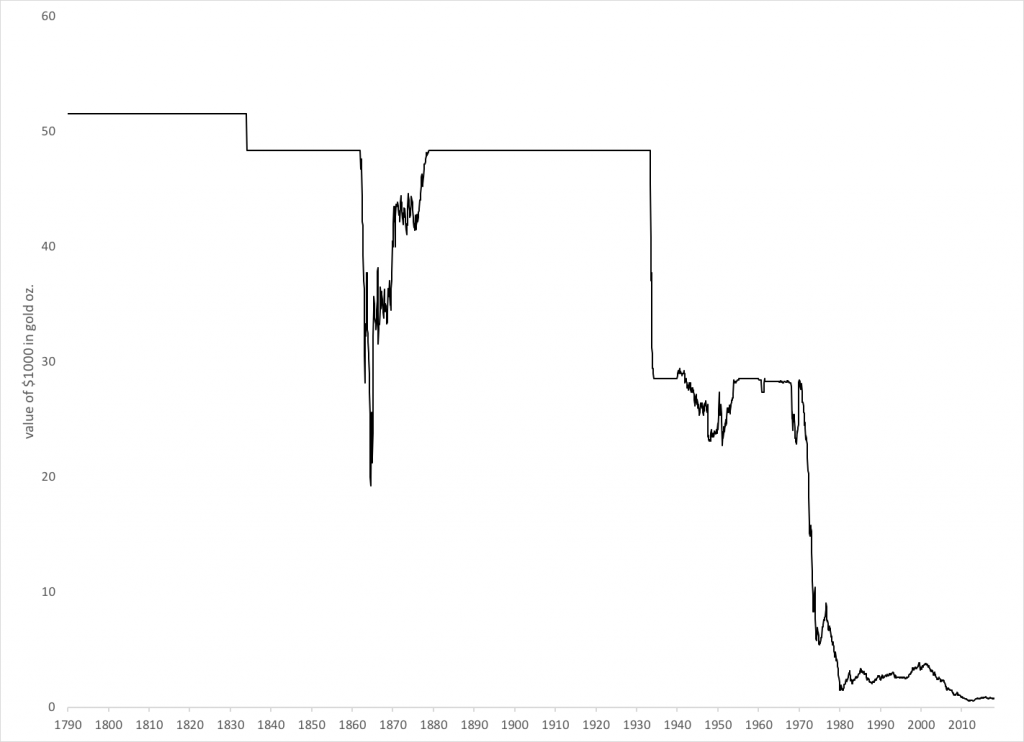

I like to use the term “gold standard” in its broadest definition, to encompass a wide variety of systems which share the common characteristic of maintaining the value of the currency at some parity to gold — such as the $20.67/oz. (23.22 troy grains per dollar) and, after 1933, $35/oz. parities that prevailed for much of U.S. history. I include in this even some pure silver systems, such as the Mexican peso or British pound before 1650. Because (prior to 1870) silver had a tight link to gold within what I’ve called the “gold/silver complex,” a currency linked to silver was also linked to gold.

The economist Edwin Walter Kemmerer — who helped several governments establish gold standard systems in the 1902-1930 period — shared the same view. In Gold and the Gold Standard: The Story of Gold Money Past, Present and Future (1944), he said:

It is not a question of the means adopted to obtain a particular result, but rather, one of the result itself. The gold standard exists then in any country whenever the value of a fixed quantity of gold in a large and substantially free international market is actually maintained as the standard unit of value.

By taking various narrower definitions of “the gold standard,” both the floating-currency advocates and also many gold standard advocates effectively make the gold standard disappear. “That was not really a gold standard because etc. etc. etc.,” they say, citing the various ways in which a real-life system that really did keep the value of the currency close to a gold parity did not fit their narrow definitions of a “gold standard.”

Let’s look at some of these:

Bimetallism: The common system in use before 1870, throughout the world, was some form of “bimetallism.” Both gold and silver full-weight bullion coins were used, along with banknotes. Because silver’s market value was very closely tied to gold, typically around 16:1, silver and gold were effectively two “denominations” of the same thing, much like a one-dollar bill and a ten-dollar bill. The effect of this was to keep the value of the currency quite close to where it would be under a “monometallic” gold-only arrangement. The fact that the U.S. dollar was on a “bimetallic” system at $20.67/oz. in 1850 and a “monometallic” system at $20.67/oz. in 1910 did not amount to very much, in terms of the dollar’s value compared to gold. I call this a “gold standard system” but other people attempt to define this away.

Silver-centric systems: A purely silver-centric system — where gold does not have a monetary role — is hard to find, in history. Often we find cultures with silver coinage, but gold in bullion form, and sometime gold coins of foreign manufacture, trade in a monetary role. This was true for a long time in Ancient Greece, Ancient Rome, Britain before 1650, and China before 1930. Nevertheless, because the market value of silver was, in that time too, extremely stable vs. gold, the value of the silver coinage was effectively tied to gold. Using the broadest meaning of the term, I would call these “gold standard systems.” I have, more precisely, called them part of the “gold/silver complex,” but, unless you have read my books, you wouldn’t know what I was talking about.

Systems where other commodities have a monetary role: In practice, before 1850 or so, other commodities were often used in payment, although typically within a framework of gold and silver as the “numeraire.” For example, payment might be made in cattle, tobacco or wheat. But, prices and debts were defined in terms of silver and gold. So, you would make a payment in wheat or tobacco of “$10,” depending on the market price of wheat or tobacco as expressed in dollars defined as silver and gold. This was true in the early U.S., in China in the first century, and also Sumer of the twenty-fifth century B.C. Because we are unaccustomed to this today, we tend to assume that if payment could be made in wheat or cattle, that means that the entire monetary system was based on wheat or cattle. Typically, the monetary system was still based on gold and silver.

The “gold bullion standard”: In the 1920s, it was common (notably in Britain) to find a system where banknotes were linked to gold, and could be redeemed for gold with the currency issuer, but only in the form of large bullion bars, not small coinage. The effect of this was to distance the connection between gold and the currency in the public’s mind, which probably was a factor in the eventual dissolution of the gold standard in 1971. Nevertheless, the currency’s value was still linked to gold, and it was even redeemable in gold, so it was a gold standard system.

The “gold exchange standard”: Already by 1913, many countries had adopted the widespread use of banknotes, which were redeemable only in the currency of an international gold standard currency such as the British pound. Or, a currency might be redeemable in gold coin, but in practice, foreign exchange transactions in reserve currencies was the primary method of currency management by central banks. This system became more common in the 1920s, as a series of countries (especially in Latin America, and also new countries in Eastern Europe that emerged after World War I) adopted this system. Despite various criticisms of these arrangements, nevertheless, the value of their currencies were linked to gold.

The Bretton Woods System: The Bretton Woods system, which emerged in 1944, had a long list of problems. The heart of the system was the U.S. dollar, which was linked to gold at $35/oz., although this was rather shaky from time to time. Other countries were linked to the dollar via “gold exchange standard” systems. The dollar was redeemable for gold bullion internationally, but U.S. citizens were actually outlawed from owning gold. Obviously, this system deserves quite a lot of criticism for its many flaws; flaws which led to its demise in 1971. Nevertheless, the dollar’s value was, somewhat messily, linked to gold at $35/oz. during that period.

The “price rule”: Some have argued that a currency issuer need hold no gold bullion at all, and that convertibility into bullion on demand is not necessary, to keep the value of a currency linked to gold. The early economists David Ricardo and John Stuart Mill made this argument, and it is still popular today among some, who want to make the point that piling up bullion in vaults is not necessary or even helpful. Arguably, the U.S. used this system between 1968 and 1971, after gold conversion was effectively terminated. This system too would be a “gold standard system,” and the value of the currency would be maintained at a gold parity, such as perhaps $1250/oz. today. Gold would remain the “standard of value.”

Obviously, if we exclude bimetallic systems, silver-centric systems, “gold exchange standard” systems, “gold bullion standard” systems, and the Bretton Woods system, we are going to be left with a very small list indeed. Basically, it is the U.S., Britain, Germany and France between about 1880 and 1914. Poof! The gold standard has disappeared from human history. This is gross misrepresentation.

The gold standard advocates, for their part, tend to use the “definitional argument.” Basically, they want to argue that a “gold coin standard” — a system in which banknotes are redeemable by the currency issuer for gold coins, and gold coinage is a common element of the circulating currency, as was the case in the U.S and Britain before 1914 — is the superior system. Probably, they are right about that. But by claiming that this or that system — such as the arrangements of Japan in 1910, or the world in the 1920s or 1960s — was “not really a gold standard,” they also effectively limit the “gold standard” to a few small examples. Kemmerer also complained about this. Some gold standard systems are better than others — the Bretton Woods system was particularly flawed — and yet, they were gold standard systems.

Gold — or the “gold/silver complex” if you want to be picky — has been the basis of money for much of human history until 1971. It has even been, I would argue, the informal basis of money for much of the time since 1971 too. There is a reason why humans keep coming back to it over and over: because it has always worked. Even the last decade of the worldwide gold standard — the 1960s — was perhaps the most prosperous decade in the century since 1914. For about fifty years now, we’ve been trying to get by on the “PhD standard,” which has never worked very well. Fans of the “PhD Standard” want to fool you into believing that the gold standard never really existed. But, you aren’t that stupid.