Foreign Exchange Rates 1913-1941 #3: The Brief Rebuilding of the World Gold Standard System

April 20, 2014

Today, we continue our investigation of currency history in the 1914-1941 period.

April 6, 2014: Foreign Exchange Rates 1913-1941 #2: The Currency Upheavals of the Interwar Period

March 30, 2014: Foreign Exchange Rates 1913-1941: Just Looking At the Data

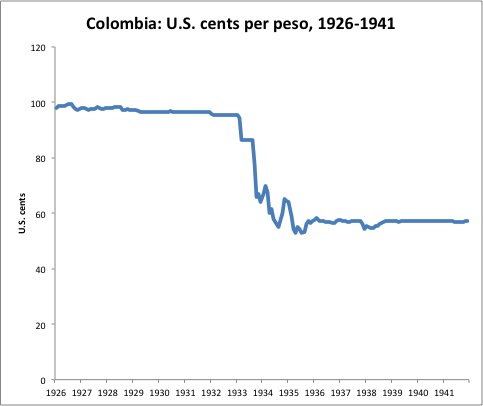

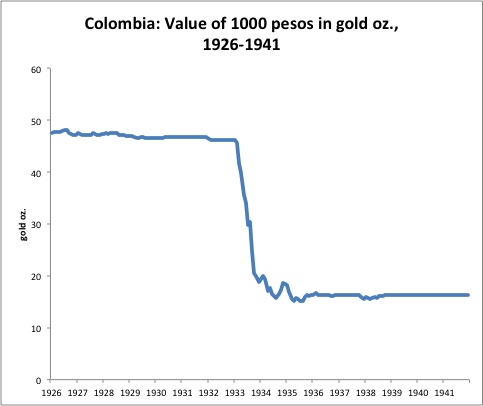

Colombia:

As befits a Latin American country within the U.S. sphere of influence, Colombia’s history mirrors that of the U.S. dollar. However, when the U.S. devalued in 1933, Colombia concurrently devalued even farther.

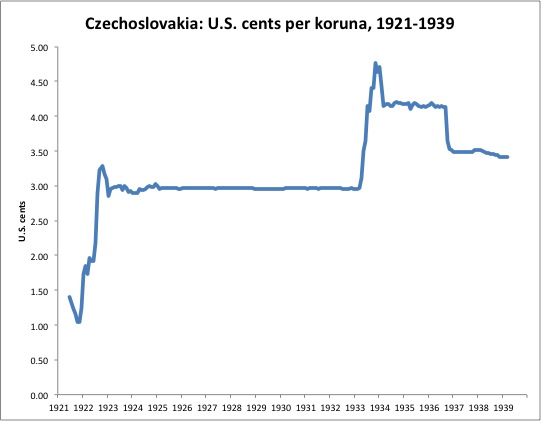

Czechoslovakia:

Czechoslovakia didn’t devalue alongside the British in 1931, but the devaluation of the U.S. dollar in 1933 was too much. Czechoslovakia undertook a small devaluation at that time, and another in 1936, perhaps in response to the devaluation of the French franc. The German military occupied Czechoslovakia in 1938.

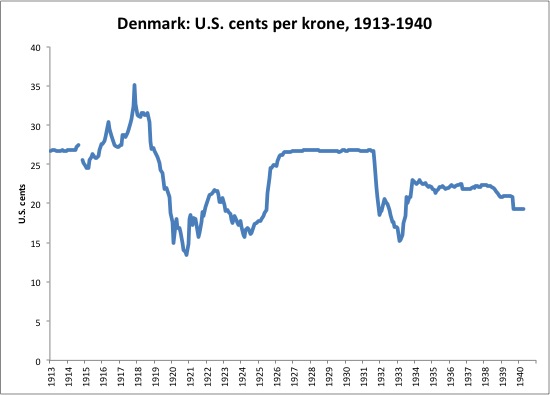

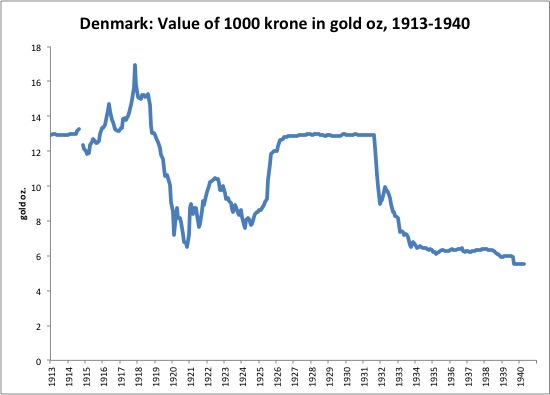

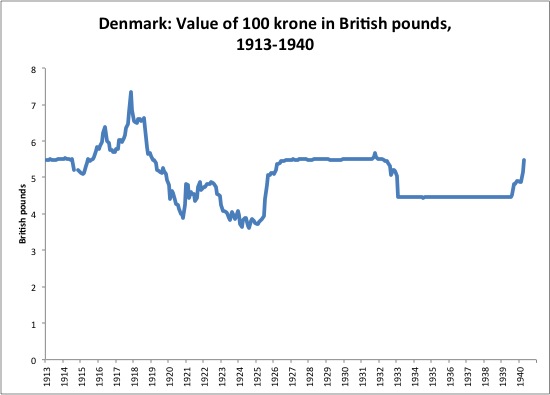

Denmark:

Denmark shows a combination of British and U.S. influences. After floating during and after WWI, the krone was repegged to gold in 1926 at the prewar rate. Britain repegged at the prewar rate in 1925, and France (and Belgium) repegged at a devalued rate in 1926. The krone followed the British pound lower in 1931, devaluing alongside such that the krone/pound rate did not change. (Probably, Denmark was using a British pound currency board type arrangement at the time.) The U.S. devaluation in 1933 prompted Denmark to devalue a bit alongside, although this was preceded by slippage against the British pound in 1932. After that devaluation, Denmark returns to a British pound peg, but by this time the British pound was a floating currency. The British pound devaluation in 1940 was not followed by Denmark.

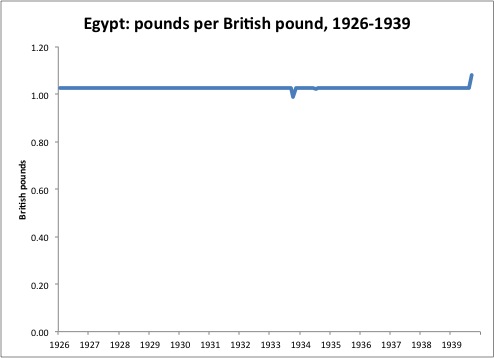

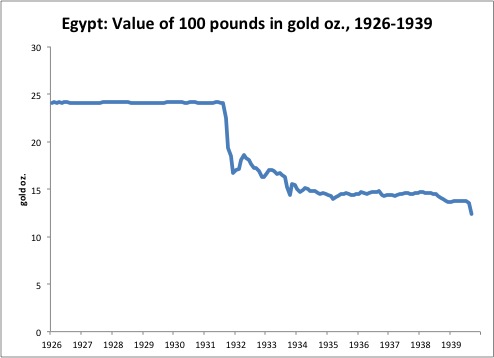

Egypt:

Befitting a British territory, the Egyptian pound remained pegged to the British pound throughout this period. This meant that the Egyptian pound was devalued in 1931 and became a floating currency afterwards, mirroring Britain.

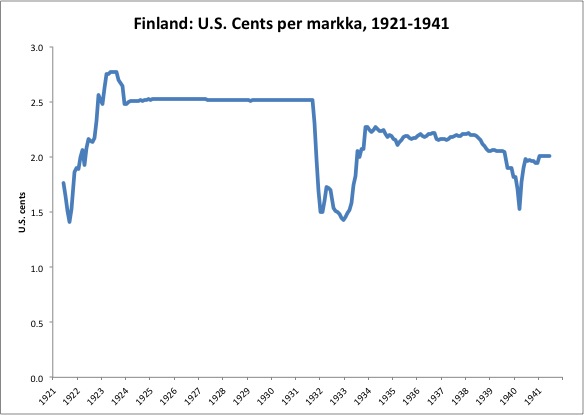

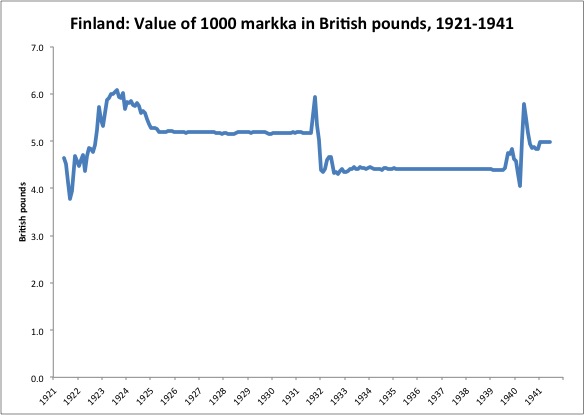

Finland:

Finland followed Britain’s lead. The markka floated vs. the British pound in the early 1920s, but Britain’s return to gold in 1925 apparently inspired Finland to do the same. Britain’s devaluation in 1931 was followed almost immediately afterwards by a devaluation in Finland, of slightly greater magnitude than the British devaluation. Afterwards, the markka was pegged to the British pound, which meant that it was a floating currency vs. gold. Britain’s devaluation in 1940 apparently led to a bit of indecisiveness with Finland, which eventually decided to stick to gold (or the U.S. dollar) instead. Finland was invaded by the Soviet Union in 1939, but fought off this invasion. This prompted an alliance with Germany. Germany’s invasion of Russia in 1941 prompted Russia to invade Finland soon afterwards.

As before, I find this strangely satisfying. I get a sense of the turmoil and chaos of that time period.