We were looking into Good Money, Part I: The New World, a compilation of Friedrich Hayek’s early papers on monetary topics.

January 13, 2019: Good Money Part I: The New World, by Friedrich Hayek

What I discovered from this book, and its companion Good Money Part II: The Standard, is that Hayek was at no point in his life, from the 1920s into the 1970s, a gold standard fan. He consistently advocated for a commodity basket standard. This is not so strange today, since an agnostic sort of economist, coming to the question without much background, might wonder which is better, and why. But it was a little strange in the 1920s or 1950s, when all the world was on a gold standard; and also his intellectual compadres like Ludwig von Mises were themselves gold standard advocates. Hayek, in other words, was a subversive. At the least, he effectively played that role, perhaps due to honest convictions rather than any overtly subversive intent. But, remember that he was the founder and first director of the Austrian School of Business Cycle Research in 1927, which was, von Mises tells us, largely funded by the Rockefeller Foundation. It still exists today, with a staff of 124, and is involved in “studies on European integration” and “commissioned research and consulting for domestic and international decision-making bodies, the European Commission, the OECD, major business and financial institutions.” In other words, it is part of the Globalist network. In 1931, Hayek migrated to the London School of Economics, founded in 1895 by the Fabian Society.

From Wikipedia, we find:

The Fabian Society is a British socialist organisation whose purpose is to advance the principles of democratic socialism via gradualist and reformist effort in democracies, rather than by revolutionary overthrow.

As one of the founding organisations of the Labour Representation Committee in 1900, and as an important influence upon the Labour Party which grew from it, the Fabian Society has had a powerful influence on British politics. … The Fabian Society founded the London School of Economics and Political Science in 1895. …

The Fabian Society was named … in honour of the Roman general Quintus Fabius Maximus Verrucosus (nicknamed “Cunctator”, meaning the “Delayer”). His Fabian strategy sought gradual victory against the superior Carthaginian army under the renowned general Hannibal through persistence, harassment, and wearing the enemy down by attrition rather than pitched, climactic battles.

An explanatory note appearing on the title page of the group’s first pamphlet declared:

“For the right moment you must wait, as Fabius did most patiently, when warring against Hannibal, though many censured his delays; but when the time comes you must strike hard, as Fabius did, or your waiting will be in vain, and fruitless.”

According to author Jon Perdue, “The logo of the Fabian Society, a tortoise, represented the group’s predilection for a slow, imperceptible transition to socialism, while its coat of arms, a ‘wolf in sheep’s clothing’, represented its preferred methodology for achieving its goal.” The wolf in sheep’s clothing symbolism was later abandoned, due to its obvious negative connotations. Today, the society functions primarily as a think tank and is one of 21 socialist societies affiliated with the Labour Party.

John Maynard Keynes was another prominent member of the Fabian Society. But, perhaps Hayek’s LSE job was innocent. It has never been easy making a living as an economist, and sometimes you have to take what you get. Nevertheless, Hayek’s distaste for the gold standard, and active advocacy for solutions that mirrored those of Keynes at that time, is nevertheless noteworthy.

The first paper, “Stabilization problems in gold-exchange countries,” is from 1924. Hayek was 25 years old. Here we see the genesis of the ideas that, it turns out, Hayek would follow for the rest of his life. At the time, Austria was just getting over its hyperinflation of the early 1920s, and apparently had instituted a “gold-exchange standard” (basically a currency board) linked to the U.S. dollar, which was also linked to gold at $20.67/oz. This, Hayek asserts, was a mistake; and should be replaced by a policy of “stabilization of the price level.”

There is no need to emphasize how welcome such a stabilization of the price level would be … Stability of foreign exchange rates, on the other hand, is a much less urgent concern. … The fact of the matter is that the rigidity of the exchange rate actually threatens the stability of internal prices and therefor a planned, stepwise lowering of the exchange rates is undoubtedly a better policy than their stability. (p. 69)

Hayek then declares that he is fully in the camp of Irving Fischer:

The measures proposed above are far from novel. The well-known economist Irving Fischer already proposed such a regulation of the domestic price level in all countries by the foreign currency policy described above ten years ago in his book on the purchasing power of money. … It is therefore not a matter of prestige to keep the dollar exchange rate fixed, for fear that confidence in Austrian stabilization might be undermined. If the Nationalbank were to publicize explicitly its intention to focus on maintaining the stability of the price level and to announce that it would occasionally make small alterations in the dollar excahnge rate with this objective in mind, the execution of measures of this kind would only increase confidence in Austrian economic stability. (p. 70)

The next paper, “Monetary policy in the United States after the recovery from the crisis of 1920,” is from 1925. It deals with Federal Reserve activity from 1920 to 1925. This was basically a placid time. The dollar was linked to gold at $20.67/oz., with full convertibility. The Federal Reserve was talking a lot about “managing the macroeconomy” with its various policy tools, but in actual fact it wasn’t able to do very much, or in any case didn’t.

December 23, 2012: The Federal Reserve in the 1920s 4: The Historical Record

December 16, 2012: The Federal Reserve in the 1920s 3: Balance Sheet and Base Money

November 25, 2012: The Federal Reserve in the 1920s 2: Interest Rates

November 18, 2012: The Federal Reserve in the 1920s

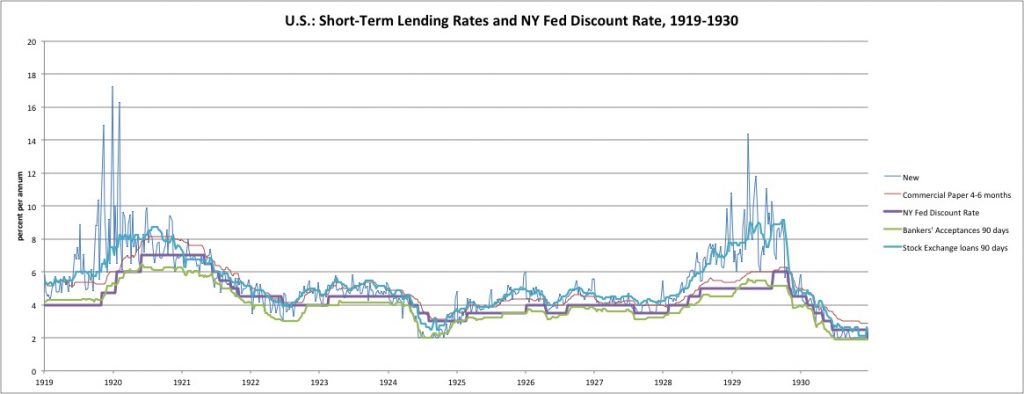

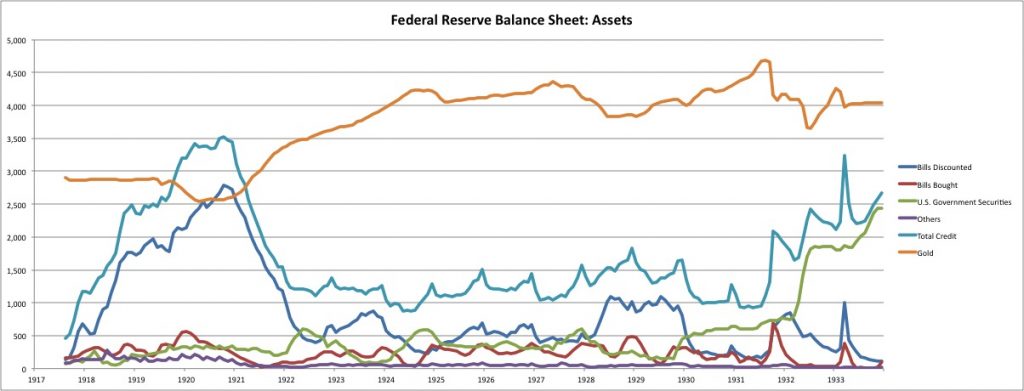

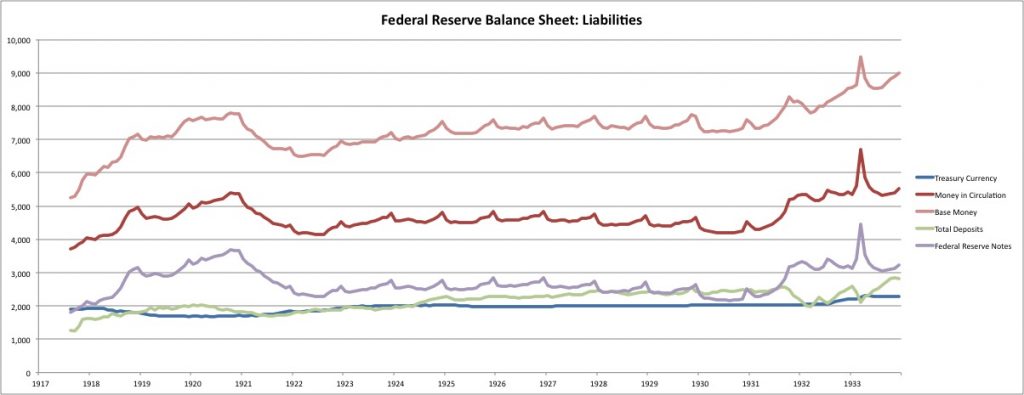

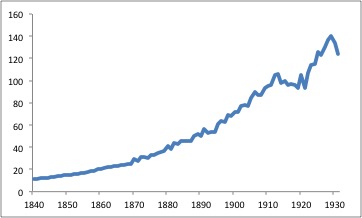

The Federal Reserve had been pressured by the Treasury, during WWI, to help the funding of the war effort by capping interest rates, which was done by aggressive use of discounting (basically the discount rate was below the market rate, as we can see in the chart of interest rates). When the gold embargo was lifted in mid-1919, gold flushed out and the Fed had to contract to maintain the $20.67/oz. gold parity. This was done by raising the discount rate, which consequently led to a big decline in discounting (this runs off naturally if it is not continuously renewed). Soon, around early 1921, the contraction of discounting was enough that the dollar was actually rising above its gold parity, causing gold inflows. Nevertheless, the Federal Reserve continued to allow its discounting to roll off until it returned to “normalcy” in early 1922. This continued reduction in discounting (leading in itself to a reduction in base money supply) naturally led to gold inflows to compensate. Overall base money contracted in 1921. At first, I thought this was part of the process of returning the dollar’s value to its gold parity. But, it appears that that goal was already accomplished around the beginning of 1920.

May 14, 2017: More on the Depression of 1921

So, we can interpret the decline in base money in 1921 to a reduction in base money demand, in the context of the recession of that time and major decline in prices, leading to a consequent reduction in base money supply, within the context of the functioning gold standard system that was actively maintaining the parity at $20.67/oz. If there was any “shortage” of base money, it would have been automatically corrected by a gold inflow, which was exactly what was already happening at the time. After this adjustment process was complete around the beginning of 1922, things became very placid, with base money making a small rise in the context of an expanding economy. There is no evidence of the Federal Reserve doing much of anything, since base money is basically unchanged (with a seasonal pattern of course), and gold conversion was active.

The point of all this, if we assert that this description is correct, is that Hayek apparently had no idea of what was going on during that time. I consider this to be a basic failure to understand rudimentary gold standard operating principles, as they had been used at central banks around the world for much of the past sixty years. This is not very promising for someone who is supposedly a “monetary expert,” and who builds much of his broader economic thinking (the “Austrian theory of the business cycle”) on a monetary basis. But, in this as in all things, Hayek was probably better than most other economists, which tells us just how bad things were even then.

I will spare you the pages of “this factor and that factor and …” Here is just one paragraph:

Several factors contributed to the slackening and eventual cessation of the gold influx to the United States in 1924: the large loans abroad extended during that year; the strong competition exerted by India, which managed to absord a record quantity of gold that year because of the rupee’s high exchange rate and from New York alone received about 15 million dollars, and the elimination of some of the previously mentioned causes of the gold influx, such as political instability in Europe. Yet it is improbably that the present reversal of the gold movements will persist for long and that the United States will continue to be able to extend loans to finance the enormous surplus in its trade balance. Only after most of the other countries have been back on the gold standard for extended periods of time can the influx of gold to America be expected to cease. (p. 76)

As you might expect from a prediction based on such claptrap (blame India!), Hayek was wrong. Significant gold inflows ceased in early 1924, over a year before Hayek published this paper. But the general tone is that Hayek does not see gold conversion inflows and outflows as the natural consequence of the mechanisms that maintain the parity value, and consequently, maintain the appropriate base money supply for that parity value. For him, gold flows arise from all sorts of variegated external factors having little to do with the domestic economy. From this one quickly arrives at the conclusion that changes in base money supply arising from gold flows are unnatural distortions caused by somewhat random external events, and he spends lots of time describing what he thinks these unnatural distortions are.

Besides the above-cited arguments for sterilizing the gold influx as far as possible, a further consideration may have carried even greater weight in shaping the policy actually adopted than any other argument, despite its having only partial validity. It was the belief that whatever gold had flowed to the United States as a result of the abnormal circumstances prevailing in Europe would remain there only until normal circumstances had been restored in Europe and currencies had stabilized there. (p. 91)

The whole idea that the gold standard system was a self-regulating means to establish an appropriate amount of base money seems to be alien to Hayek.

We have long been searching for guidelines to determine the proper volume of circulating media. (p. 139)

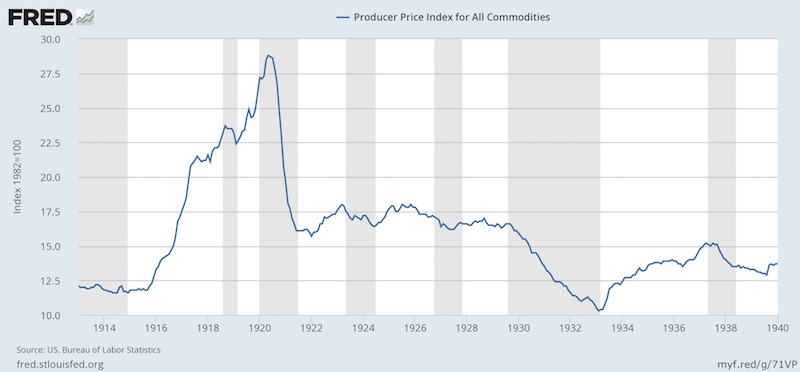

There then follows a lot of arguments more-or-less in the line of Irving Fischer, and much silliness. The basic idea was that gold was undergoing some kind of wrenching changes in value, causing all kinds of havoc; this was indicated by the variance of commodity prices (assumed to be a perfect representation of value) compared to gold. Yet, at the time, commodity prices were quite placid, although on a highish plateau. The U.S. economy was very strong, along with that of France.

The basic reason for high commodity prices was that commodity production had been curtailed by World War I. This combined with high demand for commodities, first due to wartime, and then, due to economic expansion in the postwar recovery. It takes a while to bring commodity production on line. When production began to rise again around 1926, prices abated. Much the same happened during and after WWII, another time of relatively high commodity prices.

That is enough for now. We have seen some of Hayek’s basic errors, which will become more pronounced over time.