How much homes cost is the most popular topic at any dinner party. But, people rarely think about how much homes should cost. If this topic is taken up at all, it is typically in the framework of “social justice”; and the solutions are typically some kind of government subsidized housing – what can be bluntly, and accurately, called: communist central planning.

So, let’s look at this from a different angle.

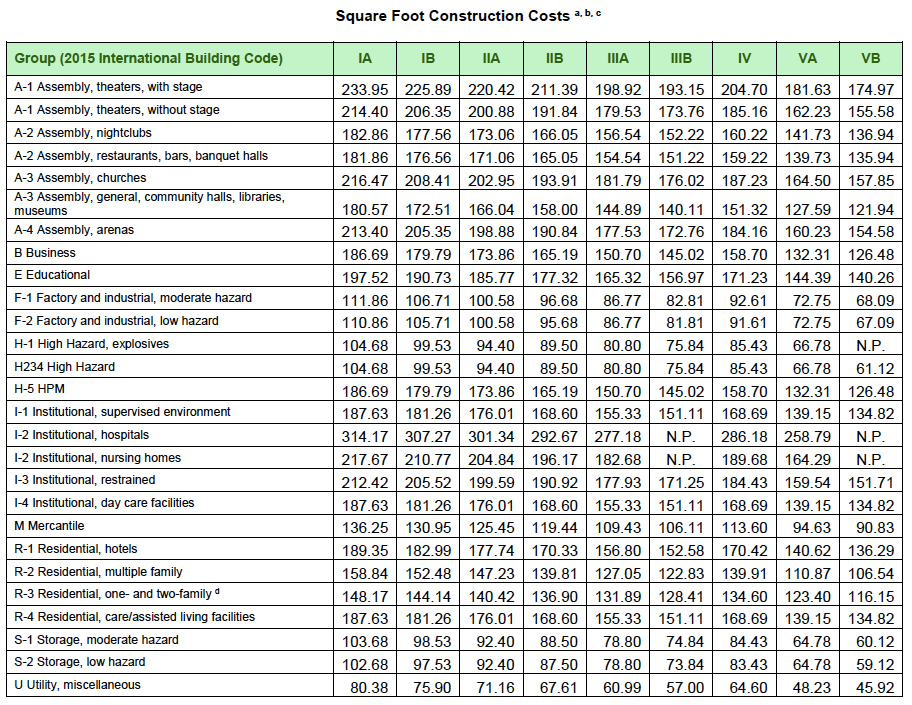

Construction costs are fairly well known and common throughout the United States. Cheap wood-framed structures, like the typical suburban detached house, can be built for about $100 a square foot. Better-quality steel-framed structures, in buildings of four stories to seventy stories or more, come in around $200 a square foot There is a little variation, depending on quality level and local particulars, but costs are rarely above $250 a square foot. Some developments will also have to include costs for utilities, streets, parks and other factors.

Thus, a new 1000-square foot two-to-three bedroom apartment should cost between $100,000 and $250,000, for construction costs alone. This is true whether you are in rural Pennsylvania or on the sixtieth floor in Brooklyn.

To this we add land costs. Land can be almost costless, or extremely expensive, depending on the situation.

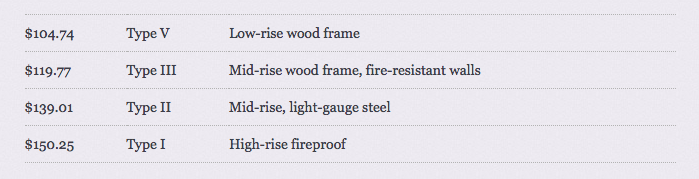

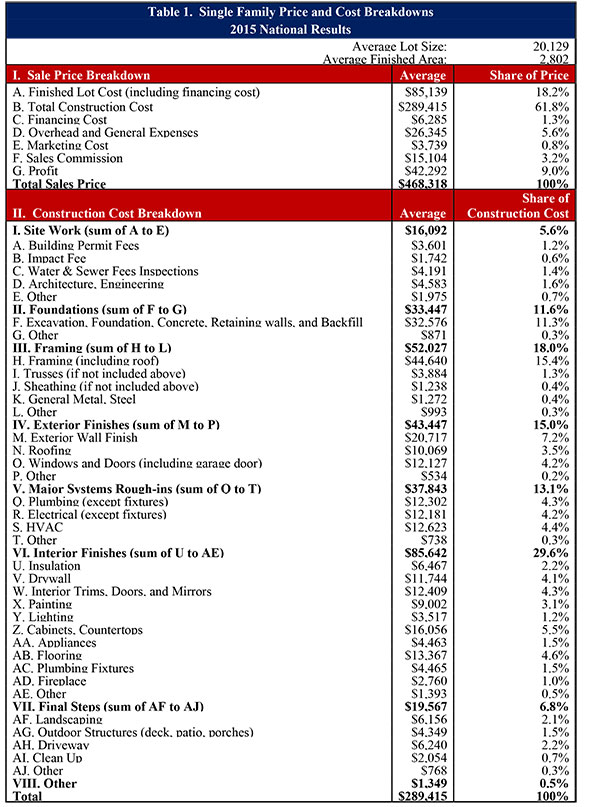

Then, we have some assorted additional expenses — in this example, Financing Cost, Overhead and General Expenses, Marketing, Sales Commission, adding up to 11% of the total cost. Finally, there is an adequate risk-adjusted return on capital for the developer, which here is a profit margin of 9%. The construction cost for this suburban low-rise woodframe format is 2,802 square feet for $289,415, or $103/sf. The total cost is $468,318/2,802sf, or $167/sf.

Theoretically, there shouldn’t be much more than this, but in practice there is a third category, which is “extraneous expenses.” These include all kinds of regulatory costs, including the time it takes to get permits, and might also include local unions, organized crime, or any other factor that drives costs beyond common market rates.

So, if you are paying perhaps $1000 per square foot, then that can be broken down into perhaps $225/sf for construction costs, $75/sf for other expenses, $100 for profit, and $600/sf for land and extraneous expenses.

Why is the implicit land cost – the difference between the market price and the construction cost — so expensive? It is mostly a matter of supply and demand. Land seems like it is in short supply. “They aren’t making any more of it.” But, this scarcity is largely artificial, and caused by various restrictions on development. These restrictions can be in the form of height restrictions and other zoning issues, the simple bureaucratic difficulty of accomplishing anything, and many other factors. It is easy to see that, while land costs per acre (or square meter) might be very high, land costs per unit can be low, depending on how many units you put on the site — basically, the Floor Area Ratio.

There is no meaningful shortage of land in any U.S. city. Of course, the land is occupied – there is something already built upon it. Yet, the difference between – to take the extreme case – a ramshackle old two-story structure, and an eighty-story highrise, is so great, that the land might as well be empty. In other words, the potential for redevelopment in most any U.S. city is hardly even touched today. I would say that even in Manhattan – which itself is only about 7% of the land area of New York City’s five boroughs – about half the total land area is underdeveloped. This includes about half of everything west of Eighth Avenue, the Lower East Side, parts of the areas east of Second Avenue, and most of everything north of 110th street. There is no shortage of land at all. There is only a shortage of access for developers.

Hong Kong today represents the most aggressive use of high-rise construction in the world. Localized population densities can reach one million per square mile. Sixteen square kilometers of housing estates house 2.43 million people (394,000 per square mile). It would seem like there is hardly any more that can be done. And yet, even in Hong Kong, this seeming scarcity of land is largely artificial. In an article in the Hong Kong Economic Journal titled “Why there is no shortage of land in Hong Kong,” Long Zi Wai noted that sixteen square kilometers of land are zoned for “warehouses and open storage areas.” Big swathes are owned by the military, and other such entities. Even in Hong Kong, there are many, many opportunities to redevelop land to higher value uses.

The present population density of Manhattan is 72,000 per square mile. The Upper West Side, which is mostly residential, hits 110,000/sqmi. You can see how far short of Hong Kong’s example this falls. I am not suggesting that the Upper West Side be demolished for Hong Kong-style highrises. The Upper West Side is already highly developed. But, if that represents an area that we would already consider “highly developed” in Manhattan today, you can see that the bottom 30% most worthy of redevelopment is woefully underutilized.

And the other four boroughs? Ninety-five percent of New York City’s land area is so underdeveloped – by Hong Kong standards – that it might as well be vacant lots. Queens has a density of 21,500/sqmi. Staten Island is 8,100/sqmi. If the entirety of the City of New York (28,000/sqmi) was built out to the density of the City of Paris (55,000/sqmi), twice as many people could live there. That would mean an additional 8.5 million people – approximately the population of all the suburbs of New York in the Tri-State area. Paris has almost no highrise buildings, so even this standard falls far short of what could be accomplished.

What determines the price? This is Economics 101: Let’s say that 1000 people would be happy to live in a certain San Francisco neighborhood at a cost of $300/square foot – in other words, a $300,000 1000sf apartment. But, there are only 100 units available. The price must rise until you get to the point at which there are only 100 people willing to pay the higher price, and 900 people turn away, saying: “I’d love to live there, but it’s too expensive.” Let’s say this is $1000/sf. ($1 million for 1000sf.) Since construction costs are basically a given, this is translated into land costs. Now, let’s say that there were 1000 units available. All 1000 people are satisfied, at a cost of $300/square foot, or $300,000 for a 1000sf apartment.

Now, we have seen already that there is really no limit to the amount of building that can be done in any U.S. city today. There is no real land shortage. There is only an artificial shortage. What does this mean in terms of price?

I suggest that it means that there is really no good reason that homes should cost more than $400/sf or so, except perhaps in a few small localities favored by the very wealthy. Even with high construction costs, and an adequate developer profit margin, that allows for a more-than-adequate budget for land, since there is really no scarcity of land even in the U.S.’s most popular cities. Housing costs could be as low as $150/sf in some areas, where three-story wood-framed buildings can be built cheaply. But even this wood-framed low-rise form can achieve densities in excess of 30,000/sqmi, and commonly does so in Asian cities.

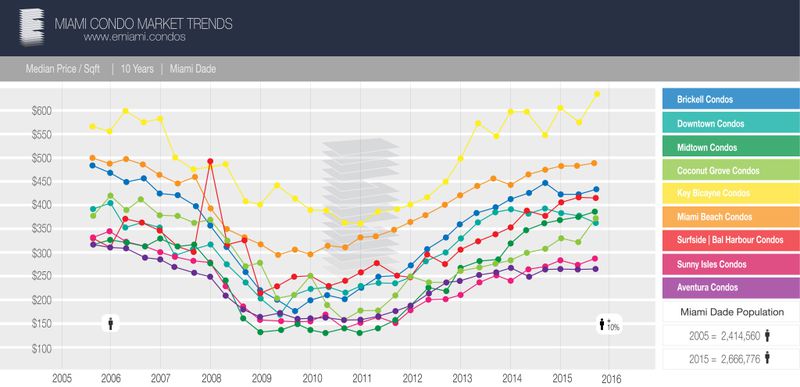

Something like this has been happening in Miami. The City of Miami, the central area, had population of 362,000 in 2000, and estimated 453,000 in 2016. With the Miami metro area having 5.5 million, this represents the central zone only, where all the land was already taken in 2000.

“It’s almost impossible to turn in any direction in downtown Miami and Brickell and not see a construction crane. There are so many projects coming out of the ground that most untrained eyes can’t tell one from another,” the South Florida Business Journal reported in April 2016.

Look around your city. Do these words apply to where you live?

Maybe it is a Latin thing. Or a Florida thing. They are not afraid to let developers build.

And yet, through all this, Miami condo prices were generally below $400/sf.

“Whiff of Panic in Miami’s Condo Market,” reported Wolf Street in November 2016. Why? Too much supply! Prices were going down.

Miami-Dade County was adding about 15,000 condos per year, year after year. The thing that held developers back was not a shortage of land, or permitting difficulties, but a shortage of buyers. This is how it is supposed to work. This is how it works for every other good and service. The Ford Motor Company would make more cars, if it could find more buyers for them. It is never supply-constrained, only customer-constrained. As a result, you can buy Ford cars for, on average, a little more than the manufacturing cost.

I previously outlined a plan where you could buy a 120 square foot micro-studio, potentially in the San Francisco area, for $50,000 This works out to about $400/sf. Of course, many people would want something bigger. But, you wouldn’t have to pay more than $50,000 for a place to live, even in the U.S.’s most desirable cities, if you didn’t want to.

On the lower end, we also have a hard floor on costs, which is of course construction costs plus the necessary profit margins, marketing costs and so forth, with a per-unit land cost of near zero. Thus, the minimum cost of a housing unit is basically the construction cost of that type of architecture (woodframe/steelframe/masonry etc.) multiplied by square feet. At some point, to reduce the total cost of the unit, you have to reduce square footage. (You can have market prices below construction costs in a place where there is more property than buyers — basically, a shrinking market.) Thus, we should get away from the entitlement mentality that “everyone deserves a three-bedroom apartment/house for $600 a month,” or, a common variant, that certain kinds of low-cost housing options are prohibited, presumably because landlords/developers are just being evil when they build 300sf studios instead of 700sf one-bedrooms. The private market will provide options at every price point, if you let it — but, it can’t create free goodies out of thin air. Ford Motors sells $17,000 automobiles, and $80,000 automobiles, but it doesn’t sell its best autos for $17,000. I don’t necessarily think that “inclusivity” — that people of dramatically different incomes live nearby each other — is a worthy goal, but it can be easily achieved, with market-rate housing, if you let developers build anything in the range of 100sf micro-studios to 3000sf luxury apartments alongside each other.

So now we have an answer. Newly-built housing should cost between $150 and $400 per square foot, in almost any neighborhood in any U.S. city. If it doesn’t, it’s not because of any “land shortage,” but because something is broken. Go fix it.