(This item originally appeared at Forbes.com on July 10, 2019.)

Naturally, I am thrilled that President Trump nominated Judy Shelton for a position on the Federal Reserve Board of Governors, the body that sets monetary policy. Shelton has long been one of our best people in favor of “stable money,” which is one half of what I call the “Magic Formula.” The “magic formula” — Low Taxes and Stable Money — is the basic economic strategy by which the United States (and Britain before that) became the wealthiest and most powerful country in the world.

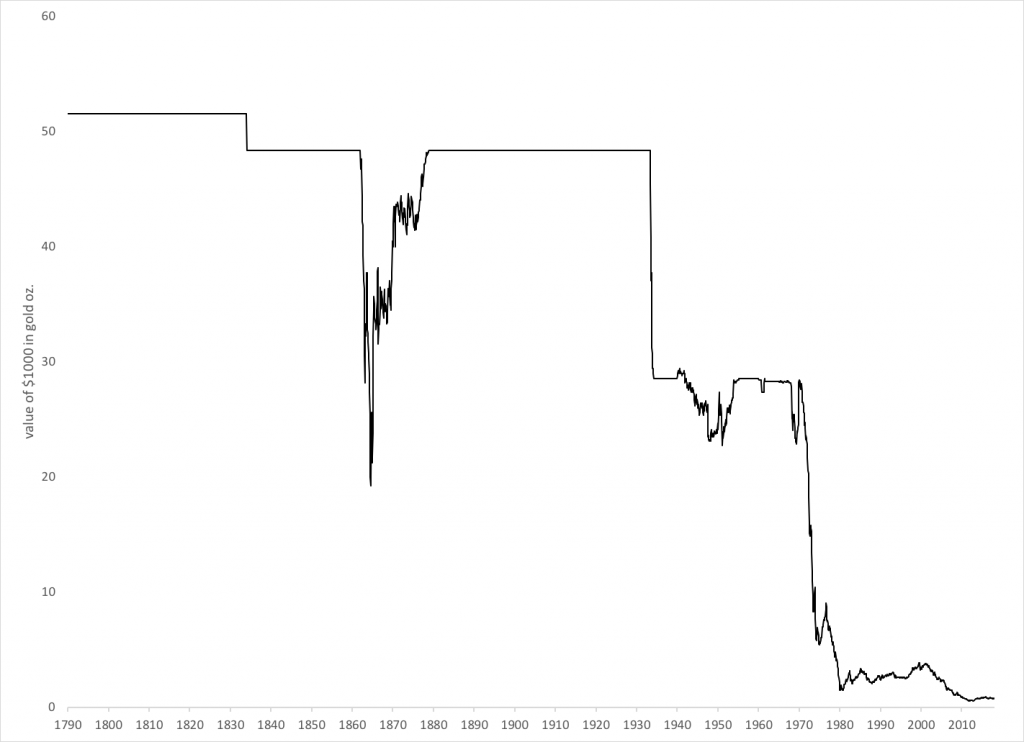

“Stable money,” “hard money,” or “sound money” are various names for the monetary principle that the United States followed for nearly two centuries until President Richard Nixon’s fateful break with gold in 1971. Shelton, formerly of the Sound Money Project, wrote a short and very worthwhile book about it in 2011, Fixing the Dollar Now. This is a subtle title, as it means both “repairing” the dollar, and also, “linking” its value to a definite benchmark. In the United States — just as in Britain, Germany, France, Russia, Japan, and every other major world power — this meant a currency “fixed” to gold; or, as it was known, a gold standard system. For much of U.S history, this meant a dollar “fixed” at $20.67/oz. of gold, or 23.22 troy grains per dollar. After a devaluation in 1933, the dollar was fixed (rather sloppily) at $35/oz. Today, the dollar’s value vs. gold is less than one thirtieth of this.

You would think that it shouldn’t be very controversial to be in favor of the monetary principle that is literally written into the U.S. Constitution (Article I Section 10), and which proved itself, over a period of 180 years, to produce exactly the results hoped for. You would think that having one person on the twelve-person board that agrees with Thomas Jefferson on these matters would not be terribly threatening. (It appears that the U.S, has actually had a sort of “shadow gold standard” for much of the time since 1971 as well.)

But you know how it is with academics these days. Any deviation from their shared dogma sends them howling in complaint. This is “funny” when confined to the academic sphere, but not so funny in the real world, where there are real consequences.

The idea of “stable money” is that money should be as stable in value, reliable, neutral and free of human intervention as possible. In the past, this meant money linked to gold. Today this principle remains very common, in the form of a link to a major international currency like the dollar or euro. Most countries in the world “fix” their currencies to some major international currency, in this way usually achieving better “stability” than if they had their own independent floating currency, and also achieving stability of exchange rates with major trading partners. Ideally, this is done with something like a currency board; and when a currency board is used, the country has no domestic “monetary policy” at all. Obviously, a euro-linked currency like the Bulgarian lev can only be as “stable and reliable” as the euro itself; which is to say, not very. But, we can see that this currency board-linked currency nevertheless is “stable, reliable, neutral and free of human intervention,” compared with an independent floating fiat currency. The lev has an established, known value (vs. the euro), and there is no “domestic monetary policy.” A gold standard system is basically the same idea: a “currency board linked to gold.”

“Stable money” is desirable because only with money stable in value can people cooperate effectively in the market economy. The information, or signals, provided by prices, interest rates, profit margins and returns on capital organize our market economy today. A high price of oil, for example, indicates that some people should reduce their consumption of oil, and other people should invest in new oil production. Billions of people change their behavior based on the information contained in the price of oil; so, naturally, we want these prices to represent actual conditions of the oil market, not monetary manipulation or other forms of currency “noise.” For centuries, people have compared changes in money to changes in other constants of weight and measure such as the kilogram, meter, or hour. Just as people’s ability to cooperate would be deranged by a “floating kilogram,” and cause much confusion and waste, so too is people’s ability to cooperate in the monetary economy deranged by changes in the “dollar.” This principle was recently elucidated with great depth and insight by George Gilder in The Scandal of Money (2016).

Today’s academic dogma in these matters is what I’ve called the “soft money paradigm.” The “soft money paradigm” has been around in one form or another for millennia. It is the idea that money should be an active tool of policy, changeable, under constant human control, the means by which a broad variety of goals can be achieved: government finance, interest rate manipulation, credit expansion and contraction, unemployment, trade relationships, and every other sort of “macroeconomic management.” This requires a currency that changes in value; commonly, a floating currency. It is through intentional “monetary distortion” — artificial manipulation of the relationships of price, interest rates, profit margins and returns on capital — that these schemes attempt to attain their goals. In general, the “soft money” paradigm sounds great on paper — we can make all these wonderful things happen and it doesn’t cost a cent! — but it doesn’t work so well in reality.

Seventy years ago, Ludwig von Mises lamented:

The most fanatical attacks upon gold are made by those intent upon credit expansion. With them credit expansion is the panacea for all economic ills. It could lower or even entirely abolish interest rates, raise wages and prices for the benefit of all except the parasitic capitalists and the exploiting employers, free the state from the necessity of balancing its budget — in short, make all decent people prosperous and happy. Only the gold standard, that devilish contrivance of the wicked and stupid “orthodox” economists, prevents mankind from attaining everlasting prosperity.

Sound familiar? It is important to see here that the supposed “problem” of the gold standard, according to its legions of detractors, is not that it fails to serve as a tolerably stable measure of value — that it is an ineffective means of achieving “stable money,” and that some other means would be better. No, the problem with the gold standard is that it disallows monetary manipulation.

In 1650 — this was the very dawn of paper currencies in the West, when they were as innovative and new as cryptocurrencies today — William Potter in England wrote a book called The Key to Wealth: or, a New Way, for Improving Trade: Lawful, Easy, Safe, Effectual. In those days “trade” meant what we call “the economy.” Potter’s “new way” was simply: printing money. Potter listed twenty-five supposed macroeconomic advantages of his scheme; they are little different from what is found in macroeconomic textbooks today. In the 369 years since then, we have basically proven Potter wrong. No country has risen to wealth and prominence by some kind of skillful manipulation of a floating currency — “You can’t devalue yourself to prosperity.” The pattern has been all the other way. The countries that have the most stable and reliable currencies have done best. This has even been true in the floating currency era since 1971: although the dollar has hardly been “stable, neutral and reliable,” nevertheless, nearly every other currency has done worse.

You are going to hear a boatload of criticism about Judy Shelton from all sorts of academic economists, both Left-leaning and Right-leaning, and probably mainstream media outlets also. This will seem very complicated, but actually it is very simple: They are Soft Money advocates; and Shelton is a Hard Money advocate. Just as is the case in Bulgaria today, when the Hard Money principle is fully embraced, there is no place left for money manipulators. To them, Hard Money is like sunlight on vampires. This affects academics where they feel it most: The Federal Reserve, with a staff of 19,000, is the largest employer of economics PhDs in the country, all of them engaged, one way or another, in the process of managing Soft Money. Before 1913, it didn’t even exist.

In the end, the practical choice boils down to the Gold Standard, or the “PhD Standard.” If your money isn’t based on gold, it will be based on the variable opinions of people bearing PhDs. One has always worked; one has never worked; and I think most Americans already understand this pretty well.