I thought I would add a little commentary to this item from Bullionstar:

Should We Restore the Gold Standard?

It consists of a sort of virtual discussion between Larry White and David Glasner, who we looked at recently regarding his views of the Great Depression.

I say “virtual” because it appears that the two did not have an actual discussion, but rather, the author compares some of their public statements. The article is a nice summary of what a discussion today on this topic might look like.

David Glasner is, of course, concerned about the stability of gold’s value, especially since he is convinced that purchased by the Bank of France in the late 1920s basically caused the Great Depression singlehandedly, apparently in the absence of any other factor — this seems to be a point of pride among certain monetary-themed economists. I think we have kicked that idea around enough now that we don’t have to talk about it much more.

February 25, 2018: David Glasner Cheers For Hawtrey and Cassel

This paper is by Larry White, who is about the only economist I can name that has some real expertise in the matter. Most economists’ disdain of the gold standard is based in large part on their lack of understanding of the system, and poor grasp of history. I think we could use another hundred economists with Larry White’s expertise.

read: “The Merits and Feasibility of Returning to a Commodity Standard” (2014), by Larry White.

However, I would quibble on some points, which I think are actually important.

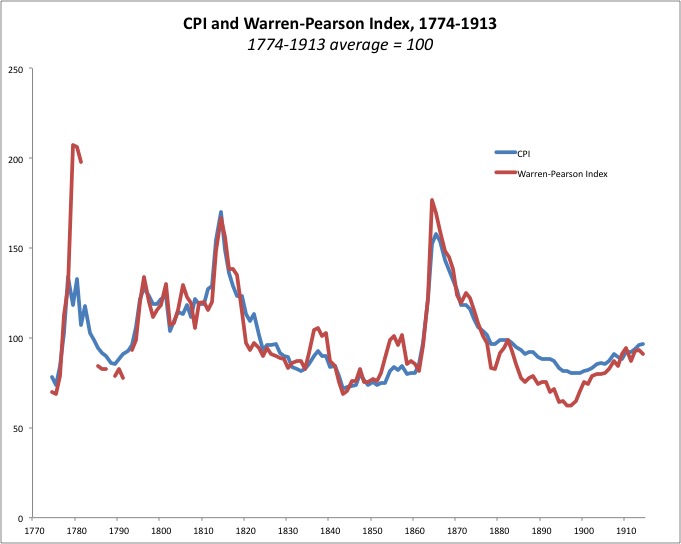

In general, there is way too much concern with the “price level,” “inflation rate” and “purchasing power.” Most any price index for the pre-1918 period (actually pre-1940) is closely correlated to a raw commodities index, like the Warren-Pearson index. You can call it a “CPI” if you wish, but it really has no similarity with today’s CPI. We looked at this here:

March 3, 2016: The Myth Of “Price Instability” During the Gold Standard Era

You can see here that the so-called “CPI” (from measuringworth.com) is very closely correlated with the Warren-Pearson index of raw commodities, before 1913.

This has no relation to a contemporary CPI index, which doesn’t have much correlation with commodity prices at all, and often is used in the “core” or “ex-food and energy” version to specifically exclude volatility from commodity prices.

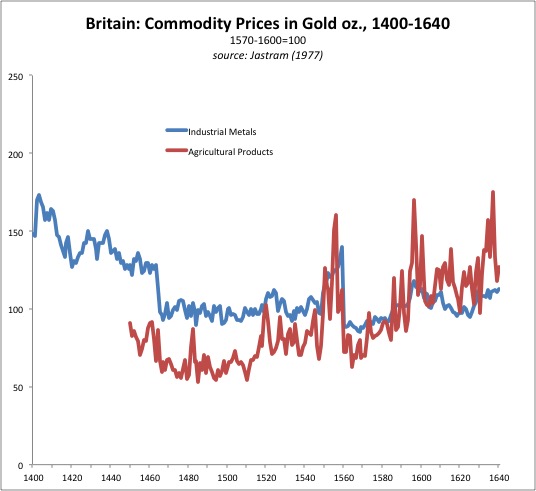

I have said over and over that the “value” of a currency is NOT the same as “purchasing power,” as illustrated by this, that or another price index. Even with a currency of theoretically perfectly stable value, prices will go up and down, especially commodity prices, and price series that are closely correlated with commodity prices. The better economists have always understood this, including Adam Smith. Smith actually considered “corn” (staple grains such as wheat, rye, oats and barley) to be a better measure of long-term value than gold. He especially was focused on the increase in the price of “corn,” in terms of gold, between about 1560 and 1650. During this time, the price of “corn” roughly doubled in gold terms — not really such a big deal, stretched over a century, but it bothered Smith.

I noted that metals prices did not rise, which suggests to me that the rise in the price of wheat was more of a wheat-centric thing than a gold-centric one. Nevertheless, Smith had a practical view of this: the price of a man’s labor was related to how much it cost to feed him, in terms of wheat. He meant this in a physiological kind of way, like it takes coal to fire the furnace of a train, which was perhaps reasonable at the time. Smith noted that the lower class of workingmen had a high rate of infant mortality, and the fundamental cause was malnutrition. More nutrition=more people=more labor. But even though Smith considered “corn” a better measure of long-term value than silver, he considered silver to be a better short-term (decades not centuries) measure of value than wheat, whose price, he said, moved up and down from year to year due to short-term variation in the wheat market.

In this, as in so many things, most of today’s economists have a lot of catching up to do compared to Adam Smith.

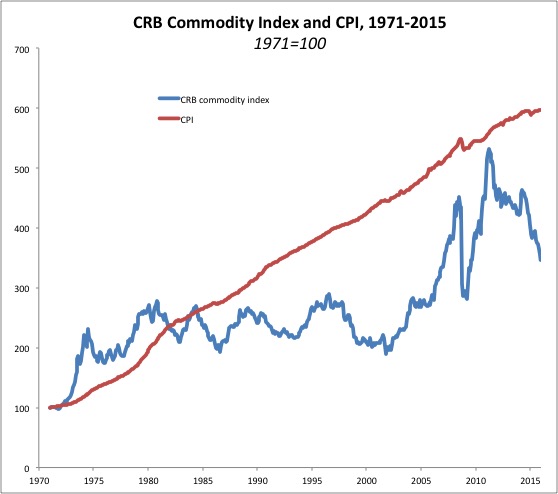

Charts like this (from a 2010 paper by White et. al.) basically show the evolution of the so-called “CPI” from nearly a pure commodity index to its current state today. It says almost nothing about either gold or floating fiat currencies.

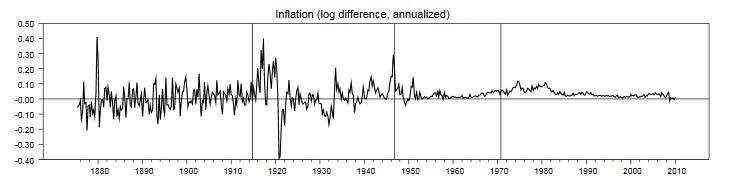

The fact of the matter is, commodity prices were much more stable in the short-term during the gold standard era than they have been since 1971. I calculated an annual standard deviation of 14.7% for 1971-2015, and 6.7% for 1880-1913.

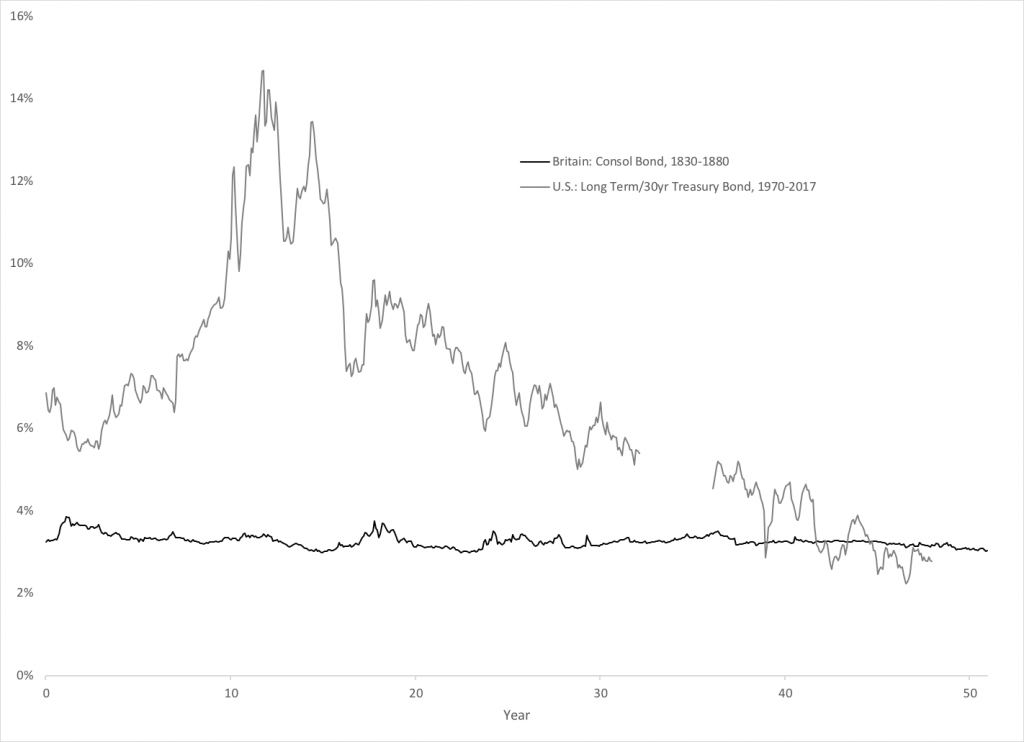

The result of this overemphasis on the “purchasing power” of gold, rather than recognizing it as basically a statistical artifact (the so-called “CPI” of the past was far more closely correlated to commodity prices than a “CPI” today), gold standard advocates tend to apologize for the supposed “price instability” during the gold standard era, and rely on arguments about “long-term price stability.” I think gold was stable in value in both the short and long term, and that “price instability” is basically a beneficial feature of the free market economy as long as the currency is stable in value. The unbelievable stability of interest rates during the era supports my view. Interest rates in the floating fiat era since 1971 are just like commodity prices — way, way more volatility than during the gold standard eras.

But, I don’t think that a CPI would necessarily be low or stable with a gold standard system today. It would reflect economic conditions, with growth generally pushing the CPI higher and contraction generally pushing it lower. These are entirely nonmonetary effects.

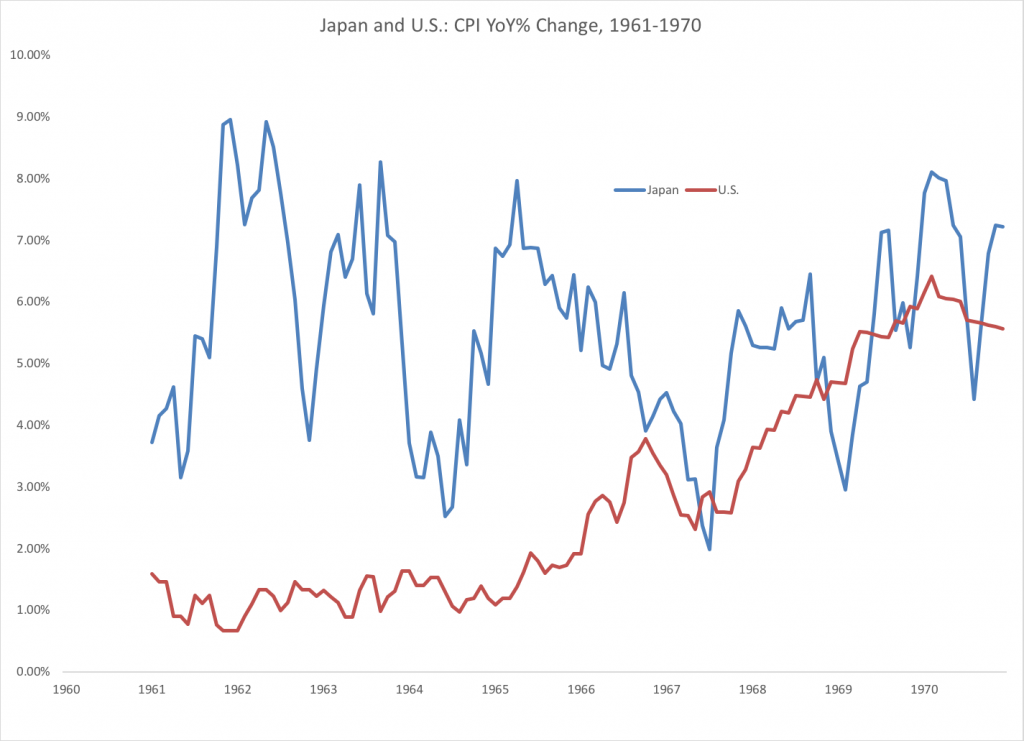

In 1960, the Japanese yen had been pegged to the U.S. dollar at 360/dollar for over ten years. Also, the U.S. dollar was pegged to gold at $35/oz. In practice, the dollar deviated from this gold parity a little due to the internal contradictions of the Bretton Woods “pegged” system, but it was usually pretty close.

As you can see, the CPI under the “gold standard” in Japan was definitely not zero, nor was it even stable. It was all over the place. It was also very different than the CPI in the U.S., although they were essentially using the same currency. The CPI in the U.S. was also all over the place, especially in the late 1960s, although this may have been in part due to the weak dollar (resulting in gold outflows) during the time. The nice thing, however, is that you didn’t have to worry about it. Japan just enjoyed blistering growth for year after year, and they didn’t really care that the CPI was often over 5%. If any central bank today had the kind of variability and high values in the CPI that Japan had during the 1960s, they would be pooping their pants. But, it was one of the greatest eras of wealth creation that any country has ever experienced. That’s because Japan enjoyed Stable Money, NOT because the yen’s “purchasing power” was stable vs. the Japanese CPI, which it certainly wasn’t.

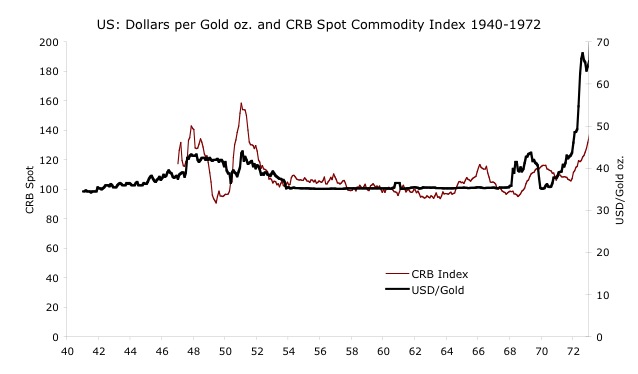

The CRB commodities index, during this period, was flat as a board, showing that there wasn’t really much evidence of any meaningful variation in gold’s value:

The fact that commodity prices were pretty stable suggests that the high CPI of the 1960s in the U.S. was primarily not a monetary effect, but perhaps reflected strong economic growth following the 1964 Kennedy tax cut. The burst in the CPI beginning in 1968 may have reflected the end of the London Gold Pool and effective floating of the dollar vs. gold in 1968, and the dollar’s decline to around $42/oz. before Bill Martin at the Fed reeled it back in to its $35/oz. parity.

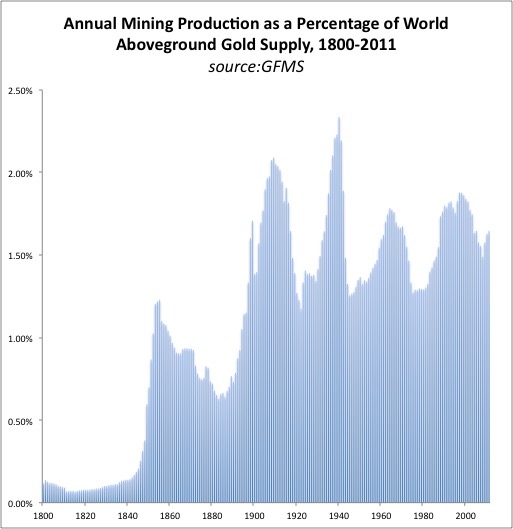

Another point brought up in the Bullionstar article is the idea of gold production naturally adjusting to supposed changes in the value of gold: in other words, when the value of gold rises, production increases, and this increase in production depresses the value of gold and brings it back to a long-term average. I think that White makes too much of this supposed effect, which he describes in more detail in his book The Theory of Monetary Institutions (1999). (That is a pretty good book, actually.)

I think that lowish commodity prices, or low wages, in terms of gold, or also economic conditions (recession) that might produce low commodity prices and low wages, and also low returns on capital in other industries that makes the gold mining industry relatively attractive, do introduce some incentive (lower costs, higher profit margins, and better returns on capital) to mine more gold. You tend to find gold when you look for it — when money is being invested in exploration and development. Plus, the output of an existing mine can usually be increased at least a little bit. Also, known but undeveloped deposits might be put into production.

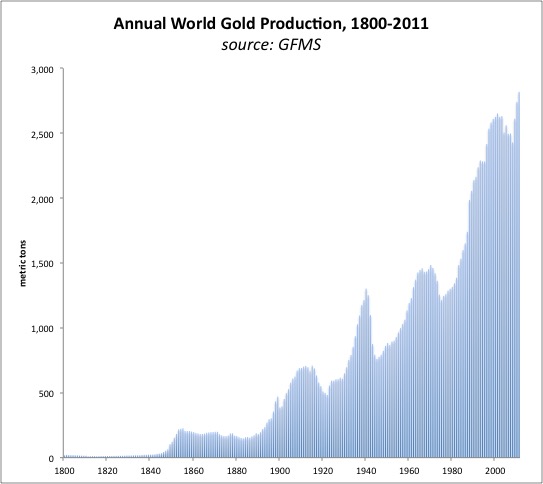

However, I don’t think this effect matters very much. I don’t think gold’s value really changes that much. The big increases in gold mining, during the 1850s and again in the 1890s, did occur during times of somewhat depressed commodity prices, but these discoveries (California in the 1850s and South Africa in the 1890s) were so freakishly enormous that they amounted to something close to blind luck. Total world gold production rose tenfold in the 1850s, compared to 1830. It rose another fourfold between 1885 and 1910. And yet, I don’t think these immense increases in gold production had much effect on the value of gold, in either the 1850s or 1890s. If even a tenfold increase in production has no noticeable effect on the value of gold (and consequently, the very low production levels prior to 1830 also had no effect), and this increase in production came about more or less due to blind luck, then you can hardly make the case that there is some kind of delicately calibrated feedback mechanism between the market value of gold and the gold mining industry. Gold mining goes up and down; and it doesn’t matter very much.

I talked about the mining boom of the 1840s and 1850s here:

January 24, 2016: The Gold Mining Boom of the 1850s

I looked at the 1890s briefly here:

Also, this item:

November 21, 2015: Let’s Resolve the Gold Standard “Deflation” Fallacy

Plus, I talked about the topic in Gold: the Final Standard.

People today are worried that gold would not serve well as a stable standard of value — that its value goes up and down, in a way that would be excessive and destructive. But, there is, I would say, no evidence of this in the past five hundred years. The fact of the matter is, most governments in the world today link their currencies to the dollar or euro, in a manner broadly similar to the way governments in the past linked their currencies to gold. But, the values of the dollar and euro do indeed go up and down in a manner that has certainly been destructive on several occasions just in the four decades since 1971. Gold has never been anything but stable; floating fiat dollars or euros have never been anything but unstable. Projection hmmmm?