(This item originally appeared at Forbes.com on May 28, 2020.)

Now that the House has passed a $3 trillion — 14% of 2019 GDP! — spending bill, coming on top of all the other measures this year, I think it is clear that Deficits Don’t Matter now. Thank goodness that, after millennia wandering in the dark, we just discovered that the Federal Reserve can print money. It makes everything so much easier. Since everyone else is telling Money Santa what they want, I am also going to put in my policy-wonkish request, which is: progress toward a proper Federal tax system.

The best “stimulus” is a more business-friendly policy environment. This is the Magic Formula: Low Taxes, Stable Money. Let’s not spend money on everything else under the sun, except for that.

This is an old topic — there were studies at the U.S. Treasury on optimal taxation systems in the 1970s, and their conclusions haven’t changed much over the years. The best tax systems are broad, flat, and simple. Today, these are things like the payroll tax, VAT and retail sales taxes. They are one-rate taxes that are, by nature, “indirect.” Even the payroll tax, which looks superficially like an income tax, is actually more like a retail sales tax on the sale of employment labor. There is no tax return. Everybody pays the same rate (although there is typically an upper limit).

For the last forty years, variants of these basic principles — the Flat Tax, the FairTax — have been carefully worked out into policy proposals. Over thirty governments implemented Flat Tax systems, mostly between 2000 and 2012.

Those proposals were crafted in part to address the political conditions of that time. But it seems to me that the political situation is changing. Big things are becoming possible — for better, or for worse. Let’s concentrate on something better. As any kid knows when getting ready to Ask Santa: If you know what you want, you might get it.

The Flat Tax and the FairTax are both technically sound solutions. But, I think that they are not politically sound. In democratic systems, higher-income taxpayers are always a political minority. There will always be a majority that will vote to take the money of the minority, for all manner of virtuous-seeming reasons. This is three wolves and a sheep voting on what’s for dinner. The argument that “we will give you extra goodies or lower taxes, funded by the rich” will always be an election-winner, even when it is not really true.

The real-life results of dozens of countries that adopted Steve Forbes-style Flat Tax systems in the 2000s proved that all the promises were true. But, only a few years later, many of these governments succumbed to the constant political temptation to promise goodies to the majority funded by tax increases on the minority. Political truth overpowered economic truth.

To my mind, it is no coincidence that Hong Kong, which has had flat, low-rate taxes for years, has also never been a democracy.

The FairTax includes a “prebate” — again, a technically satisfying solution, but one that, I think, would be politically unsound. It is very similar to a Universal Basic Income. Pretty soon, politicians are promising to double or triple the “prebate.”

The “progressive” income tax system, with higher rates on higher incomes, was promoted by Karl Marx in the Communist Manifesto of 1848. He did not advocate it because he thought it would make capitalism kinder and gentler, and thus allow capitalism to flourish for another thousand years. He thought it would destroy capitalism, the free markets and liberty, and make way for his centrally-planned state nominally for the “worker” but ruled by an unelected administrative elite. The old word for it was: serfdom. (Marx called it: “equal obligation to work.”)

The Libertarian side of the aisle, in the 1840s, had much the same reasoning as Marx, but arrived at a different conclusion: because a “progressive” income tax system would immediately cause endless class warfare between the voting majority and the productive business owners, it must be avoided. This is the principle of “uniformity”: everyone gets the same tax rate. Now, some voters can’t tax other voters at different rates. Taxes for everyone rise and fall together. The question of balancing the costs and benefits of government taxing and spending engage everyone in a similar fashion.

This principle was included in the “uniformity clause” of the U.S. Constitution in Article I Section 8, reflecting common Enlightenment-era ideals of government. It was a cornerstone of statecraft in the nineteenth century. The Constitution was written before the modern income tax (which appeared in Britain in 1799), but the idea was soon applied to income taxes. In 1845, in a book called Taxation and the Funding System, J. R. McCullough concluded:

The moment you abandon the cardinal principle of exacting from all individuals the same proportion of their income or of their profits you are at a sea without a rudder or compass and there is no amount of injustice and folly you may not commit.

Since the passage of the Sixteenth Amendment in 1913, we have been proving McCullough right.

So, I propose a Federal tax system that is both Flat and also Uniform. We will throw out all aspects of “progressivity.” No prebates. No targeted deductions. One rate for everyone, from the first dollar to the last. This would be similar to today’s payroll tax, but with no upper limit on income (and also, no additional income tax). Business income would be taxed at the same rate as the payroll tax. Or, it could be a VAT or sales tax, with no income or payroll taxes. (Economist Lawrence Lindsey favored a single VAT system.) You could combine them. (Herman Cain’s “9-9-9 Plan.”) Probably, any of these proposals would require repealing the Sixteenth Amendment, and replacing it with a new Amendment that updates the original “uniformity clause” to today’s needs. Big steps, I admit, but I think they are becoming politically possible.

Congress could focus on real problems instead of endlessly trading tax favors for campaign contributions.

All taxes on capital (capital gains, inheritance, dividends) should be eliminated. Capital is taxed either with a flat business tax with the same rate as the flat payroll tax, or as part of the VAT. Interest is best made non-deductible at the corporate level, and tax-free at the individual level. (This is known as “VAT base” and has been around for decades.)

I think a tax system like this would naturally lead to a smaller government, because when everyone is taxed at the same rate, everyone tends to want lower taxes. However, I think you could also fund big socialist governments this way too. Then, you could have some big socialist government programs, and also, have a low tax environment that is good for business and job creation.

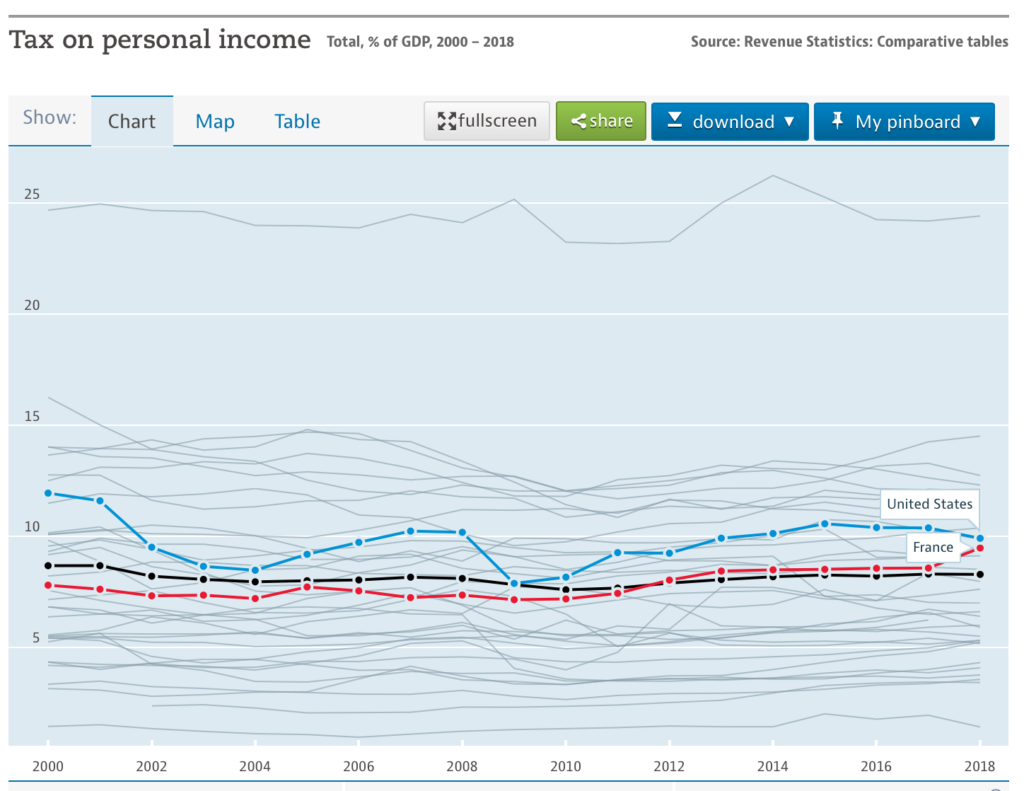

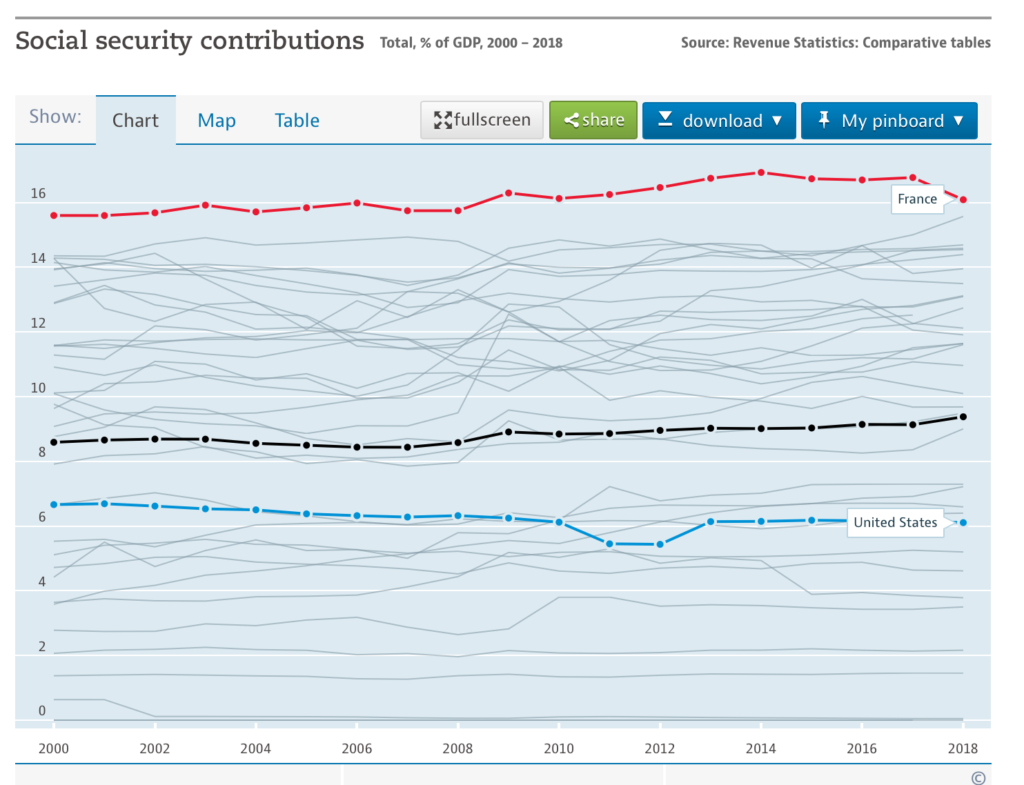

Let’s look at France. The tax revenue/GDP ratio in France was an appalling 46.09% in 2018, compared to 24.33% in the U.S. the same year. However, if we look at the income from the personal income tax, it was 9.47% in France and 9.91% in the U.S.

In other words, France does not get any of its additional revenue from “taxing the rich.” It comes from payroll and VAT taxes — flat rate, “uniform” taxes. To put it another way, if France eliminated its personal income tax altogether, and also its corporate profits tax (2.11% of GDP), it would still theoretically have 34.51% of GDP in revenue — much higher than the U.S. today, and certainly enough to fund the most ardent socialist’s fantasies.

Then what would happen? Well, GDP would probably grow a lot, because that’s what happens when you eliminate all personal and corporate income taxes. So, you would get 34.51% of a much bigger pie. Oceans of tax revenue pouring in.

The next thing that would happen in France is: Because business is booming, and lots of people are getting well-paid jobs, government socialist programs cost less money, and there is less perceived need for government support. Everyone concludes (remember that when taxes are uniform, voters tend to think alike) that there is really no need to have such high taxes, and big socialist spending programs. So the tax rates come down. At the same time, rising GDP means that a lower tax/GDP ratio is compatible with more spending.

The point is: whether a small, Libertarian government, or a big socialist one, the idea of a Flat, Uniform tax system seems to work well. It is both economically sound, and politically sound.

This is the Magic Formula. It is not about “tradeoffs.” It is about getting on the Spiral of Success.