(This item originally appeared at Forbes.com on February 4, 2019.)

The idea of income tax rates of 70% and above is making a strange comeback. You would have thought this notion would have died out by now, along with other once-fashionable twentieth-century failures like Soviet communism. Everyone tried it; and nobody could make it work. So, quite naturally, they dumped it.

Britain is often considered the birthplace of the modern income tax. An income tax with a 10% top rate was imposed in 1799 specifically to fight the wars with France, which had begun in 1793. But direct taxes had been considered a mark of slavery since the times of the Ancient Romans and Greeks. After Napoleon’s defeat at Waterloo in 1815, the long era of war ended. In 1816, Britain eliminated the income tax, returning to a tax system based entirely on indirect taxes such as excises and tariffs.

Nevertheless, the idea could not quite be exterminated, in part because it had proven to be a great revenue generator, and also because the primitive system of excise taxes common then was woefully overcomplicated and inefficient. Eventually, the excises were rationalized into the modern retail sales tax and VAT, but that did not come until much later, during the 1920s and 1950s. In 1842, Britain reintroduced an income tax at a flat rate of 3%. In practice, it was structured as something like today’s payroll tax, on the first and last dollar earned – in effect, a sales tax on employment, with a corresponding tax on business income. This allowed a great simplification of the tax code, in which tariffs on more than 700 items were eliminated.

During the nineteenth century, a central principle of government was that taxes should be “uniform”; that is, weighing equally upon everyone. This arose due to the terrible injustices common in the eighteenth century. Throughout history, a common pattern had emerged in which those with power and influence had been able to exempt themselves from taxation. In monarchies and aristocracies, this had usually meant the nobility, the wealthy and the church. In France before the Revolution of 1789, the nobility had been able to avoid taxation while the peasantry faced oppressive burdens that drove them into destitution. A similar pattern happened in Spain during the sixteenth and seventeenth century. Thus we find in the French Constitution of 1791, Article 9:

“Pecuniary privileges, personal or real, in the payment of taxes are abolished forever. Taxes shall be collected from all the citizens, and from all property, in the same manner and the same form. Plans shall be considered by which the taxes shall be paid proportionately by all, even for the last six months of the current year.”

Thus, already “uniformity” meant “proportionately” – basically, at the same tax rate, or percentage.

James Madison, the primary author of the U.S. Constitution of 1789, argued in The Federalist No. 10 that, in a democracy a different pattern would emerge: the majority would attempt to overtax the minority. Since the wealthy are always a minority, and also have a disproportionate amount of money, this made them a natural target. Article I Section 8 of the Constitution reads:

“all Duties, Imposts and Excises shall be uniform throughout the United States”

However, the Constitution predated the modern income tax, so it did not refer explicitly to a uniform rate of income taxation.

The principle of uniformity nevertheless became a centerpiece of nineteenth-century thinking about taxation. In Taxation and the Funding System of 1845 – this was only a few years after the introduction of the income tax in Britain – British writer J. R. McCullough asserted:

“The moment you abandon the cardinal principle of exacting from all individuals the same proportion of their income or of their profits you are at a sea without a rudder or compass and there is no amount of injustice and folly you may not commit.”

In all the years since the introduction of the income tax in the U.S. in 1913, we have proven exactly what he warned of. The 1840s were a particularly creative time for thinking about taxation, for we find then also Karl Marx, who wrote in the Communist Manifesto of 1848:

“A heavy or progressive or graduated income tax is necessary for the proper development of Communism.”

Note that he did not say “socialism,” by which we might take to mean, a means by which revenue is raised for “social spending,” or some kind of “redistribution of income” within the context of the capitalist free-market economy. From the start, Marx saw the “heavy, progressive, graduated” income tax as a way to destroy capitalism, and make way for Communism in which private property, individual liberty and the free market system was eradicated in favor of universal state serfdom.

If you wanted to raise money for “social spending,” you could raise the rate within the context of the one-rate British income tax system. This is exactly what happened, as Britain, along with Germany and others, introduced some modest social programs in the late nineteenth century, financed with slightly higher tax rates. But in nearly seventy years following the introduction of the income tax in 1842, the “uniform” tax rate never rose above six percent. Any rise in the tax rate was felt by all, in the same proportion, and political resistance to higher taxes was universally shared. You couldn’t “buy votes.” Everyone knew exactly what the cost would be, and knew that they would have to pay it along with everyone else.

In 1894, Democrats introduced an income tax in the United States, at a rate of 2% on income over $4000 (about $240,000 today). But many feared that rates would soon rise, as the temptation of overtaxing the minority proved politically irresistable. In 1895, the Supreme Court declared the tax unconstitutional, and it was repealed. In the case, Supreme Court Justice Stephen J. Field found:

“If the Court sanctions the power of discriminating taxation and nullifies the uniformity mandate of the Constitution … it will mark the hour when the sure decadence of our government will commence.”

In 1910 in Britain, the Marxist idea of “graduated” (multiple tax brackets) and “progressive” income taxes was introduced for the first time. World War I soon followed with higher tax rates, and in the century since then, the top income tax rate in Britain has never been below 40%.

The twentieth century saw the development of several new ideas in taxation that proved to be quite effective: the retail sales tax, the payroll tax, and the VAT. These are all “one rate” taxes that exemplify the principle of “broad base and low rate,” and they are all applied “uniformly” (although payroll taxes commonly have an upper income limit).

“The history of taxation shows that taxes which are inherently excessive are not paid,” explained Treasury Secretary Andrew Mellon at the dawn of the modern peacetime income tax, in 1924. “It seems difficult for some to understand that high rates of taxation do not necessarily mean large revenue to the Government, and that more revenue may often be obtained by lower rates.”

In nearly a century since then, we have proven Mellon exactly right. High tax rates generate no additional revenue, and since they generate no revenue, they cannot fund any additional services. However, they have a definite “cost” in economic performance, in addition to social and political strife. The resulting economic stagnation creates exactly the kind of distress among the working classes that the socialists sought to remedy. It was all downside and no upside.

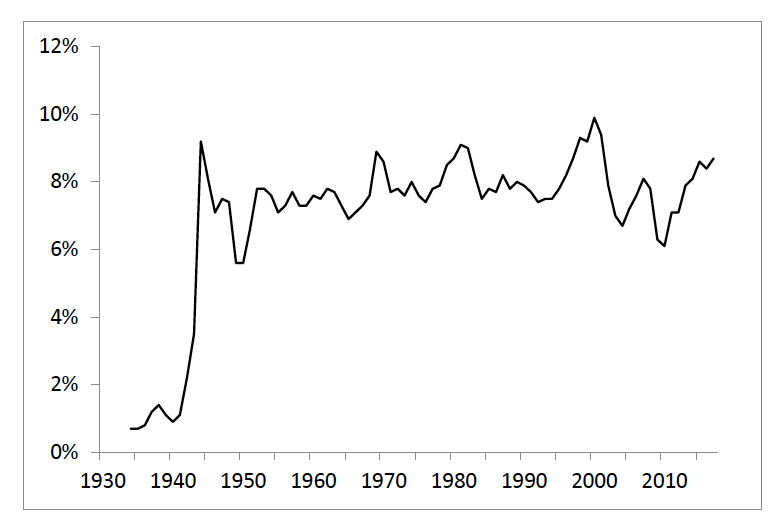

In 1963, the top personal income tax rate in the United States was 91%. Federal income tax revenue, as a percentage of GDP, was 7.7%. In 1989, the top rate was 28%, and revenue/GDP was 8.0%. In 2016, revenue/GDP was 8.4%. Each time the top rates were reduced, the proportion of revenue paid by upper incomes increased. The “rich” paid more, with lower rates; lower incomes also got a reduction in rates, and ended up paying proportionately less.

There was a time when Democrats understood this. The entire journey, from 91% to 28%, had enthusiastic support from the Democratic Party. The 1964 Kennedy/Johnson tax reform, which lowered the top income tax rate to 70%, had 92% support among House Democrats, and only 63% support from Republicans. The 1981 reform, that lowered the top rate to 50%, passed the House with a vote among Democrats of 113:93 in favor. The 1986 reform that lowered the top rate to 28% passed the Senate 97-3. As the economy expanded, the need for socialistic spending itself dissipated.

It took a century of experimentation to figure all this out. To the dismay of small-government fans everywhere, average tax revenue/GDP in the OECD was 34.3% in 2016, the highest in history. In 1965 it was 24.8%. For the U.S., tax revenue/GDP was 27.1% in 2017 and 23.5% in 1965. But this increase in revenue was not accomplished with punitive tax rates on high incomes – for the simple reason that it could not be. We tried it—everyone tried it!—and failed. To generate revenue, you have to have a tax that people are willing to pay; and that has turned out to be taxes with low rates on a broad base, especially retail sales, payroll and VAT taxes. Europe finances its welfare state with high VAT and payroll taxes. The top income tax rate in the U.S. today is 51.8%, including the highest State and Local taxes; the average top combined rate for the OECD is 41.4%.

Marx is dead, along with the Soviet Union, which turned out to be a diabolical horror. Yet “cultural Marxism” lives on, poisoning minds with the same familiar noxious garbage whose end goal – Marx himself told us so – is not “social justice” but grim slavery. “Graduated” taxes (taxing people at different rates) produces endless political contention, a form of “divide and conquer” that we are now well familiar with. The former communists of the Soviet bloc themselves embraced “flat tax” income tax systems with one “uniform” rate, alongside “uniform” payroll and VAT taxes.

It would be best if government was small enough that it could be easily funded with a simple consumption-based tax, like a VAT or “FairTax” universal sales tax. But if a high revenue/GDP is a goal, this could be combined with a “uniform” and universal income tax, in the model of the successful British system of 1842. This is basically a one-rate “employment tax” equivalent to today’s payroll tax, paid on all employment compensation, from the first dollar earned and with no upper limit on income. (There would be no additional income tax or payroll tax.) This would be combined with a “business tax” with the same rate, paid by corporations, partnerships, passthroughs, sole proprietors and the self-employed.

In the last hundred years, we already made every mistake. It would be a little too stupid — especially for those seeking the means to fund greater government services — to make the same mistakes again. Democrats and Republicans alike used to understand this; and they should come together again to finally eradicate this Marxist error from the Republic.