We have been talking about NGDP Targeting (or “NGDP Level Targeting,” “NGDPLT”). It is a popular notion among somewhat conservative-leaning economist types today.

September 15, 2019: Let’s Talk About NGDP Targeting

September 22, 2019: Let’s Talk About NGDP Targeting #2: The Classicals and the Mercantilists

September 29, 2019: Let’s Talk About NGDP Targeting #3: What’s The Value?

Today, we will look at a recent expression of this idea:

read “Facts, Fears, and Functionality of NGDP Level Targeting”, by David Beckworth

Beckworth is one of the leading proponents of the idea. He is Senior Research Fellow at the Mercatus Center at George Mason University. The Mercatus Center is a right-leaning economics institute that has long promoted “rules based” monetary approaches, although rather pointedly avoiding the most popular and common rules-based approach today, used by more than half of all countries worldwide, which is a fixed-value link — for example, a link (fixed exchange rate) with a major international currency like the dollar or euro, or, in the past, a link to gold; in either case, maintained (ideally) with a system resembling a modern currency board.

This is a nice, short paper, in plain language intended for a general audience. Writing of this sort is very useful, because it is usually a good window on what the writer really thinks.

The paper consists of seven Facts, and then addresses seven Fears. The most interesting thing about this section is what it leaves out: there is no mention anywhere of currency value, which I consider the primary operating mechanism of the system. There is no mention of what it would look like on an international basis, with over forty countries now part of the “dollar bloc,” or what major exchange rates would look like. It is, as I characterized earlier, intensely domestic-focused.

“Fact 4: NGDPLT is a work-around to the supply shock problem” deals with minor deviations to trend growth, imagined as “supply shocks” (changes in productivity) and “demand shocks” (basically, recessions). These are imagined as brief episodes lasting perhaps a couple years, around a trend of perhaps 4% NGDP growth, deconstructed to 2% “inflation” and 2% “real growth.” The notion of an economy entering an extended period of growth, where NGDP might be on the order of 7% for a decade (as the U.S. economy did in the 1960s) is not considered. Nor is a period of continued economic difficulty, due to a variety of bad policy decisions, as was the case during the Great Depression worldwide, and as has happened many times in many other countries, with Greece a recent example that I like.

“Fact 5: NGDPLT is a work-around to incomplete financial markets” basically makes the assertion that an unchanging NGDP growth rate would reduce financial instability. I generally agree with this, since it is easier to make debt payments when the top line (revenues; in aggregate this is NGDP) is experiencing steady growth. This is basically accomplished with currency devaluation, not so much different than similar arguments applied to the devaluation of 1933. “I went on to more carefully test these relationships and found support for causality running from NGDP stability to financial stability,” Beckworth wrote. It is not too surprising that a healthy economy (expanding NGDP) might also lead to financial stability; and that a recession (low or contracting NGDP) might be associated with rising default rates. But, to go from this rather bland assertion to the notion that steady NGDP growth should be manufactured from monetary manipulation and distortion is exactly the kind of simplistic notion that gets NGDPLT fans excited. It seems like they have the secret to everlasting prosperity! Note how all of economic policy outside the central bank is ignored throughout this paper. It is the extreme form of the “prices, interest, money box” that I talked about earlier.

July 10, 2016: The Tyranny of Prices, Interest and Money

November 27, 2016: The Tyranny of Prices, Interest and Money #2: The Old Historicism

You could argue that: “nonmonetary policy, such as taxes, tariffs and so forth, were really crap, but the central bank couldn’t do anything about that; and so, to keep things from tipping into disaster, the central bank had to use the only tools at its disposal.” I don’t particularly like that argument, but I see the sense of it. But, that argument does not appear. No aspect of policy, or economic fundamentals, outside of monetary manipulation gets even a mention. It simply does not exist.

“Fear 1: Changes in potential real GDP will create problems for NGDP” addresses one of the issues that I like to bring up. One proposal in the paper is to change the NGDP target. Another is to just ignore it; and allow the difference to affect “inflation.” The paper imagines that the NGDP target could be changed every 3-5 years. I think it is an interesting point at which politics will intervene; and it will have to intervene, because before long, the NGDPLT system will produce some kind of unpleasant outcome — basically, a currency whose value is doing some funny things, perhaps leading to reactions in interest rates.

I am not sure that we will get much more out of this paper, so I will leave it at that.

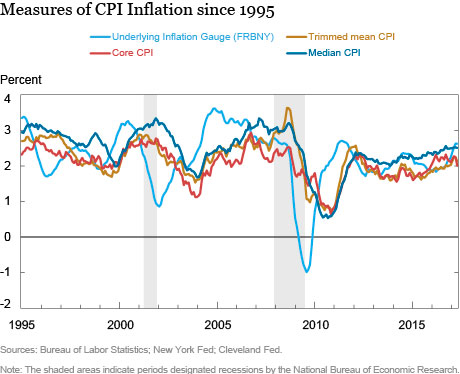

NGDPLT fans like to compare themselves to CPI target fans, naturally asserting that NGDPLT is superior. Basically, NGDPLT introduces a more aggressive element of macroeconomic manipulation. The CPI target, or “single mandate” idea arose out of the desire to reduce central bank influence on the macroeconomy, thus taking a step toward Classical ideals of a currency that is “neutral” in character. It is a sort of crabbed version of Stable Money — money that is stable in value. In practice, a healthy economy with Stable Money, such as when currencies were linked to gold during the Bretton Woods period, or during the “Greenspan gold standard” period of the 1990s, does tend to produce CPI growth of about 2%, as it is commonly calculated. But, that does not mean that, if you have a 2% CPI target, you end up with Stable Money. It doesn’t work that way at all.

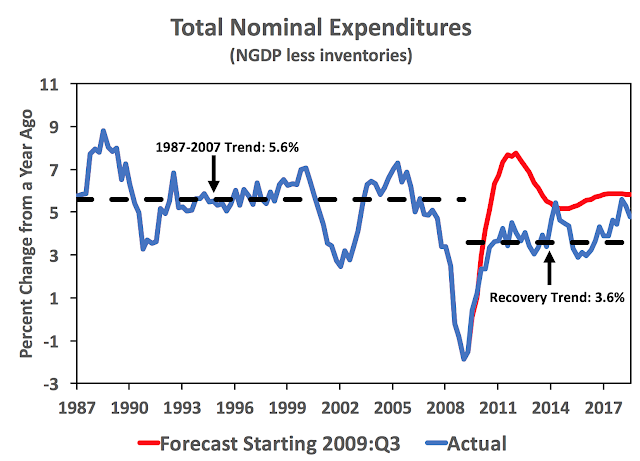

I think this chart is a good way of getting an idea of what NGDPLT would look like in real life. It is from Beckworth’s Macro Musings blog, April 2019:

As I read it, it seems to make the claim that an NGDPLT system, with perhaps a 5.6% target as was the trend in the 1990s, would have avoided the recessions of 2001 and 2008, and also the low growth after 2008.

It is worth nothing that this choice is actually more than a choice for trend inflation. It is implicitly a choice for lower trend aggregate demand (AD) growth. As seen below, aggregate demand growth was averaging 5.6 percent in the decades before the crisis. Since the recovery started, it has averaged about 3.6 percent. That is a 2 percentage point decline in the trend. The red line in the figure shows what a naive autoregressive forecast would have predicted over the past decade conditional on past nominal expenditure history. There has been a sizable AD shortfall.

In my view, it is this dearth of aggregate demand growth rather than the low inflation that is a problem. The slowdown in AD growth has arguably contributed to problems like hysteresis and populism. If so, this policy choice has been costly.

“Aggregate demand” is basically NGDP. “Demand” basically means buying things. NGDP is basically a measure of sales. Not surprisingly, buying=selling. Yes, much of modern economics really is that silly. “A sizeable AD shortfall” basically means that the Fed should have been stepping on the gas, and printing more money (causing a decline in dollar value) to goose NGDP. From this all good things arise.

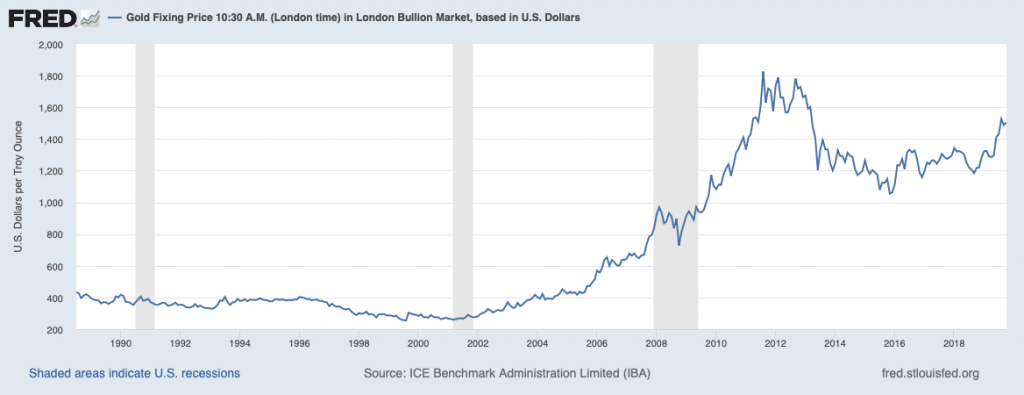

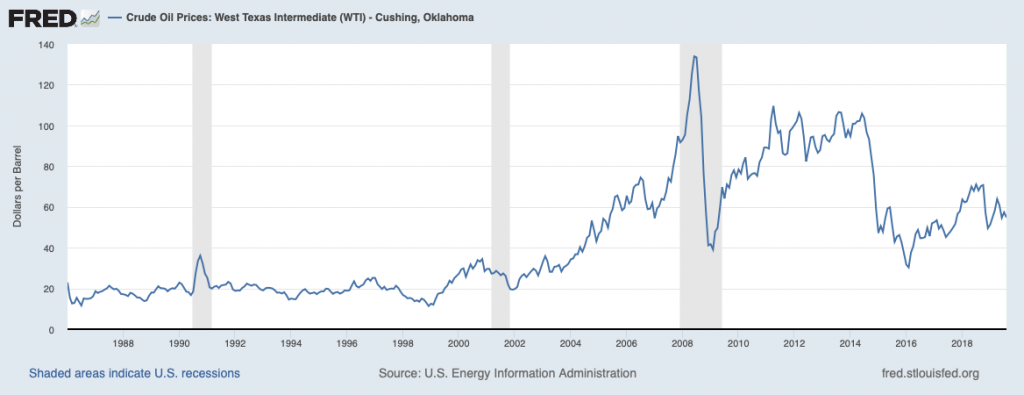

Now, let’s look at what really happened during this period. The dollar had a big decline in 2001-2008, falling from around $280/oz. of gold to about $1000 in 2008. Then there was a brief but intense dollar rise during the financial crisis of late 2008, and then another leg lower for the dollar to a low of $1900 in 2011 before stabilizing around $1250/oz. in 2013-2018, the “Yellen gold standard” period. During this time, the price of oil went from around $20/barrel to about $60-$80, and oil companies are going broke at those levels. They need more like $80-$100 oil to make an adequate return on capital. Young people today might be surprised to hear that, before 2005, a pound of coffee had sixteen ounces, and a gallon of orange juice contained four quarts.

In other words, I think that the dollar/gold ratio tells a more-or-less accurate tale of dollar depreciation during that period. At first, this dollar depreciation was welcome, as the dollar was really too high in the 1998-2001 period. The initial corrective to $350-$400/oz. was beneficial, but this trend then continued (I think it was on purpose) to eventually produce a large decline in dollar value. In other words, it was a big devaluation. The CPI was heavily massaged during this period to produce politically acceptable figures.

In other words, whether a “CPI target” or an NGDP target, each would have produced or allowed, during 2001-2008, a big decline in currency value. This continued into 2011, and then it seems to me that calmer and more sensible heads prevailed, that realized that a continuous trend of currency depreciation was dangerous and destructive. The outcome effectively amounted to a rough gold standard in 2013-early 2019, with a midpoint around $1250/oz., or less than a third of the $350/oz. plateau of the 1990s. This approximation of Stable Money produced lower figures for CPI and NGDP, since 2013 or so.

It appears that, if the Federal Reserve would have followed Beckworth’s suggestions, the pattern of declining dollar value would have continued past 2011, to hit the 5.6% NGDP target. A CPI target would have produced a similar result.

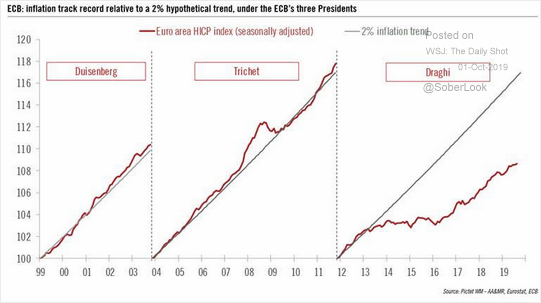

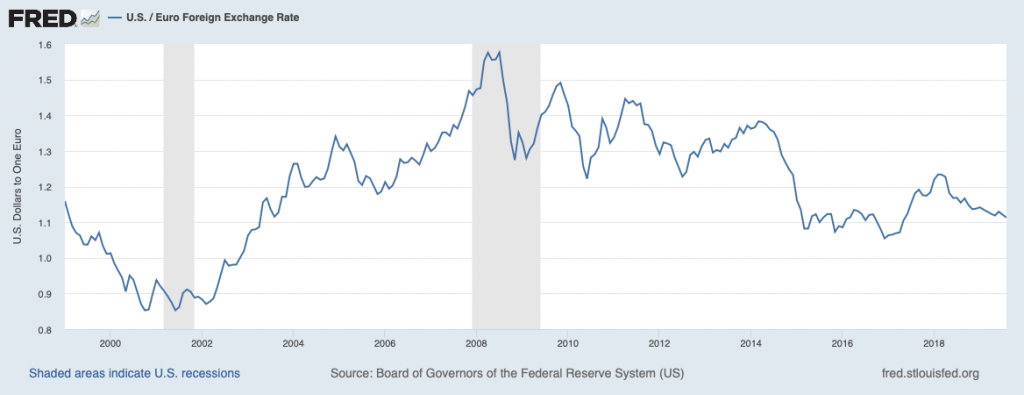

For the euro, the ECB has come under criticism for falling below CPI targets, in the midst of a rather weak economy. (Note that the 2% CPI target in 2001-2013 was achieved with a significant decline in euro value, much like the dollar during the same time period.) To hit the CPI (or NGDP) targets via purely monetary means, the euro would have had to decline in value. (The pickup in euro CPI beginning in 2016 could be seen as an effect of the big euro decline in 2014-15, with a bit of lag.)

But, the euro has already been on a rather disturbing declining trend since 2009. What if the euro had fallen more, to hit CPI or NGDP targets? Where would the euro be? $0.90? $0.50? That sort of thing would have led to all kinds of turmoil in all international financial and trade relations. Among other things, it would have ignited pressure on the U.S. to depress dollar value (this is already happening today) to normalize exchange rates. The outcome would be a “race to the bottom.” Central bankers rarely like to talk about exchange rates — there are no good answers to this politically-charged question — but in practice, maintaining some stability of exchange rates is a high priority. Basically, that has taken priority to CPI and NGDP concerns. Even so, the euro is not looking too healthy.

It appears to me that, if we had taken Beckworth’s advice, we would have ended up with a pattern of continuous currency depreciation. Note that Beckworth recommended (red line) a compensatory move, with NGDP reaching about 8% in 2011, compared with the actual result around 3.5%, which itself was produced with substantial currency decline. It is interesting to think about what conditions would have produced that purely from monetary means. I also note that Beckworth could have recommended a lower NGDP target in 2001-2008, perhaps one that could have avoided currency decline (as per Fear #1), but, even with all the curve-fitting convenience allowed by the hindsight of history, did not. Major declines in currency value are, apparently, okey-dokey.

Actually, CPI Targeting seems like it would have produced much the same thing. If the 2001-2011 trend in dollar depreciation had continued, where would we be today? We saw earlier how that worked for Greece in the pre-euro days. Basically, we would have proven, once again, that “you can’t devalue yourself to prosperity.”

Take note of how little these things — the most important things — are addressed in the paper we are examining today.

For hundreds of years, the primary monetary principle throughout the world was Stable Money — in practice, this meant a gold standard system. Even when, in their weakness, governments debased their coinage and currencies, this failure and deviation from the ideal was noted and scorned. Not one of these countries, that experimented with floating and devaluing their currencies, ever enjoyed any lasting advantage from it, while those that stuck to unchanging gold parities rose to the top. Even today, most countries maintain a fixed-value policy with a major international currency, mostly the dollar or euro. Floating currencies with a long-term trend of depreciation compared to the dollar or euro — the Argentine peso, Mexican peso, Turkish lira, etc — do not get much respect. Just as was the case during the gold standard era before 1914, none of these countries seems to have enjoyed any lasting advantage from this process. The “fixed value” rules-based system worked very well in the past, and it continues to work well today. Perhaps someone will invent a better measure of Stable Value than gold. But, that hasn’t happened yet, and I doubt that it will anytime soon, if only because it seems that nobody wants to try. Neither CPI targeting nor NGDP targeting will produce anything like Stable Value.

The return to gold does not depend on the fulfillment of some material condition. It is an ideological problem. It presupposes only one thing: the abandonment of the illusion that increasing the quantity of money creates prosperity.

Ludwig von Mises