(This item originally appeared at Forbes.com on May 4, 2023.)

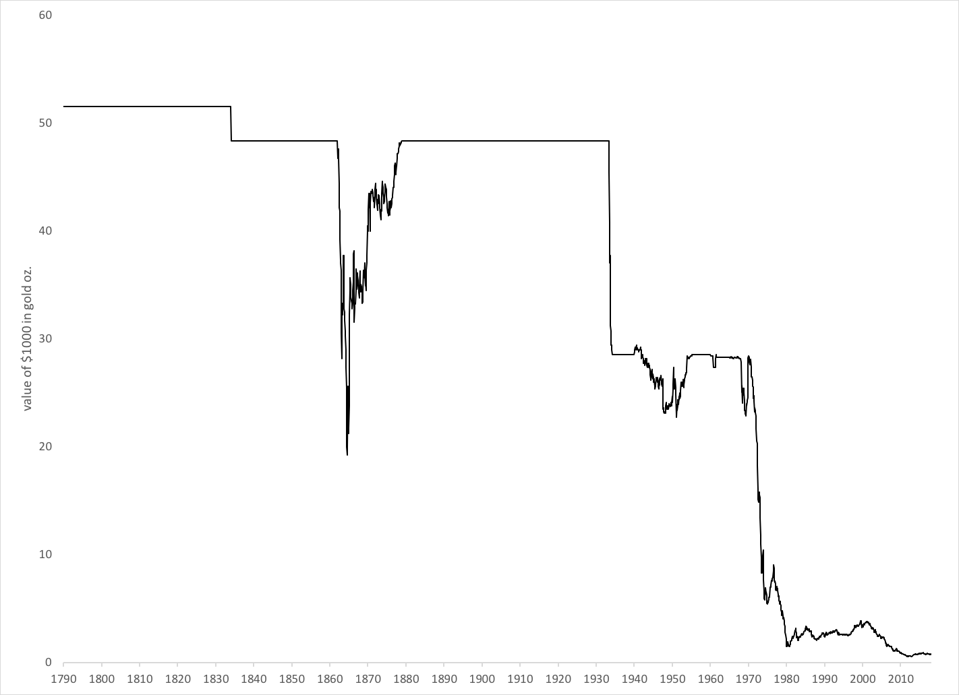

“To advocate the complete, uninhibited gold standard runs the risk, in this day and age, of being classified with the dodo bird,” wrote Murray Rothbard in 1962. This was certainly odd, since the official policy of the Federal Reserve, the U.S. Treasury, the International Monetary Fund, and all major governments including Britain, France, Germany and Japan, plus communist China and Soviet Russia, was that currencies should be linked to gold. The US dollar was the heart of this system, established at Bretton Woods, New Hampshire in 1944. The dollar’s value was to be 1/35th of a troy ounce of gold, or about 890 milligrams. And, in fact, the dollar really did have a value close to that, at the time; and did so until 1971.

Part of the problem was that gold standard advocates including Rothbard had gone off the deep end with pointless radicalism. The quote comes from a book called The Case for a 100% Gold Dollar, in which Rothbard, in an effort to eliminate “fractional reserve banking” (which had coexisted with gold-based money since the Renaissance), proposed devaluing the dollar by 95%. Sensible people classified Rothbard with the dodoes.

The gold standard had served America well for nearly two centuries, from 1789 to 1971. The final decade of the gold standard — the 1960s — was a high point of prosperity that has not been matched since. Gold worked; floating fiat currencies have not. Nevertheless, just as in Rothbard’s time, to be a public advocate of gold-based currencies is to invite disdain from the intellectual class.

This has created, among public personages who want to avoid needless controversy, a tendency to suggest commodity baskets as a guide to policy, rather than gold itself. One such person was Wayne Angell, a member of the Federal Reserve Board of Governors in 1986-1994. Angell publicly used a commodity basket as a guide to his voting on the FOMC. This was not so much different than Chairman Alan Greenspan, who several times said that he used gold as a guide. During Greenspan’s tenure, 1987-2006, there were ups and downs, but the value of the dollar vs. gold was roughly the same at the end as at the beginning.

But when Angell was invited to Russia in 1993, which was then suffering hyperinflation, Angell did not recommend a commodity basket currency. He recommended that the ruble be linked to gold. Angell was still at the Federal Reserve at the time.

Angell was not the only one, of that era, who was hesitant to say what he really thinks in public. Greenspan became much more public about his gold standard advocacy after his retirement.

In the 1980s and 1990s, the “commodity basket” idea was thought of as a way to move public debate — the “Overton Window” — away from the idea of a floating fiat currency as a tool of continuous macroeconomic interventionism, and toward the ideal of Stable Value. “A currency, to be perfect, should be absolutely invariable in value,” wrote early economist David Ricardo in 1816. The principle worked for America, which had only one permanent devaluation in 1933, and became the wealthiest country the world had ever seen. This is completely contrary to the idea of a currency that is constantly manipulated to respond to last week’s macroeconomic figures, and the political winds that result.

Supposedly (people thought in the 1980s and 1990s), this “commodity basket” idea would lead eventually to a more meaningful debate about gold. At the right time, the commodity basket idea (as with Angell in Russia) would be discarded. This political ploy never worked, which is no surprise, because it is hard to be convincing when you are afraid to say what you really think. Everybody knows — the common people of the United States, and also those of India, Iran or Zimbabwe — that gold, and only gold, is good money.

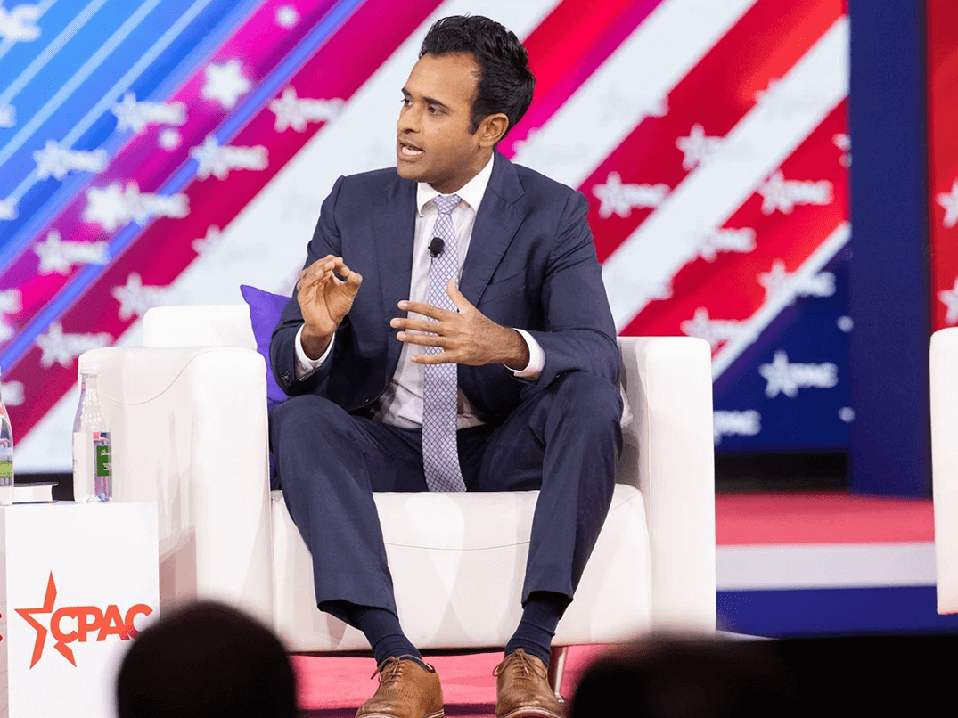

Republican presidential candidate Vivek Ramaswamy has a better idea. Like any presidential candidate, he has to be a centrist figure. In a recent oped for the Wall Street Journal, he talked about the principle of Stable Money, which hasn’t changed much since Ricardo’s day; but did not get into too many details. The WSJ assured us that this is a “commodity basket” proposal, although Ramaswamy did not say that, and doesn’t on his website either.

I’ve heard that some advisors to Ramaswamy are giving him the “commodity basket” idea, explicitly copying the old 1980s playbook. I say throw that crap out. You don’t have to imitate the politics of a bygone era, especially when it didn’t work. Just say what you think, like Congressman Jack Kemp — author of the Gold Standard Act of 1984 — used to do. Or Mike Pence, who later became Vice President. Explain the Stable Money ideal, and then explain that the way that Stable Money has always been achieved, in US history and the history of the whole world over the past half-millennia, is using money based on gold — not commodity baskets.

The “commodity basket” idea is very old. Ricardo mentioned that it was a topic of debate in Britain, in 1816. Beginning in the late 19th century (economist Irving Fischer was a proponent), the “commodity basket” became a tool to undermine the established order based on gold. Economist Friedrich Hayek was never a gold standard fan during his lifetime, but always promoted a commodity basket instead. In effect, he acted as a subversive.

The “commodity basket” idea has long been used not as a way of moving debate toward a gold standard, but actually for diverting debate away from it. We can wonder at the motivations of Fischer or Hayek. But I would caution that there are those today that would really rather keep the existing system of central bank interventionism, and avoid any progress toward a gold standard system. One way to do this would be to hobble possible leaders like Ramaswamy with “commodity basket” diversions. He wouldn’t be the first.

This is the principle of “controlled opposition.” If the opposition to the existing floating fiat regime is some “commodity basket” crank, or Monetarist, the floating fiat people can sleep easy.

Everybody knows gold works. Gold’s track record is so exceptional (I wrote a book about that — Gold: The Final Standard), that I can say this and common people know it is true. Politically, I don’t think we are ready for such big changes yet. But we might be there before the end of this decade, and we need to be ready for that time.