Today, we will continue our discussion about “Economic Nationalism,” which is one of the most important economic issues of our time. To address this properly would really take a lot of research and review of available literature — something that would be a lot of fun, if I had a year with not much on the agenda. Instead, I have taken the approach of collecting bits here and there, as a process of accumulation. My commentary along the way is simply my provisional view, which may change over time.

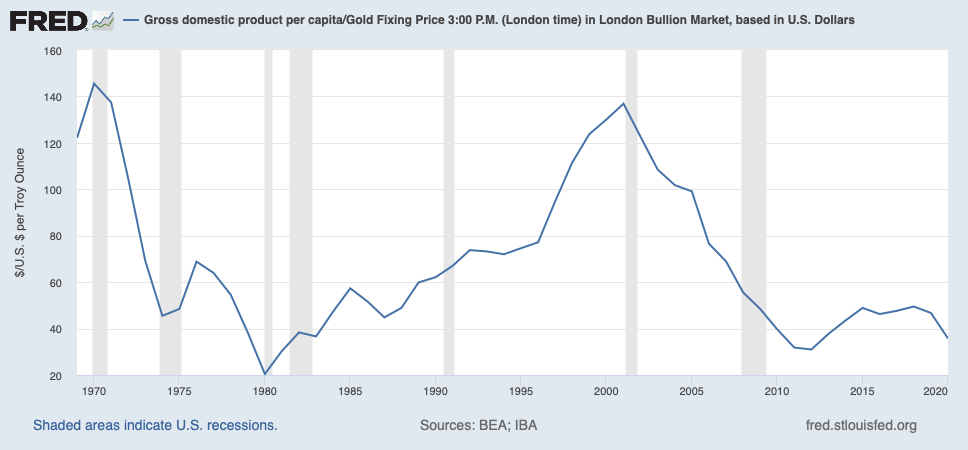

As we know, the world went from a (rather poorly managed) gold-based Stable Money system, the Bretton Woods system, to a chaotic floating fiat environment, in 1971. Today’s dollar is worth only about one fiftieth the value of the dollar of 1970, compared to gold. This has consequences: you would expect economic performance to be rather bad when you do stuff like that. Here is US per-capita GDP as represented in gold oz.

In practice, I don’t think things are quite this bad. I think there has been an effective shift in the price structure, which you could argue is related to the much cheaper prices of food these days compared to the 1960s, due to the Green Revolution. But, anyway, the picture is one of stagnation, which is exactly what you would expect when currencies decline in value, and what we in fact see over and over again in emerging market countries that suffer from chronic currency depreciation. Basically, we’re Mexico.

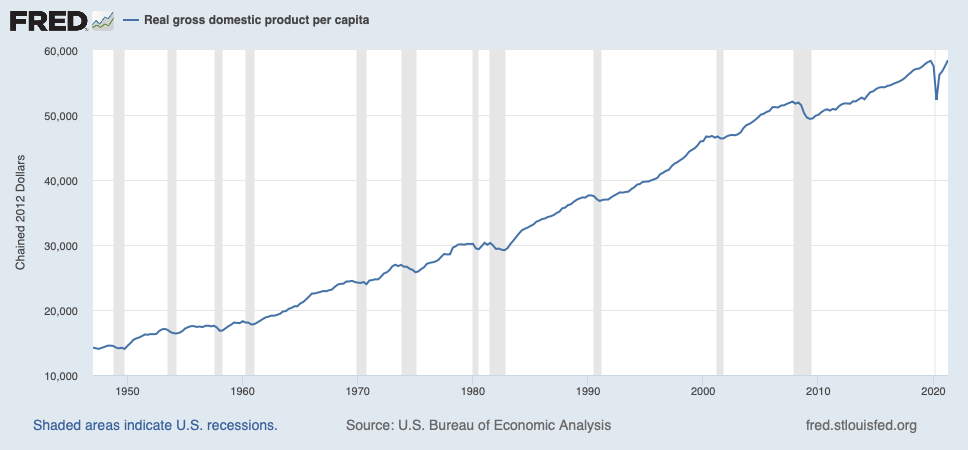

But, let’s look at the official statistics regarding “real” GDP per capita, adjusted by the CPI or GDP deflator.

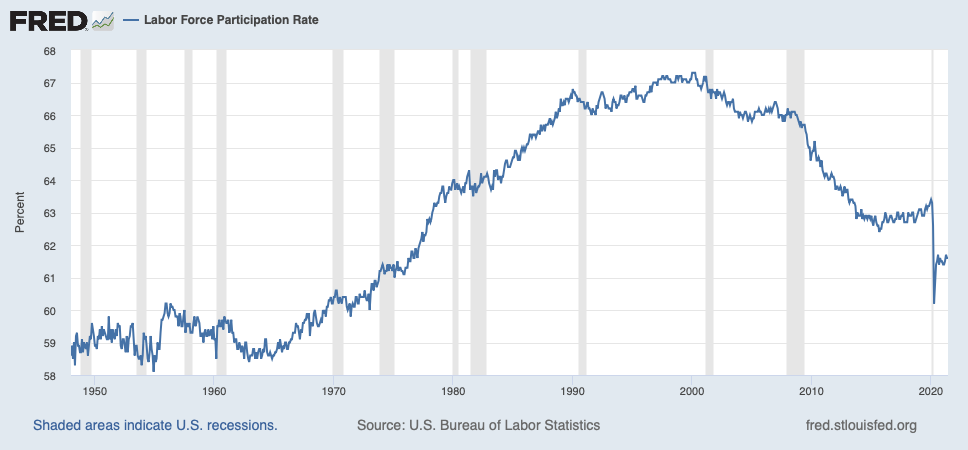

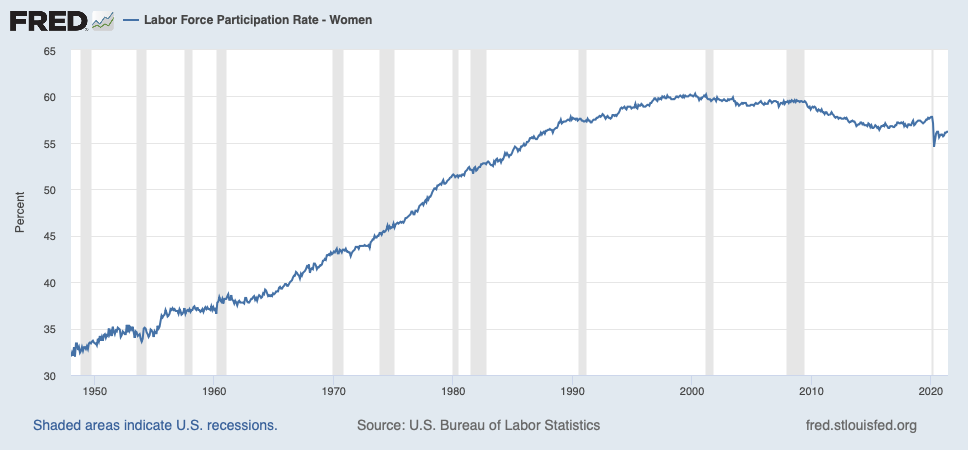

According to this, the average American is more than twice as wealthy as they were in 1970. According to this, they actually got wealthier during the 1970s, which everyone living at the time agreed was an economic disaster. Riiiiight. I do not think this accurately describes reality. Part of this represents the increasing activity of women in the workforce.

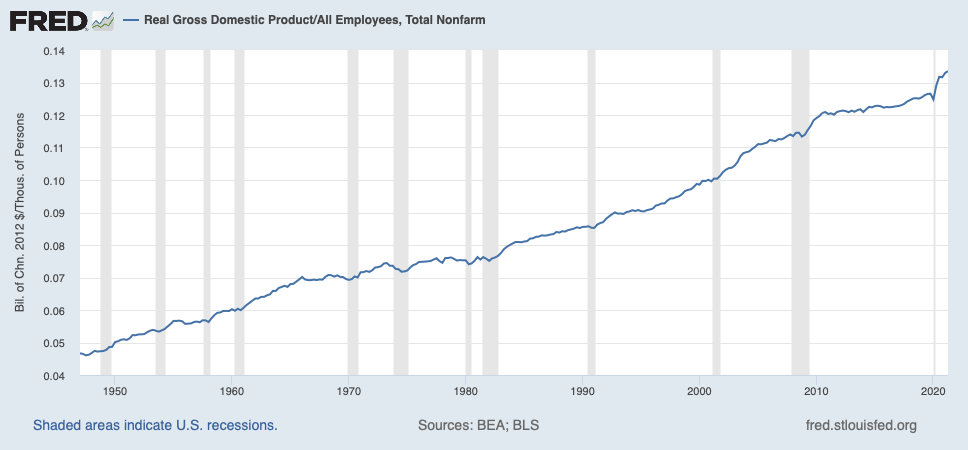

Dividing “real” GDP by the number of employees gives a better idea of per-employee productivity. Supposedly, we’re still all 2x better off these days. I don’t think so.

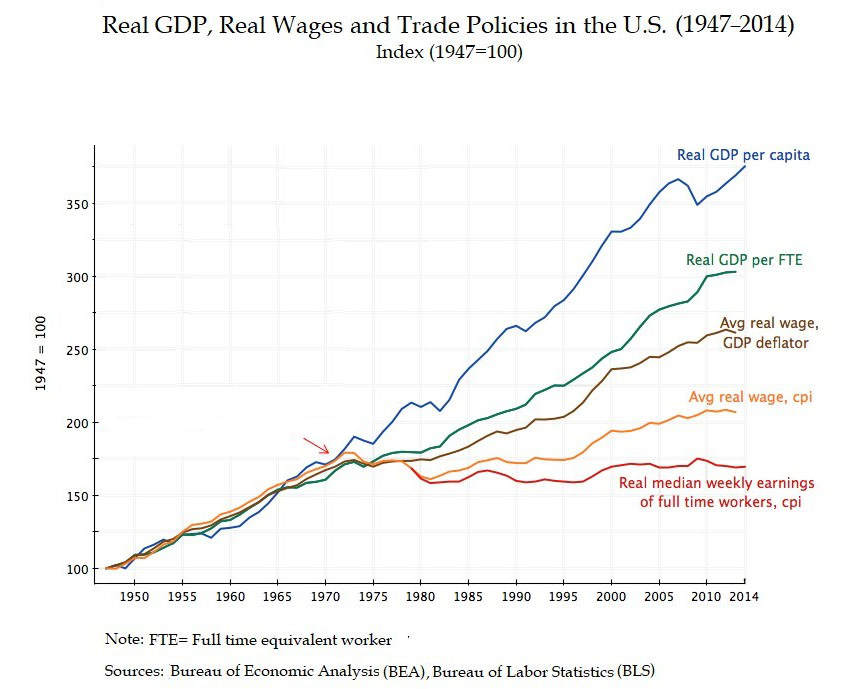

But, these sorts of investigations do not very well explain the dispersion of income within the economy, which has also had some big changes since 1970. Here are some graphs from wtfhappenedin1971.com:

Most people have not participated in the (largely phony) doubling of “real” productivity since 1970.

There is quite a lot to say about this, which I hope to get to over time. Basically, I think it is a combination of certain policies (the Immigration Act of 1965 and accompanying wave of illegal immigration, among them), certain historical developments (a huge amount of cheap labor coming onto the capitalistic world market, beginning with China’s conversion to capitalism beginning in 1978), certain economic conditions (our floating fiat environment), and so forth.

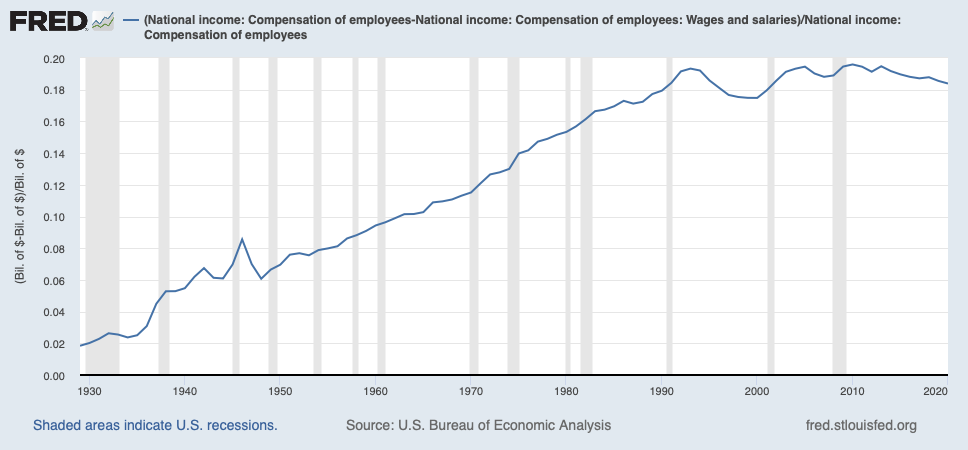

Among the issues, which we will not go into a lot today, is the fact that “compensation” and “wages” have diverged quite a lot since 1970, mostly due to healthcare expenses borne by corporations. Healthcare spending was 5.0% of GDP in 1960, 6.9% in 1970, and 18.0% (an all-time high) in 2020. That extra 11% of GDP — a lot! — largely goes into the divide between what employers pay for an employee (total compensation or total personnel expense) and what employees get in their after-tax wages. This has a bigger effect at lower incomes: If healthcare expenses are $10,000 per year per employee, then an employer is paying $50,000 for an employee but the employee only gets $40,000. Another employer is paying $250,000 for an employee and the employee gets $240,000.

From the GDP statistics, the percentage of compensation of employees that is nonwage rose a lot from 1960, but it apparently stabilized in the 1990s.

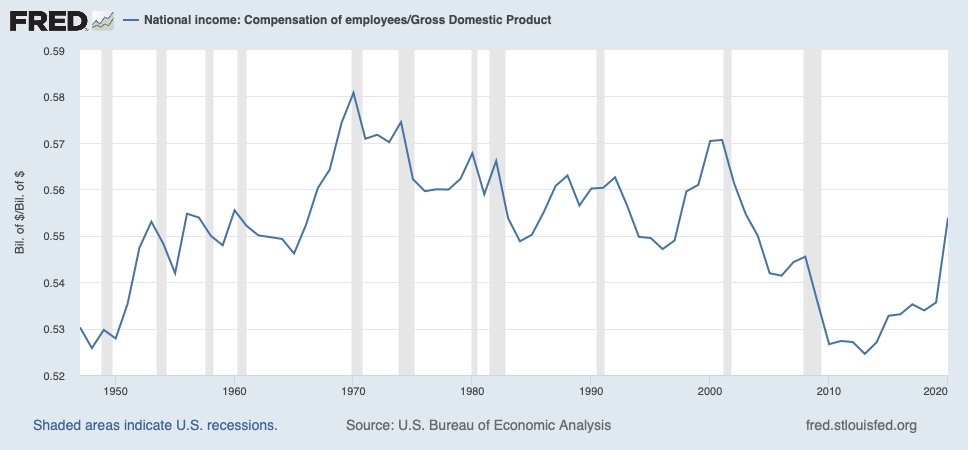

Overall compensation of employees has been a little low, but only by a couple percentage points compared to longer-term averages.

Another factor is payroll taxes, which have also gone up. This largely reflects the increasing size of the retired population since 1970:

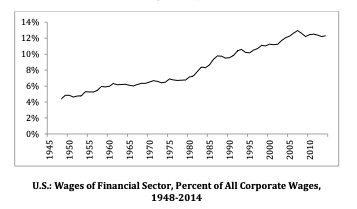

The floating fiat environment has resulted in increasing financialization:

These financial jobs are mostly higher-paid jobs. The financial industry creates no final goods and services. It is basically a middleman — at base a necessary middleman, but I think we have gone well into the realm of parasitism. These salaries are basically paid by people and companies who are not in the financial industry.

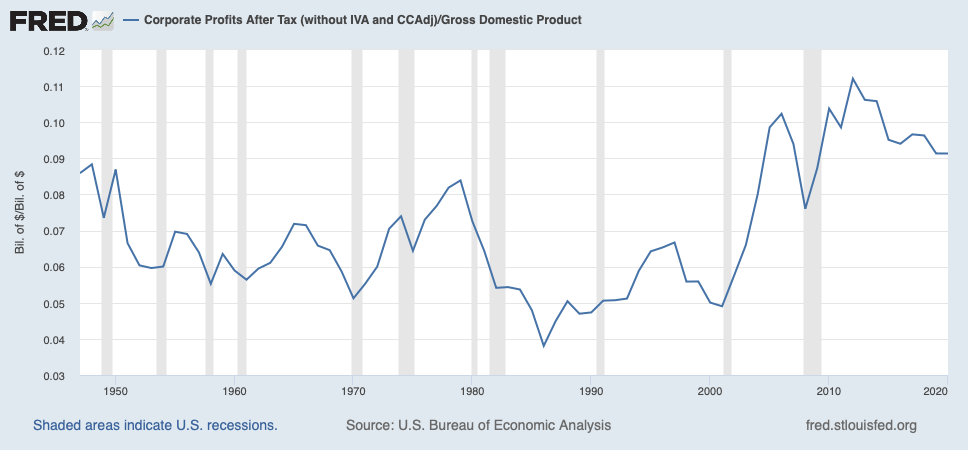

When talking about “income inequality,” there tends to be way too much focus on the very wealthy. This is, as I have argued, largely a factor of very high asset market valuations. These people’s wealth is mostly a matter of large equity holdings. The valuation of these equities today is 2x-3x historical norms, making these people apparently 2x-3x more wealthy, than they would normally be if asset markets had typical valuations. The “wealth” of being a business owner is basically the income from the corporations that they own. Corporate profits today are a little on the high side, but not so much.

Corporations have been making about 9% of GDP in profits recently, instead of a long-term average around 6%. This extra 3% is significant (it is a 50% increase from 6%), but I think it is not really such a big deal in the larger picture. If you took this 3% and somehow gave it to employees — in other words, if this fell back to its average, as it seems to be doing over the last few years — it wouldn’t change things much.

What is supposed to happen, in capitalism, is that all these big profit margins should attract new investment. This “new investment” basically means new jobs. As capital competes for labor, wages are driven higher. Or, to put it a little differently: Do you want to work for a highly profitable company that is growing and thriving, or do you want to work for a company with marginal profitability that is stagnating and shrinking? Obviously, you want the former.

I think that you would find that the companies that are making big profit margins (think Google) are actually paying employees pretty well, and the companies that are cutting employment and wages are those that are actually not making much money, or have very slim profit margins, probably due to foreign competition. Rather, the more important issue is the dispersion between the upper middle class, the higher-paid employees, and the lower-paid employees.

Here is a paper about that topic, from the Levy Institute.