Taxes and Money

September 30, 2007

Here’s a rule that is very useful in both interpreting and planning policy:

Tax cuts tend to make a currency rise.

Tax hikes tend to make a currency fall.

That’s it. Pretty simple.

Even a central banker could remember it, if you wrote it on a piece of paper and pinned it to their shirt.

These are “tendencies.” If there are other “tendencies” around, such as an aggressively easygoing monetary policy, then the currency may not actually rise in response to a tax cut. Also, these “tendencies” for currencies to rise or fall in response to tax policy are generally proportional to the scale of the tax cut/hike. An eeny-beeny tax cut, for example a 15% expansion of the deduction for children, would produce eeny-beeny results, essentially imperceptible. A whopping great tax cut, such as one of the flat-tax programs now popular in eastern Europe, can introduce a strong tendency for the currency to rise. The central bank of the country may not actually want the currency to rise, for example if they are targeting stability vs. the euro, as they are required to do as new eurozone members. In this case the central bank would suppress the currency’s tendency to rise, and the result would be the aimed-for stability.

It is hypothesized that the currency tends to rise after a tax cut (or even before, as expectations of policy change build) because of expectations (and the reality of) economic expansion in the country following the tax cut. As you reduce the barriers to commerce, i.e. taxes, you get more commerce, and a greater demand or need for the circulating medium of commerce, money. A bigger economy tends to demand more currency.

This is all fairly straightforward. Note, however, that in a great many situations, people tend to conclude the exact opposite: that a tax hike would lead to a stronger currency, and a tax cut would lead to a weaker currency. No no no.

The typical reason for this is the idea that a tax hike would lead to a smaller government budget deficit, and that the smaller government budget deficit would lead to more confidence in the currency. (Sometimes there’s another step: that a smaller government deficit would lead to a smaller “current account deficit,” leading to more confidence in the currency.) Well, first of all, this places way too much importance on the government’s budget, which really doesn’t have that much effect on the broader economy in most situations. Also, most attempts to increase government tax revenues by way of higher tax rates fail. This is because the higher tax rates tend to cause a slower-moving economy or even a recession. So, in actuality you get a) a weaker currency, due to depressed demand for the currency, b) a depressed economy leading to depressed tax revenues, and c) likely a larger government deficit. Typically, the preferred policy response to this predictable outcome is: another tax hike!

Don’t wanna go there.

Then, there is some interaction with monetary policy. If a central bank is trying to keep the currency from rising excessively in response to a tax cut, it may well engage in an “easier” monetary policy, which often means lower interest rates. Particularly for emerging market countries, which historically have had low-quality currencies and high domestic interest rates, this can introduce a very nice reduction in interest rates on top of the tax cut. Also, for those countries that are trying to stabilize their currencies with another (the euro for example), they are often quite successful. So, you have a triple positive of lower taxes, lower interest rates, and a more stable currency. (The more stable currency also tends to result in lower interest rates as investors in western Europe, for example, go yield-hunting in local currency debt, resulting in interest rate convergence.) Woo hoo! Party on Garth!

Lower taxes, lower interest rates, more stable currency…

Schwing!

On the negative side, perhaps there’s a central bank operating in a country where the government raised taxes. The currency would tend to decline, and in response, the central bank may become “hawkish,” which often leads to higher interest rates. Thus, the economy experiences a tax hike, higher interest rates, and some currency worries. Poof — instant recession!

These concerns are doubly — triply — important for emerging market economies that often have a large amount of foreign-currency denominated debt outstanding. The consequences of currency decline can be quite disastrous.

In 1969, reneging on his 1968 campaign promises to reduce taxes, Richard Nixon piled on a new capital gains tax that drove the top capital gains tax rate to almost 50%, from about 25% previously. Needless to say, this was not well received by markets and the economy as a whole. Taxes on capital and the investment process can have some of the most negative effects on economic health in general, despite their meager revenues. As a result, the dollar tended to sag against its promised $35/oz. gold parity. In response, Fed chairman Bill Martin became very “hawkish” and drove the Fed funds rate to 10% in early 1970 as he reeled in the dollar back to its parity at $35/oz. Now, the economy had two major problems: the capital gains tax hike and the Fed at a whopping 10%. (The Fed was also reacting to the aftermath of the introduction of Special Drawing Rights in 1968, which effectively put an end to gold convertibility for the dollar in London. The dollar immediately dropped to about $40/oz.) There was a short, nasty recession in 1970, and the stock market plunged. You can imagine that Richard Nixon was not too happy with this, as he wanted to get re-elected in 1972. Nixon figured the Fed was the problem, so he booted out Bill Martin and installed his handpicked inflationist Arthur Burns in January 1970. Burns lowered interest rates, the stock market recovered, and Nixon was indeed re-elected. However, the “easy money” stance at the Fed touched off the inflation of the 1970s, a disaster from which the world has never really recovered.

See the weakening in the dollar beginning in 1968? It worsens a bit in 1969, before being reeled in by Bill Martin’s hawkish policy.

Martin is replaced in January 1970 by Arthur Burns, and awaaaay we go!

The Fed funds rate ends up near 10% as Martin tries to reel in the sagging dollar.

The stock market does a faceplant in 1969, until Burns steps in to slash rates. As the inflation intensifies, Burns eventually goes to 14%.

Now, it was not actually necessary for the Fed to drive rates toward 10% in 1969 as it tried to make good on the $35/oz. dollar promise. “Raising rates,” as it is conceived of today (and apparently in those days as well) doesn’t work all that well as a currency-supportive measure. For one thing, as rates rise, the economy tanks, and a weakening economy tends to exhibit less demand for a currency — leading to a tendency for the currency to decline! Also, the opportunity cost of holding currency (the interest rate), as opposed to debt, may introduce a tendency to hold less base money/currency. In any case, the proper thing to do would have been to reduce the supply of base money directly. It is possible that this would have introduced a modest (1% or so) rise in short-term interest rates, but the end result is typically lower interest rates as the currency becomes stronger. Thus, blame for the 1970s lies in part with Bill Martin. Although he did the noble thing in trying to keep the dollar pegged to $35/oz. — and he was in fact successful — he did it in a way that practically insured that such “hawkishness” would be very unpopular. Now people are generally convinced of the idea that currency quality requires a “hawkish” Fed, higher rates, and a certain measure of economic destruction, while actually currency quality should lead to a better economy and lower rates — just as we’ve seen in many EM countries recently.

There is another example of the “let’s hike taxes to support the currency” theory, resulting in a major disaster. That was Britain in 1931. In the midst of a worsening worldwide economy (which had not quite evolved into the Great Depression), the British government made a priority of maintaining the British pound’s link to gold, which had persisted (with some lapses) since 1698. They were convinced that a sound currency required sound government accounts. The British government’s accounts weren’t doing so hot in 1931, as the worldwide recession led to sagging tax revenue and more demands for welfare-type spending. So, in September 1931, in an effort to insure a secure, gold-linked pound, the British government hiked taxes. (I’m looking for more info on this tax hike, by the way.)

Of course that was exactly what the British economy needed in 1931, on top of all its other problems. A brand new tax hike. The result was immediate downward pressure on the pound. Higher taxes leads to currency weakness. At the time, the Bank of England managed the gold standard by way of the discount rate (it’s a long story about where that came from), and a weakening pound required, according to their mechanisms, a higher discount rate. Now, once again we have this confusion of monetary policy. The correct response would have been to adjust base money directly, rather than this funny business of interest rate adjustments. Actually, the discount rate was a means to effectively adjust base money at that time (as opposed to the Fed funds rate target, which is not an effectively means), but by a somewhat indirect manner. Anyway, the BoE balked, as they thought a rate hike on top of a tax hike would be bad for the economy. So, the BoE abdicated its responsibility to maintain the gold standard by the mechanisms then in force, and the result is that the British pound was devalued in September 1931. This was quite shocking all around the world, as the gold standard and fixed exchange rates were the norm. In addition to introducing a new element of monetary turmoil, it set off a round of competitive devaluations around the world. That was when the recession morphed into the Great Depression.

Germany was doing much the same thing at the time, namely the Bruening tax hike of 1930-1931. “Bruening” (<— be sure to click this one) is today cited in Germany as a kind of shorthand for “don’t be so stupid as to hike taxes in the middle of a recession,” in the same way that “Smoot-Hawley” is often cited in the US for “a tariff war can ultimately lead to unimaginably bad consequences.” Bruening’s tax hike led to — do I even need to say it? You know exactly what’s coming — a devaluation of the german mark in August 1931. Bruening was so unpopular that the entire Weimar republic folded as a result, and Germans looked around for someone who would Do Something. Adolph Hitler became chancellor in January 1933, cut taxes, the economy recovered somewhat, and he was wildly popular. (That’s about where the good part of the story ends for Hitler alas.)

Now, what might have happened in Britain in 1931 if they had cut taxes instead? Well, the economy would get a boost, and the pound would have had a tendency to rise, and thus interest rates would have remained low. Thus, often the best way to deal with a weak or sagging currency is not even via the central bank, but via tax policy.

So, you see, this might seem like simple stuff, but quite a lot potentially hangs in the balance.

* * *

Here’s a short piece with some very interesting information about William Steiger’s 1978 capital gains tax cut. The 1978 tax cut essentially reversed Nixon’s 1969 tax hike, returning to the pre-1969 status quo.

http://www.safehaven.com/article-8482.htm

In 1978 Congress for once did the sensible thing and slashed capital gains taxes: this resulted in the supply of venture capital exploding. By the start of 1979 a massive commitment to venture capital funds had taken place, rising from a pathetic $39 million in 1977 to a staggering $570 million at the end of 1978. Tax collections on long-term capital gains, despite the dire predictions of Keynesian big-spending critics of tax cuts, leapt from $8.5 billion in 1978 to $10.6 billion in 1979, $16.5 billion in 1983 and $23.7 billion in 1985.

By 1981 venture capital outlays had soared to $1.4 billion and the total amount of venture capital had risen to $5.8 billion. In 1981 the maximum tax rate on long-term capital gains was cut to 20 per cent. This resulted in the venture capital pool surging to $11.5 billion. Astonishingly enough — to conventional economists that is — venture capital outlays rose to $1.8 billion in the midst of the 1982 depression. This was about 400 per cent more than had been out-laid during the 1970s slump. In 1983 these outlays rose to nearly $3 billion. Compare this situation to the period from 1969 to the 1970s which saw venture capital outlays collapse by about 90 per cent. All because of Nixon’s ill-considered capital gains tax. But then Nixon — unlike so many journalists — never professed to know anything about economics.

In 1982 the US General Accounting Office sampled 72 companies that had been launched with venture capital since the 1978 capital gains tax cut. The results were startling. Starting with $209 million dollars in funds, these companies had paid $350 million in federal taxes, generated $900 million in export income and directly created 135,000 jobs!

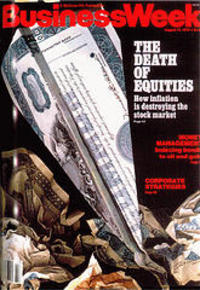

I didn’t know that! It’s amazing that there was such a venture capital boom in the midst of the terrible, horrible, awful late-1970s, when Businessweek famously declared the Death of Equities.

The way it looked on August 13, 1979

“How inflation is destroying the stock market.”

Actually, Businessweek wasn’t too far off the mark. The US stock market didn’t really start to recover until August of 1982, three long years later. Practically an eternity by Wall Street standards.

* * *

Interesting breakout in gold last week. Doesn’t look like the market wants to cooperate with those “supply siders” on TV who argue that a lower Fed funds rate is just the ticket for a stronger dollar. The relationship between an interest-rate target policy and a currency is chaotic. “Chaotic” means that you can’t make easy rules like “if A then B.” Now, I happen to agree that a higher Fed funds rate target would not necessarily be all that effective either. But just because a higher rate arguably wouldn’t work doesn’t mean that a lower rate would. So, if neither the Fed cutting rates, nor raising rates, nor leaving them the same is an effective response to the inflationary dollar, what are we going to do? Besides sell a lot of central bank gold and hope nobody notices? In the 1970s we eventually ended up throwing out the interest-rate target policy and adopting monetarism. The Fed will probably come up with something creative eventually — but not before it becomes politically acceptable to do so.