The Bank of England, 1844-1913

April 14, 2013

In 1844, there was a new regulation of the Bank of England called the Bank Charter Act of 1844, also known as Peel’s Act.

Read Wikipedia on the Bank Charter Act of 1844

This officially made the Bank of England the sole issuer of banknotes in England, although it was functionally the sole issuer before then. It also split the Bank into two Departments: an Issue Department, wholly responsible for banknotes, and a Banking Department, which was not involved in banknote issuance, and operated more like a regular commercial bank. However, the Bank of England’s Banking Department had, by then, assumed many of the roles of today’s central banks, including acting as a central clearinghouse for interbank payments. Thus, the Banking Department’s deposits also acted in essentially the same way as deposits at central banks today, which are functionally a final means of payment, which is why we now consider central bank deposits to be a form of base money alongside banknotes.

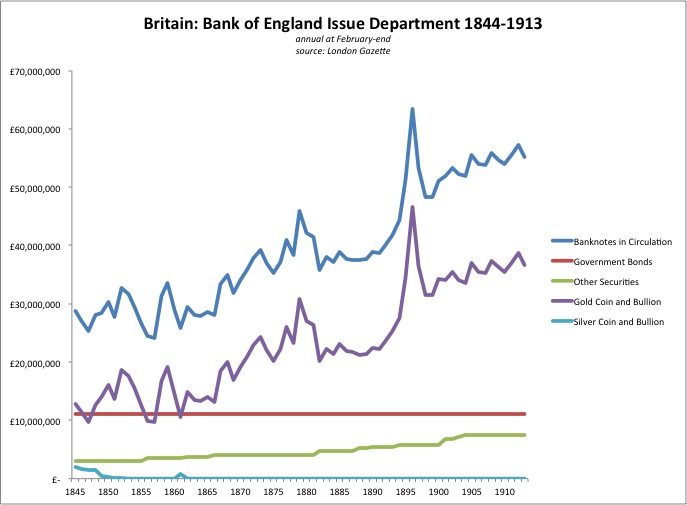

The 1844-1913 period is nice because not only does Peel’s Act delineate this time from the period previous, but the Bank of England also became the leading example of other governments and central banks to follow, as the Most Perfect Monetary System Ever Created came into being. Also, Peel’s Act required weekly reporting of the BoE’s balance sheet, so there’s a lot more documentation of what was going on.

January 3, 2013: The World Gold Standard of 1870-1914: the Most Perfect Monetary System Ever Created

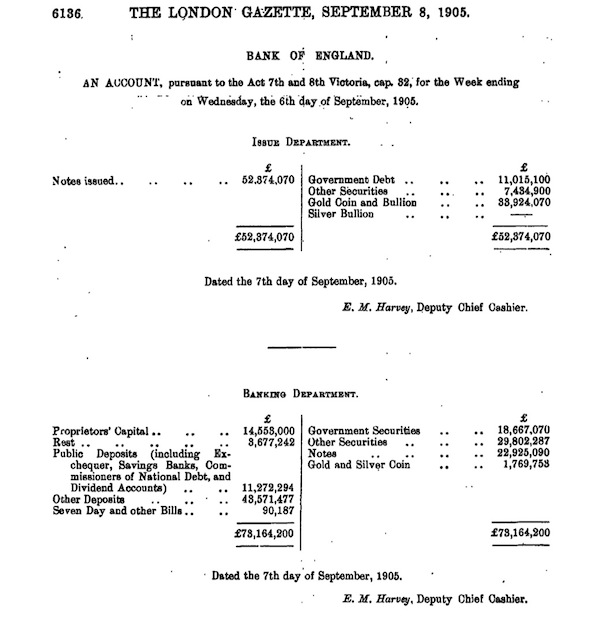

Here’s what it looked like:

This is a copy of the balance sheet, of course.

March 23, 2008: How Banks Work 7: the Lender of Last Resort

March 16, 2008: How Banks Work 6: Liquidy Crises and Bank Runs

March 9, 2008: How Banks Work 5: Selling Loans

February 24, 2008: How Banks Work 4: Banks and the Economy

February 17, 2008: How Banks Work 3: More Elephant Poop

February 10, 2008: How Banks Work 2: Shitting Like an Elephant

February 3, 2008: How Banks Work

What do we see here? Of course, there is the Issue Department and the Banking Department.

The Issue Department has, as its liabilities, banknotes in circulation. This is your basic paper money. It has no liabilities except for that.

As assets, its has government debt, “other securities,” and gold coins and bullion. There’s a ledger item for silver, but by this time the Issue Department held gold exclusively. Britain went to a monometallic (gold-only) monetary system in 1816.

I’m not sure what “other securities” means. It is probably debt of some sort, perhaps high-quality corporate debt. It could be gold-based debt of other governments.

The Banking Department has, as liabilities and equity, “proprietors’ capital.” This is an old accounting convention which separates what we today call “shareholders’ equity” into the original capital of the company — the original investment — and what amounts to retained earnings. The retained earnings are the “rest.” Because book value or equity is a residual — it is the remainder after you subtract the liabilities from the assets — the “rest” can vary naturally. Also, it varied due to earnings retained (increasing) and dividends paid (decreasing). We will see that the “rest” is quite stable, indicating that the Banking Department’s earnings were largely paid out in dividends.

There’s a ledger for Public Deposits, which basically means the deposits of the government. Today, this is recognized as a portion of base money.

Then, there’s a ledger for Other Deposits, which is deposits of nongovernment entities. This was mostly other commercial banks, including foreign commercial banks, and other governments and central banks. This is also recognized as a form of base money today.

December 1, 2011: What is Money?

There’s a small item for “seven day and other bills,” which is short-term borrowing by the Bank of England on the money market.

This indicates that the Issue Department operated pretty much in the Making Change system I’ve outlined before.

July 28, 2011: Making Change: The Simplest Practical Gold Standard System

January 29, 2012: Gold Standard Technical Operating Discussions 3: Automaticity Vs. Discretion

January 15, 2012: Gold Standard Technical Operating Discussions 2: More Variations

January 8, 2012: Some Gold Standand Technical Operating Discussions

In other words, the Issue Department would trade gold bullion and banknotes at the parity value of £3 17s 10.5d per ounce of gold. Either the Issue Department would accept gold and give banknotes, or accept banknotes and give gold, depending on what the private market participants (“PMPs”) wished to do. Banknotes in circulation sometimes goes up, indicating that PMPs were bringing gold to the Bank and taking banknotes in return; or, it goes down, indicating that PMPs were bringing banknotes to the bank and receiving gold bullion in return.

This is identical operation to a currency board today.

Steve Hanke in GlobeAsia, May 2012: A Gold-Based Currency Board Please

Note that, like a currency board today, the Issue Department did not have a “100% bullion reserve,” just as a currency board does not hold exclusively base money (banknotes and central bank deposits) in the target currency. Some of the assets were interest-bearing government bonds, and also other types of bonds. At first, gold bullion was less than 50% of total assets, or in other words, bonds were more than 50%. Bullion holdings rose over time, as a percentage of total Issue Department assets, but as we will see later, I think this was a reaction to the increasing importance of Banking Department deposits as a component of base money.

The Issue Department’s management sometimes decided to increase its holdings of interest-bearing debt, in this case exclusively non-government bonds. In this case, gold bullion would be sold and, with the proceeds, bonds would be bought. This operation would not change the monetary base.

It was a pretty simple system. Over time, holdings of gold bullion increased.

Note that this was apparently a “non-discretionary” system. There was no day-to-day decisionmaking involved as to how to manage banknotes in circulation. It was totally reactive, in response to PMPs wish to transact bullion and banknotes.

For now, just think about how the Issue Department operated. We will look at the much more complicated Banking Department later.