The Bank of France, 1915-1940

July 27, 2014

We continue our look at central banks in the 1914-1941 period.

July 20, 2014: The Bank of England, 1914-1941

July 18, 2014: Foreign Exchange Rates 1913-1941 #8: A Brief Summary

January 19, 2014: The Federal Reserve in the 1930s

January 26, 2014: The Federal Reserve in the 1930s #2: Interest Rates

The source of our data is the Federal Reserve Banking and Monetary Statistics, 1914-1941.

http://fraser.stlouisfed.org/publication/?pid=38

Today, we have the Bank of France. Here’s a brief history of the French franc.

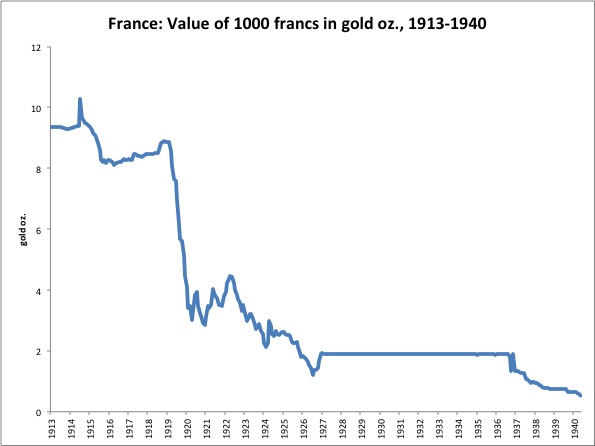

The Bank of France, like most central banks worldwide, printed money to help finance WWI. This actually continued after the end of hostilities, as was the case elsewhere as well. The result was that the value of the franc declined to about one-fifth of its prewar gold parity. In 1926, the franc was repegged to gold, which was made official in 1928. The franc was devalued in 1936, and then slid downward further into WWII.

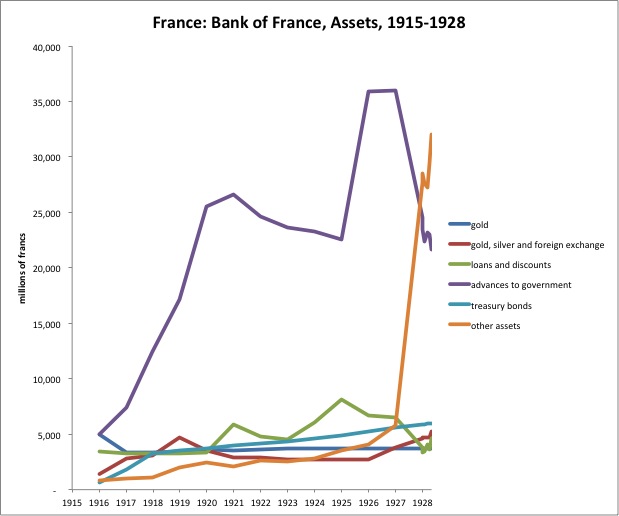

The first data series is annual, as of the year-end. The December 31, 1915 data appears next to the indicator for 1916. When looking at this, remember that gold (and perhaps foreign exchange) is valued at prewar parity assumptions, not market prices. We see the large increase in “advances to goverment” (i.e., loans), due to wartime financing. This actually continues after the war, especially in 1925-26. The first datapoint here is 1915-end, so we don’t get to see the expansion during 1914 and 1915.

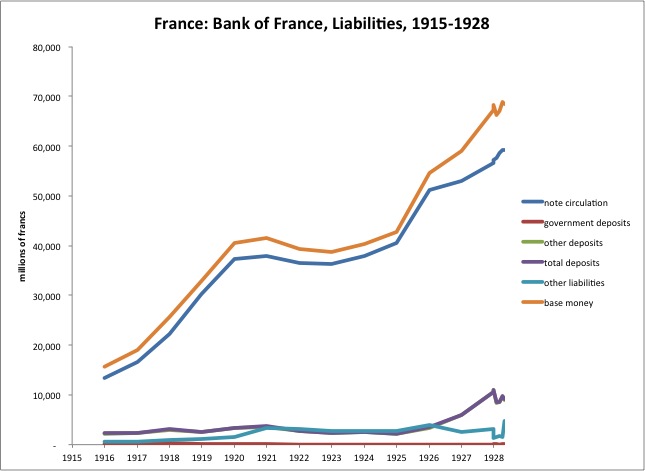

Base money also grows considerably, mostly in the form of notes in circulation. Again, this data is from 1915-end. We can see that there was no particular contraction of base money with the repegging of the franc to gold in 1926.

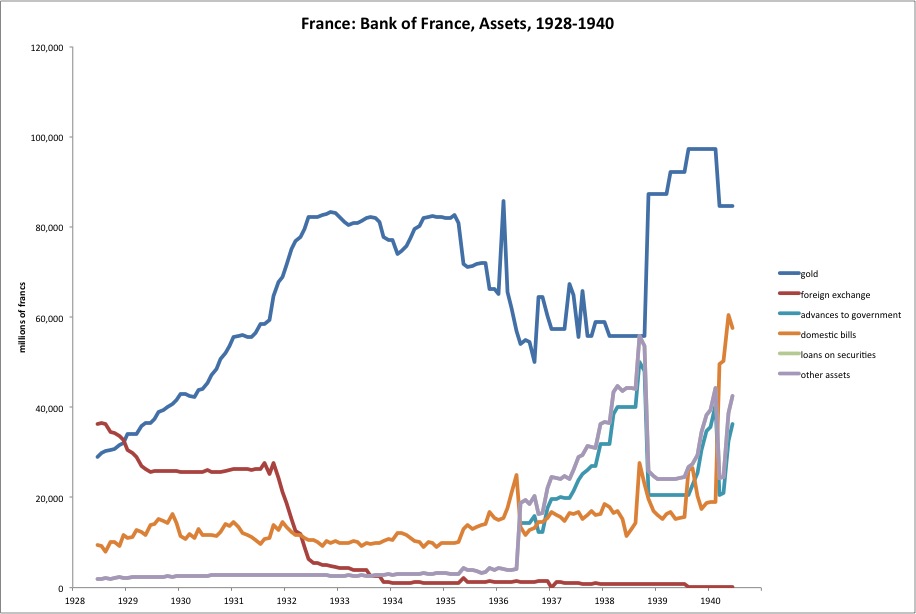

Now it gets a little more interesting, with monthly data. This is a new data series, and doesn’t quite correspond with the older one. Here are some notes to the data:

“Gold revalued in June 1928, October 1936, July 1937, November 1938, and March 1940.” The value of the gold (in terms of francs) is changed to reflect the new parity value imposed in 1926.

“[foreign exchange assets and other liabilities] includes foreign exchange loaned, not previously included in assets or liabilities.” (Borrowing and lending in foreign currencies seems to have been eliminated by the end of 1928.)

“In each of the weeks ending April 20 and August 3, 1939, 5 billion francs of gold transferred from Exchange Stabilization Fund to the Bank of France; in week ending March 7, 1940, 30 billion francs of gold transferred from Bank of France to Stabilization Fund.”

We see a big decline in foreign exchange assets (foreign government bonds, mostly British government bonds I expect) beginning at the end of 1931. With the Bank of England devaluing the pound (and thus the value of British government bonds), beginning September 1931, you would expect that. Several other governments followed, as we looked into recently. The extent to which this decline in foreign exchange assets represents a decline in market value, and what extent it represents selling, is unclear. However, it is clear that, after 1931, the Bank of France had no interest in holding the bonds of other governments that were devaluing their currencies. It appears that the Bank of France sold their bonds and bought gold bullion. Nothing in particular wrong with that, and a very sensible thing to do at the time.

After 1936, France appears to relapse again into printing-press finance. The Bank of France revives “advances to government” (loans), along with a big jump in “other assets” which are probably a similar sort of thing, such as a special-issue treasury bond or something of that sort.

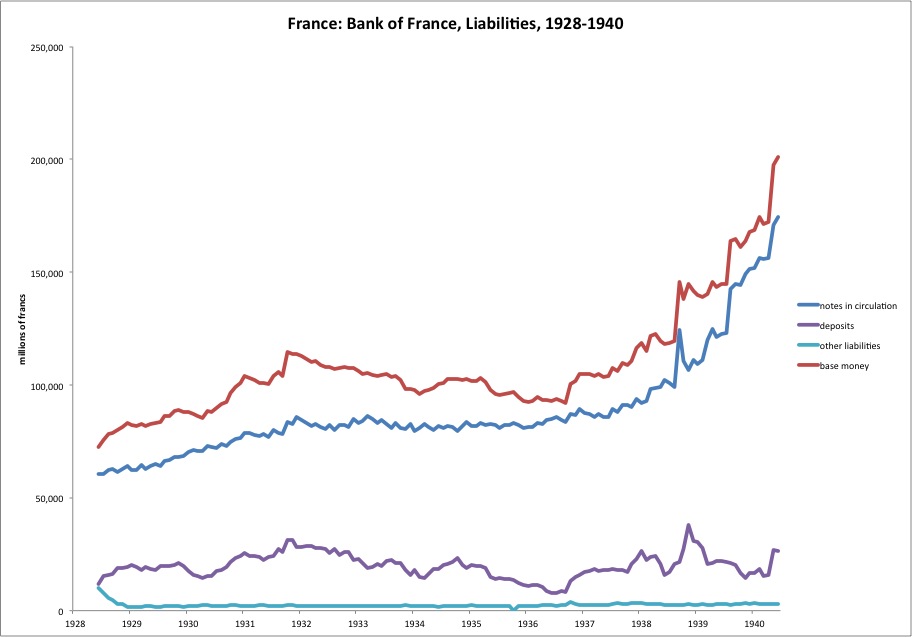

We see that base money, during this time period, consisted mostly of notes in circulation. Base money did not expand all that much immediately before or after the 1936 devaluation. However, afterwards it expands rather aggressively, related to printing-press finance. Not surprisingly, the franc’s value declined during this period 1936-1940. We see that the decision to change the composition of reserve assets, removing foreign bonds and adding more gold bullion, did not lead to any particular changes in base money as a whole.