We’ve been looking at how Russia and the BRICs are migrating toward a gold-based international (or domestic) monetary system.

January 29, 2023: Gold Ruble 3.0

How Russia Can Go To A Gold Ruble series

Why are these countries gradually figuring out that gold is their solution?

These countries have no history of success with any kind of independent “floating fiat” system. The US or Euro floating fiat system is bad, but, maybe, tolerable. But, the history of Brazil, China or Russia has generally been: A loose or tight link to some external standard (gold, USD or EUR), or chaos. (Brazil seems to have had some success with a “CPI targeting” system, but I would say that “success” is only relative to Brazil’s past history of repeated hyperinflationary disasters. Nobody in the US would tolerate the level of monetary chaos from Brazil’s “success.” Or, in other words, nobody buys BRL bonds.)

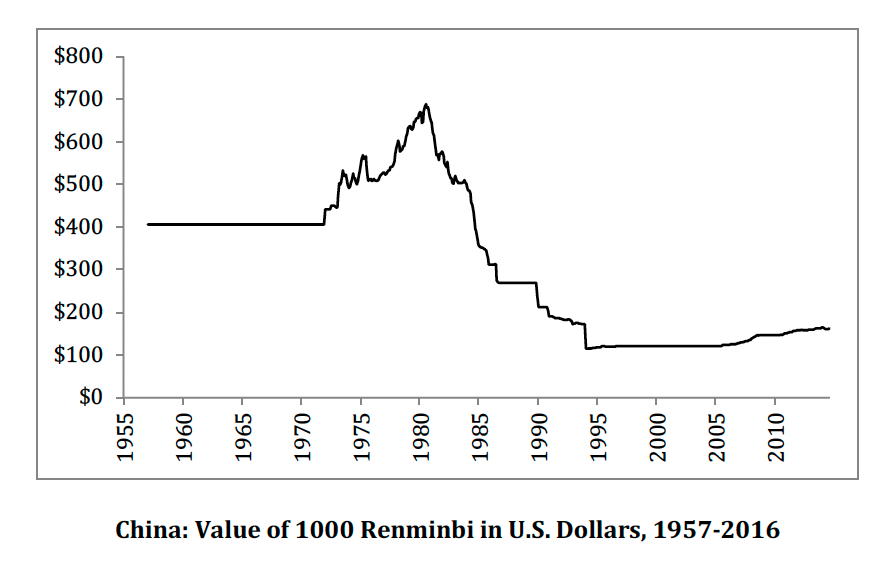

These countries understand, at least at a basic level, the importance of having fixed or, at least, tolerably stable foreign exchange rates, as a basis for commerce and investment. But, nobody is going to tolerate a “Renminbi-centric” system similar to today’s floating fiat USD system. (Everybody links their currency to a floating Renminbi.) This has two problems: one is, the RMB is simply not very reliable. The only time in the last seventy years when it “floated,” it soared and then crashed.

We saw that Malaysian prime minister Mahathir Mohammad expressed exactly these sentiments.

June 18, 2019: Mahathir’s Asian Gold Currency Is A Return To Asian Values

Mahathir said that gold was the best basis for an international currency, because it was more stable and reliable than the USD or any other floating fiat currency. But also, it was free of political influence. If any floating fiat currency were promoted to be the basis of all others, it would also create a loss of sovereignty and create political influence. This is, of course, resolved by having a domestic currency also be linked to gold. Then, the domestic currency (it could be the ruble or yuan) could serve also as an international currency, because it would be free of the politics of a floating fiat currency.

Maybe it would be best here even to skip the idea of a “currency” altogether, and just go with bullion itself. For example, you could have contracts denominated in gold, and deliverable in a gold-based medium. If Sberbank, Russia’s largest bank, offered “gold checking accounts,” which would allow people to pay each other in gold, then you could also easily have contracts denominated in gold, such as bonds, which also bypass all centralized “currencies.” They would ultimately be payable in bullion itself, such as kilogram bars, or smaller 10 gram coins. If you wanted to “withdraw” your funds from your “gold checking account” in the form of 10 gram coins, you could. But, since that is inconvenient, nobody would actually do it.

These “gold checking accounts” could be linked with various payment mechanisms, such as we have today with debit cards, Paypal, Venmo, Apple Pay or Zelle, all linked to checking accounts. These are basically just communication mechanisms by which to pay each other, using these gold checking accounts.

This is simple technology. GoldMoney was a good attempt to set up a payment system like this, but it ran into problems with regulation.

A cryptocurrency stablecoin, like PaxGold (PAXG), is the same basic idea. It keeps the ledger of accounts on an Ethereum blockchain, instead of a centralized system like a bank checking account. But, bank checking accounts do not have a track record of failure, but instead seem to be extremely reliable, so what is the problem exactly?

If an importer in Iran wanted to pay an exporter in Bolivia, they could pay with their gold checking accounts at Sberbank. It would be very similar to the crypto stablecoin version of the same thing.

We see that Russia and Iran have taken steps in this direction, by setting up a gold-based crypto stablecoin.

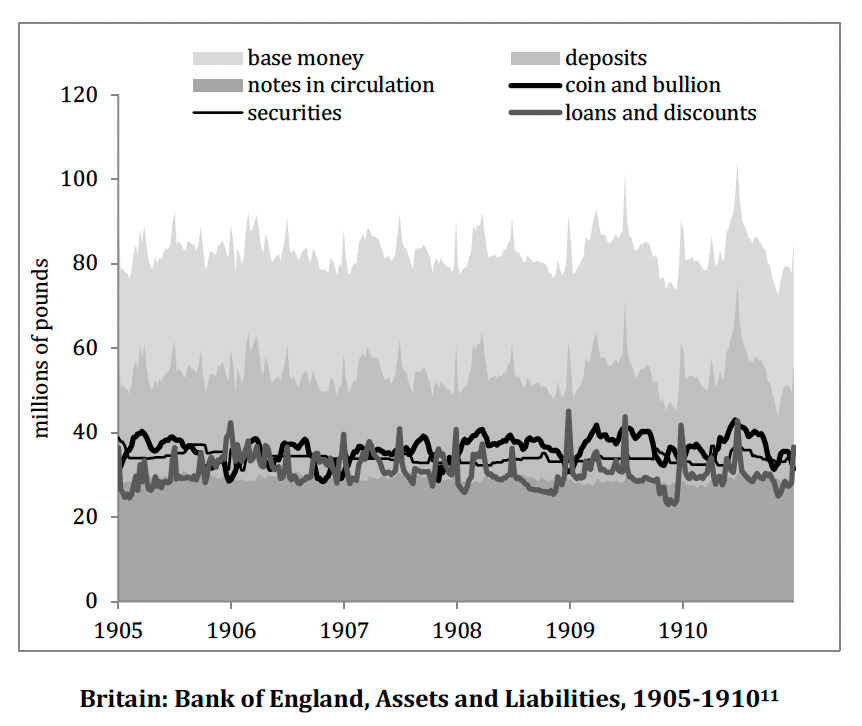

This is good, but I think having a gold checking account at Sberbank would be more attractive for enterprise-class customers — the people who actually want to pay for six shipping containers of goods from Bolivia. This is how things were done before 1913, when businesses and banks all over the world paid each other using their checking accounts at the Bank of England, which was, at that time, still a private corporation.

Big corporations, and governments, are going to need a basis for debt finance soon. In most of the world, big corporations and governments finance (issue bonds) in USD or EUR. There isn’t much of a market for local-currency bonds, and interest rates are very high, because these currencies have a terrible track record of intermittent failure. But, if they are locked out of the USD and EUR bond markets, then what? A bond denominated in gold would be an attractive proposition worldwide. I mean actually denominated in gold. For example, I borrow 100kg of gold, and then pay back 104kg a year later. There are no “rubles” or “renminbi” or “stablecoins based on gold.” Now, in actual fact, we don’t send gold here and there. A company borrows using its Sberbank gold checking account (i.e. it issues a bond or promissory note, and then receives a deposit in its “gold checking account), and pays back using the same mechanism. Or, maybe they could use a gold crypto stablecoin. We are not too picky about the settlement mechanisms, as long as they are based on gold, and are acceptable to both parties. In extremis, the lender could insist on physical delivery of bullion, but since that is troublesome nobody would do it unless there was a good reason. The US used basically this system, in the “gold clause” found in all commercial contracts before 1933.

Now, we have a problem. The revenues of a big corporation, or the tax revenues of a government, are maybe in a domestic floating fiat currency like the RUB or BRL, but its obligations (bonds) are in gold. But, this is not so different from the situation today, where obligations are in USD and EUR. The solution is simple: Businesses, or a government, can also denominate its revenues in gold. In other words, it can use a domestic gold-based solution. You would be using your Sberbank gold checking account not only for paying bonds owned by foreigners, but also as your basis of domestic commerce. You could do this even if there is still a floating fiat domestic currency, like the RUB. This is a “parallel currency.” This is also the common situation today, where domestic business in Costa Rica or Turkey is also often done in USD or EUR.

This was the gist of my presentation in US Congress in 2012:

August 5, 2012: My Testimony in Congress

Today, there is a need to get solutions up and running now. Just start trying things out. Sberbank already has the infrastructure for checking accounts, and also has a wide variety of app-based “mobile banking” solutions which allow people to pay each other using these checking accounts. Tens of millions of people already use these Sberbank mobile banking apps.

These checking accounts could have “100% bullion reserve coverage,” as GoldMoney and PaxGold do. But, they could also have 50% of reserve assets in the gold-based bonds and loans we spoke about earlier. This would allow a lot of reliability (50% bullion reserve coverage), but also, provide some profitability. This was the normal practice of the Bank of England, which maintained about 1/3 bullion coverage, 1/3 discount lending (bank lending) and 1/3 government bonds as its reserve asset mix, in the late 19th century.

You can do the same thing with an “international currency basket” if you like. This could be: 25% RUB, 25% CNY, 25% INR and 25% BRL. It would be something like a “multi-currency money market fund.” Sberbank would offer “checking accounts” in this currency basket, which would allow holders to pay each other.

This can also be used as the basis for foreign exchange and trade settlement (payment). For example, Sberbank would have a foreign exchange desk that offered to buy/sell many international currencies, with exchange rates with this currency basket — we will call it the BRICDR (“BRICs Depositary Receipt”). This is no different than the IMF’s SDR, but of course different currencies. You would have a Peruvian Sol (PEN):BRICDR exchange rate and market. Also, there would be an Nepalese Rupee (NPR):BRICDR exchange rate and market. Then, anyone who wanted to sell PEN and buy NPR would sell PEN for BRICDR, and then sell BRICDR for NPR. This is how forex works today, but using USD as an intermediary. Of course, to make this work, you have to be able to buy/sell BRICDR. Thus, you need a BRICDR checking account, instead of a USD checking account. So, Sberbank could set all this up, and it wouldn’t be that hard.

The main reason for this is simply to get from PEN to NPR. You don’t hold BRICDR for any length of time, or have contracts in BRICDR. So, it doesn’t matter too much if BRICDR is not very reliable. But, you could also use your gold checking accounts for this same purpose. It would work just as well. Then, you wouldn’t need BRICDR. What use is it, otherwise?

For now, I would just get busy and start setting these things up. It shouldn’t take more than a few weeks. For bankers, this is easy.