Let’s continue our look at the Federal Reserve and monetary conditions in the 1930s.

January 19, 2014: The Federal Reserve in the 1930s

December 23, 2012: The Federal Reserve in the 1920s 4: The Historical Record

December 16, 2012: The Federal Reserve in the 1920s 3: Balance Sheet and Base Money

November 25, 2012: The Federal Reserve in the 1920s 2: Interest Rates

November 18, 2012: The Federal Reserve in the 1920s

This is a touchy time. Everybody has their own idiosyncratic notions of what they think happened in the 1930s. Let’s just look at the data.

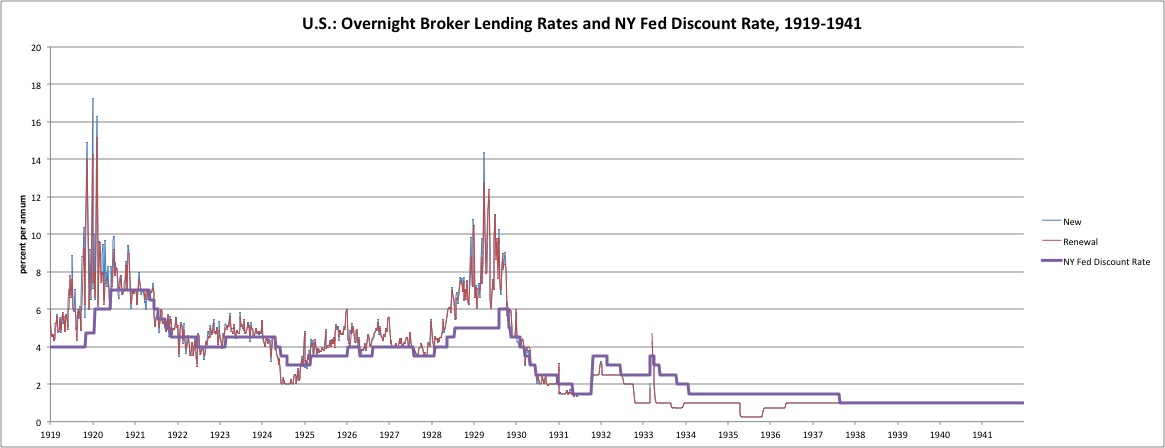

First of all, there wasn’t really a “Fed funds rate” in those days. Banks mostly didn’t lend to each other that much, at least not on an overnight basis. Most of the overnight lending was to brokers, for margin loans. Margin was big in those days, up to 1930, as it was unregulated and people used leverage up to 10x on stocks. What do we see here? Rates fall to low levels, and volatility goes down. Volumes go down too, naturally. We don’t have data on credit volumes here, but I may look into that at some point.

There’s a bit of a blip toward the end of 1931. This is related to the devaluation of the British pound in September 1931. The British pound was the world’s premier gold standard international currency in those days. Also, Britain was (I think) the first major country to devalue. It was pretty shocking, and set off turmoil everywhere, including dozens of “echo” devaluations since the British pound was also the premier reserve currency. We will look into that a little more later I think.

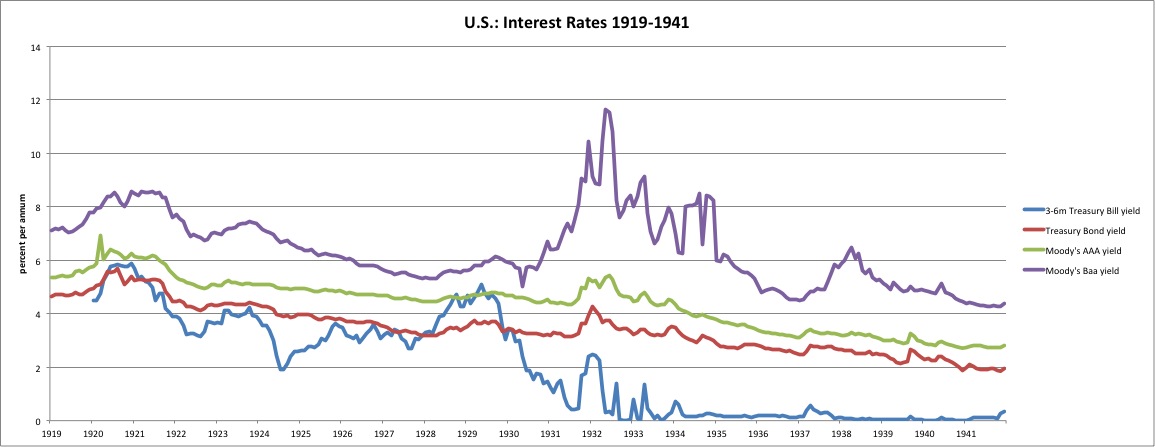

Here are some longer-term interest rates. We see that T-bill rates fall to low levels. They jump up in September 1931, naturally because people were afraid the U.S. would devalue too. And indeed the U.S. did devalue, but not until 1933. Credit spreads blow out of course, with Moody’s Baa credits basically becoming untouchable, while Treasury bond yields drift lower.

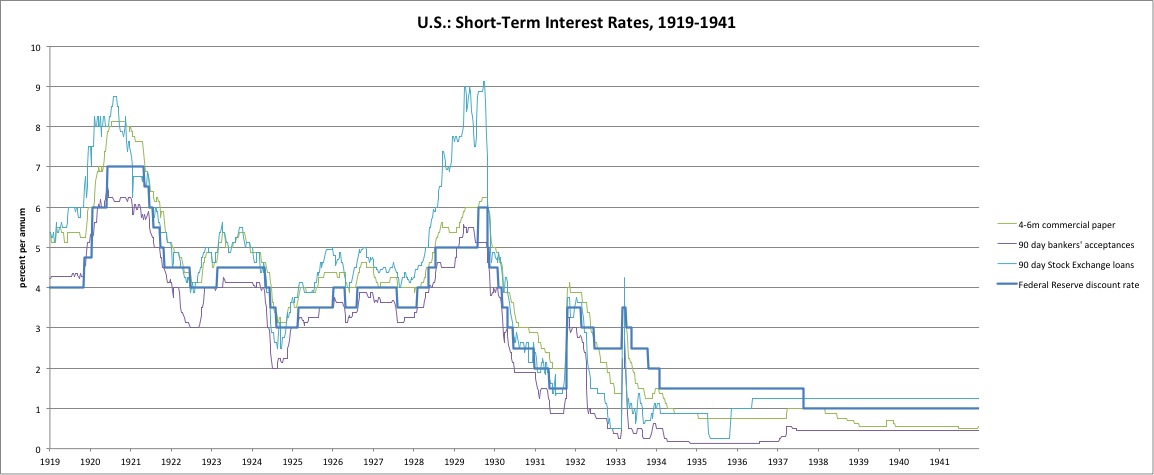

Here are some more short-term interest rates, this time with weekly data. A lot of fuss is made about the increase in interest rates in 1931, but that wasn’t really the Fed’s doing. It was the result of the panic that ensued in the monetary turmoil and uncertainty of the time. Also, interest rates didn’t really reach such a high level in absolute terms. The fact that corporations briefly had to pay 4.0% on their 4-6 month commercial paper, before yields dropped again to the sub-2.0% range, doesn’t really mean anything. The real problem was the broader monetary and macroeconomic turmoil, which induces a mood of extreme caution.

One funny thing about these charts is that obviously, interest rates were very low. All of Keynesianism is based on “lowering interest rates,” but they were already at rock-bottom levels!

That’s it for this week. We will have more in due time.