Today, we will continue our discussion of the “gold sterilization” of 1937.

June 18, 2017: The “Gold Sterilization” of 1937

June 25, 2017: The “Gold Sterilization” of 1937 #2: Fumbling and Bumbling

We will look at an influential 2011 paper by Douglas Irwin, available here:

http://www.nber.org/papers/w17595.pdf

All in all, I think the paper is pretty good, at least in its basic descriptions. It meanders into the usual channels of pointless Monetarism, with some equally pointless math, but it does describe the basic event much as we have already. The overall conclusion of the paper is that the “gold sterilization” was a Big Deal, a major cause of the Recession of 1937-38. This is not such a surprising thing from one with strong Monetarist leanings. Monetarists in general tend to identify symptoms as causes. Broad monetary measures like M2 tend to rise and fall in line with nominal GDP. From this, people drift toward attaching a causality which is usually much weaker than they think. The decline in nominal GDP is caused by the decline in M2. I do think that bank credit can have a strong effect on an economy — but this is mostly on the asset side of banks’ balance sheet, not the liabilities where deposits (the primary component of M2) lie. If banks cut off new lending, and demand that prior lending be repaid, the economic consequences can be significant. This is the “debt-deflation model” that Irving Fischer outlined. This repayment naturally takes money; this causes the decline in deposits. In any case, the assets and liabilities of banks must balance, whatever the chain of causality one might like to draw.

The reason for Irwin’s focus on monetary effects is apparent in his first statements:

The Recession of 1937-38 was America’s second most severe economic downturn in the twentieth century, the first being the Great Depression of 1929-33. Real GDP contracted 11 percent and industrial production plunged 30 percent between the second quarter of 1937 and the first quarter of 1938. The civilian unemployment rate, still high in the aftermath of the Great Depression, rose from 9.2 percent to 12.5 percent. Because this sharp downturn occurred when recovery from the Depression was far from complete, it became known as the “recession within a depression.” It set back the recovery from the Depression by two years.

The recession is often blamed on the tightening of fiscal and monetary policies. In terms of fiscal policy, the Roosevelt administration became concerned about large budget deficits and began reducing the growth in government spending and increasing taxes. In terms of monetary policy, the Federal Reserve and Treasury became concerned about the inflationary potential of excess reserves in the banking system and large gold inflows and therefore decided to double reserve requirements and sterilize gold inflows.

Yet the evidence that these policy changes were responsible for the severe downturn is underwhelming. Although Brown (1956) finds that the fiscal contraction amounted to a swing in demand of 2.5 percent of GDP in 1938, Romer (1992, 766) finds a relatively small fiscal multiplier during this period and argues that “it would be very difficult” to attribute most of the decline in output to fiscal policy. And while Friedman and Schwartz (1963) put great emphasis on the contractionary impact of higher reserve requirements, subsequent studies have found little support for this conclusion. For example, Calomiris, Mason, and Wheelock (2011) note that banks held large excess reserves at the time, and that they did not increase their demand for reserves after the new requirements took effect. The reserve requirements were not binding on the banks and therefore they had little, if any, effect on the money multiplier and the supply of money and credit.

If these factors cannot be blamed for the severity of the recession, might the big “policy mistake” of the period have been the sterilization of gold inflows? Unfortunately, the quantitative significance of the gold sterilization policy has never been fully assessed. Friedman and Schwartz (1963, 544) maintained that “The combined impact of the rise in reserve requirements and – no less important – the Treasury gold-sterilization program first sharply reduced the rate of increase in the monetary stock and then converted it into a decline” (emphasis added). Yet they did not provide any direct empirical evidence to support the conclusion that the gold sterilization policy was “no less important” than the change in reserve requirements. (pp. 1-2)

It is fairly clear that “fiscal policy” here is taken in the Keynesian terms, which amounts to increases and decreases in spending, or “government demand.” The effects of tax policy — in particular, the excess-profits tax which took the effective corporate tax rate from 15% to 42% on undistributed profits, although there were many other things going on too — are largely ignored. Irwin emphasizes the monetary factors due to the seeming lack of other factors that adequately account for the severity of the downturn. I would say this smacks rather heavily of the “Prices-Interest-Money Box” that economists — especially small-government-leaning economists who tend to minimize the claimed effects of changes in government “demand” — have tended to fall into since the 1870s.

July 10, 2016: The Tyranny of Prices, Interest and Money

November 27, 2016: The Tyranny of Prices, Interest and Money 2: The Old Historicism

Irwin noted that, during the recession, fears arose that the dollar would again be devalued by the Roosevelt administration, as it was in 1933. This led (according to Irwin) to some selling of the dollar. This is certainly one way by which the flatlining of base money growth during that time might have been a reflection of real supply/demand issues for the dollar, not necessarily the outcome of some artificial “sterilization” program alone. Irwin also noted that the “sterilization” did not seem to have much effect on foreign exchange rates. Normally, an undersupply of base money would lead to a rise in currency value. This did not seem to happen.

I have found that, when various coercive methods (in this case, the Treasury’s sterilization program to purchase bullion without changing the monetary base) maintain a gold parity ($35/oz.) without corresponding adjustments in the monetary base (in this case, an expansion), then the effects are typically not very strong until there is a change in currency value. For example, if base money had the same behavior as it did here, but the Treasury did not purchase gold, such that the dollar was free to rise above its $35/oz. parity to perhaps $32/oz., then the effects would be greater. During the Bretton Woods years, when the Federal Reserve was taking the opposite strategy of selling gold at $35/oz. without corresponding reduction in the monetary base, the effects of this oversupply were not terribly important until gold sales were halted in 1968, and then with the final break in 1971.

Irwin estimated that the effect of the “sterilization” was to undersupply base money by about 10% from where it would have been if monetary mechanisms had not been interfered with. This is roughly the same as my conclusion — with the caveat that there is still some chance that a flatlining in base money during that time represented, to some degree, a natural balance of supply and demand. Irwin called this magnitude “enormous,” but I wouldn’t call it that. He is drawn towards these adjectives due to the “Prices-Interest-Money Box” — there isn’t any thing else on the menu, so Money has to be inflated to serve all roles.

In the end, I think the actions of the Treasury and Federal Reserve did constitute a meaningful deviation from proper gold standard operating principles, possibly leading to an undersupply of base money by about 10%. However, this did not appear to lead to any meaningful rise in dollar value, so its effects were perhaps understated. By any perspective, it counts as a negative, and consequently, as a factor in the 1937 recession. The reasons it was done seem to have arisen from ignorance and confusion — the idea that banks’ excess reserves were some sort of potential inflationary disaster waiting to happen, rather than banks’ sensible policy of holding more reserves against liabilities, which is a risk-reduction measure that reduces the chances of disaster. However, the continuing tendency of economists to ignore nonmonetary factors — the Prices, Interest and Money box — except perhaps for government spending taken as a whole (Keynesian “demand”) has blinded them to other, in my opinion more important, factors at work; and consequently, overemphasize these monetary anomalies. At least there is (apparently) a monetary anomaly, compared to the 1929-1932 period when I can’t find anything of significance. Amity Shlaes delved into these nonmonetary factors in some detail in The Forgotten Man: a New History of the Great Depression (2008), but I hope that someone takes another swipe at this time period — the Recession of 1937-38 specifically — including not only all facets of U.S. tax policy, fiscal policy, various regulatory policies and socialist interventions, plus various plans in the air which can affect people’s behavior even if they do not come to pass (Roosevelt was apparently considering a big capital gains tax hike at this time, which he later abandoned), plus all the relevant overseas events from the devaluation of the franc bloc in 1936 to the military advance of Japan into China in 1937 and the German annexation of Austria in March 1938. There might have even been something going on in Latin America worth noting. We are still some ways from getting to the point where economists even know how to investigate these things. I take heart that the recent books by Jim Grant, Brian Domitrovic and Larry Kudlow will help show younger people how it should be done.

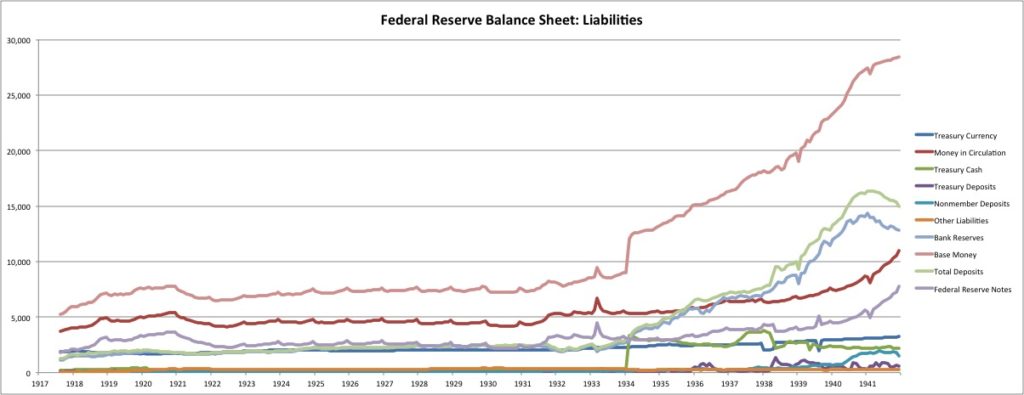

ADDITIONAL NOTE, May 2022: I mention here that there might have been a reduction in base money by about 10%, from what it would have otherwise been, based on the halting of gold inflows. However, looking at the Liabilities portion of the Fed’s balance sheet (in Part I of this three-part series), we see that there was no such deviation from the trend of the time. Thus, it appears that the Fed’s actions during this period were almost irrelevant. There appears to be something funny going on at that time, which allowed base money to expand normally, despite the halt to gold inflows. As I mention in the piece, there are a lot of funny footnotes and asterixes for that time.