Today, we will start investigating the U.S. recession of 1937, and along with that, claims that the Federal Reserve caused it by some sort of misbehavior. As is our usual practice, we will begin with just looking at some general information about that time.

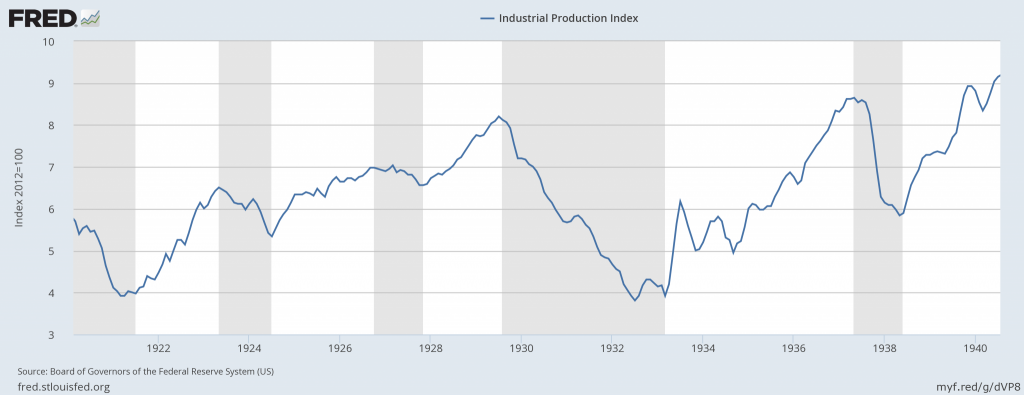

Industrial production had a short, sharp shock in 1937.

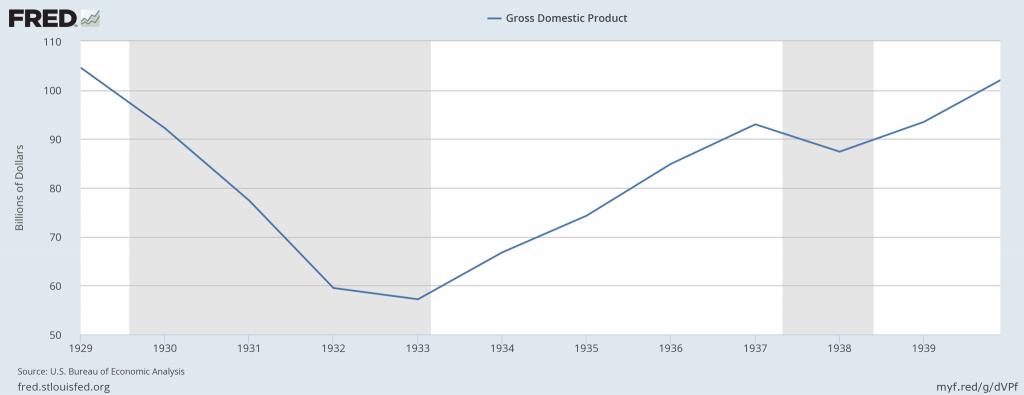

Here’s what it looked like in terms of nominal GDP:

I am not going to try to disentangle what was going on at that time. There were a lot of things, such as variety of tax hikes including the Social Security Act of 1935 (effective 1937), and the Revenue Act of 1936, which put a 27% undistributed profits tax on U.S. corporations, taking the effective corporate tax rate from 15% to 42%. More tax increases were going on at the state level.

June 27, 2010: U.S. Tax Hikes of the 1930s.

There was all sorts of wrangling regarding “regulation,” such as President Roosevelt’s attack on the private electric utilities business via the state-subsidized Tennessee Valley Authority, the potential model for a similar approach elsewhere. Amity Shlaes did a good job of describing this sort of thing in The Forgotten Man: a New History of the Great Depression (2007).

Or, it could have been related to something completely different, such as the Spanish Civil War of 1936-1939, which was really an attempted Russia-style communist revolution that was thwarted by a military takeover by General Franco. (The “Republicans” of Spain were basically the same as the “Republicans” of the Union of Soviet Socialist Republics.) People were worried that there would be similar events elsewhere in Europe. Also, there was the Japanese invasion of China, beginning the second Sino-Japanese War in July 1937; the capital at Nanking was captured by the Japanese military in December 1937. Germany’s nonviolent annexation of Austria, the Anschluss, took place in March 1938. France, and a variety of countries linked to France, that had remained on the gold standard up to that point, devalued in September 1936 and allowed their currencies to float afterwards, introducing a new aspect of currency turmoil.

July 18, 2014: Foreign Exchange Rates 1913-1941 #8: A Brief Summary

The point is, someone who tries to claim that everything was due to some sort of monetary fiddling, without even considering all these other factors and trying to weigh their importance, is probably so far lost in the Prices Interest Money delusion that they really do think that economic history is something like a chemistry experiment, rather than something that happens to real people in the real world. Once you’ve decided beforehand that only monetary influences matter, the next step is to take whatever minor aberration you can find and claim that it caused anything and everything. There is no other conclusion you can come to, except to throw up your hands and say “stuff happens” (“an autonomous decline in aggregate demand”). Money In=Money Out.

July 10, 2016: The Tyranny of Prices, Interest and Money

November 27, 2016: The Tyranny of Prices, Interest and Money 2: the Old Historicism

Nevertheless, let us look at what the Federal Reserve was up to in those days.

January 19, 2014: The Federal Reserve in the 1930s

January 26, 2014: The Federal Reserve in the 1930s 2: Interest Rates

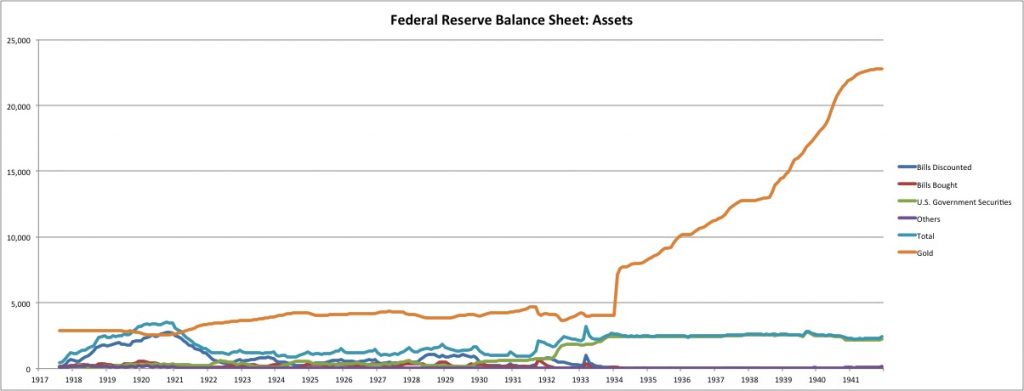

The step-up in gold at the beginning of 1934 was the effect of the devaluation of the dollar to $35/oz. from $20.67/oz in 1932. The number of ounces didn’t change, but their dollar value did. After that, we see that assets pretty much flatlined for the rest of the 1930s, except for gold. Basically, it became a “fiduciary” system where all of the activity takes place via gold conversion.

Note the flatline in gold for about a year beginning in the middle of 1937. This is the “gold sterilization” that we will talk about.

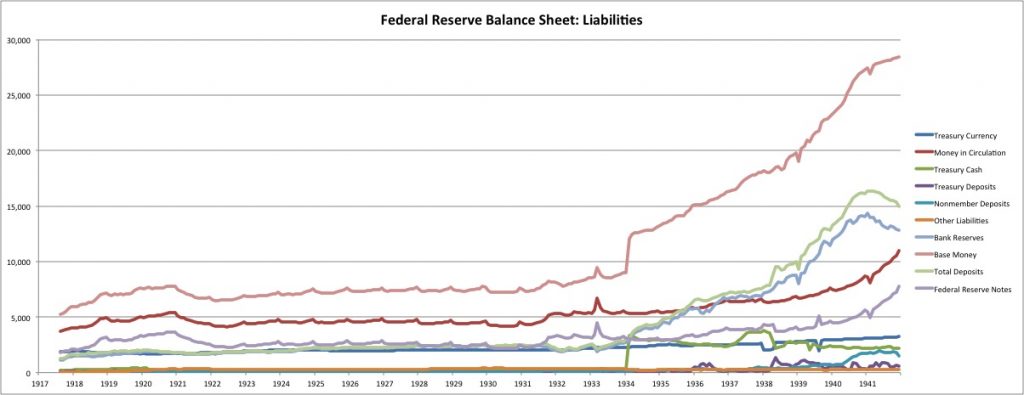

Here we have the liabilities side, including base money, which is the top line in pink. Although gold has something of a flatline in 1937, we see that this is not so much the case for base money as a whole. It more-or-less follows the trendline from 1934-1940. Most of the expansion in base money is in bank reserves, or deposits at the Federal Reserve. Money in circulation, which is banknotes and coins (both “Treasury Currency” and Federal Reserve Notes), does expand, but modestly, and mostly after the beginning of 1939.

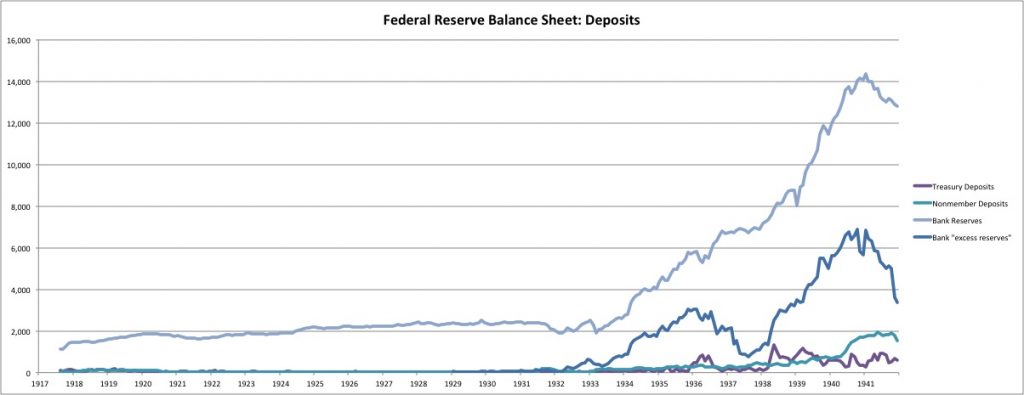

Here are “bank reserves,” which are deposits of banks at the Federal Reserve, a component of base money. We see a big increase here, which was clearly driving the overall expansion. The decline in “excess reserves” shows the effects of the increase in reserve requirements beginning around the start of 1936. One effect of reserve requirements in those days was that the “required” reserves essentially became unusable. Since they were “required,” they could not be used in payment. So the “real” reserves were, in effect, the “excess” reserves — the part that was usable in payment. In a healthy economic environment, banks tend to want to maximize their profitability by minimizing non-interest-bearing reserves. However, when they are risk-averse, they choose to reduce profitability somewhat to achieve greater safety, by holding more reserves.

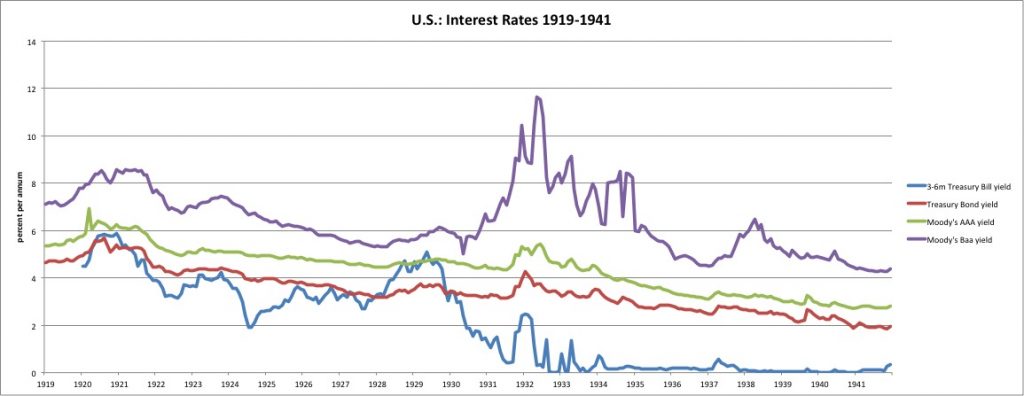

Interest rates during the time. We can see the blowout of Baa yields during the 1937 recession.

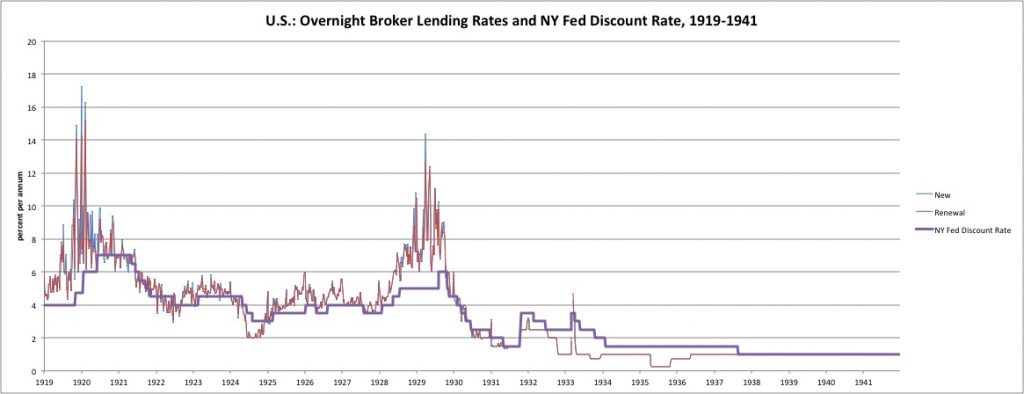

Discounting and lending became a lot less prevalent after 1932 or so. These are broker lending rates. Brokers probably didn’t need to borrow so much, because they weren’t making so many margin loans. Anyway, nobody would lend it to them. The Fed’s Discount Rate becomes somewhat irrelevant, since the Federal Reserve is making essentially no discount loans during this time. The Fed’s non-gold assets are almost exclusively government bonds. Banks didn’t need any discount lending, because they held a large amount of excess reserves.

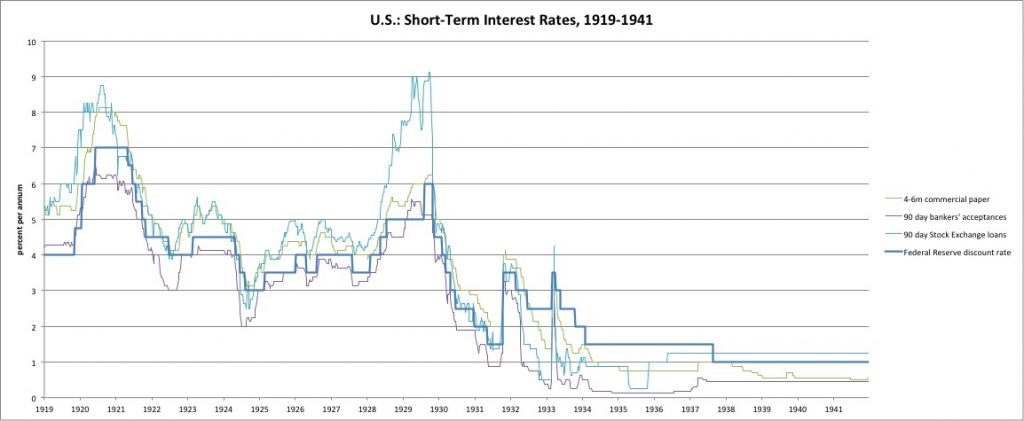

More short-term interest rates. Nothing much of interest here, except that rates tended to be very low.

For now, we will concentrate on the money side of things — the currency itself. I would also like to look into credit a bit — the behavior of banks during that time. The change in reserve requirements may have been important, although in general I think that people tend to exaggerate these things. We will continue with this topic soon.