(This item originally appeared at Forbes.com on December 1, 2018.)

For decades, we’ve heard this lament that determining a new “price of gold” (dollar/gold parity) in a new gold standard system is some kind of insoluble barrier akin to Fermat’s Last Theorem. This is silly.

The fact of the matter is, countries have often returned to gold after long periods of floating currencies. For the most part, this was successful. These countries have included: The United States in 1879, 1919 (arguably), 1934 and 1953 (arguably). France in 1926. Britain in 1821 and 1925. Japan in 1897, 1931 and 1949. Germany in 1923 and 1949. China in 1949.

Returning to a gold standard system has followed three basic paths:

The first is a return to a previous gold parity, typically following a depreciation of the currency during a war. This was true of the U.S. in 1879 and (arguably) 1953, and Britain in 1821 and 1925. This has involved intentionally raising the value of the currency back to its prewar value, a process that has some recessionary implications. In practice, these have not been too big a deal, unless other economic policy (especially tax policy) has been poor. Adding a recessionary monetary factor (in my opinion a relatively mild one) to the existing high-tax difficulties of 1920s Britain proved to be problematic. It was far less problematic in 1821, in part because high wartime tax rates had been dramatically reduced, and the country was primed for an economic boom.

The second is a situation where the existing currency is completely destroyed in hyperinflation. In this case, you can adopt any gold parity you like for the new currency. Typically, governments chose to re-introduce the traditional values. This was the case for the U.S. in 1789, France in 1801 and Germany in 1923.

The third is a case where the existing currency has been sufficiently debauched that returning to a previous gold parity (for example the $35/oz. of Bretton Woods) is not an option. But, the existing currency is still largely viable, and has not been reduced to confetti. This was the case for France in 1926, Japan in 1949, and is the case for the United States and other countries today. In this case, a new gold parity is typically found somewhere near the present market value of the floating currency vs. gold. I like to use the average currency/gold price of the last twelve months as a good first approximation.

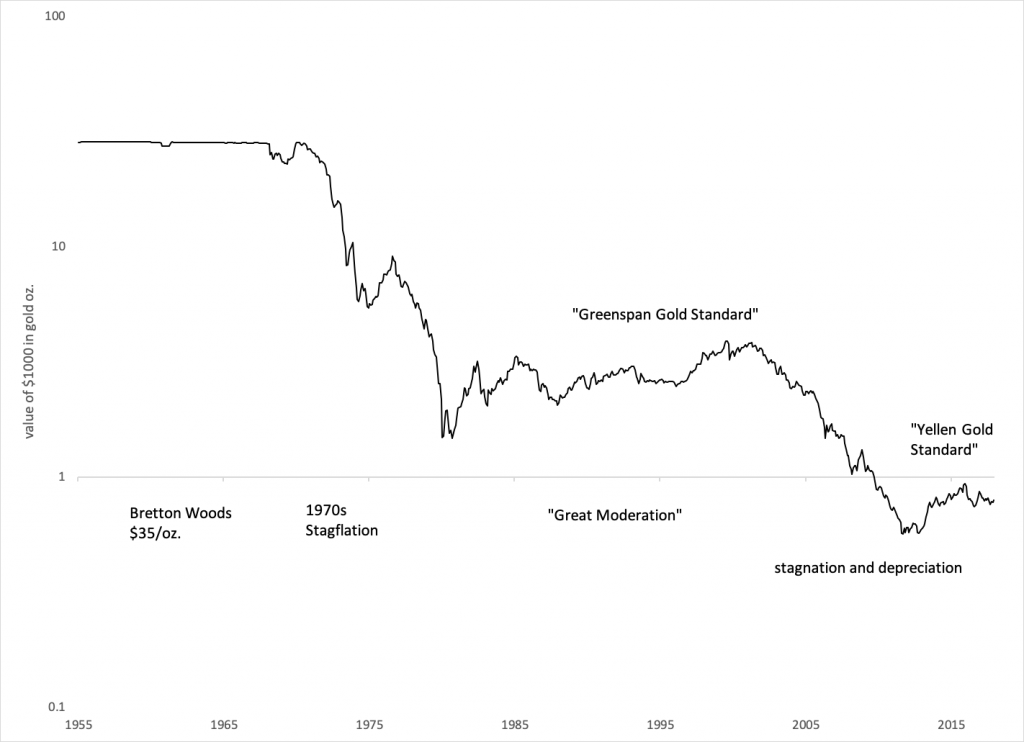

As I’ve been describing, the U.S. has had two periods of what have been apparently crude gold standard policies since 1971. The first was 1982 to around 2004, and the second has been around 2013 to the present. The first “gold parity value” – at least, central tendency – was around $350/oz., between the $300/oz. of the Paris Accord of 1985 (to deal with a strong dollar) and the $400/oz. of the Louvre Accord of 1987 (to deal with a weak dollar). The second parity value has been around $1250/oz., with variance between $1150/oz. and $1350/oz.

These effective “gold standard parity” values – around $350/oz. and then $1250/oz. – have been arrived at by the sloppiest and crudest means imaginable. And yet, they worked: the first helped produce the “Great Moderation” and economic boom of 1982-2000. The second has produced a period where complaints of monetary instability have been muted, and economies have generally been rather healthy. Central banks have engaged in other kinds of macroeconomic manipulation (negative interest rates!) to a degree never before seen. Probably they have done some heavy-handed bullying of the gold market itself. But, it worked: in terms of the values of their currencies, central banks have largely kept to the principle of Stable Money.

These effective “gold standard parity” values – around $350/oz. and then $1250/oz. – have been arrived at by the sloppiest and crudest means imaginable. And yet, they worked: the first helped produce the “Great Moderation” and economic boom of 1982-2000. The second has produced a period where complaints of monetary instability have been muted, and economies have generally been rather healthy. Central banks have engaged in other kinds of macroeconomic manipulation (negative interest rates!) to a degree never before seen. Probably they have done some heavy-handed bullying of the gold market itself. But, it worked: in terms of the values of their currencies, central banks have largely kept to the principle of Stable Money.

It is hard to imagine any rational, deliberative process that could possibly produce a messier outcome than this. As far as I know, history shows no evidence of new gold parity values being chosen that have been radically incorrect. The outcomes have always been successful. When parity values were chosen between then-floating European currencies and the new euro, in 1999, the choices were pretty good. This is easy.

Perhaps there is one example of mistaken parity values. Following the Bretton Woods Agreement of 1944, new parity values for the British pound, French franc, and other currencies were chosen in relation to the dollar and gold. The problem was that, in 1945 there were such capital controls and a general paucity of international trade and finance that nobody had a good idea of what the market values of these currencies were. The original parity values may have been rather far from economic reality. In that case, they were quickly fixed; a wave of revaluations in the late 1940s resulted in the establishment of parity values that lasted throughout the next two decades. (These “revaluations” may have also been caused by aggressive “easy money” policies.) The point is: if you make a big mistake, you can fix it. But, considering that things are not so murky today as in 1945, there is no reason for such a problem to even emerge.

Actually, there has been a different sort of problem: rather than simply taking something near the present market value of the currency vs. gold – as has always been the case in these situations – there has been an unfortunate minority, following the notions of Murray Rothbard, who have talked about “revaluing gold” to some silly stratospheric number like $10,000, $20,000 or $50,000 per ounce. But you can’t “revalue gold.” No government ever has. This is just a “revaluation of the currency” to 1/10000thor 1/50000thof an ounce of gold – in other words, a hyperinflationary devaluation. I think the serious people now give these fever dreams the ridicule they deserve.

The gold standard is easy. Humans have done it for centuries. We’re sort-of doing it right now. Don’t make it seem harder than it is.