(This item originally appeared at Forbes.com on May 3, 2019.)

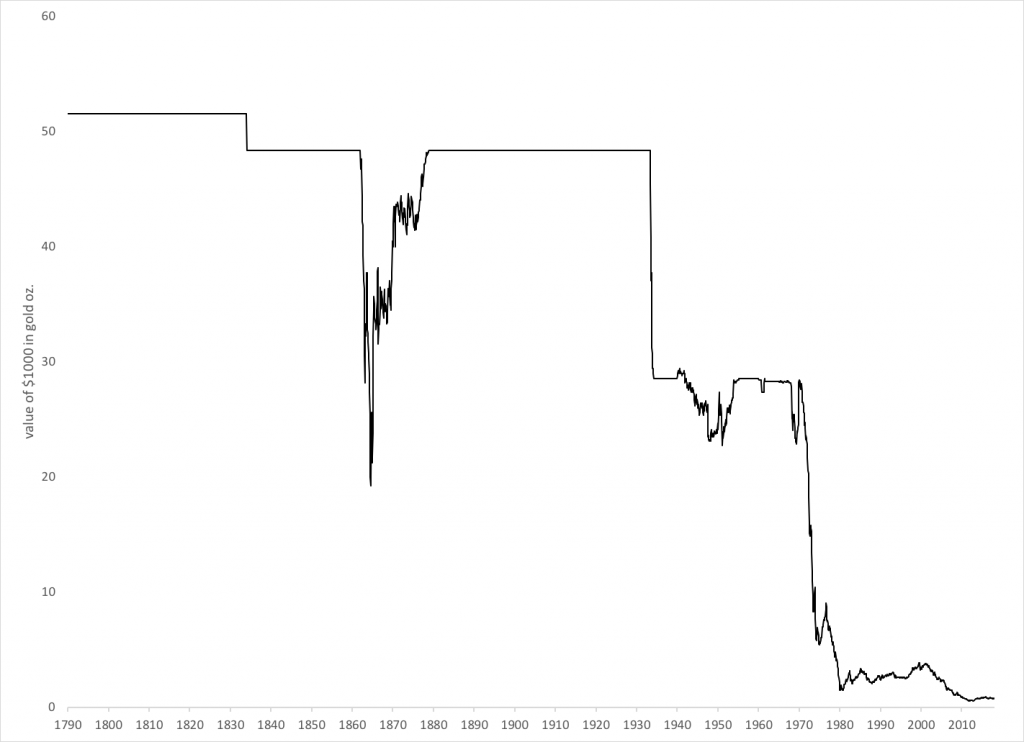

Recently, people have been asking me about “the political path to a new gold standard” system in the United States. I have been a little surprised by this. It has long been a topic of discussion among a teeny subset of gold standard advocates who are more-or-less monetary specialists; but apparently there is a much larger group of general conservatives who sense that we really should return to the monetary principles that made America great, for nearly two centuries between 1789 and 1971, and they want to get something done.

Some time ago, in 2012, I took up this topic, and concluded that we still really needed the intellectual foundation and, from that, broad political consensus from which political action naturally emerges. Where do things stand today?

First, I think we have made a lot of progress from where we were at that time. I myself have written two more books about technical and historical issues related to the gold standard, Gold: The Monetary Polaris (technical, 2013) and Gold: The Final Standard (historical, 2017). These built on Gold: The Once and Future Money (2007) to comprise the “gold trilogy,” which did a lot to establish what I have called the intellectual foundation. To this has been added several excellent new works by others, including Fixing the Dollar Now (2013) by Judy Shelton, and Money: How the Destruction of the Dollar Threatens the Global Economy, and What We Can Do About It (2013), by Steve Forbes. This later became the core of a nice documentary In Money We Trust? (2019), which aired on thousands of public television stations nationwide.

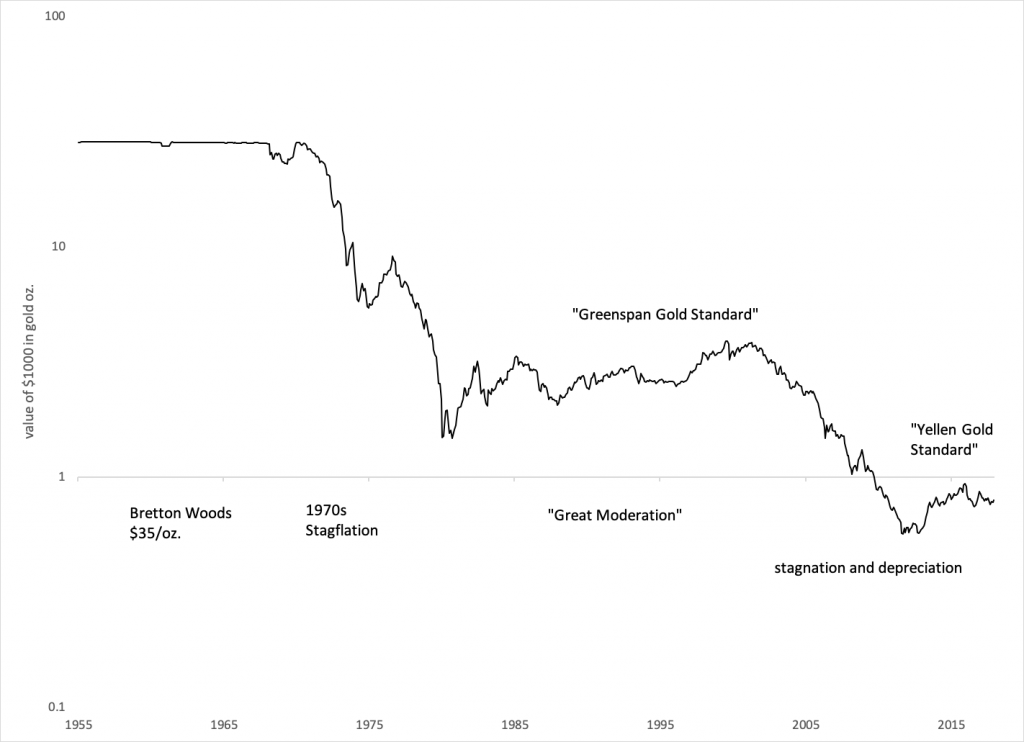

I suppose some will snicker that the dollar was not destroyed and the global economy not threatened, as Forbes suggested; but, that is because the dollar, which had a huge decline in 2001-2011, suddenly stabilized beginning in 2013, which I have called the “Yellen Gold Standard.” Maybe it is better to think of the book as a record of discussions that were being held around Washington DC in the 2011-2013 period.

The economist Lawrence Lindsey served on the Board of Governors of the Federal Reserve in 1991-1997, and was the Director of the National Economic Council in 2001-2002 under George W. Bush. In 2007, Lindsey reportedly called himself: a card-carrying member of the brotherhood of international central bankers, and once a member always a member; all for one, and one for all. In 2011 (while the dollar was dropping badly in value) he said: “I’m sure we’ll do it again [the gold standard],” adding, “probably in the next ten years.” In practice, it took only two years.

I have long argued that the real obstacle is not the various Keynesian or Monetarist types who are enamored of the idea of macroeconomic manipulation via currency distortion. They are going to do what they have always done, and nobody is going to change them. The real problem, for a long time, has been the sorry state of gold standard advocates themselves, who, although their hearts and principles are often in the right place, have long lacked basic technical knowledge and mastery of the subject. When even the gold standard guys themselves make arguments full of fallacy and error, there is really no chance that they are ever going to get anywhere. Today, the level of mastery among gold standard “experts” is much improved from where it was in 2012; and this is noticed by those who are not necessarily true believers, but want to hear some rational arguments.

I have made the analogy to an airplane. We can all agree that an airplane is the best way to get from New York to Los Angeles. You can have perfect political consensus on that point. But we are going to need aerospace engineers — “experts” — with the technical mastery to actually create a functioning airplane. Unfortunately, for a long time our gold standard “experts” have lacked the knowledge of how to create functioning monetary systems, and the likely result would not be a pleasant trip at 30,000 feet, but the monetary equivalent of a “plane crash.” People sense this inadequacy, and naturally it makes them hesitant. As bad as our current situation is, it is nevertheless much better than a monetary “plane crash” caused by some do-gooder who doesn’t know what they are doing.

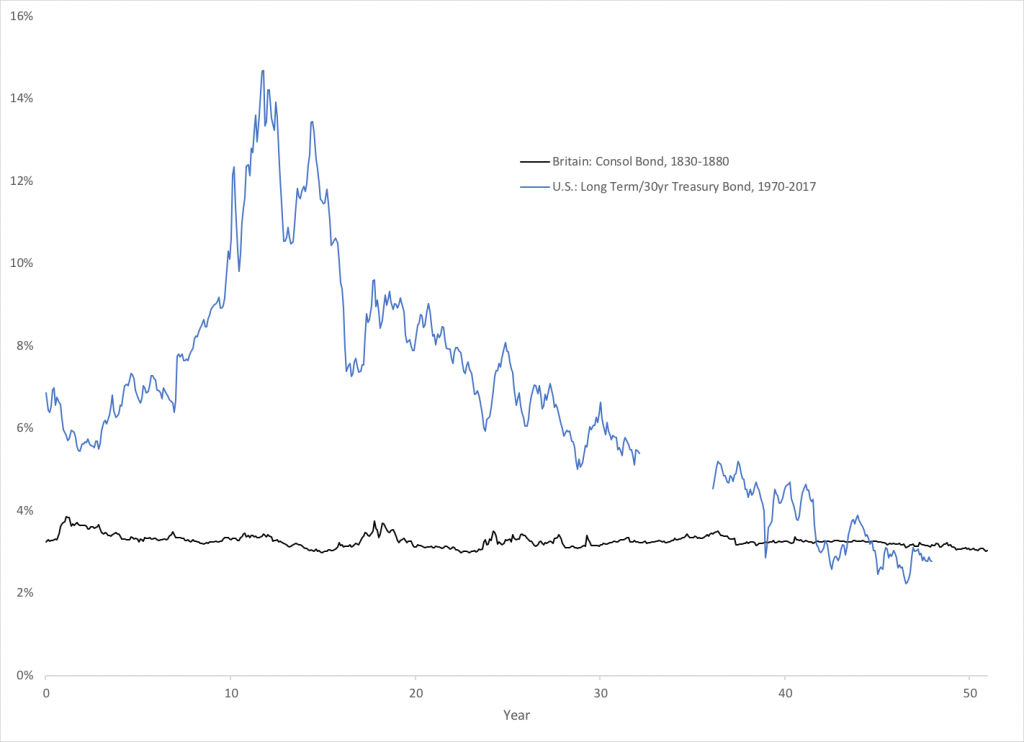

Actually, this is the core reason why we don’t have a gold standard system today. Neither president Richard Nixon nor Federal Reserve Chairman Arthur Burns, nor any other major government or central banker, wanted to leave the gold standard in August 1971. The 1960s had been a highly successful decade worldwide with the dollar fixed at $35/oz. of gold. Nixon himself attempted to put the Bretton Woods gold standard back together in the Smithsonian Agreement of December 1971, only a few months after the fatal break, with the dollar worth $38/oz. But, nobody knew how to do this properly. The airplane they attempted to assemble at the Smithsonian Agreement wouldn’t fly. The stagflationary disaster of the 1970s was their “plane crash.” So, you can see what a big deal this is.

The second element that I would like to see is a broad enthusiasm for Stable Money principles among conservative “generalists,” as opposed to monetary “specialists.” This does not have to be directly related to legislative action, but simply something that is widely perceived to be a good idea and which people have a pretty good concept of, similar to the Flat Tax or FairTax proposals today. People like Rush Limbaugh, Glenn Beck, Ann Coulter or Ben Shapiro should be familiar with the idea and in general support. It would be nice if some of the major conservative policy think tanks like the Heritage Foundation or the American Enterprise Institute took up the proposal in more detail. My latest book The Magic Formula has a short and, I hope, easily digestible section on the gold standard that can serve as a “generalist” introduction to the topic, as opposed to the highly “specialist” focus of my previous books.

After all, the United States actually did this for nearly two centuries, and ended up the wealthiest and most powerful country in the world. The last decade of the gold standard, the 1960s, was probably the most prosperous decade worldwide since 1914. The gold standard is just a means to an end; it is the best way we know of creating Stable Money, a currency that is, as closely as possible, stable in value, neutral, unchanging, and free of human manipulation; similar to other weights and measures like the kilogram or meter. It shouldn’t be very controversial.

There is already practical support for the gold standard among the leadership elite. We have been on the “Yellen gold standard” for about five years now, and I don’t think it is a coincidence or accident. President Trump just put forth two gold standard fans (Stephen Moore and Herman Cain) for the board of the Federal Reserve. But, as I see it, making the move to legitimize and formalize this policy still requires a broader embrace, among an “expert” class and also among the conservative political base. Many pro-business liberals might also get on board, just as it was the Democrats that supported tax reforms in 1964, 1981 and 1986. They should see that Stable Money is good for business; and what is good for business is also good for job creation and rising incomes, especially among the lower 50% of society.