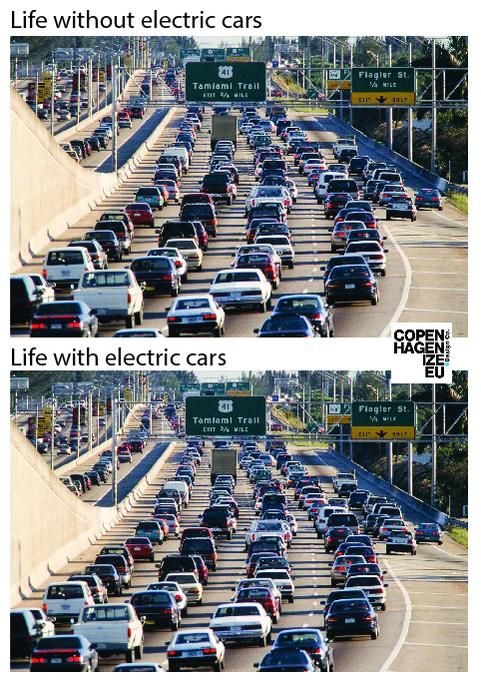

Today, $1 trillion+ has been invested in “renewable energy,” backed by government programs, ESG nonsense, etc. etc. I think this is a lot like the battery EV car. It is different, but not obviously much better. Maybe it is a little better. (“better” here meaning: uses less energy) Plus, there are other issues.

Even despite amazing declines in the cost of solar panels, solar and wind power remain somewhat like EVs: different, but not obviously better. Both have major problems with intermittency, which are not really solvable. Actually, all of this is apparent at the level of the single off-grid home. You don’t just replicate the energy use patterns of an on-grid home, using solar and wind. That would mean A LOT of solar and wind power, plus very large batteries to deal with the intermittency. Batteries, in particular, are very expensive and wear out. Rather, the typical solution for an off-grid home involves using a lot less electricity. Maybe 80% less. The end result is not shivering in the dark, but living comfortably, with new systems that inherently use a lot less energy.

I looked into this in 2009:

May 3, 2009: A Bazillion Windmills

Since then, we really have spent trillions of dollars building a bazillion windmills, and other “green energy transition” solutions. It didn’t work very well, just as I expected.

To give an idea of what we have learned in that time, below is some commentary by energy and commodity specialists Leigh Goehring and Adam Rozencwagj.

But, since this is very long, I will get to my conclusion.

Changing the energy inputs, to a vastly inefficient and also rather ugly and troublesome system, doesn’t accomplish very much. Like the Tesla battery EVs above. Rather, a solution is a better system, that inherently doesn’t use much energy. If you reduced energy use by 80%, which is not that hard, then it wouldn’t matter if that remaining 20% came from coal, natural gas or wind power. It wouldn’t be that much either way.

To give an example of what I mean, a popular new item these days is the battery-powered electric cargo bicycle.

This should be combined with segregated bicycle lanes on streets:

This is a new system, that maybe would allow people to get things done around town, or commute to work, even in the context of mostly-automobile-dependent Suburbia today, while using very little energy. Even if the family still owns a three-row SUV, it doesn’t get used very much.

I will continue with some of these themes later. For now, read the long and detailed item below about how “alternative energy sources” will never work.

***

Nothing demonstrates this better than what Chevron did back in February. Rattled by Engine No. 1’s Exxon success, Chevron committed to invest $10 bn to reduce its carbon emissions through 2028 and be completely carbon neutral by 2050. As a first step, Chevron announced the acquisition of Renewable Energy Group, an Iowa based producer of biodiesel and renewable diesel, for $3 bn.

Biodiesel is a renewable fuel that is manufactured from vegetable oils, animal fats, and recycled restaurant grease. Although “advanced biodiesel” and “renewable diesel” might earn Chevron some ESG bone fides, we should stress that biodiesel will do little to reduce the overall level of CO2 in the atmosphere. Furthermore, the energy efficiency of biodiesel is so much worse than traditional hydrocarbons that both society and the environment are ultimately left worse off.

Consider this: Chevron spent $3 bn to acquire Renewable Energy Group. The acquisition will produce 32,000 b/d or 11.5 mm barrels per year of biodiesel. Assuming the assets last 20 years, Chevron will produce 230 mm barrels of biodiesel over the coming two decades. How does this compare to a traditional upstream investment? Assuming Chevron instead invested this $3 bn in their prime Permian basin acreage, and that a Permian barrel can be drilled, completed, and produced for $12, a comparable investment would produce 250 mm barrels of oil equivalent – 9% more than the biodiesel. These figures do not tell the whole story. With the Permian investment, 80% (or 200 mm bbl) are produced within the first four years. In other words, it will take the biodiesel plant 17 years to produce what the conventional oil and gas investment produces in four.

Furthermore, manufacturing biodiesel is incredibly energy intensive. The hydrocracking process used to turn waste fats and oils into biodiesel requires a huge amount of energy as does growing, harvesting, and processing feedstock crops (i.e., soybeans, dates, sunflowers, seeds, etc).

We calculate the total energy returned on energy invested (EROEI) for manufacturing biofuels is only 2.5 or 3:1. By comparison, the production of diesel from crude oil is extremely energy efficient. For every unit of energy used to drill, produce, transport, and refine a barrel of oil into diesel, 30 units of energy are released when it is consumed – diesel has an EROEI of 30:1.

With 6.1 GJ contained in every barrel of oil (or diesel), were Chevron to invest $3 bn in the Permian, it would produce 1.2 bn GJ of energy in just the first four years. Assuming a 30:1 EROEI, Chevron would expend only 40 mm GJ of energy in the process, leaving 1.16 bn GJ of net usable energy in the first four years.

By comparison, Chevron’s $3 bn investment in Renewable Fuels would yield spectacularly less. In the first four years, Chevron’s biodiesel investment will produce 50 mm barrels of biodiesel with gross contained energy of 300 mm GJ – already 75% less than the Permian. However, the EROEI is so poor, 100 mm GJ will be consumed just to produce this already diminished output. Therefore, Chevron’s biodiesel operation will produce only 200 mm GJ of net usable energy over the first four years, compared with 1.16 bn GJ in the Permian — a reduction of nearly 85%.

Over its full 20-year life, Chevron’s biodiesel investment will eventually produce 230 mm barrels, but again the low EROEI will consume 35-40% of the embedded energy. We estimate that over 20 years, the biodiesel operation will only produce 925 mm GJ of net usable energy – 40% less than the 1.5 bn net GJ produced from a comparable investment in the Permian.

A conventional hydrocarbon investment will generate more usable net energy and will deliver it much more quickly. The world is currently in the midst of an acute energy crisis. Diversifying out of hydrocarbons towards things like biodiesel will only make the current crisis much worse.

The deeper one investigates Chevron’s biodiesel acquisition the worse it gets. Thus far we have discussed economics and energy intensity, but even from a CO2 perspective, biodiesel makes little sense.

Because of its extremely low energy efficiency, CO2 produced from manufactured biodiesel is at best on par with diesel refined from crude oil and at worst is much greater. We calcu- late that each barrel of diesel sourced from conventional hydrocarbons releases 460 kg of CO2 – 440 kg released during the combustion itself and 20 kg emitted during the drilling, transporting, and refining of the crude oil.

A barrel of biodiesel will still emit the same 440 kg of CO2 during combustion, but instead of emitting 20 kg during its manufacture it will now generate 230 kg due to the low EROEI. In total a barrel of biodiesel will release 670 kg of CO2 compared with 460 kg for conven- tional diesel – an increase of 45%. Offsetting this inefficiency is the fact that the biodiesel feedstock will capture and sequester carbon as the plant grows due to photosynthesis. The question becomes how much carbon the feedstock for a barrel of biodiesel can sequester.

This critical metric depends on the feedstock (i.e., corn, soybeans, etc.), the farming techniques (i.e., fertilizer application, responsible farming, etc.), and whether the feedstock is grown for diesel or waste products are used. The key issue is whether ultimately the feedstock can sequester at least 210 kg of CO2 per barrel of biodiesel to offset its inherent energy ineffi- ciency.

As you can imagine, the analysis becomes fiendishly difficult, but there is a growing consensus that under the best scenarios, biodiesel’s carbon intensity is on par with diesel and at worst it is much greater.

Chevron made a $3 bn investment to deflect potential activist harassment, like what happened to Exxon and Shell. Unfortunately, we believe this investment made little operational sense. It is terribly energy inefficient on both a short- and long-term basis. Even stretching the energy recovery period over 20 years, Chevron’s biodiesel business will produce 40% less energy than a comparable investment in the Permian. Next, from a CO2 output standpoint, amount of CO2 produced from a manufactured barrel of biodiesel is at best even and at worst 45% greater than the CO2 produced from crude-oil based diesel.

The supermajors are pouring billion and billions into another area with inferior energetics: offshore wind. In just the last year BP, Shell, and Total have committed to a massive offshore wind build-out off the coast of New York and New Jersey. BP announced three huge offshore wind projects off the coast of Massachusetts and Long Island. The estimated installed capacity for all three projects (Beacon, Empire Wind 1 and Empire Wind 2) totals 3,300 megawatts. BP will own 50% in all three projects. Shell has announced its 50% interest in the newly awarded Atlantic Shores Offshore Wind Bite project off the coast of New Jersey with an installed capacity of 925 megawatts. Total announced its 100% interest in the Attentive Energy project off the coast of New Jersey with estimated capacity of almost 1,000 megawatts.

Rising steel, concrete, and copper prices over the last three years have caused the capital cost on these projects to soar. In 2015, we calculated that it cost $3.50 to $4.00 per watt to build and install offshore wind capacity. Since then steel, cement, and copper prices have all risen more than 75%, driving capital costs to as much as $5 to $6 per watt.

Using $5.50 per watt as a base, the wind projects just discussed will now cost Shell, BP, and Total a combined $17 bn for 3,100 megawatts net to them. BP will be on the hook for $9 bn to build 1,650 megawatts net to them. Shell will invest $2.6 bn to build 465 megawatts net to them and Total will need to invest $5.5 bn to build out their 1,000 megawatts of power.

Just like Chevron’s biodiesel acquisition, these massive wind investments will make the current energy crisis much worse. Windfarms, much like biodiesel, have a vastly inferior energy efficiency compared with traditional hydrocarbons. On an “un-buffered” basis — that is, without any storage backup — the best offshore windfarm produces in an EROEI of 10-15:1. “Buffering” the wind farm with battery storage (desperately needed, but so far barely implemented), drops the EROEI to between 5-10:1, compared with 30:1 for traditional hydrocarbons.

Clearly offshore wind compares unfavorably with offshore oil and gas. How unfavorably? Assuming that an un-buffered offshore wind farm will be operating with a 37% load factor for 20 years, the supermajor’s $17 bn investment will generate 10 mm mwh per year or 200 mm mwh over two decades. This equates to 36 mm GJelec per year or 720 mm GJelec total.

If our supermajors had instead taken this $17 bn and invested in a traditional hydrocarbon project (say a large offshore development), the results would be much different. Assuming total finding and development costs of $25 per boe, they would have produced some combi- nation of 680 mm bbl of oil and 4.8 tcf of natural gas.

If this natural gas was piped onshore and burned in a combined-cycle natural gas plant sporting a “heat-rate” of 60%, the investment would ultimately produce 122 mm GJelec per year or 2.45 bn GJelec over its 20-year life.

Again, the difference in net energy produced between a renewable energy project and a traditional hydrocarbon project is huge. The offshore wind farms will wind up producing 70% less power than a similar investment made in offshore hydrocarbon projects over their full useful lives.

Back in 2020, Wood Mackenzie, the energy consultant, estimated that well over $200 bn would be invested in offshore wind farms in the next several years. They believed that the oil and gas industry, which at the time had little in the way of offshore wind farm exposure, had the potential to become a huge participant. For example, Equinor, the Norwegian oil and gas company, has stated that they plan to invest in as much as 6,000 megawatts of offshore generating capacity in the next six years and by 2035 to have 16,000 megawatts. And please note that Equinor has already aggressively committed itself to entering this market—Equinor is the 50% partner with BP in the Beacon, Empire Wind 1, and Empire Wind 2 projects. We estimate Equinor will have to invest up to $100 bn to build-out these 16,000 megawatts of capacity. Spending levels of this magnitude will prevent Equinor from investing in its traditional upstream business. For example, over the last 10 years Equinor has spent approx- imately $140 in upstream capital spending, so you are talking about a huge diversion of capital amounts (up to 70%) that will now be invested in energy projects that will produce 70% less energy.

As the examples above clearly show, the supermajors have already begun to divert significant amounts of capital away from their traditional upstream business. In the case of Chevron’s investment in renewable biodiesel, the energy ultimately produced by this investment will fall by almost 80% and the amount of CO2 produced at best will be the same and at worse be 45% higher. In the case of offshore wind, the investments needed are huge, but the drops in actual energy produced are huge as well—approximately 70%.

The cutbacks in upstream capital spending by the supermajors has already impacted tradi- tional upstream production—the supermajors are shrinking very much in line with the projection we made in our first essay on the “Incredibly Shrinking Supermajors” back in the Q2 2021. Now, it looks like these supermajors, because of intense ESG pressure, are diverting huge amounts of capital away from their traditional high EROEI oil and gas businesses into ventures with energy efficiencies that are 80% lower. The energy crisis we are in now will only be made worse by what the supermajors are doing.

In our next installment of this series on the incredibly shrinking supermajors, we will discuss BP’s massive new investment in the Asian Renewable Energy Hub (AREH). Estimated capital cost of this project could approach $25 bn ($10 bn net to BP). We will discuss its terrible energy efficiency, another example of how the supermajors are destroying themselves in an attempt to placate the hostile ESG pressures now pushing in on all sides. We believe BP’s investment in the AREH project will be a huge mistake.

In the case of BP’s Australian hydrogen project, you are combining the unconventional production of electricity (wind) with the production of hydrogen, another highly uncon- ventional energy source. Combining the incredibly low energy efficiency of windfarms with hydrogen manufacturing is a guaranteed recipe for failure. There is a saying in the oil and gas business that you cannot combine two unconventional elements in a major project. We believe BP’s investment in the AREH project attempt just that – and will ultimately produce extremely low returns.