What Happened to the Greenspan Put?

August 5, 2007

“Easy” Alan Greenspan is underrated. When he entered office in August 1987, the average value of the dollar was $460.20/ounce of gold. When he left in January 2006, it was $549.86/oz., and that weakness appeared only in the last few months of office. For most of his tenure, the dollar was in the $300-$400/oz. range. Over a period of 19 years that is not a bad record. In response, interest rates fell during his tenure, from 8.76% on the ten-year Treasury bond in August 1987 to 4.42% in January 2006.

This relatively good track record — it could have been much, much worse — was due at least in part to the fact that Greenspan took gold seriously as an inflation indicator. His writings on the gold standard as a young man are well known. However, even as late as 1981, only a few years before entering office at the Fed, he remained a gold standard advocate (of sorts).

“The only seeming solution is for the U.S. to create a fiscal and monetary environment which in effect makes the dollar as good as gold, i.e., stabilizes the general price level and by inference the dollar price of gold bullion itself. Then a modest reserve of bullion could reduce the narrow gold price fluctuations effectively to zero, allowing any changes in gold supply and demand to be absorbed in fluctuations in the Treasury’s inventory.” — 1981

I know that he used to have regular private meetings during his Fed tenure in which the dollar/gold ratio was openly discussed. Here is Greenspan’s answer to a question from Ron Paul (R-TX), on February 24, 1999:

Mr. GREENSPAN. I think the price of gold has, over the decades, been a generally usable indicator of what the level of inflation has been. Obviously, during the period of an active gold standard, which was really prior to World War I, the price level pretty much locked itself in to the gold price. In fact, by definition it did.

The issue of buying and selling gold as the price changes is indeed exactly what we used to do. We used to, at a certain thing called the gold points, which was the price of gold plus the transportation cost differentials, we, that is, the United States Treasury, stood ready to buy and sell gold at a spread, as indeed all other participants in the gold standard did. So in that regard that was exactly what was happening.

But, needless to say, since we have gone off the gold standard, and especially since 1973, there has been basically a general float of the dollar vis-a-vis gold, which means that the gold price is like another commodity’s price.

Nonetheless, like a lot of commodity prices, and perhaps better than most, it has been useful, in my judgment, in trying to get some sense of what inflationary pressures have evolved in this country.

Rather wishy-washy in typical Greenspan style, but not something you’re likely to hear from the ECB. It seems to me (based on his writings as a market commentator during the deflations in 1982 and 1985) that Greenspan always looked at gold primarily as an inflation indicator, while I see it as a stable measure of value which can thus indicate both inflation and deflation. Thus, when the dollar was high vs. gold (i.e. low “gold price”), Greenspan saw that as an indicator of less inflation, a good thing, rather than possible deflation, a bad thing.

And yet, despite a pretty good track record based at least in part on a desire to stabilize the dollar/gold price, Greenspan has a reputation as a mad inflationist. Why? Part of this is generalized dissatisfaction with the “Creature From Jekyll Island” and the long-term loss of dollar value which followed the Fed’s establishment in 1913. Part of it is a certain lack of understanding on the part of various commentators, who see any form of what they call “money creation” as inflationary, although it is a normal feature of healthy economies. But mostly, it is due to two actions taken by Greenspan. First, the surprise rate cut of 1998, and second, the reduction of the Fed funds rate to 1% between 2001 and 2003, it’s lowest since the early 1950s. Both were interpreted to be very favorable to the financial markets (particularly the one in 1998), and have subsequently been labeled the “Greenspan Put“.

But was Greenspan always “Easy Al?” Not so. In 1994, Greenspan engaged in what was known as a “preemptive strike” against inflation that nobody else perceived at the time. This surprise rate hike led to a number of bond market blowups, notably the bankruptcy of Orange County, CA due to its derivatives portfolio. Here’s an editorial from Businessweek from March 14, 1994, that captures the mood of the time:

ENOUGH IS ENOUGH, MR. GREENSPAN

When Federal Reserve Board Chairman Alan Greenspan tightened monetary policy on Feb. 4, there was a widespread belief that the move would curb inflationary expectations and actually lower long-term interest rates. It turns out everyone was wrong.Since Greenspan raised short-term interest rates by 25 basis points, long bond rates have risen nearly twice as much, jumping to about 6.8%. Instead of soothing the savage beasts of the bond market, Greenspan’s move appears to have induced a frenzy.

What has gone wrong, and how can it be fixed? It’s tempting to say that Greenspan’s preemptive strike against inflationary expectations was wrong from the start. Not so. What really spooked the markets was his subsequent confession that he believed monetary policy had been too loose, too long.

The markets inferred that Greenspan’s strike was only the first in a series of attacks against inflation. Market players around the world concluded that the Fed would push interest rates much higher in the months ahead.

Worse, Greenspan added to confusion in the markets by admitting that the conventional monetary measures were no longer reliable and that he was turning to more exotic measures, including that “arcane metal,” gold.

All this happened while the consumer price index, the gross national product deflator, and even the price of gold itself were showing a surprising degree of price stability. Certainly the fourth quarter of 1993 came in at a stunning 7.5% growth rate, but that’s history. Almost every forecaster is saying that the first quarter will grow at about 3%, if that.

Paradoxically, rates have already shot up so much that the probability of the economy overheating is virtually the same as the January change in the CPI–zero. Indeed, the appropriate worry now is that the economy will slow down too much by summer.

Greenspan surely knows last year’s recovery was caused by a fall in long-term rates. That makes a sharp rise in long-term rates the clear and present danger. The bond market vigilantes are screaming for another tightening from the Fed, but it’s unnecessary now. Rates have already risen enough so that the main force driving consumer spending, mortgage refinancing, has run out of gas. Get real, Mr. Greenspan: Preemptive strikes should not turn into wars.

Why was Greenspan so worried about inflation, when nobody else was? Well, the op-ed shows why: he was watching the dollar vs gold, which dropped following President Clinton’s “preemptive strike” on the deficit via an unpopular rise in income taxes. With this dollar move, the “super low” 3% rate that had prevailed –the lowest since 1963! — seemed too low to Greenspan. Indeed, the rate cuts of the early 1990s was not only in response to the recession of the time, but the fact that the dollar had risen to the mid-$300/oz. range in 1991. That year was when Greenspan finally got busy cutting rates, as his inflation indicator showed that it was “safe to do so.” The December 1990 average Fed funds rate of 7.31% fell to 4.43% by December 1991, and then, with the dollar a very “non-inflationary” $340/oz. in 1992, to 3.1% in October 1992.

The $400/oz. level was an important “line” between an acceptable and too-weak dollar because that was the level that the Louvre Accord was signed at in February 1987. The Louvre Accord was basically an international agreement that the dollar was too weak and, implicitly, that it was the US’s duty to support the value of the dollar. On the other side was the 1985 Plaza Accord, which was the agreement that the dollar was too strong. It was signed at $330/oz. So, with the dollar/gold near its Plaza Accord “too strong” level, and the economy in recession, it was a no-brainer to get aggressive with low policy rates.

Greenspan started office in August 1987, picking up some weak-dollar problems from the Volcker period. A few ill-considered comments at the beginning of his tenure no doubt contributed to the Crash of 1987, when it seemed that Greenspan would allow greater inflation going forward. After that shocking event, however, he became very hawkish — especially after the beginning of 1988. On the first trading day of 1988, central banks around the world intervened to support the value of the dollar, and Greenspan was part of this international stronger-dollar policy consensus as he drove the Fed funds rate nearly to 10% in 1989. No “Easy Al” there. The weak dollar was reflected in the fact that it took more and more dollars to buy an ounce of gold, in fact $500 of them at the beginning of 1988.

The point of all this is:

A) Greenspan watched gold.

B) When gold told him there was inflation and the economy was doing well, Greenspan tended to be hawkish.

C) When gold told him there was inflation and the economy wasn’t doing well, Greenspan tended to be hawkish (1989-1990).

D) When gold told him there was no inflation but the economy was doing well (2000 for example) — or maybe a little too well — Greenspan went with the flow and had somewhat higher rates.

E) When gold told him there was no inflation (1992, 1998, 2001) but the economy was not doing well, Greenspan was surprisingly aggressive on the side of easing.

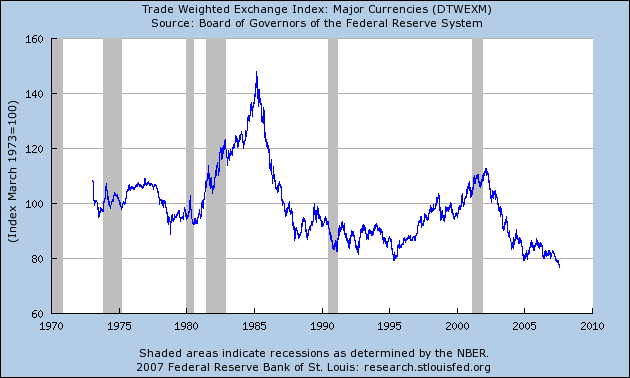

The events which have gained Greenspan his “Easy Al” and “Greenspan Put” labels were the deflationary periods of 1998 and 2001-2003. The present period is wholly different, with the dollar at $670/oz. of gold, which, except for a few recent months, is its weakest since 1981. This is reflected not only in gold, but in the Fed’s own currency indexes:

Conclusion? Don’t expect a Greenspan Put!

Alas, Easy-To-Predict Al is no longer at the Fed. We’ve got Ben Bernanke. He’s still something of an unknown entity, although he is probably in discussions with Greenspan. How might Bernanke be different than Greenspan? He probably puts less emphasis on gold, although that deteriorating currency index tells basically the same story. However, Bernanke is also apparently a big believer in the idea that aggressive Fed action is the proper response to economic deterioration, such as we are seeing in a big way emanating from the US housing sector. Will Bernanke try to save the day with rate cuts? That would likely be quite disastrous for the dollar. On balance, I’d say that the Bernanke Fed will probably be more hawkish than most people assume, as they are still operating on assumptions from the “Greenspan Put” days. While Greenspan was “preemptive,” as he was watching gold and had the confidence to act on his interpretation, I’m guessing that the Bernanke Fed will tend to be more reactive, and stay within what they feel is politically desired and acceptable. Thus, while they are likely to be more hawkish than some would like, they are not likely to be hawkish enough to turn around the general trend of declining dollar value, as that would tend to imply much more aggressive (and economically negative) action than people would like to see. Are they going to do a 1988 Greenspan and push the Fed funds rate to 10%? With the ARM resets coming up? Remember that the dollar was a mere $500/oz. of gold at that time, even at its lowest point. The Fed may eventually go to 10%, just as the rampant inflationist Arthur Burns was forced to 13% in 1974, but they would probably be kicking and screaming all the way up. Eventually, it will be politically acceptable to be hawkish again.

Another funny thing about Bernanke is that he keeps talking about “inflation expectations,” as if inflation is caused by people thinking about inflation, instead of a change in currency value. It is perhaps no surprise then that the official governments statistics are their most corrupted ever, perhaps to keep people from thinking about inflation. This ploy hasn’t fooled everyone, but it has fooled enough people that inflation fears are relatively subdued despite the weakest dollar/gold, dollar/other commodities, and dollar/FX in decades. One result of this has been that political support for a “hawkish” Fed is muted, and thus the likelihood of the Fed taking effective, dollar-supportive, inflation-subduing action is even less! Maybe “suppressing inflation expectations” causes inflation? What do you think Ben?