What If We Abolished the Federal Reserve?

October 27, 2009

The idea of “abolishing the Fed” has been surprisingly popular. Ron Paul reports that a large number of college-age people support the idea.

OK, what would happen if we abolished the Fed?

The Fed was created in 1913, and didn’t really start full operations until 1917 or so. Obviously, the United States got along without the Fed for many years, well over a century actually.

What was that time like?

In many ways, it was a wonderful time. The United States had no federal taxes (except for tariffs), and the money was pegged to gold. It was the Magic Formula on steroids.

Low Taxes

Stable Money

In a few short decades, a tiny scattering of uppity farmers on the edge of the wilderness became an agricultural powerhouse, an industrial powerhouse, a world power, and eventually a superpower.

However, it wasn’t all peaches and cream.

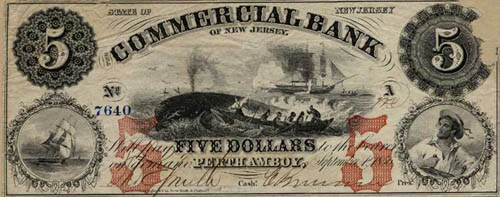

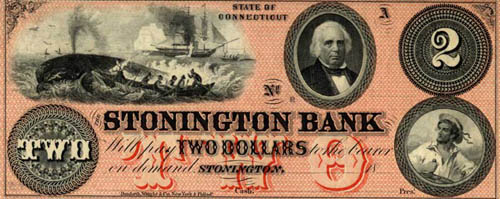

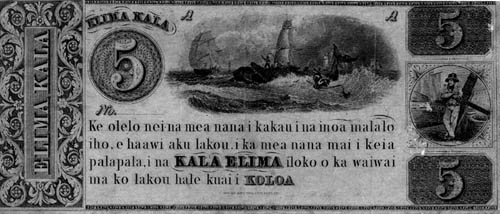

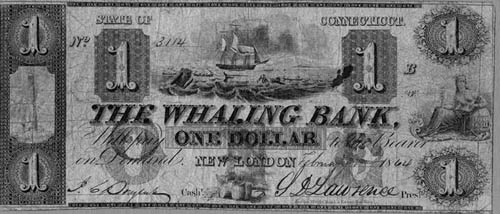

For one thing, the United States did not have a unified currency in those days. Paper money was issued by individual banks. The paper notes were redeemable in gold, or at least they were supposed to be. The Hodges Genuine Bank Notes of America, 1859, lists 9,916 legitimate bank notes issued by 1,356 banks. The banknotes often traded at a discount depending on the distance of the issuing bank and the bank’s reputation. Of course this was a big mess.

Banknote from the Commercial Bank of New Jersey, 1856

Banknote from the Mechanics Bank of New Bedford, 1858

Banknote from the Stonington Bank of Connecticut

Hawaiian Banknote

The Whaling Bank of New London, Connecticut

The next step was the establishment of the National Bank Notes system in 1863. This standardized the currency in the United States.

First National Bank of Oxford, Mississippi, 1902

National Bank of the City of New York, 1882

National Bank of Honolulu banknote, 1929.

This system is still in use in Hong Kong and Macau. In Hong Kong, three banks are chartered to issue banknotes.

Government of Hong Kong $10 note

HSBC $20 note

Standard Chartered Bank $20 note

Hong Kong Bank of China $20 note

At first, the Federal Reserve was just one of many banks that could issue bank notes. During the 1920s, the Fed became the largest issuer of banknotes. During the 1930s, notes issed by independent banks were phased out, leaving only Federal Reserve Notes and United States Notes, issued directly by the Treasury (the original “greenbacks” of 1861). The United States Notes were not used in circulation much, and were phased out in 1971. This left only the Federal Reserve Note.

“Greenback” United States Note, 1861.

United States Note, 1966.

So, the first thing we should think about, if we were to abolish the Fed, is to decide who issues the currency. I don’t think “free banking” (the system prior to 1863) is appropriate for the United States, because it is just too large a country. (On the other hand, maybe it could work, in the Hong Kong style.) The United States Note, issued directly from the Treasury, seems like a sensible solution.

The second thing to think about is providing a “bank clearinghouse.” This is where banks settle transactions with each other. Today, this is done with electronic base money, in the form of bank reserves held at the Fed. In the past, it was done with paper money, with banknotes in amounts up to $10,000. I don’t think we need to do things with paper money today, which implies that the Treasury would have to maintain a clearinghouse system, much as the Fed does today. This is not very difficult to do.

The third thing to think about is the provision of what used to be called “elasticity” in the money supply. This is the original purpose of central banks. I wrote a whole chapter about it in my book (Chapter 8), which describes the original problem of “liquidity shortage crises” which led to the development of central banks which could issue their own currency. This should be considered required reading for anyone who wants to understand these issues. (Let me say also: if you think you understand these issues, but you haven’t read the book, then you probably don’t. Only about 1 in 100 academic economists understand this stuff.)

I don’t think I’ll go on about it here. You need to read the book for a full explanation. However, this is also a function which can be assumed by the Treasury, and indeed was assumed by the Treasury on many occasions from the 1850s onward, before the establishment of the Fed. (The Treasury would issue United States Notes at key times.)

An excellent reference on these matters is Richard Timberlake’s Monetary Policy in the United States: An Intellectual and Institutional History.

Timberlake is the 1 in 100. He has a lot of wonderful detail from the 19th century, especially the period before 1860.

Thus, the Treasury would take over the operations of the Fed, which is not a bad idea if you ask me.

There is some history of a self-adjusting banking system using “clearinghouse currency,” which is to say, base money that banks print up on demand. This was the primary system in place from the 1850s to 1913. After it was formalized with the Aldrich-Vreeland Act in 1908, it seemed to work pretty well. However, this system was only in place a few years before being replaced by the Federal Reserve system.

What people usually mean by “abolish the Fed” is to eliminate floating currencies, and Keynesian monetary manipulation via interest rate targets and so forth. Unfortunately, all of these things are just as possible without a Fed. There are many examples of floating currencies in history that predate central banks.

Of course I am an advocate of hard money principles. A sound gold standard is mandated by the U.S. Constitution, a fact that is conveniently ignored today. Under a gold standard, currencies do not float and there is no Federal Reserve or government department to manipulate interest rates. We would still need some form of “elasticity,” or the original central banking role, which would be provided by the currency manager, presumably the Treasury. This in no way implies a change in currency value. It means that supply (base money) is flexible enough to match changes in demand.

For example, let’s say that everyone had $20 in their pocket and $100 in their bank account. The bank held $5 of cash and bank reserves on hand in case of withdrawals. Thus, there is $25 of base money per person. If everyone wanted to withdraw $20 from their bank account, then they would hold $40 in their pocket and have $80 left in their account. Here we see that the demand goes up — before, they “demanded” $20 of money in their pocket, and now they “demand” $40. The bank still wants to hold a little cash against withdrawals, of $4 perhaps. So, there now needs to be $44 of base money per person. The monetary system needs to be “elastic” enough to accomodate this increase in demand with an increase in supply — literally printing another $19 of money per person. Maybe later, people decide that $20 in their pocket is fine, so they deposit the extra $20 back in the bank. This reduces “demand” to $25 per person again. Now $19 per person needs to disappear.

This is more-or-less what has happened recently with banks. Although maybe people aren’t carrying more money in their pocket, banks want to carry much more money “in their pocket.” Banks’ “pocket” is their bank reserve account at the Fed. So, base money has grown enormously in response to this demand. However, in today’s floating currency environment, there is no mechanism like a gold standard to exactly match supply and demand. The Fed is monetizing (“printing money”) for all kinds of reasons — to accomodate banks’ demand for more bank reserves, but also to “avoid deflation,” to lower mortgage rates, to absorb the huge supply of Treasury issuance, and general “quantitative easing” easy-money theories. Thus, the currency has had a tendency to decline in value. Under a gold standard, you could have an increase or decrease in base money supply in response to a change in demand, such that there is no change in the value of the currency. This is the 19th-century style “elasticity” that central banks were originally supposed to provide.

All of these functions could also be performed by the Federal Reserve. However, maybe people sense that the Fed is too corrupt to be fixed, and that it would be better to start with a clean sheet of paper. If so, we will need people out there who understand all the functions I’ve listed above, and how to implement them properly within the context of a new gold standard. Otherwise, we would have a big disaster.