(This item originally appeared at Forbes.com on February 25, 2020.)

When the gold standard — the principle by which the U.S. dollar was managed for nearly two centuries until 1971 — is brought up, it usually doesn’t take too long before someone asks: “But, didn’t the gold standard cause the Great Depression?” With noted gold standard advocate Judy Shelton recently in Senate hearings to be confirmed to the Federal Reserve Board of Governors, this question has recently been revived.

Here’s my answer: No.

But, you probably guessed that. So, let’s see what other economists have said about it, over the past eighty years:

Keynesians: No.

Monetarists: No.

Austrians: No.

This might seem contrary to what you may have heard, so let me clarify. Many economists — in the 1930s and ever since then — have been of the opinion that a devaluation, or some other kind of “easy money” policy such as base money expansion, would have helped during that time. They thought a currency devaluation would help ameliorate a catastrophic downturn caused by things they didn’t understand. Or, that it did help, since most central banks did actually devalue, or use these various “easy money” schemes, eventually. It didn’t actually work that well, and the Great Depression dragged on throughout the decade. “Beggar thy neighbor” currency devaluations were later blamed for causing many of the problems of the 1930s. By the end of the decade, many currencies floated freely.

At the Bretton Woods conference in 1944, governments got together to create a new world gold standard system, with additional safeguards (the International Monetary Fund and the World Bank) to make sure that the sort of unilateral, unplanned devaluations and floating currencies of the 1930s would not take place again.

Obviously, if people thought the gold standard caused the Great Depression, they wouldn’t get together in 1944 to make a new world gold standard that was even more safe and secure (they thought) than the 1930s version. This was the consensus of the people that actually lived through the Great Depression and World War II. And it worked great: the Bretton Woods years, the 1950s and 1960s, are today considered the best decades for economic abundance worldwide since the Classical Gold Standard disintegrated in 1914.

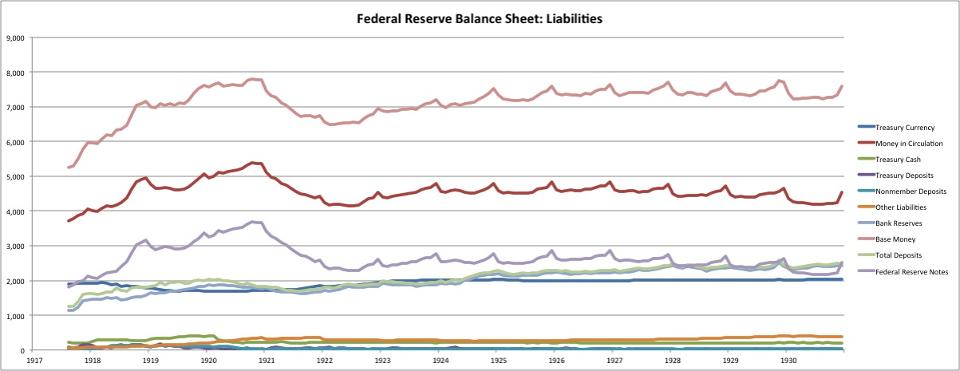

In 2016-2017, I undertook an extensive review of different views of monetary conditions during the 1930s. A summary of this is in my third book, Gold: The Final Standard (2017), which you can read here. But the meat of the details are on my website Newworldeconomics.com. This includes monthly balance sheet data for the Federal Reserve, Bank of England, Bank of France, Reichsbank, and Bank of Japan. Plus, there is info on interest rates and foreign exchange rates. I reviewed all the major “interpretations” of that period, including the Keynesian, Monetarist and Austrian, and also several others. A summary is here and here. So, you have all the tools to make up your own mind.

I know you still don’t believe me, so here is a quote from economist Peter Temin’s 1976 book Did Monetary Forces Cause the Great Depression?

[T]he proposition that monetary forces caused the Depression must be rejected. … This study has shown that the spending hypothesis fits the observed data better than the money hypothesis, that is, that it is more plausible to believe that the Depression was the result of a drop in autonomous expenditures, particularly consumption.

I categorize Temin as a “Keynesian,” who found that a “decline in aggregate demand” caused the downturn, with a monetary system that was basically functioning as it was supposed to. Here is economist Barry Eichengreen, from his influential 1992 book Golden Fetters: The Gold Standard and the Great Depression, 1919-1939:

The initial downturn in the United States enters this tale as something of a deus ex machina … The tightening Federal Reserve policy of 1928-29 seems too modest … Hence the search for other domestic factors that might have contributed to the severity of the downturn, such as structural imbalances in American industry, an autonomous decline in U.S. consumption spending, and the impact of the Wall Street crash on wealth and confidence.

Like other Keynesians, Eichengreen sees the problems as arising from unspecified factors, with no particular problems with the monetary system. Both Temin and Eichengreen recommended a currency devaluation (which Roosevelt did in 1933), to deal with these problems from unspecified causes. But, they never blamed the gold standard itself.

Monetarists have a similar view. In his Monetary History of the United States (1965), Milton Friedman barely mentioned the gold standard. Like the Keynesians, he recommended an “easy money” solution — in this case based on monetary quantity rather than currency devaluation, although it amounts to the same thing. In that book, look for any description of causes whatsover. There is none. It is, as Eichengreen called it, a “deus ex machina.”

There is actually a small minority that does blame the gold standard. They argue that large purchases of gold by central banks drove up the market value of gold, causing a monetary deflation. But, the briefest investigation of central bank gold-buying behavior (in aggregate, not just France) shows nothing out of the ordinary. Central banks accumulated gold, in a steady pace, from 1850 to 1960, with nothing unusual happening around 1930. They are grasping at vapor.

The gold standard did not cause the Great Depression. In my opinion, it appears to have come about from a series of disastrous policy mistakes by governments worldwide, beginning with a tariff war in 1930 and then extending to various “austerity” programs that included gigantic tax increases. In the U.S., the top income tax rate rose from 24% to 63% in 1932. By 1940, it was 79%. Other governments did similar things. In the midst of this onslaught, bank credit contracted dramatically.

When we absolve the gold standard for blame for the Great Depression (as nearly all economists have done), we find that it seems to have caused very few problems over the nearly two centuries that the U.S. used it. By providing a reliable, stable, unchanging unit of account — the monetary equivalent of other constant weights and measures such as the kilogram or meter — it allowed entrepreneurs and businessmen to engage in rational economic calculation without the “noise” of monetary distortion. The result was prosperity and abundance. The United States, with its gold standard policy, became the wealthiest country in the history of the world.