I’ve been revving up to talk about the “price-specie flow mechanism,” which is often ascribed to gold standard currencies in the past, whether as simple coinage only or in the form of gold-based banknotes.

January 17, 2016: David Hume, “On the Balance of Trade,” 1742

February 21, 2016: Problems of Coinage

February 14, 2016: The Balance of Payments

This notion has been around for a very long time. It has often been ascribed to David Hume, although, as we saw earlier, Hume mostly argued that such a phenomenon does not exist. However, it did continue after Hume. A rather appalling intellectual history of this idea — which is still embraced by most economists today — can be found in a paper by Michael Bordo, “The Gold Standard: The Traditional Approach,” in The Gold Standard and Related Regimes: Collected Essays (1999), by Michael Bordo.

“The Gold Standard: A Traditional Approach,” by Michael Bordo (1984)

Here is a description, from Giulio Gallarotti’s 1995 book The Anatomy of an International Regime: The Classical Gold Standard, 1880-1914 (p. 35)

According to the conventional, textbook models of the gold standard, the balance of payments was adjusted according to the Humian price-specie-flow mechanism. According to this vision, balance of payments was a “real” phenomenon in that it was effected by changes in trade balances, and these trade balances were stimulated by changes in prices, which in turn resulted from gold flows between nations. Assume that two nations, A and B, are trading. Nation B runs up a balance-of-payments surplus against A. Under a classic Humian process, the debt incurred by A will be eradicated through gold flows (i.e., under a Humian vision, gold is the exclusive international medium of exchange). These gold flows will produce several effects on the respective domestic monetary systems. First, the gold stock of B will be augmented by an increase in external reserves, while the gold stock of Nation A will be reduced by an equal amount as a result of a decrease in external reserves. Second, the changes in gold stocks will have the effect of pushing domestic prices down in the nation that is losing gold (A), a smaller pool of gold decreases the demand for consumer goods, and therefore domestic prices must fall to clear the market. In both cases, there occur relative price changes in consumer goods which alter consumption incentives between home and foreign goods. The lower prices in Nation A and the higher prices in Nation B will divert home and foreign demand toward A’s goods and away from B’s goods. This will reduce the imports of A and increase the exports of B (in a bilateral context, this amounts to an increase in A’s net exports and a decline in B’s net exports). In turn, this will reverse the original trade imbalance that had B running a surplus against A, as gold will now flow toward the latter, thus bringing external positions back into equilibrium.

This system as described, you might conclude, is totally bonkers. If you believed that something like this actually happened (as most economists do), then you would naturally conclude that the gold standard system was totally bonkers. Actually, economists today mostly believe that something like this happens with today’s floating fiat currencies too, which is extra bonkers.

Now, look at what is being proposed here. British enthusiasm for French wine causes gold to flow out of Britain and in to France. This scarcity in Britain makes gold more valuable in Britain (monetary deflation) and less valuable in France (monetary inflation). Prices then go down in Britain and up in France. This makes French wine more expensive, and British woolens less expensive, so British buy less French wine and French buy more British woolens. The result is that the gold goes back from France to Britain, and we start all over again.

Of course this is nonsense. Gold is the same value in Britain and in France. Prices in Britain do not go up and down, and prices in France do not go down and up. They are basically using the same currency, no different than London and Manchester. Does such a mechanism exist between London and Manchester? Or between two individuals, Mr. Smith and Mr. Jones? Actually, the only kind of “balance of payments” that actually exists is between what I previously called “economic entities,” because these are the only entities that can actually trade: buy, sell, own assets, enact liabilities and so forth. In other words, make payments. Common economic entities are individuals, households, corporations including investment funds, and various government entities. Thus, if there was a “price-specie flow mechanism” it would have to be apparent on the individual entity level, because the individual entity level is the only level there is. The only kind of trade that actually exists is between these economic entities. There is no “Britain” or “France” that is buying or selling. There are only individual entities labeled British, and individual entities labeled French.

David Hume understood this perfectly.

What happens in small portions of mankind, must take place in greater. The provinces of the ROMAN empire, no doubt, kept their balance with each other, and with ITALY, independent of the legislature; as much as the several counties of GREAT BRITAIN, or the several parishes of each county. And any man who travels over EUROPE at this day, may see, by the prices of commodities, that money, in spite of the absurd jealousy of princes and states, has brought itself nearly to a level; and that the difference between one kingdom and another is not greater in this respect, than it is often between different provinces of the same kingdom. Men naturally flock to capital cities, sea-ports, and navigable rivers. There we find more men, more industry, more commodities, and consequently more money; but still the latter difference holds proportion with the former, and the level is preserved.

You see? Gold is, “like water,” the same value everywhere. It is not more valuable here and less valuable there, Prices don’t go up and down, they too are the same level everywhere. The basic mechanisms of the “price-specie flow mechanism” do not exist.

Hume was not the only one to notice this. Here is Gallarotti’s next paragraph:

The empirical research on adjustment-related outcomes under the gold standard has shown numerous inconsistencies with the conventional models of adjustment. [i.e., the “price-specie flow mechanism”] Evidence suggests prices were much more stable and convergent across nations than the classical model would have expected. Wages, in fact, were found to be rigid downward in developed nations, thus suggesting a lack of flexibility in prices in the gold club. All of this cuts against the expectations of the conventional vision which sees adjustment as based on the flexibility and divergence in prices across nations. The fact that business cycles tended to converge, as well as prices, placed the role of trade in adjustment in an even more dubious position, given that nations were facing contemporaneous consumption patterns in their demand for foreign goods deriving from changes in income. …

In other empirical tests over selected nations, a variety of findings are equally inconsistent with the conventional vision of adjustment under the gold standard. It was found that exports and imports covaried positively rather than negatively, terms of trade were more stable than would be expected, there was little relation between international reserves and trade flows, gold flows were far smaller than trade flows, the prices of imports and exports did not move inversely, gold flows were more sensitive to changes in discount rates than to changes in prices, money stocks varied procyclically, there was a negative rather than a positive relation between trade surpluses and gold inflows, the prices of traded goods differed less between nations than within nations, adjustment occurred more rapidly than would be expected from changes in trade flows, exports often increased when their prices did not fall, the quantity of imports often declined along with their prices, there was less sensitivity of prices to money supplies and balance-of-payments positions than would be expected, and gold was usually the last thing to flow when adjustments took place.

In short, the “price-specie flow” idea fails on every conceivable basis. That is because it’s hooey.

As you have probably noticed, it is hard to talk about the details of trade. I’ve attempted to give an idea of what is really happening, but the result has a tendency to ramble.

Obviously, gold has to “flow” somehow from places with mines to places that don’t have mines, or more generally, between people who want it less and people who want it more; between buyers and sellers. This takes place via trade of course, since nobody is giving gold away. But, this is really no different than the equivalent trade in copper, or Volkswagen automobiles, or cucumbers, or anything else under the sun. You could argue that gold is marginally more valuable to the buyer (the acquirer of gold) than to the seller (disacquirer of gold). Now we are finally getting down to the individual entity level. And indeed this theoretical difference must exist to motivate the trade. But, this is also true of any traded item, so we are not really saying anything except that trade exists. (Although it is difficult to talk about trade on this level, nevertheless it is worthwhile to spend some time thinking about it.)

As Hume argued (somewhat fuzzily), we don’t really have to worry about this process. Gold is the same value everywhere, and is always in equal abundance everywhere, just as is true today of dollar bills. Dollar bills are the same value everywhere, in the United States and also outside the U.S., and there is never a shortage here and a surplus there. Entities that issued banknotes based on gold (such as central banks) would adjust their reserve holdings based on the value of their banknotes compared to bullion. This was no different than those countries today that have currency boards based on dollars or euros.

There really isn’t anything more to it than that. It has nothing to do with the “balance of payments” or the “balance of trade.” As you can see, a dismal amount of research has been done to prove this point empirically, although you can figure it out easily enough on a theoretical basis alone. Here is the conclusion of McCloskey and Zecher (1976):

What has been established here is that there is a reasonable case … for the postulate of integrated commodity markets between the British and American economies of the late nineteenth century, vindicating the monetary theory. There appears to be little reason to treat these two countries on the gold standard differently in their monetary transactions from any two regions within each country.

This comes from a paper called “How the gold standard worked, 1880-1913,” in The Monetary Approach To The Balance of Payments, ed. J. Frenkel and H. G. Johnson.

You will notice that it is essentially the same conclusion as Hume. It took only 234 years to get that far. And yet, here we are, another four decades later, and people still can’t figure this out.

As I mentioned briefly, this “price-specie flow mechanism” is actually applied today, by Nobel Prize-winning economists (who got their Nobels in part by inventing this nonsense), to currencies and trade in today’s floating-currency framework. So, it is not really about the gold standard era only, it is a confusion that still infects economic thinking across the board.

Here’s Wikipedia:

One of the three fundamental functions of an international monetary system is to provide mechanisms to correct imbalances.

Broadly speaking, there are three possible methods to correct BOP imbalances, though in practice a mixture including some degree of at least the first two methods tends to be used. These methods are adjustments of exchange rates; adjustment of a nations internal prices along with its levels of demand; and rules based adjustment. Improving productivity and hence competitiveness can also help, as can increasing the desirability of exports through other means, though it is generally assumed a nation is always trying to develop and sell its products to the best of its abilities.

Here we are again, with the values of currencies going up and down, thus affecting prices and thus trade and thus “correcting imbalances” in the Balance of Payments, which were never problems to begin with. All of the “absurd jealousies of princes” that Hume railed at are still with us. The horror!

https://en.wikipedia.org/wiki/Balance_of_payments#Causes_of_BOP_imbalances

You might even consider that today’s floating currency arrangement comes about in part not because some “price-specie flow mechanism” existed, but that people wanted it to exist, because they still believed that the “trade imbalances” that Hume dismissed were a big deal. Thus, they created a system — floating currencies — where currencies actually did go up and down in value, and actually did change prices (either nominal or effectively due to the change in currency value), and actually did influence trade, although even then it still wouldn’t change the Balance of Payments in a coherent fashion, as this is related ultimately to capital flows.

You can see this today in discussions of the eurozone, where people really do use a unified currency, and Germany and France actually do have, by any conceivable standard, the same monetary relation as New York and Pennsylvania. Nevertheless, we still have the notion that the “balance of payment imbalances” are causing some kind of horrible disaster in the eurozone. Nobody is quite sure what the mechanism is — because it doesn’t exist — but they are sure there is something awful going on, just because … well, because we have been talking about this “balance of payments imbalances” stuff since about 1600 A.D., such that, even by Hume’s time, it was a hoary old fallacy. Thus, the “balance of payments” is an all-purpose boogeyman that can be blamed for anything and everything.

Germany’s current-account surplus is partly to blame for eurozone stagnation

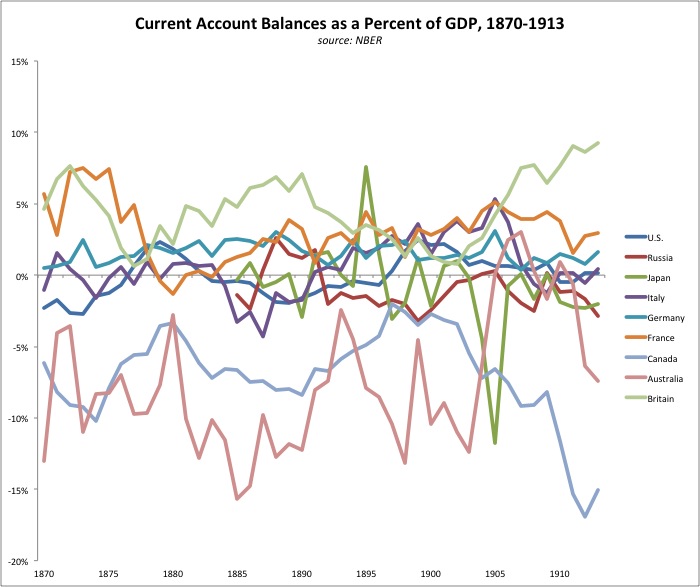

Actually, because of the stable monetary regime of the pre-1913 gold standard era, it was very easy for capital to move internationally. This created huge and persistent “balance of payments imbalances,” which is just another name for an international capital flow. This was never a problem, any more than similarly large (or in fact even larger, as a percentage of GDP) capital flows within various regions of the United States are a problem. It’s just the normal workings of capitalism.

That is as far as we will go with the “price-specie flow mechanism” today. Like essentially all arguments related to the “balance of payments,” it’s nonsense.