Today, we will leave our interests in higher education aside, and address common outcomes when countries enter a crisis period. While a common pattern for emerging market countries is a flight from the domestic currency, the pattern for Britain and the U.S. (the top international currencies over the past two hundred years) has been for a flight to the currency. In other words, base money demand expands.

Base money consists of banknotes in circulation, and bank reserves held as deposits at the central bank. Thus, a rise in demand in base money in general implies a rise in demand for banknotes and bank reserves, in particular. This is not very hard to understand. In a crisis, people don’t trust banks, and also interest rates are typically very low, so people hold more banknotes. Banks have basically the same impulse: they don’t trust borrowers or each other, and also want to hold more of their equivalent of banknotes, bank reserve deposits at the central bank.

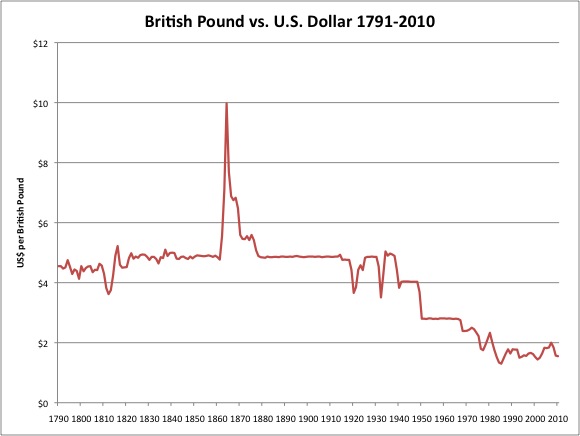

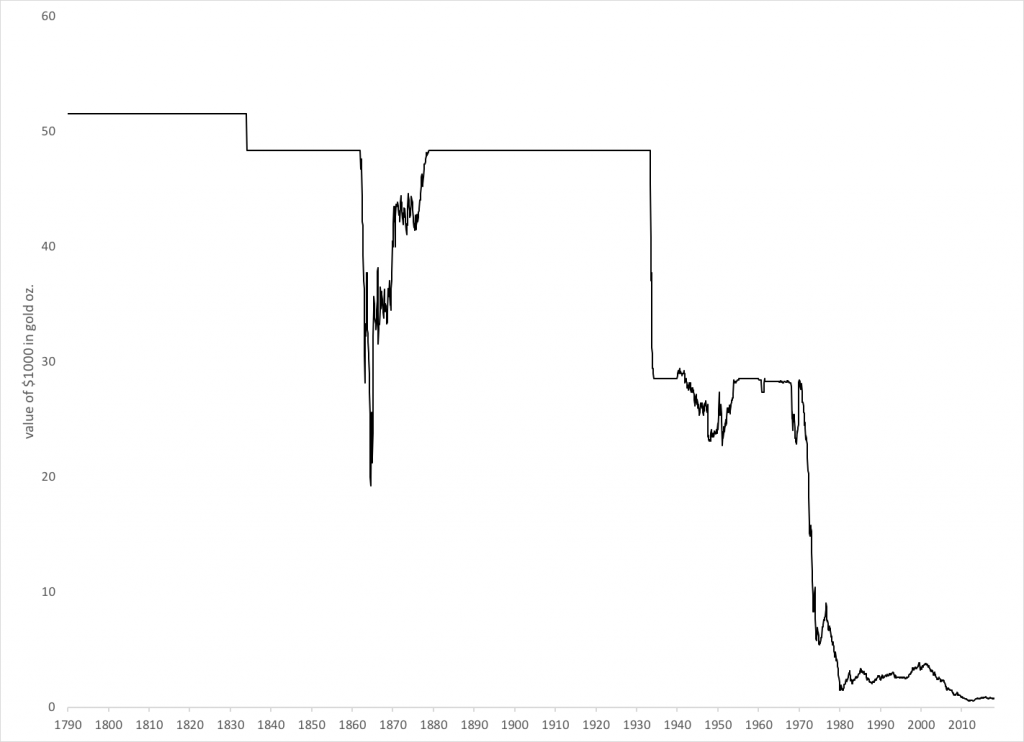

Since demand for base money is increasing, central banks are able to expand base money without much effect on the value of the currency. We will look, in particular, at World War I, the Great Depression and World War II periods, all of which had very large expansions of base money, but not much decline in currency value (inflation). There was some decline in currency value in all of these periods. But, in the midst of all the other things happening at the time, it was not very great and not very important. The British pound was a floating currency during World War I, and its value sank vs. gold somewhat. But, you don’t hear anyone complaining about it very much at that time.

What we have tended to see in these cases is: after the crisis passes (1920s and 1950s), people gradually become more risk-friendly, and draw down their high inventories of banknotes and bank reserves. People trust banks more, and are willing to hold larger deposit balances rather than banknotes. Banks gradually increase the proportion of interest-bearing loans on the asset side of their balance sheets. Thus, the demand for base money declines even as nominal GDP is growing quickly. The result is that base money tends to be flattish, even though there is a lot of economic growth.

Let’s see what I am talking about:

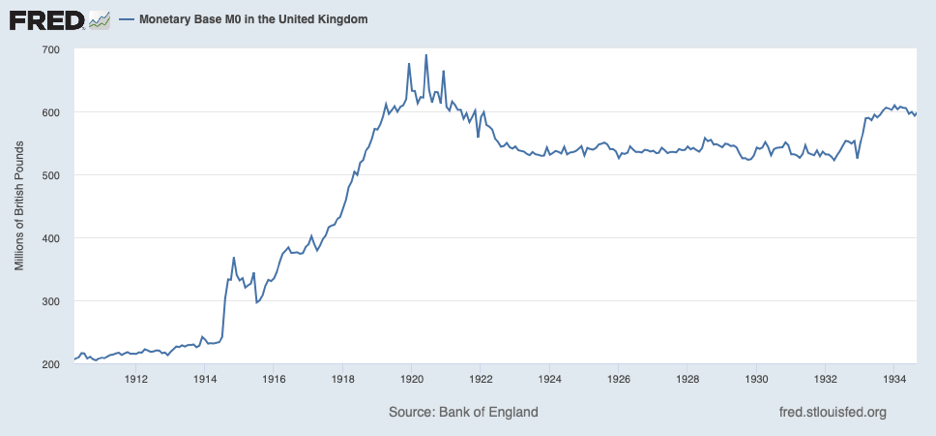

Here is the monetary base in Britain during World War I. There was a huge increase, basically a tripling from 200 million pounds to a peak of 600 million. The British pound floated after the outbreak of war in 1914, but it did not float very much, losing perhaps 30% of its value by the end of the war. This was remedied after 1919. We see that base money growth is very flat during the 1920s, although the economy was recovering. We can also see that the devaluation of 1931 was not at all related to base money growth. This might seem rather perverse: there was huge “money printing” during the war but no real consequences, and no “money printing” at all in 1931 but a huge decline in currency value. I talk about these kinds of things at some length in my book Gold: The Monetary Polaris, with examples from Russia, Thailand and elsewhere.

During this World War I period, the British government actually printed banknotes of its own, bypassing the Bank of England — much like the U.S. Treasury Notes (“greenbacks”) during the Civil War. It was not until the 1920s that these banknotes were integrated on the BoE’s balance sheet.

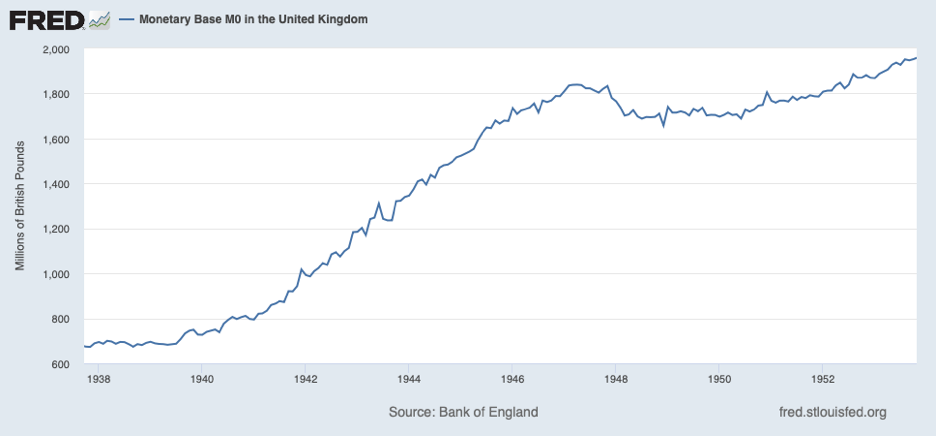

Here is Britain during World War II. Again, the British Pound was effectively a floating currency, and it did effectively lose some value during this time, but not a whole lot. For the general public, concerned with other things, it was not very relevant. We see again a huge rise in base money, again roughly a tripling, and another flattish period in the recovery afterwards.

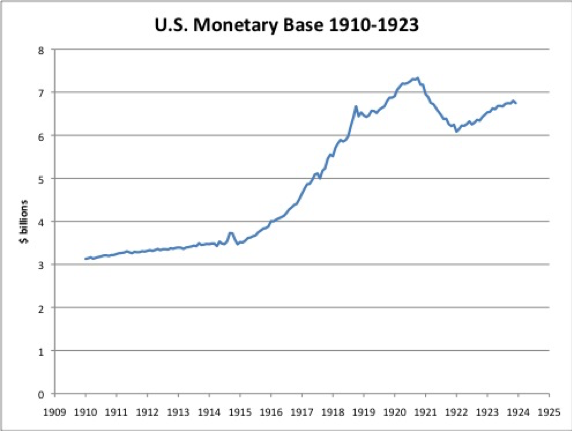

In the U.S., we do not have a monopoly central bank, but the pattern is about the same during World War I.

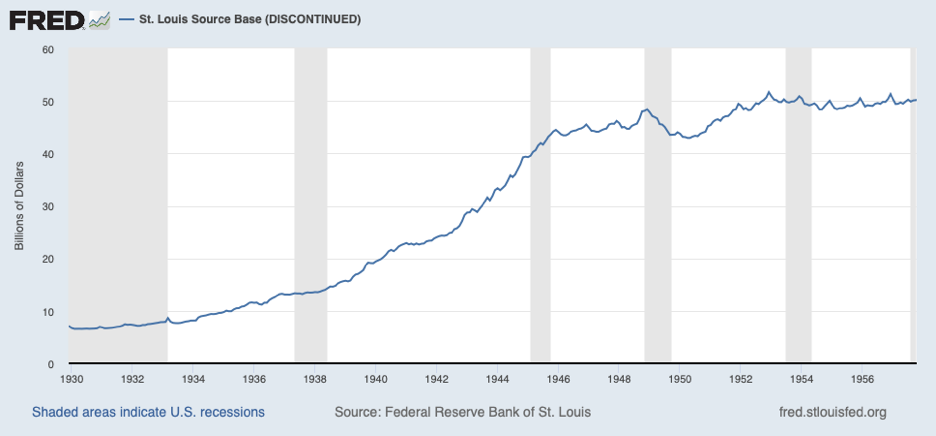

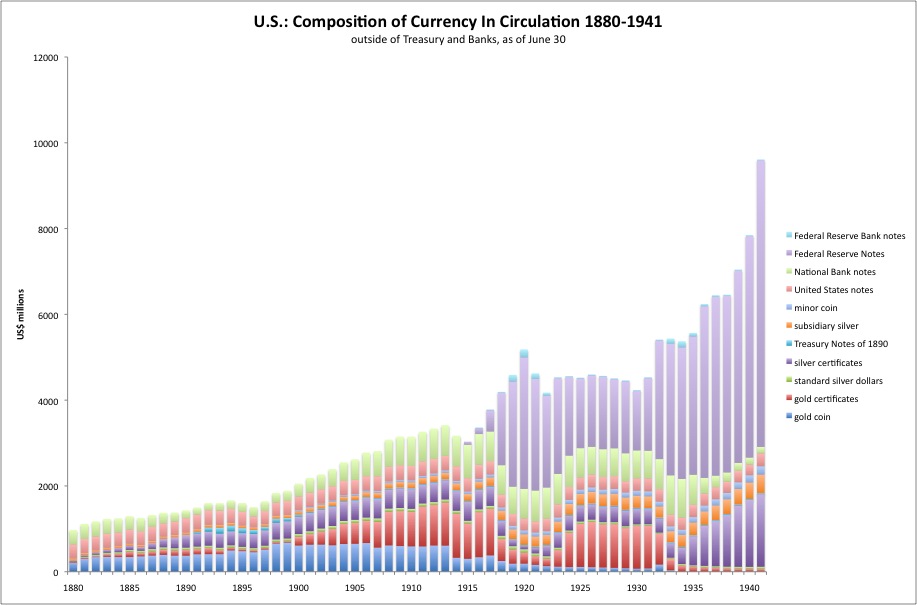

During the Great Depression and World War II, there is a long period of expanding base money demand. There was a devaluation in 1933, but this was basically a product of increased demand for bank reserves, which we looked at in some detail earlier.

June 18, 2018: The “Gold Sterilization” of 1937

June 25, 2018: The “Gold Sterilization” of 1937 #2: Fumbling and Bumbling

July 9, 2018: The “Gold Sterilization” of 1937 #3: The View From 2011

October 29, 2019: Basel III and Demand for Bank Reserves #2: Return to Normalcy

Then, base money expanded even more during World War II, basically for the same reasons.

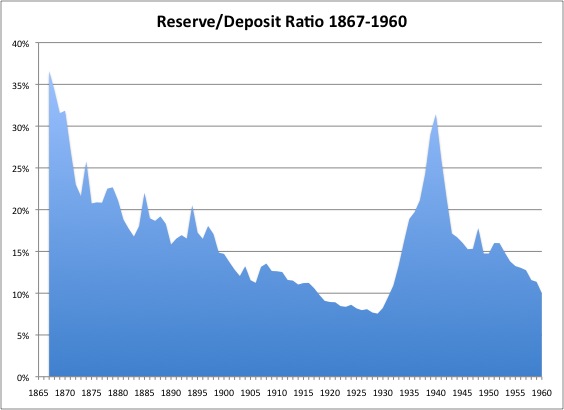

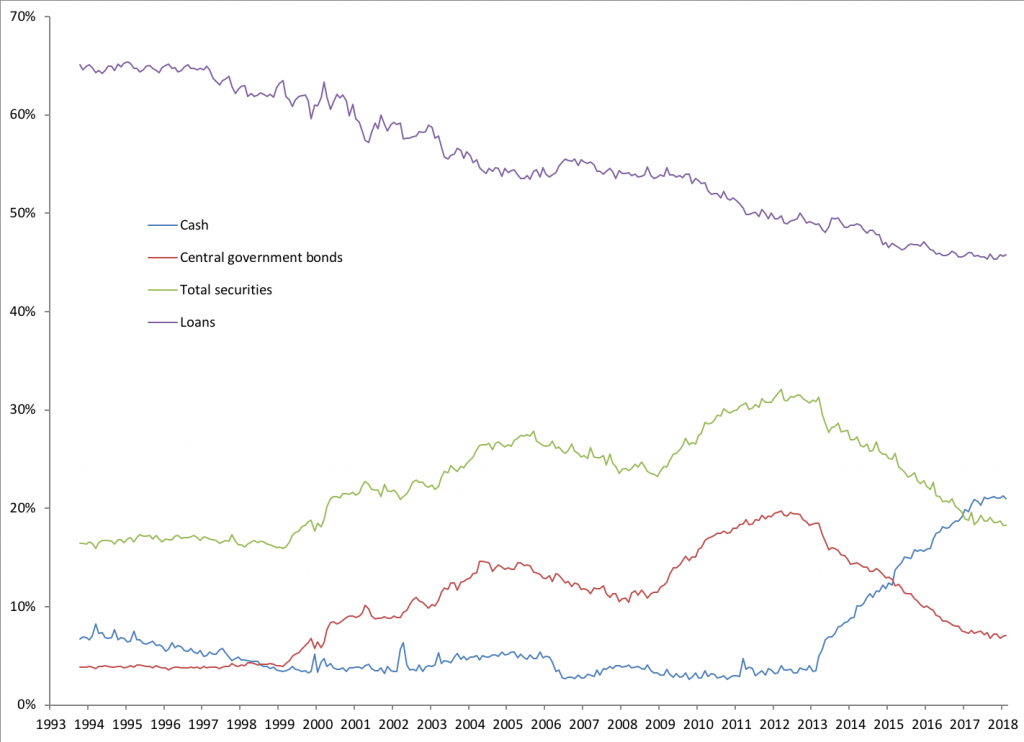

I like to look at the reserves/asset ratio of banks, but the reserve/deposit ratio is almost the same thing. During this pre-1960 period, deposits were typically about 90% of assets, so a reserve/deposit ratio of 20% is about the same as a reserves/asset ratio of 18%. We can see that banks tended to hold a lot of reserves (a form of base money) during difficult periods, and then they would draw it down and reach for more interest-bearing loans in prosperous periods.

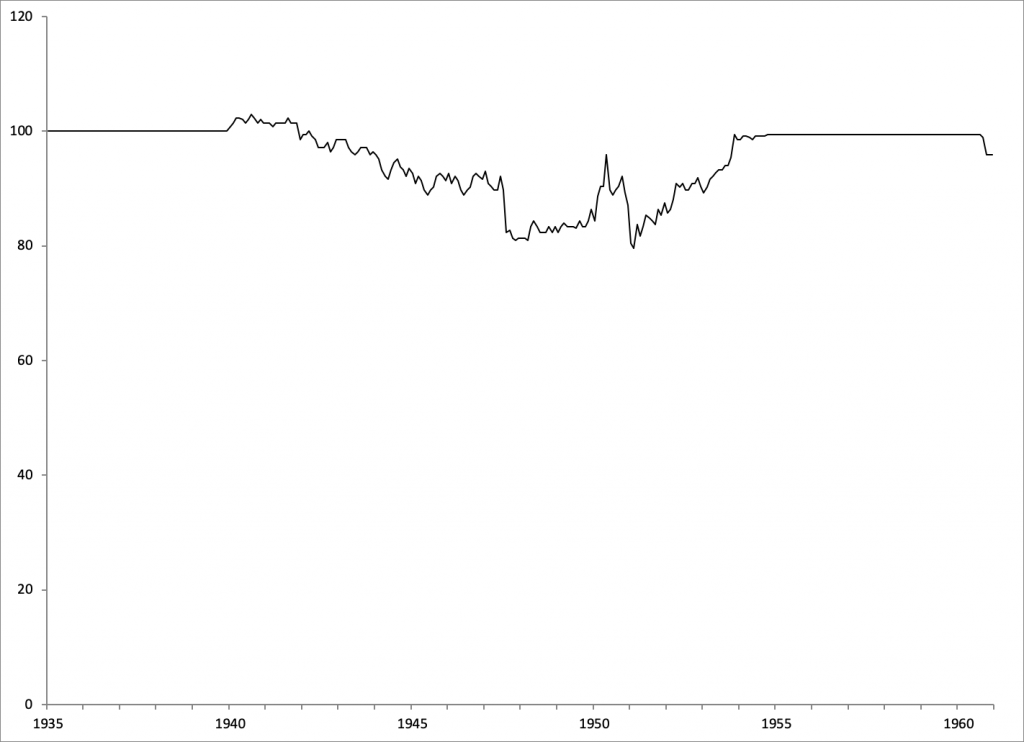

Although holding gold was actually illegal during the 1940s, we do have some data about the value of the dollar vs. gold during this time:

So we see that the dollar did sag in value somewhat, but it was not such a big deal and was resolved in the early 1950s.

During these crisis periods, these natural tendencies toward greater base money demand were commonly mixed with two government reactions. First, governments would take advantage of the increased demand for base money by, basically, printing money. This took the form of actually printing money, in the case of Britain in World War I. For the U.S., the Treasury leaned on the just-created Federal Reserve to assist in its deficit-financing efforts, and also, to keep a lid on interest rates on government bonds. This effectively amounted to money-printing, although by a somewhat oblique method.

July 15, 2012: Composition of U.S. Currency, 1880-1941

We can see that the expansion of U.S. currency in circulation during both World War I and World War II was in the form of Federal Reserve Notes. The other part of base money, bank reserves, was of course also at the Federal Reserve.

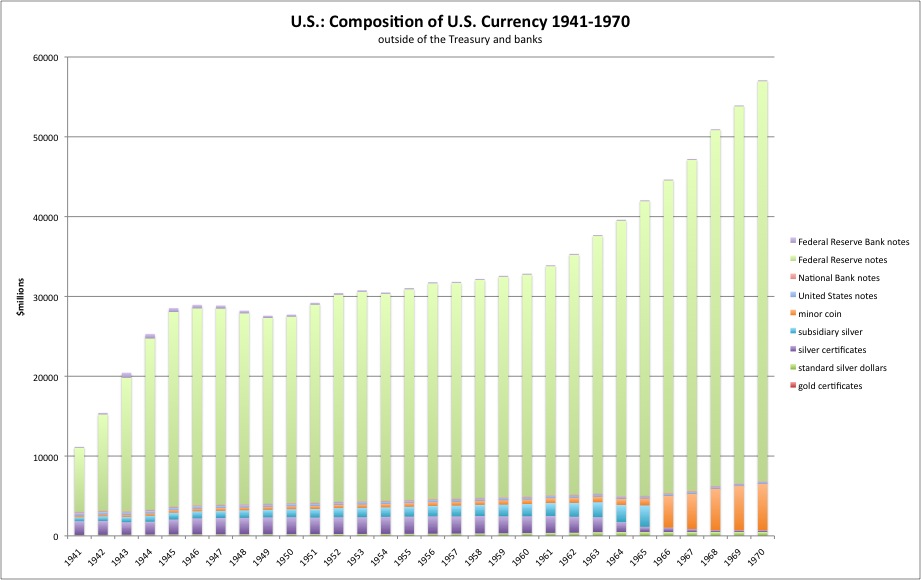

July 22, 2012: Composition of U.S. Currency, 1941-1970

During World War II, the framework of this was much like World War I. It was not framed as outright “money printing to finance the government,” but as “enabling financing of the war effort by keeping a lid on interest rates on government bonds.”

So, now we have two elements: first, the natural expansion of base money demand in a crisis situation; second, the attempt by governments to take advantage of this natural increase in demand to finance big deficits arising from wartime. We have also seen that this process can take place in a framework of what amounts to bond-market manipulation by central banks to lower the rates on government debt, which of course reduces debt service costs.

There is a third element here, which is: various forms of capital controls. We have seen that the U.S. already outlawed the ownership of gold (in a crisis) in 1933. During both World War I and World War II, there were various restrictions on gold convertibility with the central bank, and on gold exports and imports. In Britain and the U.S., the British pound and U.S. dollar did not officially leave the gold standard, but the currencies effectively floated during these wartime periods of gold-related capital controls. Also, during the wars, there were also capital controls on foreign exchange, so that official foreign exchange rates remained fixed even though the currencies were inherently floating.

Governments probably perceived that they were effectively printing money to finance their big deficits. This was risky; and they wanted to avoid the obvious consequences. What could be more fun than printing boatloads of money, and also, never suffering any consequences, like declining currency value (inflation)? So, capital controls were imposed on gold and foreign currencies. During wartime, there were also price controls, rationing and so forth.

Today, we are seeing all these patterns re-emerge.

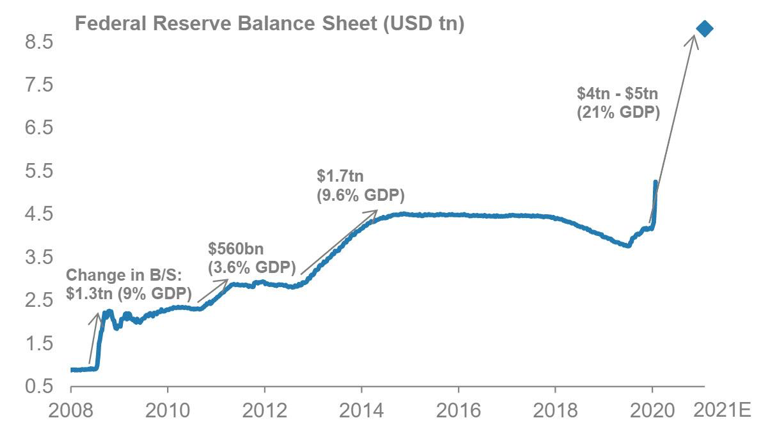

There was a large expansion of base money in 2009-2019, but this was largely a “return to normalcy” for the U.S. banking system and reserve policy, in the context of a fairly healthy economy.

October 21, 2019: Basel III and Demand for Bank Reserves

October 29, 2019: Basel III and Demand for Bank Reserves #2: Return to Normalcy

Thus, I think there is potential for base money to expand quite a bit more, as we go from “normalcy” to a wartime-like “crisis” situation.

We saw that, during the WWII period, banks at one point had a reserve/deposit ratio in excess of 30%. Banks also had these levels during the Civil War. Maybe we could go to 30% again in the near future, especially if there are a lot of carrots and sticks applied such as interest on reserves or forms of administrative arm-twisting. This would mean about a tripling from recent levels around 10% — just as we have seen a tripling of base money during Crisis periods in the past. It is not too hard to imagine also, as a wave of bad debts begins to hit, that a lot of people might hold more of their cash in the form of banknotes rather than bank deposits.

People are now talking about a Fed balance sheet on the order of $10-$12 trillion by the end of 2021, or roughly 3x where it began the recent Crisis at the start of 2020.

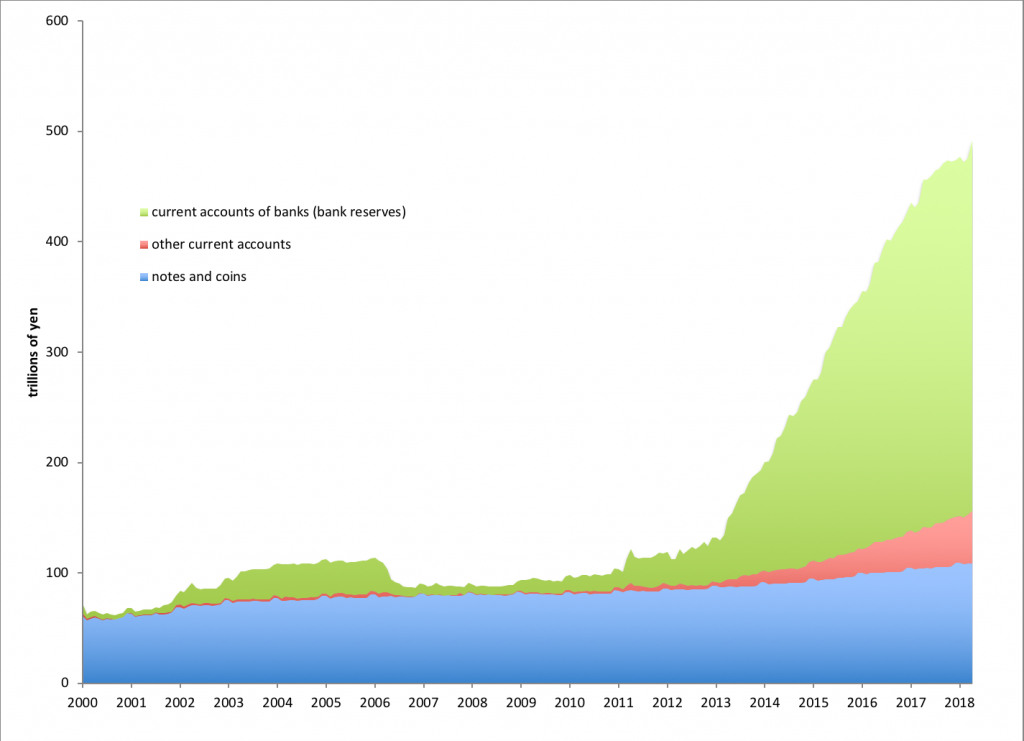

We have also seen a similar expansion of bank reserves/assets in Japan in recent years, to 20% or (now) higher. This has not been accompanied by any dramatic decline in the value of the yen.

May 19, 2018: Catching Up With The BOJ

Now, we can make some guesses as to what may happen.

I am a fan of Martin Armstrong’s cycle work. It shows that an inflationary monetary crisis is expected to begin in 2021 — not 2020. What this “begin” may consist of, we are not quite sure. For example, if the dollar sinks to beyond $2000/oz. of gold, that might constitute a “beginning.” Or, more likely in my opinion, perhaps this milestone will be passed and few people will care much; and the real beginning of “inflation” will be when the general public begins to feel the effects in a major way, for example due to big rises in food costs. Related to this, there may be a moment of “revulsion” among professional asset-managers and the general public, when it dawns on them that the currency is toast and there will never be an end to the money-printing.

For some time, the combination of natural increasing demand for base money in a Crisis, and various forms of capital controls or official intervention and manipulation (including the gold market, foreign exchange and bond markets), may allow governments to enjoy their Holy Grail of printing as much money as they like, without much consequences. But, I don’t think they will get away with it — that, as Armstrong says, this will lead to an inflationary meltdown, albeit one somewhat delayed, and NOT the outcome of World War I and World War II, where there was some weakening of currency value but not so much, and things returned to normalcy after the war’s end without any great monetary distress.

The basic reason for this is that the floodgates seem to have opened, and there is very little discipline of any sort now. Congress is primed to pass $1 trillion of support for State and Local governments, while the Federal Reserve promises to purchase $500 billion of State and Local government debt. Since the $1 trillion of Federal spending is also likely to be financed by the Federal Reserve, we have essentially promised to print money on the order of $1.5 trillion (7% of 2019 GDP) not because of World War, but because of an unusually acute flu season combined with longstanding fiscal problems at the State level largely arising from overly-generous pension programs for State employees.

Eh?

This is basically a Fourth Turning sort of scenario, in which the accumulated errors and bad habits of decades ignite in a bonfire of consequences.

Over time, there will likely be more spending of this sort — especially since, due to the reasons I have outlined, they are going to get away with it, for a while. It is not just “they,” such as Congress, but also “we,” since there seems to be very few people with much concern about these things at all, except to complain that someone else’s bailout is bigger than theirs. Can a Congressman command that tide to recede?